Extreme tail-risk events cannot be predicted, as demonstrated by the many unforeseen, rare or unprecedented events that have occurred over recent years. However, it is possible to prepare for their consequences and to build better resilience.

For example, consider the “Miracle on the Hudson” event, when a very experienced pilot managed to land a plane safely on water when both engines shut down. That emergency occurred because of a bird strike, but it could have happened for many other reasons.

Regardless of the initial shock, Captain Chesley Sullenberger was prepared for this extremely rare event. Undoubtedly, his simulated training of landing on water saved many lives, but he was also ready for other emergency scenarios because of the exhaustive approach the airline industry takes to flight safety.

That same strategy should be applied to financial stress testing. No one could have predicted COVID a year in advance, but a responsible risk manager was surely ready for a declining market, heightened volatility, and follow-on, long-term consequences – such as inflation and an increase in credit risk. (The latter was, delayed, but not eliminated, by government-support programs that offered aid to borrowers.)

The key to such resilience lies in comprehensive stress testing and exhaustive scenario analysis. Just like exhaustive flight simulation helps pilots respond to unforeseen emergencies, exhaustive scenario analysis in finance prepares institutions to face the unknown with a more resilient and adaptive approach.

By subjecting financial institutions’ balance sheets to a range of adverse scenarios, including some less commonly anticipated ones, risk managers can identify potential vulnerabilities and strengthen their ability to weather unexpected shocks.

Exhaustive scenario analysis also addresses the recent regulatory demands for reverse stress testing and contingency planning.

Multi-Scenario: The Subjectivity Concern

When it comes to analysis of extreme uncertainties, there are concerns about using the multi-scenario approach, which assesses all potential combinations of shocks – and their possible consequences.

The first is that this approach creates a false sense of security and precision, since scenarios are subjective. However, the point of exhaustive scenario analysis is not to make precise predictions, but, rather, to capture adequately the tails of risk.

Just as pilots need to know how to land on water, regardless of the reason an engine fails, financial institutions need to be prepared to deal with all relevant scenarios, regardless of the initial shock.

But can one employ the multi-scenario, automatically generated approach to assign probabilities to specific scenarios? That is a second concern, even though it is true that a few manually built scenarios designed by experts have near zero probability of being realized.

In response to this issue, scenarios must be developed to address threats facing each institution. More specifically, scenarios must be used to project a bank’s key performance indicators (KPIs) and key risk indicators (KRIs). The probabilities of scenarios can subsequently be driven by the empirical distribution of these indicators.

Working Backward

A final concern about the exhaustive scenario analysis is that automatically generated scenarios do not have narratives. But this issue can be addressed through reverse stress testing.

While traditional stress testing evaluates how the institution performs under different stress scenarios, reverse stress testing takes a different approach.

In reverse stress testing, financial institutions start with a predefined level of distress and work backward to identify the scenarios that could lead to such extreme situations. By doing so, they can pinpoint the specific vulnerabilities and potential weaknesses in their operations that may be hidden under normal stress testing.

Applying exhaustive reverse stress testing enables banks and credit unions to discover the most critical scenarios for which they need to be prepared. These scenarios may include severe economic downturns, credit market freezes, sudden withdrawal of funding by investors, or other systemic shocks. By identifying these scenarios, financial institutions can develop robust contingency plans that specifically address and mitigate the risks associated with these stressful events.

Through this approach, firms can identify and prepare for the most crucial scenarios, ultimately strengthening their ability to weather unexpected challenges and ensuring the stability of the broader financial system.

However, this requires a so-called actionable reverse stress test, which is very different from those that have been used in the past. Traditional reverse stress tests are focused on recovery and resolution, and typically ask questions such as “what can lead to liquidity crunch” or “what can push my bank to default”? Whichever scenarios are created under this conventional approach are intended to answer these questions.

Most such scenarios would consider one or two extreme shocks, but would also miss the combination of potentially much less significant events that could produce even more disastrous results. Replacing predictions with “discovery” is the core of actionable reverse stress testing.

