After years of ups and downs that effectively disqualified them as long-term portfolio holdings, crypto assets are staking a claim for investment legitimacy. Bitcoin’s sustained price above $100,000 – a floor in the eyes of longtime boosters – looks like a proxy for a sector that is attracting new classes of investors and official support from governments, some of them accumulating crypto reserves as well as regulating the products.

Typically wary of fads and volatility, pension funds are tentatively embracing crypto as a new alternative asset class to diversify their risk while addressing shortfalls in their retirement obligations.

Represented among participants in an EY Parthenon-Coinbase survey of institutional investor decision-makers were eight public funds and 12 private ones. All were investing in digital assets as of January, and 16 planned to increase those holdings this year. (Out of 352 total survey respondents, 86% had exposure to digital assets or planned to make digital asset allocations in 2025.)

Pension assets “are not sufficient to pay off in the long run,” says Vinod Jain, a strategic advisor in the capital markets team at Datos Insights. The funds “are exploring this mechanism of investing in crypto to increase the returns.”

Across all 50 states, assets under management by state pensions amounted to 49.1% of their obligations to plan participants in 2021 – an $836 billion shortfall, according to Pew Charitable Trusts.

Cryptocurrencies are “the biggest opportunity to generate attractive risk-adjusted returns,” according to the EY Parthenon-Coinbase Institutional Investor Digital Assets Survey. (352 respondents each selected their top three.)

Looking for Infrastructure

But there were, and still are, risk management considerations holding the institutions back from cryptocurrencies.

“Is there a Northern Trust in this space?”, Crisil Coalition Greenwich senior analyst David Easthope asks rhetorically, naming one of the top custodian banks that conventionally safeguard managed assets. “No, and there never will be.”

David Easthope of Crisil Coalition Greenwich

Although custodians like Northern Trust, BNY and State Street are developing digital-asset strategies in a business also served by “crypto natives,” Easthope’s point speaks to why pension funds are forgoing the tax advantages of investing through separately managed accounts in favor of registered exchange-traded funds (ETFs) that own cryptocurrency. Or they are buying derivatives contracts.

To stay within a comfort zone, they’re focused primarily on the most prominent crypto asset – bitcoin.

“Most of them have been waiting,” says Easthope. “And now they feel that, because of ETFs, they can dip their toe in now, slowly.”

Corporates and Retirement Accounts

Meanwhile, corporations are pouring into so-called bitcoin treasuries, a strategic trail blazed by Strategy, the company formerly known as MicroStrategy and led by bitcoin bull Michael Saylor.

As of January, there were $113 billion in assets under management in bitcoin ETFs, $169 billion in CME Bitcoin Futures (open interest), and $3.4 billion in CME Ether Futures (open interest), according to Crisil Coalition Greenwich, citing Amberdata. (See: Record High Number of CME Bitcoin Traders Suggests Growing Institutional Interest.)

There is considerably less crypto activity among 401(k), 403(b) and other defined contribution plans where employee/beneficiaries make selections.

Holly Verdeyen of Mercer

“Most plan sponsors have avoided crypto as a DC investment option due to regulatory and fiduciary uncertainty and price volatility,” explains Holly Verdeyen, U.S. defined contribution leader at Mercer. The few DC plans that have adopted or invested in crypto “aren’t invested in by participants on a large scale.”

Know-your-customer (KYC) compliance concerns are hard to shake, notes Mike Johnson, EY Americas financial services solutions leader for digital assets and tax.

Verdeyen adds, “We also believe reputational risk stemming from crypto’s association with fraud and speculation may further discourage many institutions from entering this space.”

In May, the U.S. Department of Labor rescinded guidance from 2022 that discouraged crypto assets in 401(k) accounts, prompting approval from the Investment Company Institute: “The choice to include cryptocurrency in retirement plan investments or not should be left up to the plan fiduciaries, who are in the best place make decisions. Thanks to DOL's action, they are once again free to set their course under the long-standing ERISA fiduciary standards of prudence and loyalty.”

One Step Back

At least one large pension fund has backed out of crypto. An SEC filing by the State of Wisconsin Investment Board (SWIB), which manages more than $160 billion in assets, on May 15 showed that it had sold its entire stake in the BlackRock iShares Bitcoin Trust (IBIT). Just three months earlier, the SWIB reported that it had invested $321.5 million in that ETF, whose price fell 16.8%, from $60.42 on January 21 to $43.59 on April 8.

EY’s Johnson and Datos’s Jain suggest as an antidote stablecoins, which are pegged to an underlying value such as a fiat currency. Five of the 20 funds in the EY Parthenon-Coinbase survey had stablecoins, and 12 others were “interested” in them.

