Risk in Commercial and

Residential Real Estate

October 2023

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

Throughout 2023, there has been a steady stream of press regarding a possible crisis in commercial and residential real estate, with warning indicators flashing in markets around the world. Risk managers face a range of challenges related to managing exposure to real estate.

The GARP Benchmarking Initiative (GBI)® invited Financial Risk Managers (FRM®) globally to participate in a survey designed to help better gauge risk in commercial and residential real estate markets worldwide and understand the steps firms have taken to manage exposure to real estate markets.

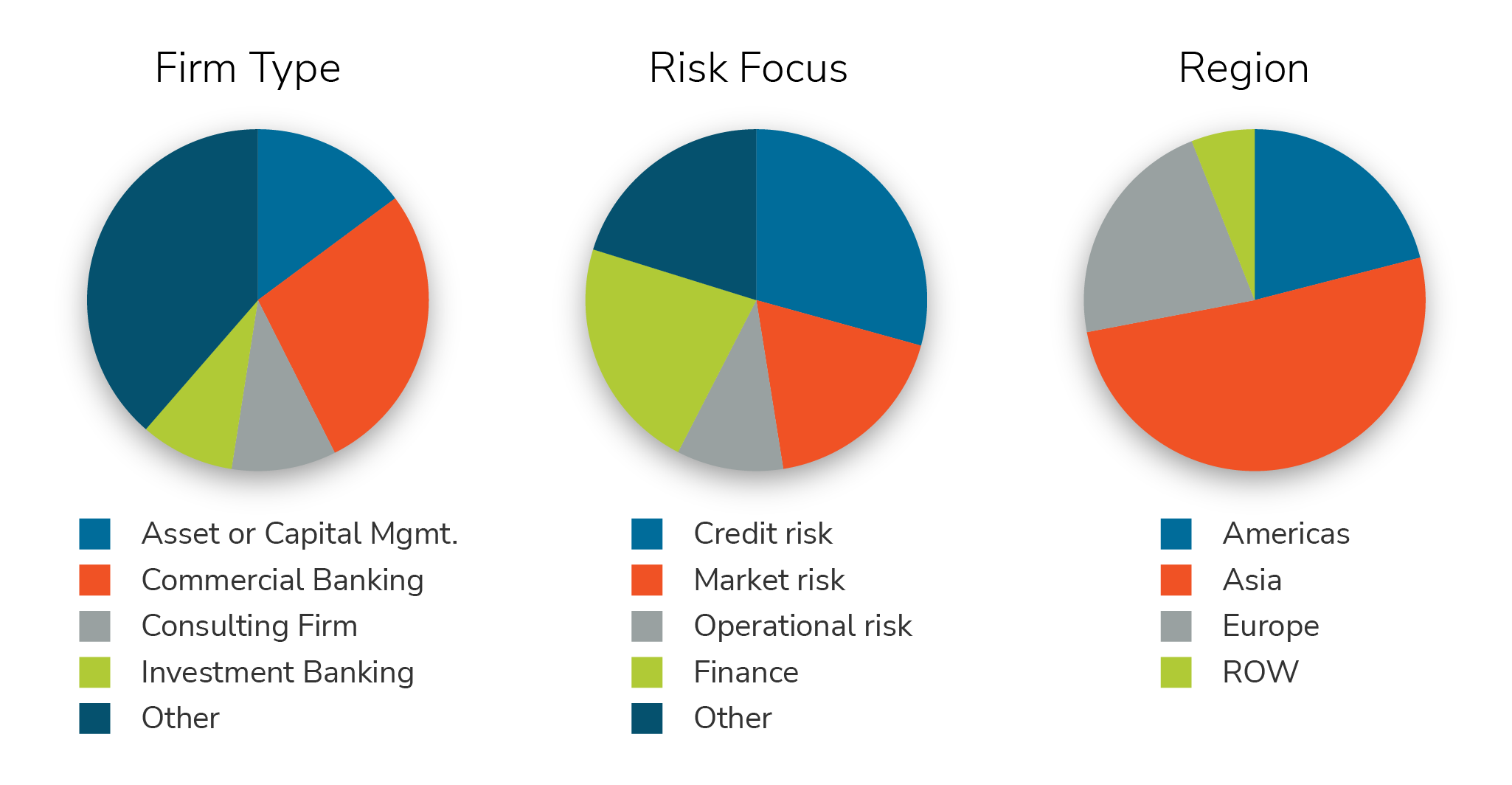

Nearly 400 FRM-Certified practitioners responded to the survey, representing a broad range of financial services firms and risk disciplines around the world. Roughly 59% of respondents work at large firms (over 1,000 employees) and more than 60% have at least five years of risk management experience.

