In the wake of recent bank failures, many long-standing notions about what constitutes safety and soundness in the financial industry have come under intense scrutiny.

The failure of existing regulations to provide adequate safeguards has prompted a reassessment of the supervisory approach to financial stability. Several measures have been proposed in response to this failure, including the expansion of reverse stress testing, the development of robust contingency planning, and the implementation of multiple stress scenarios.

Alla Gil

Placing a renewed emphasis on reverse stress testing of the balance sheets of financial institutions is proactive risk management that goes way beyond the normal “checking of the box” for regulatory compliance. It therefore seems like a constructive step in the right direction.

However, there are other proposed regulatory changes – including the Basel III Endgame (B3E) and the final rule for the Fundamental Review of the Trading Book (FRTB) – that have generated quite a bit of pushback. The implementation of these regulations will be difficult, and may at times seem impractical and overwhelming for financial institutions.

Let’s now take a closer look at the proposed rules and the obstacles they present – and also examine how financial institutions can use exhaustive scenario analysis to meet these challenges.

Basel III Endgame and the FRTB: Controversial Approaches

The upcoming regulation that has perhaps caused the most controversy is this year’s Basel III Endgame (B3E) proposal. Crafted by a regulatory coalition comprising the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency, the B3E is expected to result in a significant increase in regulatory capital for large banks.

As part of the development of Basel III, the Basel Committee on Banking Supervision has also proposed contentious revisions to the way market risk is calculated under the final version of the FRTB.

Critics argue that these regulatory changes could have adverse effects on the banking industry and its clients, including both corporate entities and retail customers, by reducing lending capacity and potentially stifling economic growth.

This criticism of B3E, however, misses the critical issue of the current imbalance between reliance (or overreliance) on historical data versus projecting future behaviors. Forward-looking projections will help to distinguish between proactive risk mitigation and the capital cushion that must be held against unavoidable shocks. The former is needed to avoid the rare yet feasible combination of market turbulence (like inflation) with a steep yield curve, declining asset values and an oil crisis.

The Federal Reserve recognizes the necessary balance between forecasting and mitigating shocks in its proposed multiple scenario approach for CCAR capital calculations. Using multiple stress scenarios for FRTB would also help identify underlying weaknesses, rather than just increase regulatory capital.

As long as such stress scenarios are customized to the firms’ specific exposures, they can provide effective contingency planning based on early warning signals. However, while the selection of historical data in the FRTB proposal can be fine-tuned, looking solely at historical data may be insufficient and even counterproductive in ensuring a bank's resilience.

Consider, for instance, a bank that has faced substantial losses in the past. It is likely that our example bank has taken corrective actions and implemented risk management measures to prevent such losses from recurring. Conversely, banks that haven't experienced large losses might be exposed to hidden vulnerabilities, which may not be apparent from their historical performance data.

Combining Historical Data with Full-Range Scenario Analysis

To address these limitations, historical analysis should be complemented by a forward-looking approach. Regulatory and internal stress testing should not only assess a bank's past performance but also scrutinize the behavioral dynamics of its assets and liabilities going forward.

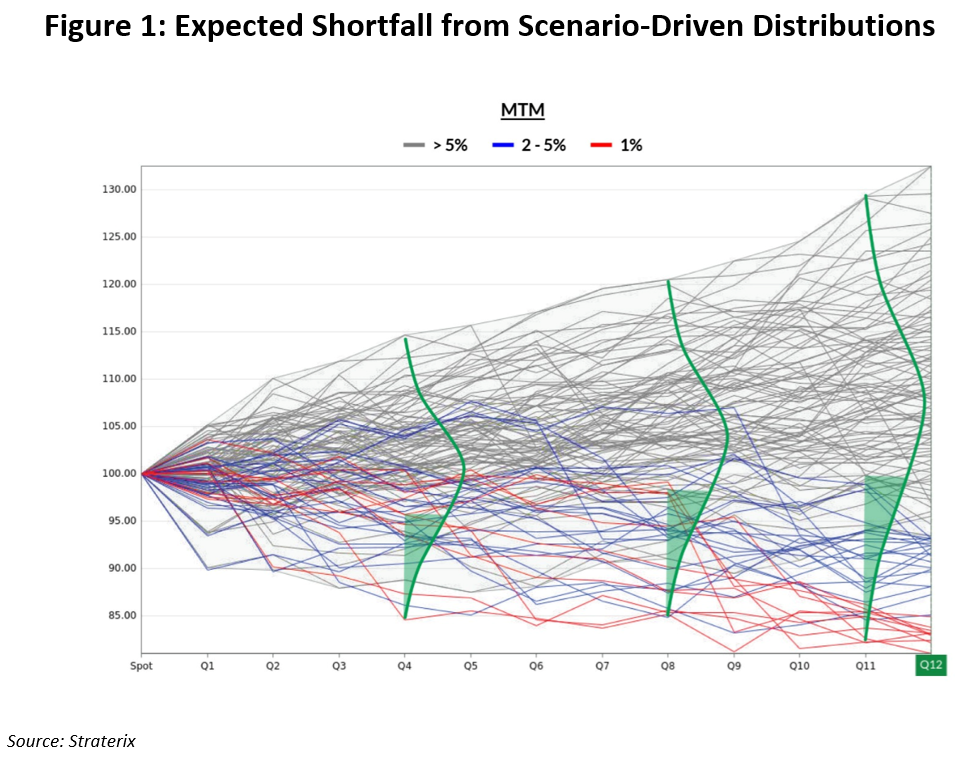

Under the updated FRTB, existing VaR and stress VAR models are expected to be replaced with expected shortfall (ES), which can be estimated using full range, forward-looking scenarios. Merely extending VaR’s time horizon or increasing the underlying parameters of underlying distributions is not helpful, because, as a measure of tail risk, ES should be obtained from the empirical distributions of respective KPIs or KRIs evolving over time as demonstrated in (see Figure 1).

