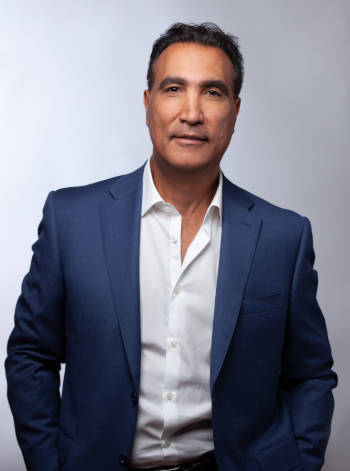

Marcos Lopez de Prado, a Cornell University professor of practice, the Journal of Portfolio Management's 2019 Quant of the Year Award winner for machine learning innovations in asset management, has joined the Abu Dhabi Investment Authority.

Lopez de Prado was named global head - quantitative research and development within the sovereign wealth fund's Strategy & Planning Department.

One of several notable senior appointments in risk and portfolio management, data, central clearing and technology during September, Lopez de Prado has had a 10-year research affiliation with Lawrence Berkeley National Laboratory, centered on high-performance computing, and he founded and led Guggenheim Partners' Quantitative Investment Strategies business. In 2018 and 2019, he was principal and head of machine learning at AQR Capital Management, and after selling some patents to AQR, he founded True Positive Technologies.

Other September announcements included Richard Wise from Credit Suisse becoming Hong Kong Exchanges & Clearing's new group chief risk officer; Zion Hilelly, moving from BlackRock to a managing director role at IHS Markit Financial Services Solutions; former Beyond Ratings chief executive officer Rodolphe Bocquet as global head of ESG at Deutsche BÖrse Group's Qontigo unit; in digital assets, Jeanine Hightower-Sellitto as CEO of Atomyze and former Nasdaq executive John Jacobs as a director of tZERO; and, in clearing infrastructure, Teo Floor as CEO of the CCP12 association and Lisa Hershey as chief compliance officer of Depository Trust & Clearing Corp.

On the last day of the month, Barclays in London announced that Taalib Shaah would become group CRO on October 5, joining the executive committee and reporting to chief executive Jes Staley. Shaah joined Barclays from Citigroup in 2014 and was most recently CRO for Barclays International. He succeeds C.S. Venkatakrishnan, CRO since 2016, who becomes global head of markets and co-president of Barclays Bank PLC.

Applying Machine Learning

At ADIA, Lopez de Prado is part of a newly created group ”tasked with applying a systematic, science-based approach to developing and implementing investment strategies,” according to the fund's announcement. “This multi-disciplinary team will draw on the latest scientific developments, in areas such as machine learning, big data and high-performance computing.”

Lopez de Prado is known for a significant body of research and academic writings and for insights on technology's impact on the financial industry.

In December 2019 testimony to the U.S House Financial Services Committee's Task Force on Artificial Intelligence, the professor acknowledged “substantial hype around the application of ML to financial problems.” He also pointed to “remarkable successes on a wide range of use cases” where there is at least potential to replace human functions, as well as where machine learning “is presently best used to enhance and support the role of human experts.”

As detailed by Cornell's engineering school, “His innovations have covered and connected a wide range of subjects, including overfitting prevention, signal processing, quantum computing, stochastic optimal control, robust convex optimization, and market microstructure. These innovations have resulted in dozens of scientific articles in the leading academic journals, and 13 patents, most of which have been acquired by asset management companies.”

“What we were trying to do is bring the power of machine learning techniques to not only evaluate how well our current methods and models work, but also to help us extend these in a way that we never could do without machine learning,” Maureen O'Hara, the Robert W. Purcell Professor of Management at Cornell's SC Johnson College of Business, said in August about the recently published Microstructure in the Machine Age. O'Hara, Lopez de Prado, Cornell professor David Easley and Zhibai Zhang of New York University's Tandon School of Engineering are the co-authors.

Lopez de Prado has produced textbooks, including Advances in Financial Machine Learning (Wiley, 2018) and Machine Learning for Asset Managers (Cambridge University Press, 2020), and is a founding co-editor of The Journal of Financial Data Science.

He earned a Ph.D. in Financial Economics (2003), a second Ph.D. in Mathematical Finance (2011) from Universidad Complutense de Madrid, and received Spain's National Award for Academic Excellence (1999). He completed post-doctoral research at Harvard University and at Cornell University, where he teaches financial machine learning within the Operations Research and Information Engineering program and directs multiple student projects.

