Use of Generative AI in

Financial Services

October 2024

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

Firms across every industry are evaluating the opportunities and challenges associated with the use of generative AI (GenAI) to enhance their business. From data privacy concerns to integration with existing processes and systems, firms are grappling with how best to ensure that this rapidly evolving technology is safely and ethically deployed.

The GARP Benchmarking Initiative (GBI)® invited Financial Risk Managers (FRM®) globally to participate in a survey designed to determine:

- How GenAI is being applied in financial services

- Challenges with the use of GenAI

- Potential effect on risk management professionals

Over 850 FRMs practitioners responded to the survey, representing a broad range of financial services firms and risk disciplines around the world. Roughly 61% of respondents work at large firms (over 1,000 employees) and more than 70% have at least five years of risk management experience. Read on for the key insights from the survey results.

Insight #1 – GenAI will have a significant

impact on the financial services sector

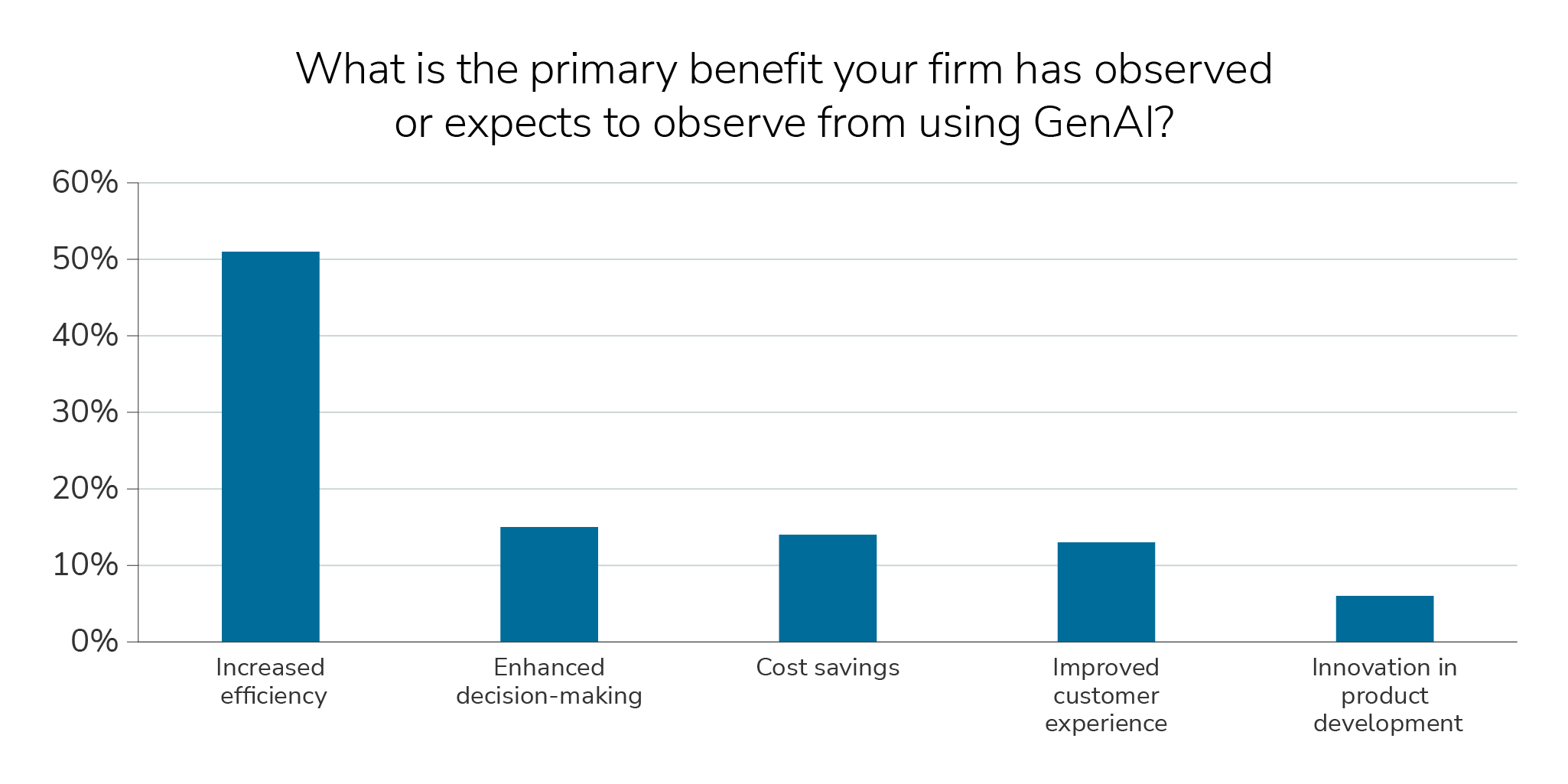

An overwhelming majority of respondents (93%) believe GenAI will be “important” or “very important” for the future of the financial services industry, with increased efficiency viewed as the primary benefit from using GenAI.