The difference between conventional and exhaustive scenario analysis methods is fundamental. The exhaustive reverse scenario analysis based on the full distribution of integrated exposures provides insights that are vastly more useful for the understanding of one’s risks in all shapes, forms, and horizons.

Narratives can be derived from reverse scenarios. When discussing with key stakeholders (like senior management, the board of directors and regulators) the results of reverse stress testing and the contingency plans those tests help to develop, it’s very important to communicate these stories.

Rather than starting with a narrative when describing a scenario, one should end with it. A few relevant selected scenarios (chosen from the full range of possible outcomes) based on exhaustive reverse stress testing can be easily converted into a narrative, as all the variables have already been quantified.

Working backward from a predefined adverse outcome enables risk managers to identify the specific factors or events that could lead to such an extreme situation. It helps institutions identify hidden vulnerabilities and potential weaknesses that may not be apparent in traditional stress tests.

Reverse Scenario Analysis: A Practical Example

Focusing on your own capital- and liquidity-adverse outcomes (based on their respective probabilities, like 90th/95th/99th worst-case values) and the scenarios that lead to them is the critical part of exhaustive reverse scenario analysis.

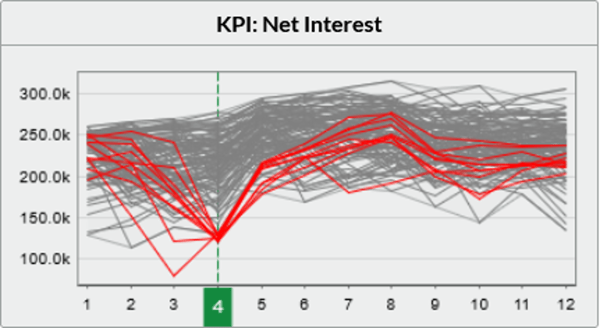

As we have seen recently, interest rate increases – which are usually beneficial for banks and pension funds – caused UK pension funds’ crisis and U.S. banks’ defaults. In the example depicted in Figure 1, out of the full range of outcomes (gray lines), a few scenarios leading to the worst-case net interest in one year were selected (red lines).

Figure 1: Distribution of Net Interest Over a Thee-Year Horizon

Source: Straterix. Time horizon in quarters.

In Figure 1, the question asked via reverse scenario analysis is, why would net interest drop by 40% in one year? One needs to analyze the behavior of other variables on the same “red” scenarios to provide an answer.