Read on for the key insights from the survey results.

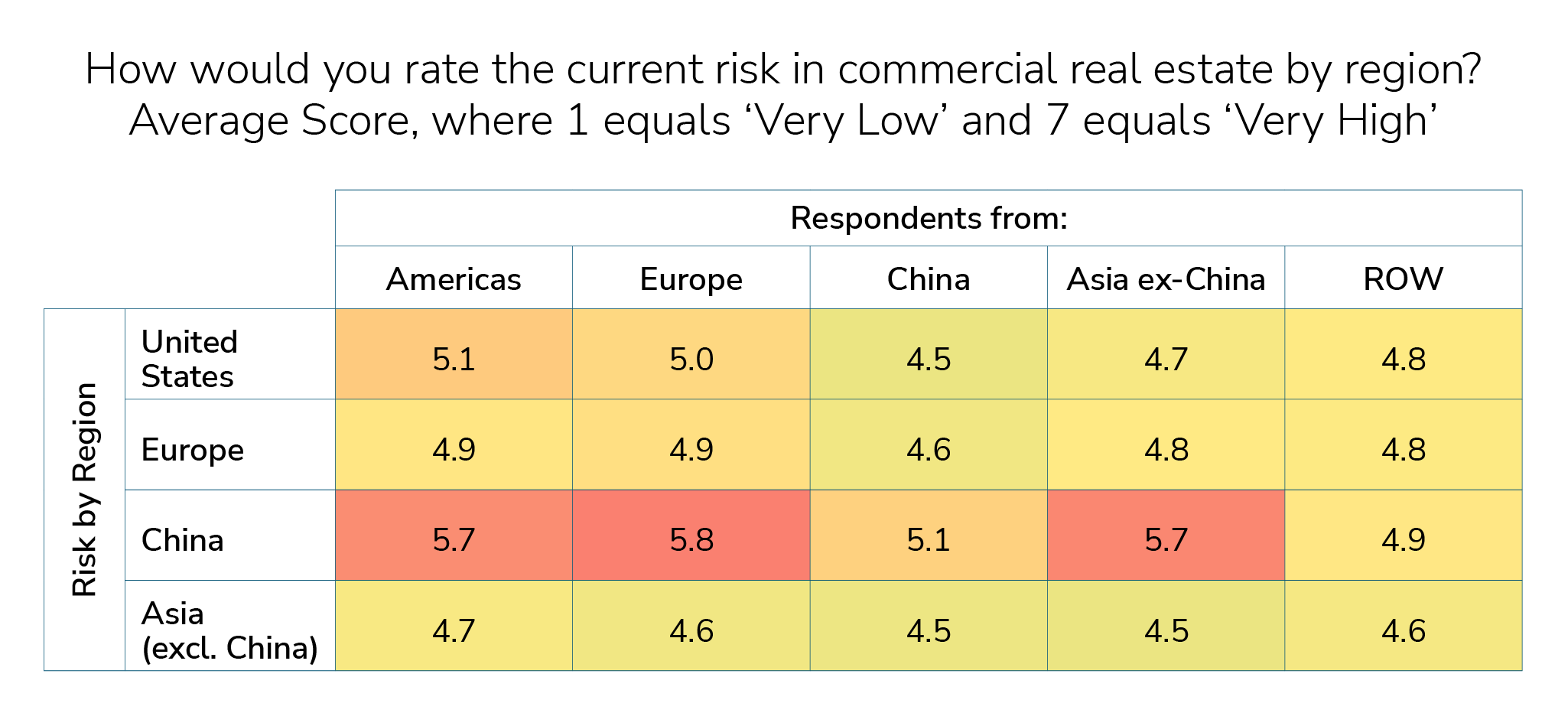

Insight #1 – Commercial Real Estate (CRE) is in trouble, particularly in China

Commercial Real Estate (CRE) is viewed as “high-risk” in all regions, with China leading the way, followed by the U.S. Asia ex-China is perceived as the least risky region.