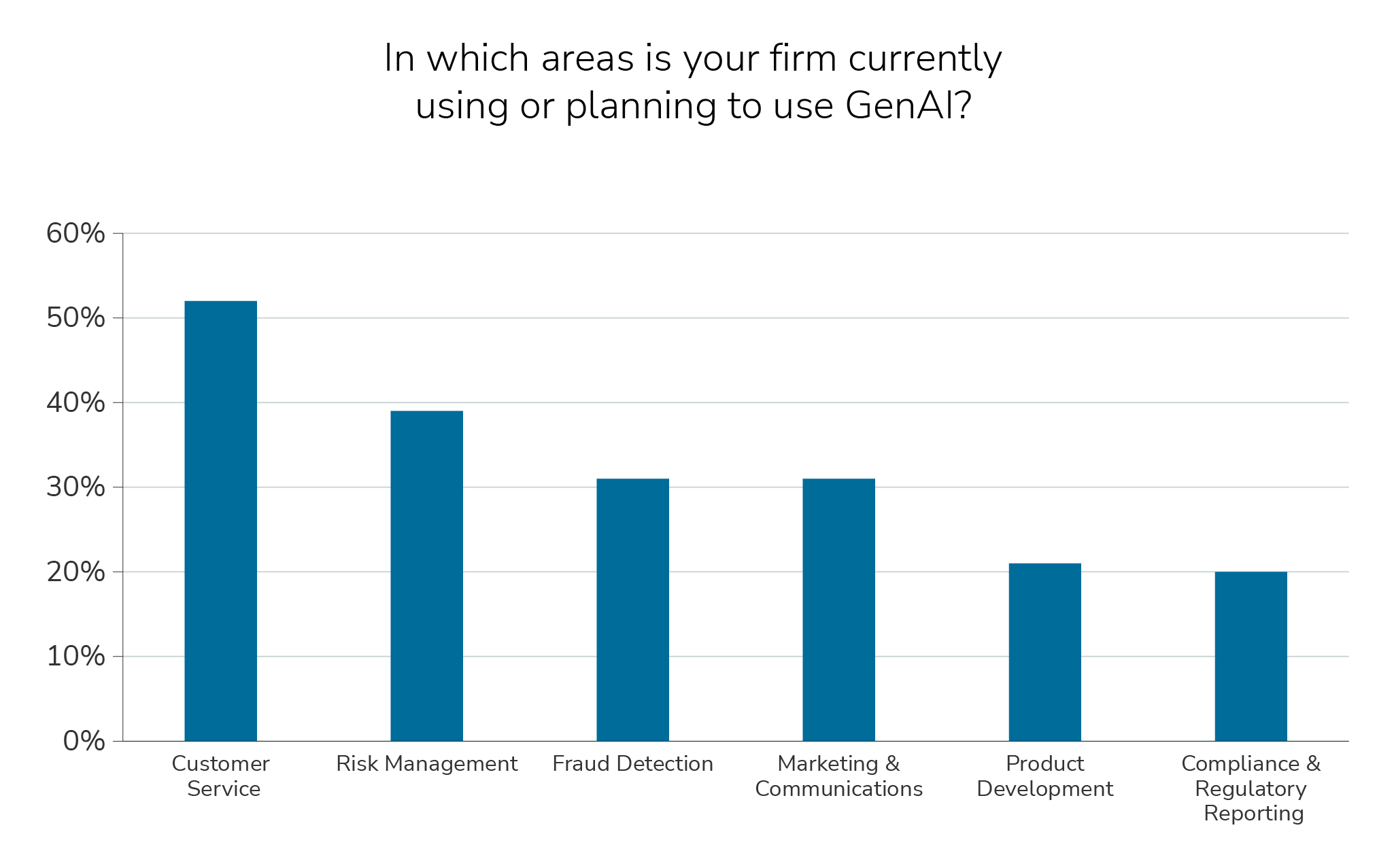

Respondents reported that customer service is the most common area in which their firm is currently using or plans to use GenAI. Just over one-third of respondent’s firms are currently using or plan to use GenAI for risk management.