Recruited from Credit Suisse

As of June 1, Roland Chai, a former group risk officer and head of post-trade at Hong Kong Exchanges & Clearing, had moved to Nasdaq as chief risk officer, based in Sweden. His move touched off a reshuffling in HKEX's senior ranks. John Killian, who had been group chief financial officer, became group chief risk officer in February, intending to retire once a permanent replacement was recruited.

On September 7, chief executive Charles Li announced that Richard Wise, Credit Suisse's Singapore-based chief risk officer - Asia Pacific, will become HKEX's group CRO in November, with Killian staying on into the first quarter of 2021 to aid in the transition.

“I am very delighted to welcome Richard to HKEX to lead our critical risk management function,” Li, who is due to retire on December 31, said in a statement. “He brings to the group nearly three decades of experience in financial markets, and will work across the business to ensure that our risk culture, policies and procedures are front and central in all that we do.”

Wise has worked in financial markets in London, Tokyo, New York and Singapore. His positions over the last 20 years included global head of market risk management at JPMorgan and CRO for JPMorgan Securities, both in New York. He started his career in London trading equity derivatives and fixed-income products, and holds a double first class degree in mathematics from Cambridge University.

At HKEX, Wise will be overseeing risk functions including group credit and quantitative analysis, group cyber and technology risk management, and enterprise risk management.

Under Killian, in August, the exchange company named Hong Kong Monetary Authority veteran Brian Lee group head of technology risk.

BlackRock's Hilelly to IHS

Data and analytics giant IHS Markit has hired Zion Hilelly, a veteran of BlackRock's Aladdin business, as managing director, head of operations, client support and service & transformation for its Financial Services Solutions business. Hilelly is filling a new position, based in New York and reporting to Andrew Eisen, senior vice president and head of Financial Services Solutions.

“We are absolutely thrilled to bring Zion aboard to advance the strategy for operations, data and service management and industry engagement throughout our entire business,” Eisen said. “Zion's expertise is well-recognized across global financial markets, and he will be instrumental in accelerating our vision for an enhanced customer experience with greater flexibility, efficiency and best-in-class delivery.”

In more than 20 years with BlackRock, where he was a managing director, Hilelly was responsible for developing and leading multiple post-trade businesses and capabilities of the Aladdin investment and risk management platform, which is used by BlackRock and a global client base

Hilelly was the creator and head of Aladdin's outsourcing business and the head of Aladdin's post-trade software development group, creating an integrated front-to-back investment platform for asset managers and asset owners.

According to IHS Markit, “he was also a senior member of the firm's transformation area, where he pioneered an innovative product and operating model with custodian banks and led the integration of key operating areas after the largest acquisitions in the asset management industry. Earlier in his career, Hilelly was the head of portfolio administration, playing a key role in developing BlackRock's operating environment servicing institutional clients.”

For IHS, he is spearheading a business acceleration and agility initiative to streamline data operations, WSO Services and software operations, cloud-hosted and managed services and global software, data and services support functions. The businesses of Financial Services Solutions include WSO (formerly Wall Street Office), ClearPar, iLEVEL, Debtdomain, EDM (enterprise data management) and thinkFolio.

“I'm excited to join forces with IHS Markit to drive a business transformation that will help us capitalize on tremendous opportunities to deliver additional value,” Hilelly said in a September 9 statement. “Through the integration of our leading multi-asset software, data, managed services and full outsourcing solutions, IHS Markit will be uniquely positioned to provide holistic front-to-back solutions that can meet the growing needs of asset owners, asset managers and capital markets participants in private and public markets.”

Hilelly earned B.S. and M.B.A. degrees from the New York University Stern School of Business after serving three years in the Israel Defense Force.

ESG Leader Joins Qontigo

Co-founder in 2014 - and CEO - of Beyond Ratings, which was sold to London Stock Exchange Group in 2019, Rodolphe Bocquet helped lead an early wave of data innovations supporting environmental, social and governance (ESG) investments. At the time of the LSEG transaction, Bocquet noted that the two companies had “worked together for some time on potential solutions and products based on client demand and market trends and will build on our strong ESG foundations to deliver valuable investment tools in the near future.”

Effective September 22, Bocquet is occupying the newly created position of global head of ESG at Qontigo, the Deutsche BÖrse Group subsidiary that includes the Stoxx and Dax indices as well as investment management technology and analytics provider Axioma, also a 2019 acquisition.

Bocquet was described by Qontigo chief business officer Holger Wohlenberg as “both a visionary and a and practical innovator in ESG, with a range and depth of experience that adds enormous credibility and traction to our ambitious ESG expansion plans.”