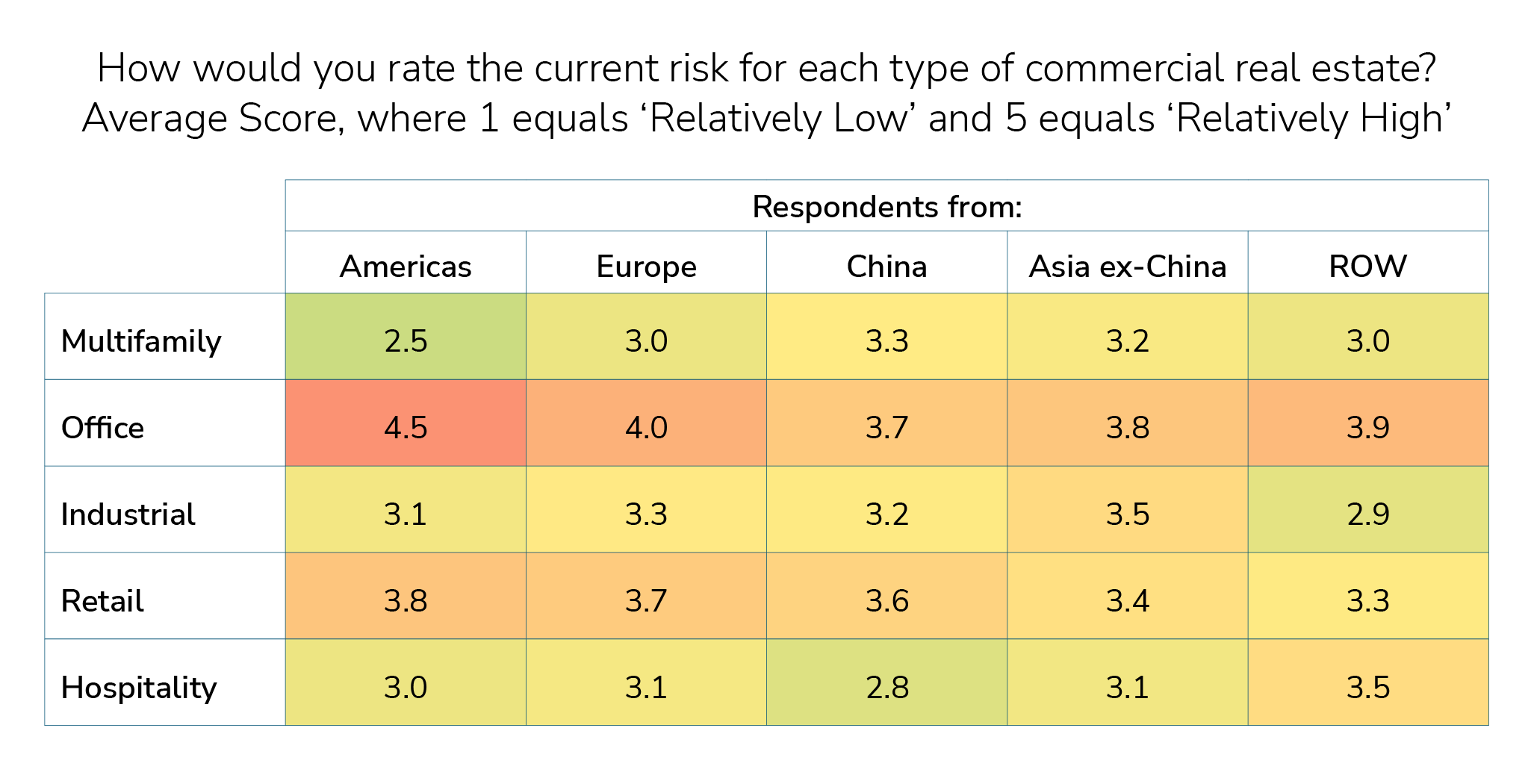

Insight #2 – Office Buildings are Highest Risk

Office is considered the riskiest category of CRE in every region, while Retail finished second. Meanwhile, survey participants rate Multifamily and Hospitality as having the lowest risk in

most regions.

