Evolving Risks Driven by U.S. Policy Changes World

April 2025

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

As the new U.S. administration advances its priorities, it’s influence on the geopolitical landscape, cross-border conflicts, markets, and risk factors has quickly become apparent.

The GARP Benchmarking Initiative (GBI)® invited Financial Risk Manager (FRM®) Certified Professionals to participate in a new survey about potential changes in the U.S. and the:

- Impact on risk management firms globally

- Preparedness of risk management firms globally

- Use of scenario analysis

Roughly 600 professionals with the FRM designation responded to the survey, representing a broad range of financial services firms and risk disciplines around the world. Roughly 60% of respondents work at large firms (over 1,000 employees) and more than 75% have at least five years of risk management experience.

Read on for the key insights from the survey results.

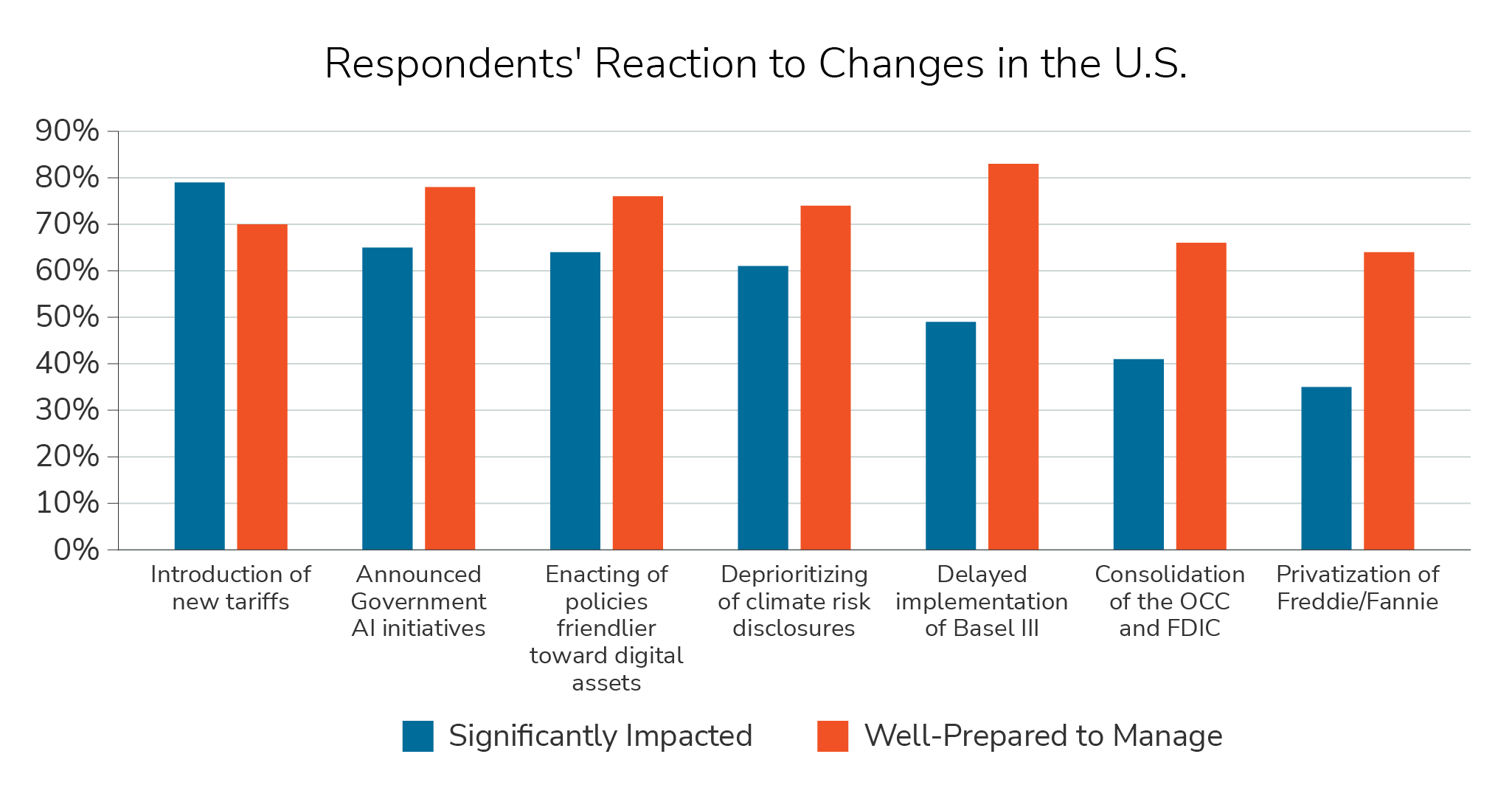

Insight #1 – Introduction of new tariffs by the U.S. seen as most impactful on firms’ risk management operations

U.S. government policies related to AI and digital assets as well as the deemphasis of climate risk disclosures were also noted as having significant impact on firms’ risk operations. A large majority of firms reported being either somewhat or well prepared to assess the consequences of a range of potential U.S. policy actions.

