The amount of capital that is needed for an institution to be resilient through the rough times, while remaining competitive, is one of the key issues being discussed by the risk community today.

Stress testing regulations, supplemented by government-support programs, certainly helped banks absorb the impact of pandemic shock. However, additional efforts are required to further protect against uncertainty and to boost growth and profitability.

The latest regulatory reforms (e.g., Basel III-IV) call for improved granularity and risk sensitivity when banks evaluate both their capital needs and the relative cost of capital specific to their business model.

Keeping all of these developments in mind, it is now the proper time to establish your institution’s place in the competitive landscape.

If your firm’s capital ratio can potentially drop by 15% in the worst-case stress outcome, is this grounds for immediate revision of its strategy and risk appetite? That depends on how close your current capital ratio is to the acceptable lower boundary, as well as how your firm stacks up (from a capital perspective) with it peers and competitors.

Alla Gil

To begin a proper evaluation process, you must ask and answer a series of important questions. For example, how does your firm measure up with its peers with respect to having the necessary capital and liquidity buffers to sustain stressed markets? Do your peers’ exposures carry more risks? Lastly, are your peers sensitive to different stress scenarios than those of your bank?

These questions are hard enough to answer for your own bank, let alone for others. But they can be addressed if your firm is focused on capturing the tails of risk, rather than making precise forecasts.

Connecting Scenarios and Segments

It is possible to evaluate a bank’s critical key performance indicators (KPIs) using publicly-available data, for example, from uniform bank performance reports (UBPRs). These databases show the historical time series of business segment performance for various segments – including commercial, consumer, real estate, agricultural loans, interest, and non-interest-bearing deposits.

By linking these segments to the scenario variables, a bank can project its own capital ratios on the future scenarios, as well as those of peer banks.

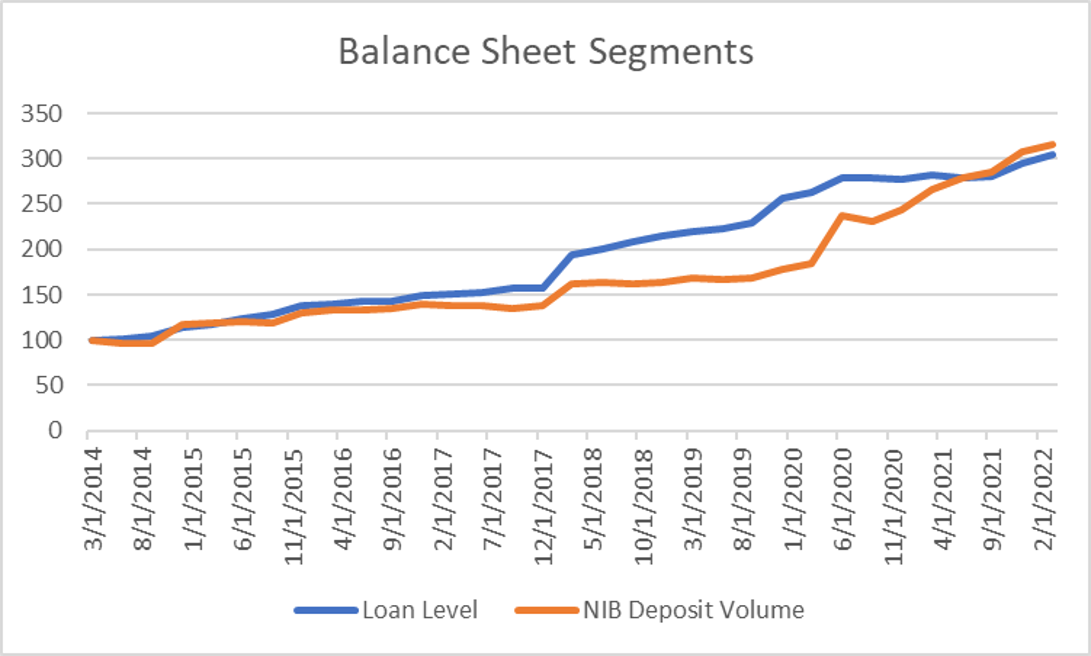

Let’s consider, for example, the publicly-available data of a bank that has been successfully growing for the past eight years. Figure 1 (below) depicts the historical performance of loans and deposits for our example bank.

Figure 1: Historical Time Series for Loans and Deposits (Example Bank)

Historical data source: FFIEC

The segments depicted in Figure 1 can be linked to the projected scenario variables using machine-learning regression, and can subsequently be added to expanded scenarios. Since all components of capital ratio calculation are included in our example, the ratio can be derived on each scenario at each point in time.