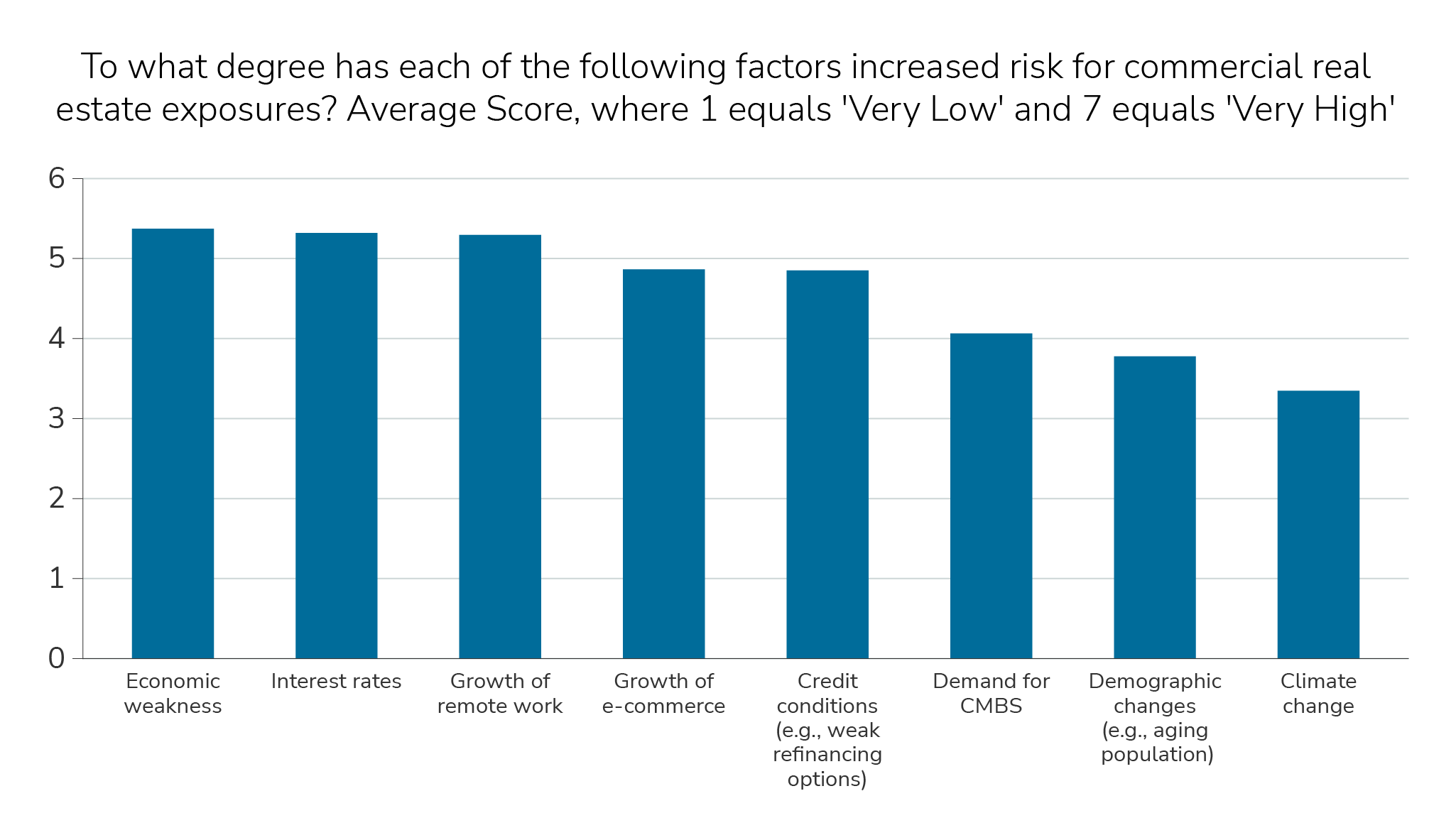

Insight #3 – Economic Weakness, Interest Rates, and Growth of Remote Work are Driving CRE Risk

Economic weakness, elevated interest rates, and the growth of remote work are viewed roughly equally as the top factors that have increased risk for CRE. The growth of e-commerce and current credit conditions are also considered significant contributing factors.