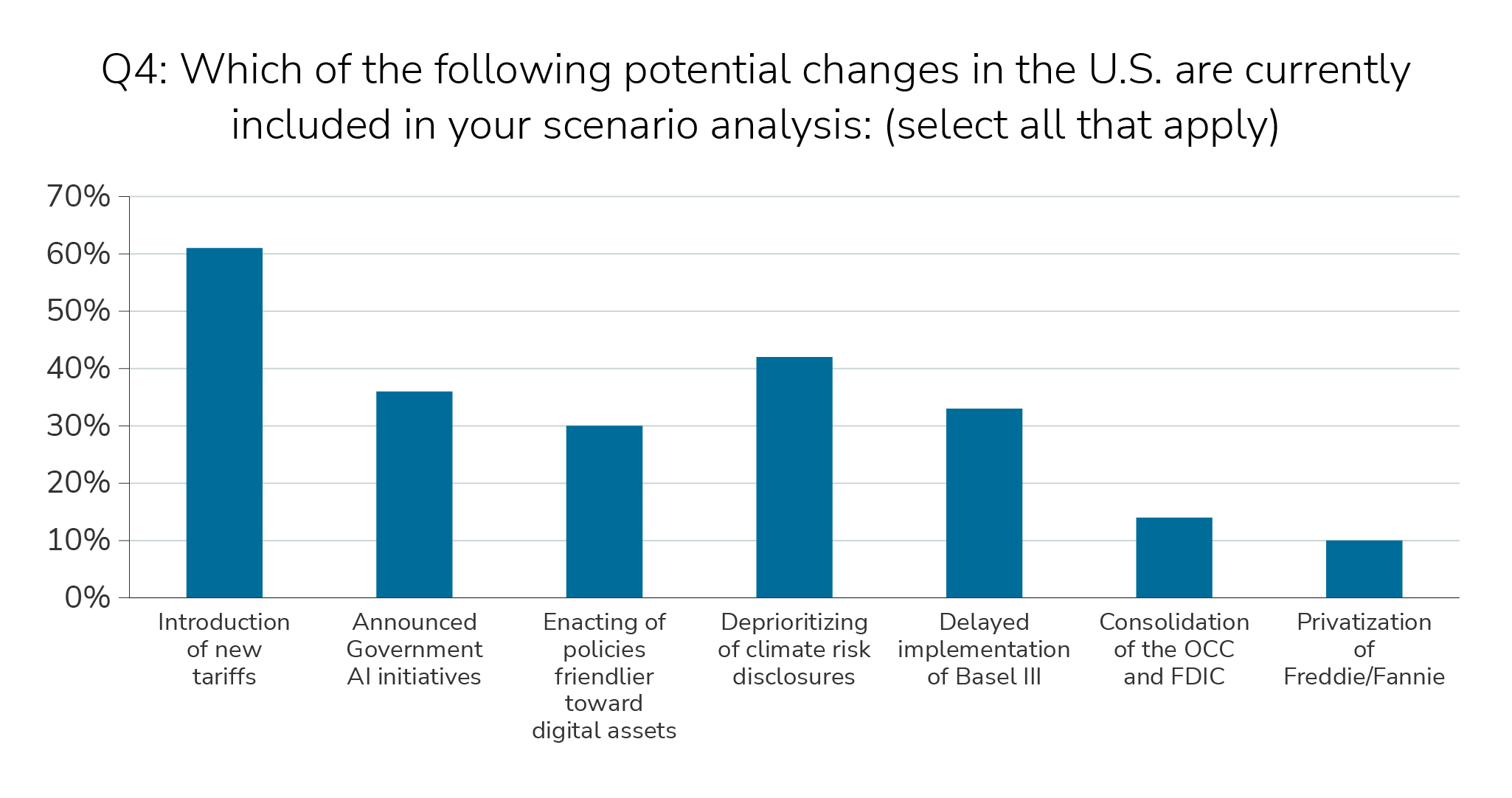

Insight #2 – Most firms conducted scenario analysis on potential new tariffs by the U.S.