DB1 in recent years has placed emphasis on “a wide range of sustainability indices that investors can use as the basis for sustainable investment,” its website says, pointing out that the Stoxx index arm “has been a signatory of the UN Principles of Responsible Investment (PRI) since 2012.”

Bocquet began his career in trading and risk management at SociÉtÉ GÉnÉrale, shifting his focus in 2001 to energy, climate and sustainability. He held positions with Carbone 4, AFTER, Agence FranÇaise de DÉveloppement, Conseil RÉgional d'Aquitaine, ADEME (Environment and Energy Management Agency), Eco-Carbone and other organizations. He was most recently an independent sustainability consultant for clients such as the World Bank and Inter-American Development Bank.

He earned an M.B.A. from HEC Paris, which included studies at NYU's Stern School of Business, and he has a master's degree in environmental engineering from Mines ParisTech ISIGE.

Executive Extensions and a New Deal

Deutsche BÖrse was active on other fronts. On September 18 it announced five-year extensions of the mandates of two executive board members, Thomas Book and Stephan Leithner, through June 2026. Both have been on the executive board since July 2018.

Book oversees the Trading & Clearing division, which includes the Frankfurt Stock Exchange, Eurex derivatives exchange, Eurex Clearing, the 360T foreign exchange trading platform, the energy and commodity business of the EEX Group and the market data business.

Leithner is responsible for Pre & Post-Trading, which includes Qontigo and post-trade services provider Clearstream.

The BÖrse also announced its purchase of a majority stake in Quantitative Brokers, a developer of advanced execution algorithms and analytics that is described as “well integrated into the buy side value chain” and “a thought leader in market structure.”

“We are investing in a growth business with a renowned, innovative and leading quant team delivering a unique set of competencies in algorithmic execution,” Thomas Book said. “The exciting QB platform and team are a perfect fit with both our existing business and our long-term strategic perspective.”

Quantitative Brokers has operations in New York, London, Sydney, and Chennai, India. The co-founders, CEO Christian Hauff and chief scientist Robert Almgren, will stay in those roles and retain “significant portions of their shareholdings,” Deutsche BÖrse said.

Marking his firm's 10th anniversary in August, Almgren said: “It has been an amazing journey, and I am grateful to our clients and the QB team members who have made QB the market structure leader that it is today. Our advances in execution analytics and technology have saved our clients hundreds of millions of dollars in transaction costs over the past decade. We will continue to be driven to advance the frontier of algorithmic execution to reduce trading costs for all clients, while delivering high quality service and market execution every step of the way.”

Atomyze for Commodities

Atomyze, a digital asset and commodity tokenization venture founded in Switzerland and part of the Hyperledger open-source blockchain community, has named Jeanine Hightower-Sellitto as CEO of its U.S. arm, Atomyze LLC.

The announcement on September 24 came two months after the effective date of her appointment, which followed nearly two years during which she was managing director, operations of Gemini Trust Co., the regulated crypto asset exchange and custodian founded by Cameron and Tyler Winklevoss. Before that, Hightower-Sellitto was chief operating officer of International Securities Exchange, an electronic options market pioneer that Nasdaq acquired in 2016.

“Jeanine has more than 20 years of experience building markets and using disruptive technology to develop platforms that serve the evolving needs of institutional investors,” said board chairman John Macfarlane. “Her combination of financial services and blockchain experience make her uniquely qualified to build and scale Atomyze,” which has its U.S. headquarters in Greenwich, Connecticut, and is currently working to obtain operating licenses.

“We believe blockchain technology will improve access to trading physical assets, will provide much needed liquidity to the market and ultimately help evolve the way commodities are traded. Jeanine is the right leader to usher in this new era of trading and help Atomyze achieve our vision,” Macfarlane added.

The company brought onto its platform earlier this year the Global Palladium Fund, which is backed by PJSM MMC Norilsk Nickel, the world's largest producer of palladium and high-grade nickel and a major producer of platinum and copper.

New tZERO Director

John Jacobs, a former Nasdaq executive vice president and chief marketing officer, has joined the board of tZERO, the capital-markets-focused blockchain enterprise that was launched by Overstock.com and is owned by its Medici Ventures subsidiary.

“Jacobs is known for his business success and expertise in working with institutional investors, IPOs and global public companies,” New York-based tZERO said in its September 21 announcement. His accomplishments in more than 30 years at Nasdaq included creating the Global Index Group and one of the world's largest exchange-traded fund families, growing out of the Nasdaq-100 Index-tracking QQQ.