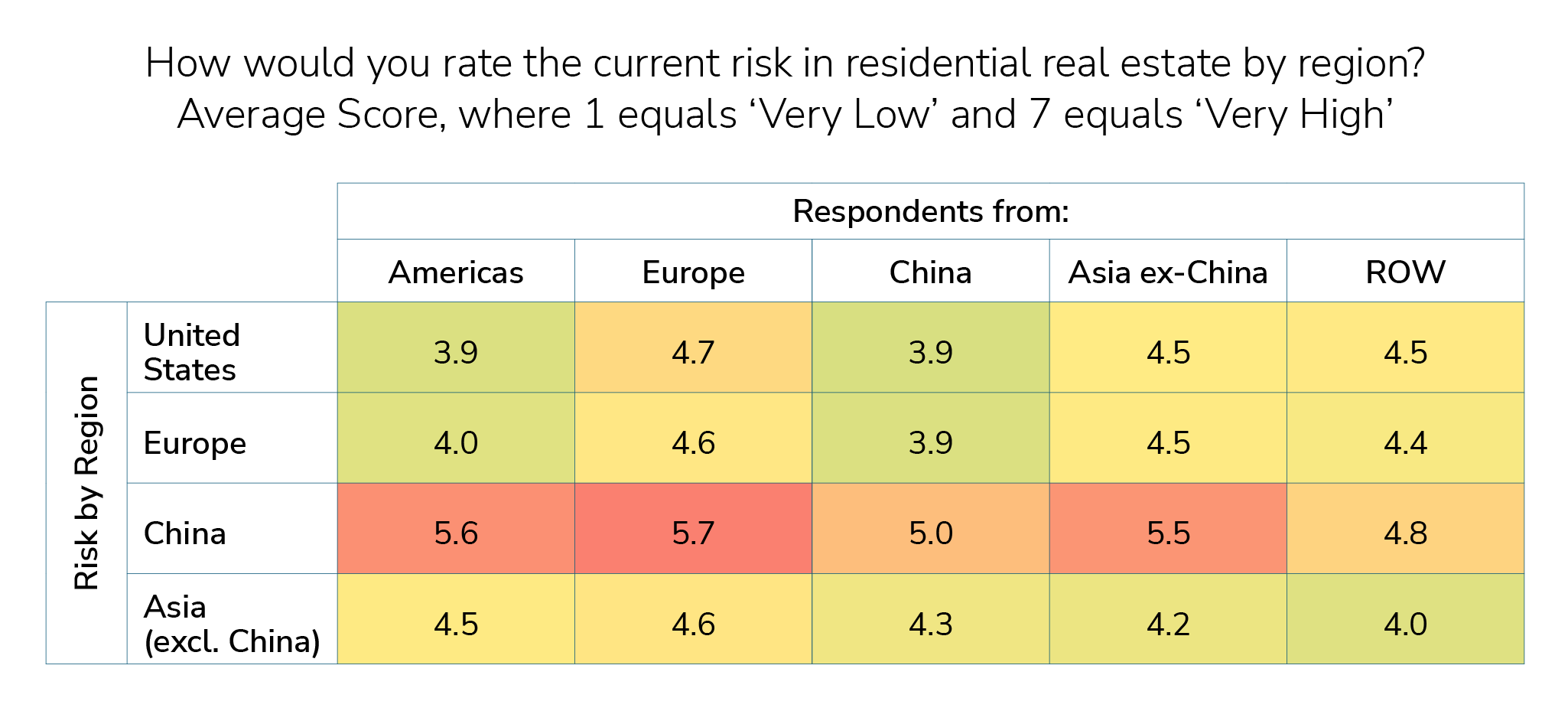

Insight #4 – Residential Real Estate Isn’t Much Better

While CRE has gotten most of the attention from observers, respondents are also quite negative on the prospects for residential real estate. Survey participants worldwide view every region as “high-risk,” with China seen as having the greatest residential real estate risk. Meanwhile, those based in Europe are the most negative for each region, including their own.