Roughly one-third of respondents’ firms conduct scenario analysis for changes to U.S. policies associated with AI, digital assets, climate risk disclosure, and Basel III. Potential changes to U.S. regulatory bodies (OCC, FDIC) and government-sponsored, housing-market enterprises (Freddie Mac, Fannie Mae) are generally not considered in respondent firm scenarios.

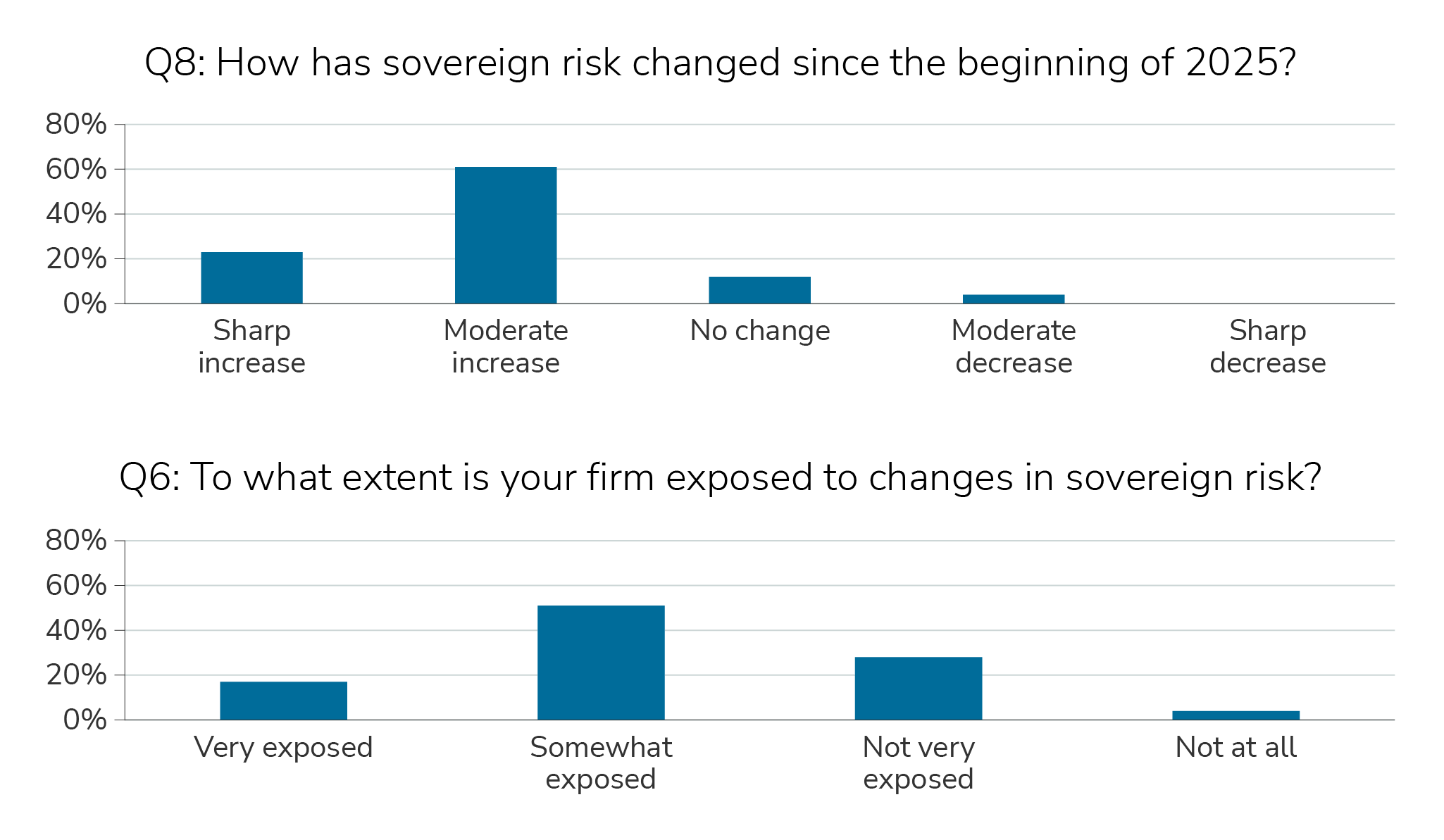

Insight #3 – Most risk managers report sovereign risk increases in 2025

Approximately 85% of respondents reported that their firm was either somewhat well- prepared or very well-prepared to manage changes in sovereign risk.