Insight #2 – Most firms will increase

their use of GenAI over the next few years

Over 75% of respondents indicated their firm already has implemented or plans to implement GenAI tools in its operations, and only 17% of respondents indicated that their firm has made “no investment” in GenAI initiatives.

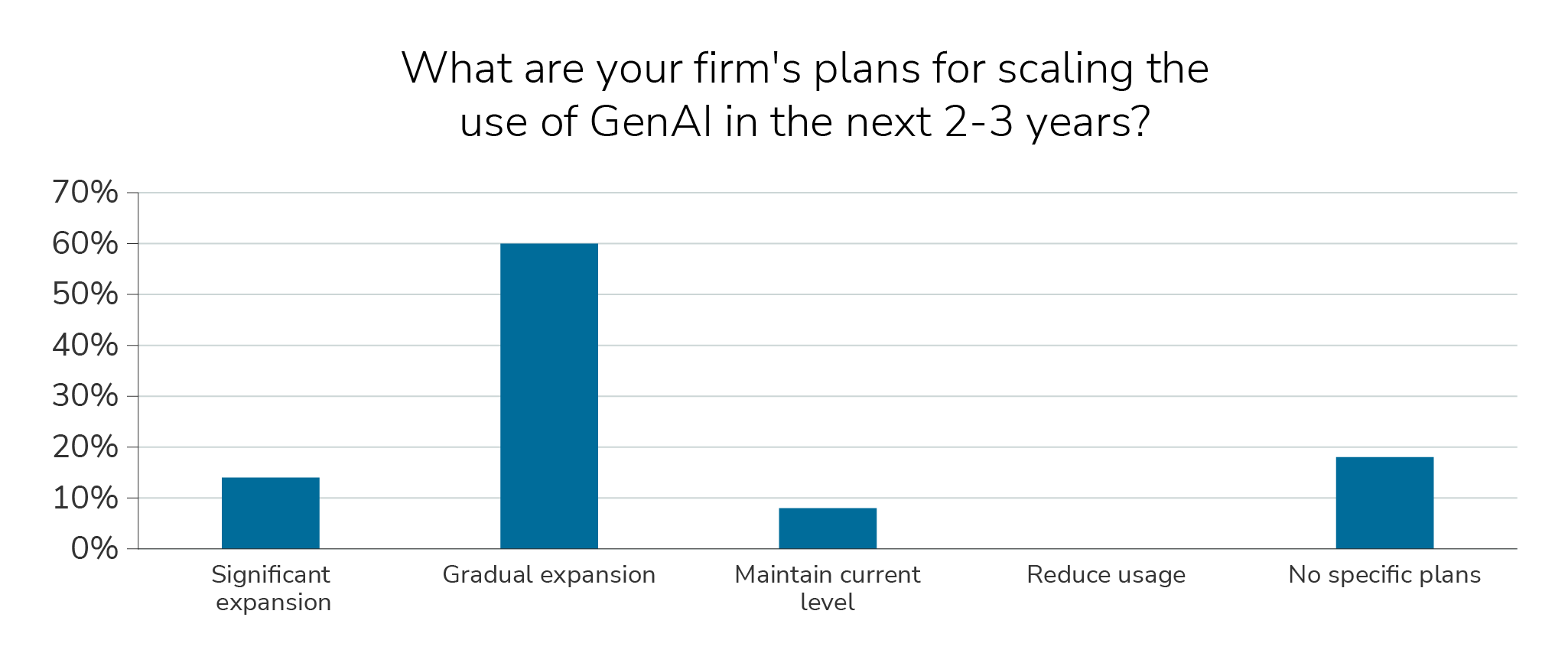

In addition, almost 75% of respondents indicated that their firm plans to expand the use of GenAI in the next 2-3 years.

The expected pace of future expansion appears to be somewhat higher in the Americas and Europe, where approximately 80% of respondents expected either significant or gradual expansion of GenAI at their firms, versus Asia, where only 68% anticipated the same level of growth.