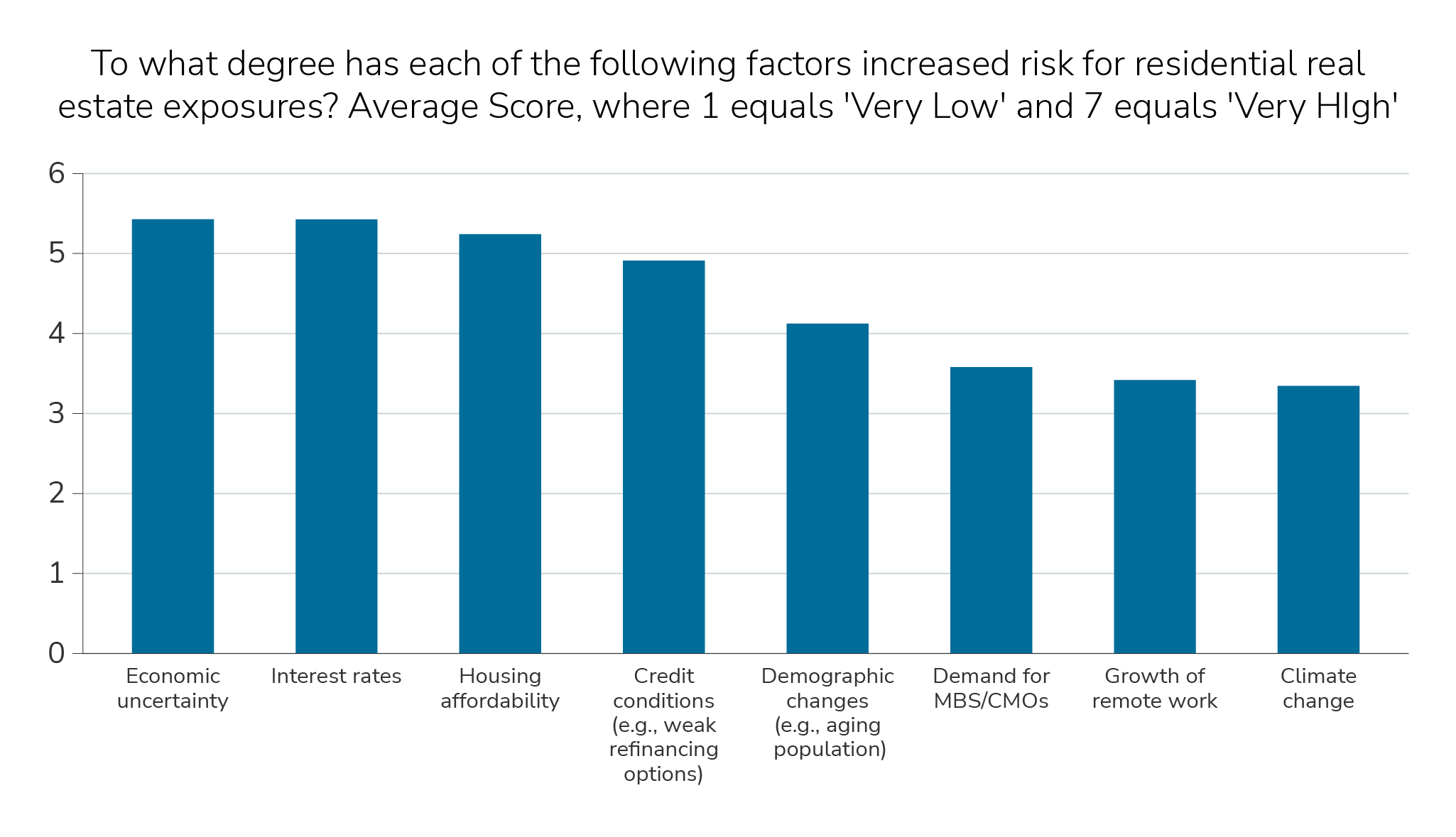

Insight #5 – Economic Uncertainty and Interest Rates Are Also Driving Residential RE Risk

Survey participants believe economic uncertainty, interest rates, housing affordability, and credit conditions — such as poor refinancing options — are the dominant factors raising residential real estate risk.