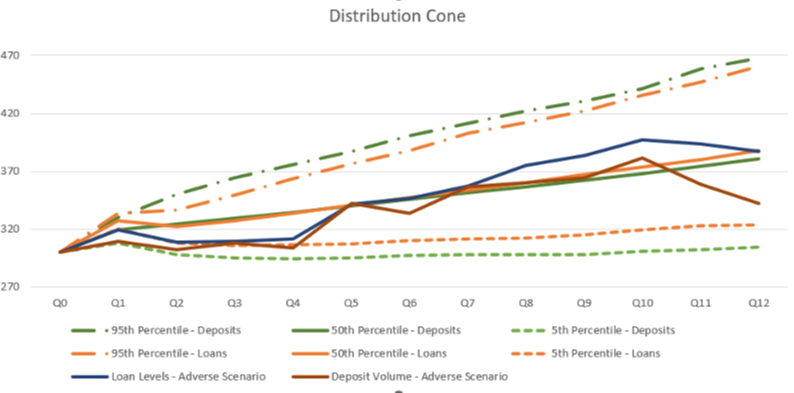

One can also obtain the forward-looking distribution of loans and deposits using the full range of scenarios. Figure 2 shows that expected growth continues for our example bank, though it lags behind historical performance.

Figure 2: Uncertainty Cone for Loans and Deposits

Source: Straterix Inc.

In Figure 2, we can also see that the deposit cone is slightly wider than the one for loans. So, there will be many scenarios where deposits are growing much slower than loans – and where the bank might need additional funding.

What does market environment look like when this occurs? Analyzing other variables on the same scenario, one can see that interest rates are going up and oil prices are through the roof, so it’s an inflationary environment. The funding therefore might be quite expensive, unless the bank’s treasury group prepares in advance using reverse-scenario analysis.

Factoring in Adverse Outcomes

One can calculate the capital ratios on the same set of scenarios and identify what is driving adverse outcomes. In our example, the analysis of reduced capital ratios demonstrates that adverse outcomes are driven by the rapid growth of loans (hence, risk-weighted assets) and lagging growth of retained earnings.

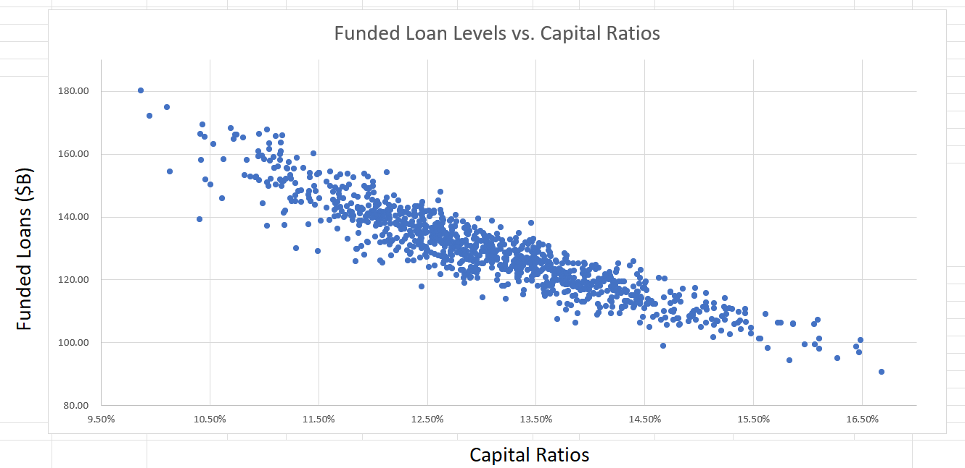

Figure 3 depicts the level of funded loans (for our example bank) at the three-year horizon vs. the respective capital ratio on the same scenario, at the same point in time.

Figure 3: Loans vs. Capital Ratios, Three Years Out

Source: Straterix Inc.

As depicted in Figure 3, capital ratios exhibit very strong negative correlation with loans (-92%), RWAs (-90%) and deposits (-78%). At the same time, their correlation with credit losses is just 16% – and close to zero with retained earnings (before losses).

What all of this information tells us is that banks’ management teams should carefully weigh their potential growth against earnings, to make sure they grow appropriately.

It is also critical to consistently perform capital, liquidity and funding costs analyses to reveal the scenarios where both capital and liquidity are under stress – and where funding costs are very high. Moreover, it’s important to understand which business segments contribute the most to adverse vs. beneficial outcomes.

By conducting such peer analysis based on publicly-available data, and by adjusting strategies to avoid idiosyncratic pitfalls, banks can build resilience way beyond just surviving the current uncertainty.

Parting Thoughts

Understanding whether a bank’s capital is under stress is critical for defining the optimal capital buffer. To achieve this, idiosyncratic scenarios specific to the bank’s business model must be identified.

By examining their risks and opportunities using full-range scenario analysis, banks can meet their objectives beyond regulatory compliance, enhancing their growth, competitiveness and profitability.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.