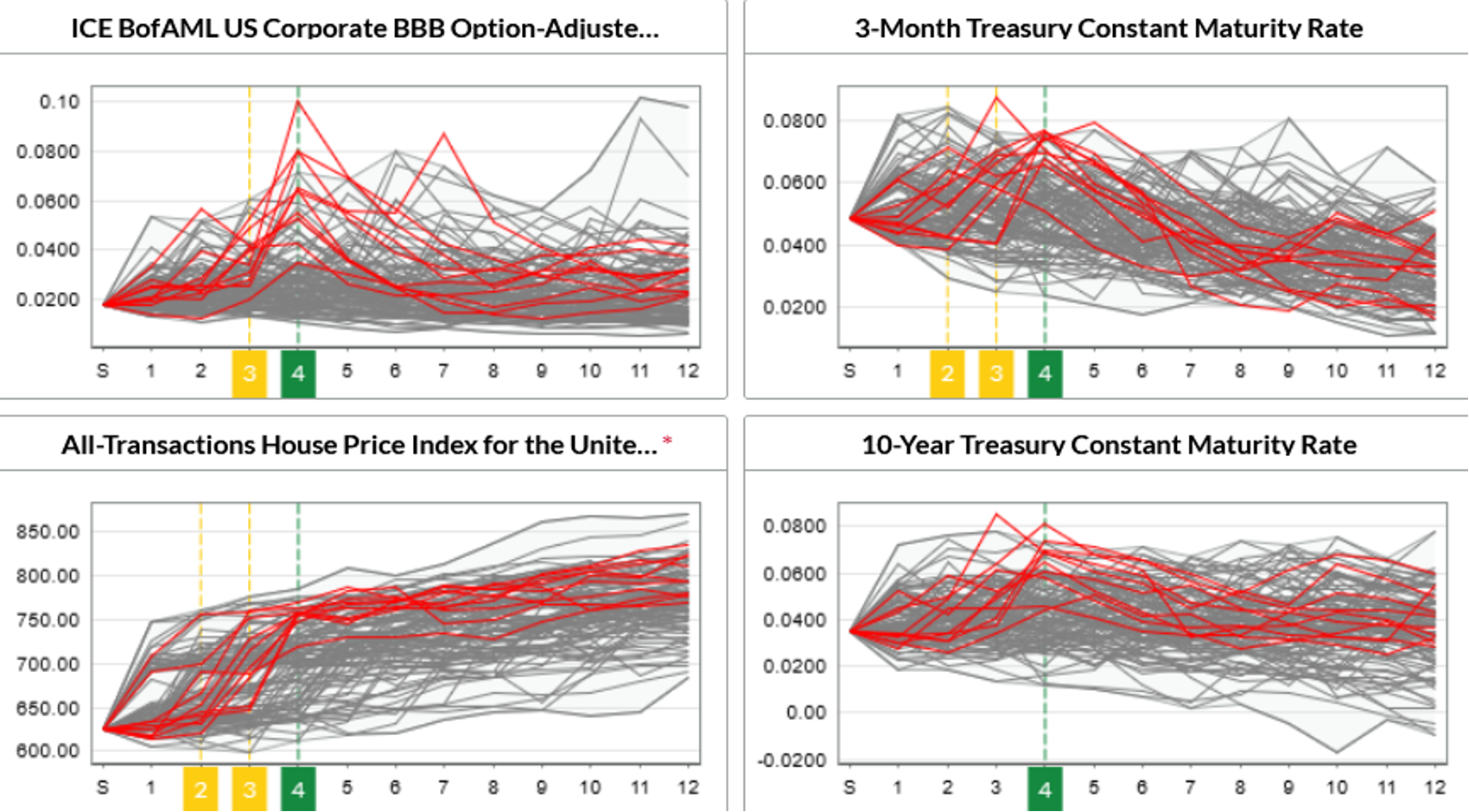

Figure 2 shows four variables that have the highest correlations with adverse net interest outcomes one year out.

Figure 2: Reverse Scenarios in an Inflationary Environment

Source: Straterix. Time horizon in quarters.

The implied correlations depicted in Figure 2 can be calculated between net interest in Q4 and other variables in the previous quarters. Consequently, early warning signals can be identified and contingency plans can be developed.

By observing the behavior patterns of identified risk drivers that correspond to the red scenarios, it is possible to build the narrative for the underlying economic environment.

Figure 2, for example, shows an inflationary environment with a very flat (if not slightly inverted) yield curve and an overheated housing market. The sharp drop in net interest is caused by a simultaneous increase in credit spreads – i.e., the correlations between risk-free rates and credit spreads go from negative in stable markets to sharply positive, as might happen in crisis situations. If a financial institution were to supplement this with similar exercises conducted for other KPIs/KRIs, it would be much better prepared for all kinds of tail risks.

Parting Thoughts

All financial institutions need to do to understand the huge importance of exhaustive scenario analysis is to examine the overall safety record of airlines, which can be largely attributed to comprehensive, intense simulations.

According to the National Safety Council, the death rate from driving a car is 595 times higher than from flying a plane. Exhaustive flight simulation used to train pilots has contributed significantly to these statistics.

By combining direct and reverse scenario analysis, financial institutions can not only gain a comprehensive understanding of their vulnerabilities but also develop robust strategies to address and mitigate these risks.

Exhaustive scenario analysis enhances firms’ preparedness and resilience, even in the face of unforeseen and challenging circumstances like the "Miracle on the Hudson" event or the COVID pandemic.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.

Topics: Modeling