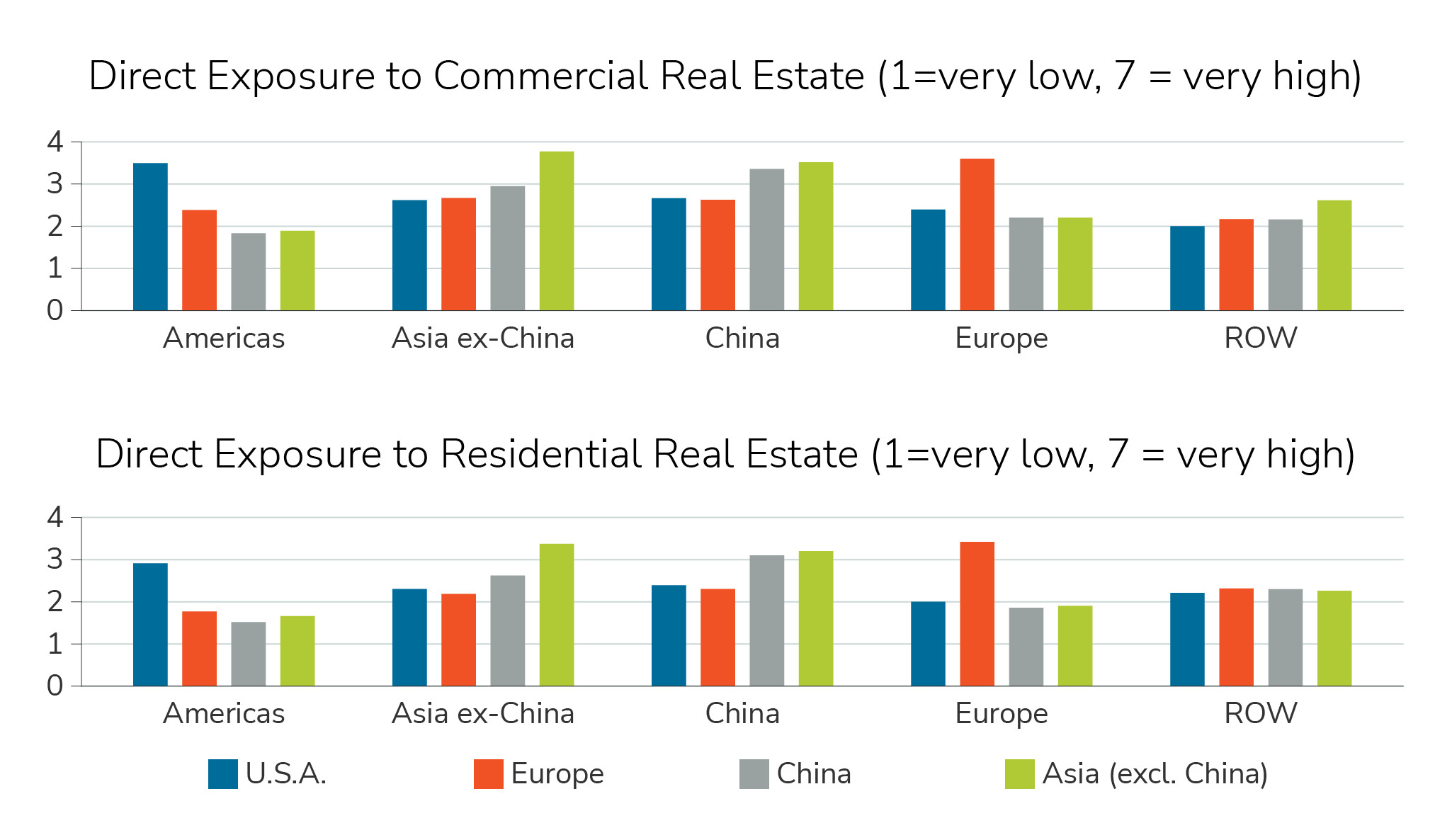

Insight #6 – Most Exposure Is to Home Geographic Region

Respondents report their firms’ direct exposure to both commercial and residential real estate was concentrated in their home geographic market.