Jonathan Johnson, chairman of the five-member tZERO board and CEO of Overstock.com, said, “John brings valuable experience in leading transformative projects in capital markets, which will play an important role in providing strategic guidance on tZERO's growth strategy.”

Securities and Exchange Commission-registered broker-dealer tZERO Markets has obtained approval as a Financial Industry Regulatory Authority member firm, which tZERO CEO Saum Noursalehi said “is an important milestone and further advances our vision of creating the most robust and innovative marketplace for private assets . . . We expect tZERO Markets to launch its services in a couple of months.”

Jacobs said that he is “thrilled” to join the board and “look[s] forward to continuing to build on the successes that the tZERO team has achieved as it continues to build its innovative private asset liquidity platform.” Jacobs' other current roles include chairman of Alerian, founder and CEO of Q3 Advisors, and executive director of the Georgetown University Center for Financial Markets and Policy. He is also an adjunct professor of finance at Georgetown's McDonough School of Business.

CCP12 and DTCC

CCP12, the Global Association of Central Counterparties, appointed its second CEO, and Depository Trust and Clearing Corp., one of CCP12's 37 members, has a new chief compliance officer.

At CCP12, Teo Floor from Deutsche BÖrse's Eurex Clearing succeeded Marcus Zickwolff as CEO on October 1. Zickwolff, who led the group since 2017, is staying on for a transition period and will remain in the industry as founder and managing director of ZIRE Consulting Services, CCP12 said on September 24.

Floor had been with Eurex Clearing since 2008, most recently as special adviser to the CEO. He was also a vice chair for the EMEA region in the CCP12 executive committee, as well as a co-chair and treasurer in the board of the European Association of CCP Clearing Houses (EACH)

CCP12 chairman Kevin McClear, who is president of ICE Clear U.S., expressed confidence that Floor “is the right person to lead CCP12 in the future and to strengthen the association's position as the global representative and voice of CCPs.”

McClear praised Zickwolff as “a true CCP expert . . . From his first contact with CCP12 in Boston 2007 to his appointment as CCP12 CEO in Shanghai 2017, Marcus held various positions within CCP12. He knows the organization and the CCP world by heart, and due to his expertise, CCP12 was able to evolve greatly in the past years to serve as the voice of the CCP world.”

DTCC said on September 23 that Lisa Hershey will take over as chief compliance officer on January 1. Hershey is a DTCC managing director, currently head of operational risk management, and will be reporting to Ann Shuman, managing director and general counsel.

The current CCO, Susan DeSantis, plans to retire in early 2021 after a 25-year career at the organization.

Since joining DTCC in 2009, Hershey “has developed a broad understanding of nearly every aspect of DTCC's business and its approach to effective risk management and compliance,” the firm said. She has overseen third-party risk management enhancements and new-initiatives functions, played a key role on the Investment & Operating Committee, and has been co-leading the Governance, Risk and Compliance Council.

“As a critical market infrastructure for the global financial markets, DTCC must comply with multiple laws, regulations and governmental guidelines while promoting the highest ethical standards for our company and our employees,” Ann Shuman said. “Lisa's expertise and experience will be critical as she oversees a team of professionals as they navigate an ever-growing list of rules and requirements across multiple jurisdictions.”

Ex-Banker, Tech CEO on Thomson Reuters Board

News and business information company Thomson Reuters said that Deanna Oppenheimer and Simon Paris will join its board of directors, effective November 11.

Oppenheimer is founder of CameoWorks, which advises leaders of early-stage companies and consultancies, and a Bain & Co. senior adviser. She previously was one of banking's highest-ranking women. She was with Washington Mutual from 1985 to 2005, rising to president of consumer banking. At Barclays between 2005 and 2011, she was chief executive of U.K. retail and business banking and vice chair of global retail banking.

She is also board chair of Hargreaves Lansdown, senior independent director of Tesco, and a director of Whitbread.

Paris is CEO of financial technology provider Finastra, formerly Misys, which he joined as president in 2015. He also served as chief sales officer before being appointed deputy chief executive in 2017 and CEO in July 2018. He was at SAP from 2007 to 2015, where his leadership positions included president, Industry Cloud.

Also a former McKinsey & Co. senior consultant, Paris currently chairs the World Trade Board, a global forum which Finastra initiated, and is a director of Everbridge.

“Deanna and Simon are forward-thinking, customer-centric leaders who will assist Thomson Reuters to re-imagine how we deliver products, employ technology and execute upon our company's strategic growth initiatives,” Thomson Reuters chairman David Thomson said in a statement. “They represent invaluable additions to our boardroom, and I am delighted to welcome them.”