Johnson predicted that with the regulatory clarity promised by pending U.S. legislation, “we will start to see a mass adoption in the next couple of years.”

Seventeen state governments already allow “or have introduced legislation to allow” including cryptocurrency as a reserve asset, and 16 others are at earlier stages of enabling their pension trusts to invest in crypto, says Geoff Buswick, managing director and sector leader of S&P Global’s U.S. Public Finance Group.

In Arizona, seven statewide pension plans allowed crypto assets in their trusts, and four of them actually owned them, according to a March 27 S&P report. Arizona Governor Katie Hobbs signed a bill May 7 to establish a state-managed Bitcoin and Digital Assets Reserve Fund to comprise up to 10% percent of the state’s assets.

On May 6, New Hampshire Governor Kelly Ayotte signed a bill that will allow that state to invest up to 5% of its assets in cryptocurrency and/or precious metals.

A Texas state senator, Charles Schwertner, claimed when introducing a bitcoin reserve bill in February that the “digital gold” would provide yields necessary to meet obligations “that our children and children’s children will be unable to pay.”

On a single day, May 21, four crypto-related bills were introduced in Michigan, Cointelegraph reported. One would allow the state treasurer to invest in cryptocurrencies that averaged a market capitalization above $250 billion over the last calendar year. Bitcoin and ether are the only two that would qualify, and they would have to be held in exchange-traded products.

Connecticut lawmakers, by contrast, moved decisively to prohibit state investment in virtual currencies.

5% Allocation Considered

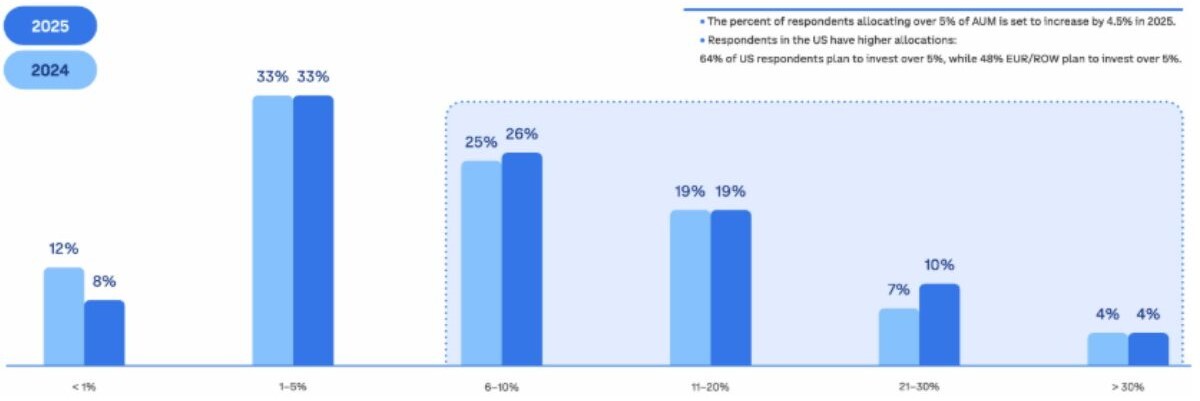

To be sure, large institutional investors are playing it safe. Twelve of the 20 pension funds surveyed by EY Parthenon and Coinbase were planning to allocate 5% or less of their total assets to crypto this year. But six out of 10 of all survey respondents were expecting to go above 5% in 2025.

Asset allocation percentages from EY Parthenon-Coinbase survey (n=345)

“In general, we view a diverse asset allocation policy as mitigating risk,” says S&P’s Buswick. “If it’s within a program, and limited in scope, there wouldn’t be an inherent credit negative.”

A 5% allocation within a diverse portfolio of stocks and bonds would increase risk minimally while substantially increasing returns, Matt Hougan, chief investment officer, Bitwise Asset Management, wrote in a June 3 note. He said 5% in bitcoin, 57% in the SPDR S&P 500 ETF Trust (SPY) and 38% in the iShares Core US Aggregate Bond ETF (AGG) would have generated risk, as measured by standard deviation, of 12.54% over five years through December 31, 2024.

That would have been only 1.2 percentage points higher than the 11.34% standard deviation of a portfolio that invested 60% of assets in that equity ETF and 40% in that bond ETF over the same period. Yet the cumulative investment return from the hypothetical portfolio with bitcoin would have been 86.63%, compared to 52.69%.

“When you think about adding bitcoin to a portfolio, don’t do it in isolation,” Hougan advised. “Think about it in the context of your entire risk budget.”

Reuters reported June 17 that Spanish bank BBVA was recommending a 3% to 7% crypto allocation for affluent clients.

Topics: Investment Management