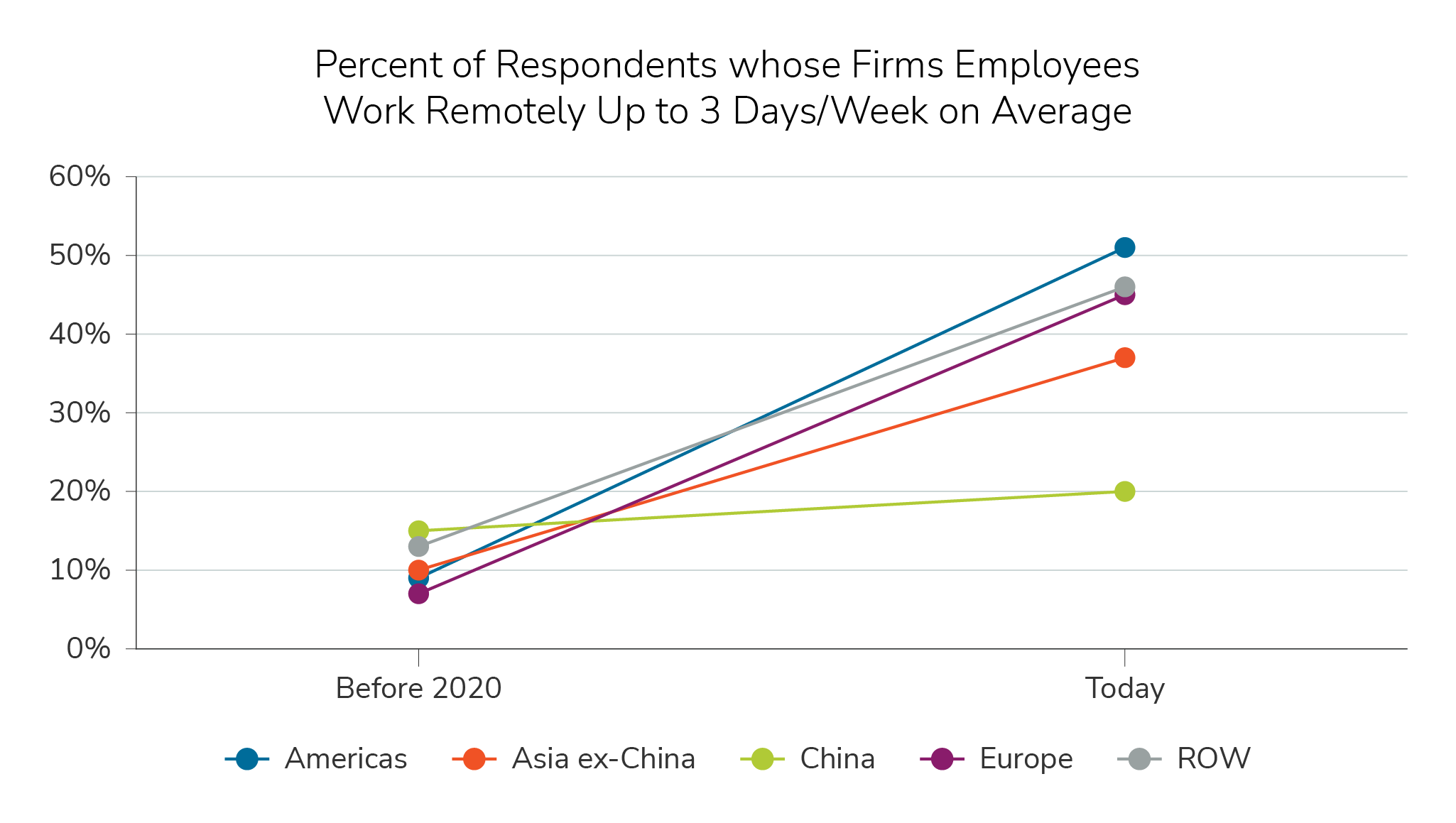

Insight #7 – Remote Work Has Increased Substantially, Except in China

Survey results show remote work has exploded across the globe since the pandemic. The exception is China — previously the top region for remote work — where growth has been far more modest.

Survey Demographics

Nearly 400 FRM-Certified professionals participated in this survey. They represent a broad swath of financial services firms and risk disciplines across the globe as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

Want to read more?

Download the full report now!