The chosen KPI in Figure 1 is a portfolio mark-to-market on thousands of scenarios over the considered time horizon. Every quarter (or any other selected frequency), the full distribution of outcomes allows for explicit calculation of ES for any preferred tail percentile.

The grey lines in the chart represent all scenarios; the blue lines show scenarios leading to 95th percentile at a three-year horizon; and the red lines indicate 99th percentile at the same time point. The ES – the area under the curve corresponding to the selected percentile – is illustrated in green.

Since the distribution comes directly from the forward-looking scenarios, it is possible to trace which scenarios have a higher probability to end up in the shaded area – i.e., the tail covering expected shortfall. This enables risk managers to turn the FRTB regulatory exercise into proactive risk-mitigation action.

Full-range scenario analysis addresses the incremental risk charge proposed in the FRTB, and should contain three types of variables: macroeconomic and market variables (e.g., rates, credit spreads, GDP and unemployment); institution-specific variables (e.g., loan levels, deposit volumes, delinquencies and prepayments); and the final derived KPIs (e.g., capital and liquidity ratios, net income, positions values and cash flows). Exhaustive scenario analysis should capture all defaults and downgrades – as well as changes in correlations between such events.

Behavioral risks can be included in scenario projections – as well as operational risks, counterparty exposures and other risk types that are usually not included in VaR.

Capturing Shocks for Structured Products

Another controversial element of the FRTB is its recommended changes to charges for structured products. Specifically, the FRTB reduces the capital charge for some AAA-rated tranches and increases risk weights on securitizations with less subordination.

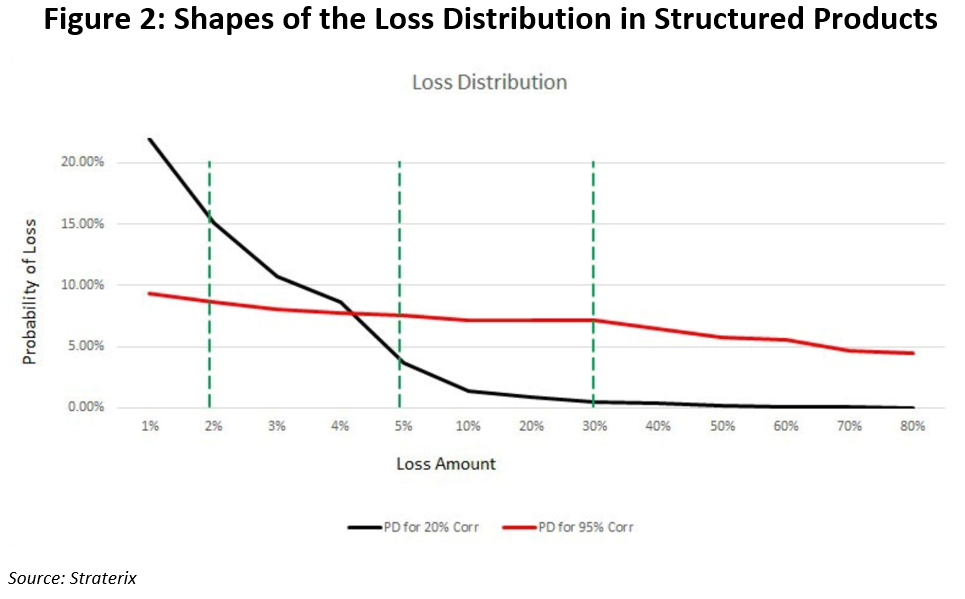

However, it is important to remember that neither high rating nor substantial subordination helped holders of structured products during the global financial crisis (GFC). The shape of the loss distribution function for the entire collateral pool in such products depends, rather, on the correlation of the underlying assets.

Figure 2 shows how tranches with the same loss subordination can have very different probabilities of being "hit," depending on the correlation of the underlying pool. The black line represents a well-diversified collateral pool, while the red line illustrates what happens when the external shock impacts the correlations.

In the area under the curve in Figure 2, total loss remains steady – but it’s distribution across the tranches depends on the diversification of the pool.

An external event pushing up correlations between downgrades and defaults would make the probability of the first loss and the last loss (with the highest subordination) almost the same. That’s how AAA-rated tranches defaulted during GFC. So, the capital cushion for the structured products risk should consider such potential dynamics.

Full-range scenarios capture these shocks and enable proactive management of risk weights, regardless of their initial rating or subordination.

Parting Thoughts

Capital reserves continue to be indispensable for cushioning financial shocks. But an anticipatory approach is just as crucial.

Proper capital planning requires a seamless integration of strategies that encompass both the ability to cover shocks and the steps that can be taken to prevent them. Banks must take proactive measures to protect themselves against plausible yet unforeseen situations involving feasible combinations of variable fluctuations. Identifying these combinations may be challenging, but mitigating them is more straightforward.

Full-range scenario analysis can and should be used to integrate market, credit and liquidity risks (including unprecedented tail risk) in the trading book. This comprehensive risk management approach addresses regulatory concern about black-box models, establishes a more comprehensive foundation for capital reserves, and enhances the strength and resilience of the banking sector.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.

Topics: Regulation & Compliance