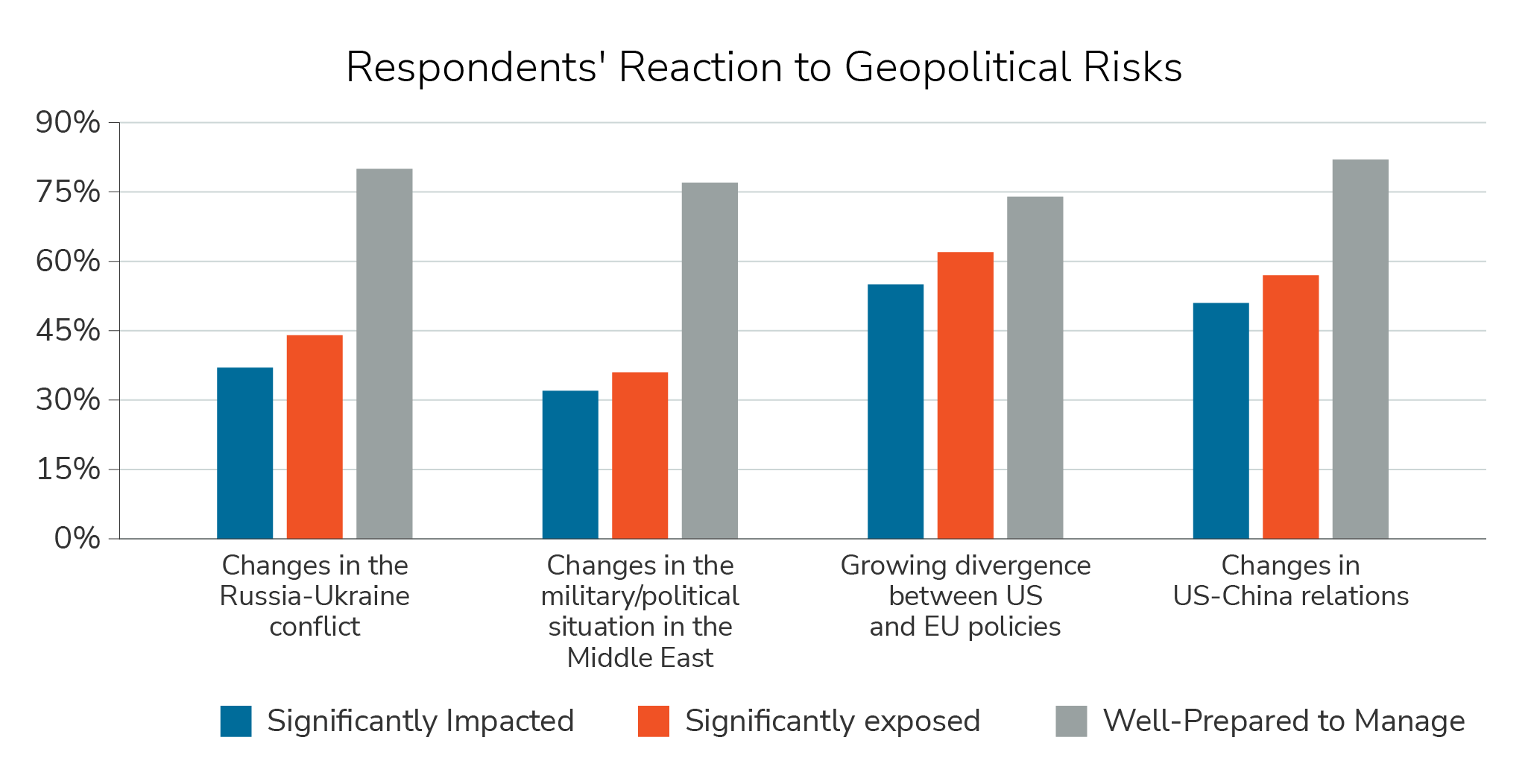

Insight #4 – Divergence between U.S. and EU policies seen as most significant risk-related event in 2025

About three-quarters of respondents reported that their firm was prepared to manage the risks related to the major geopolitical events of 2025. Approximately two-thirds of respondents indicated that their firm conducts scenario analysis on geopolitical risks; of those that do, only about half report that the growing divergence between U.S. and EU policies, changes in U.S.-China relations, or changes in the Russia-Ukraine conflict are included in their firm’s scenario analysis.

Want to read more?

Download the full report now!