Insight #3 – Data privacy and security is the largest concern with the use of GenAI

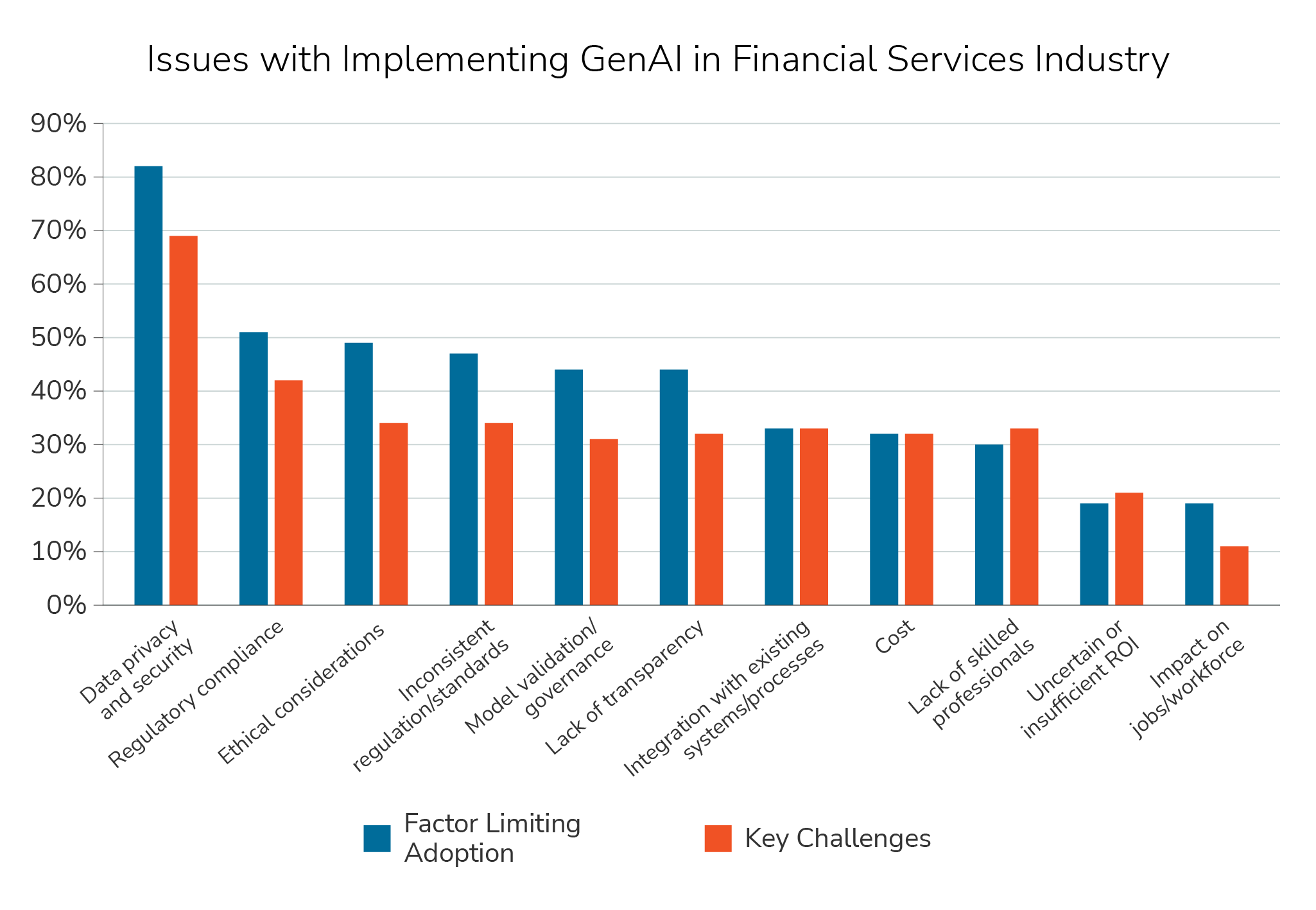

There are many issues with using GenAI in Financial Services. According to respondents, data privacy and security concern is the biggest challenge that could limit adoption of GenAI.

- Regulatory compliance challenges with the use of GenAI was identified by over half of respondents as a factor that could limit its adoption.

- Close to half of respondents viewed ethical considerations, inconsistent regulation, model validation and governance and lack of transparency as factors that could limit adoption.

- Cost and lack of skilled professionals were only viewed as a key challenge for roughly a third of respondents.

- Regulatory compliance was reported as a factor limiting the future adoption of GenAI by 56% of respondents in Europe, 11% higher than the 45% of respondents in the Americas.

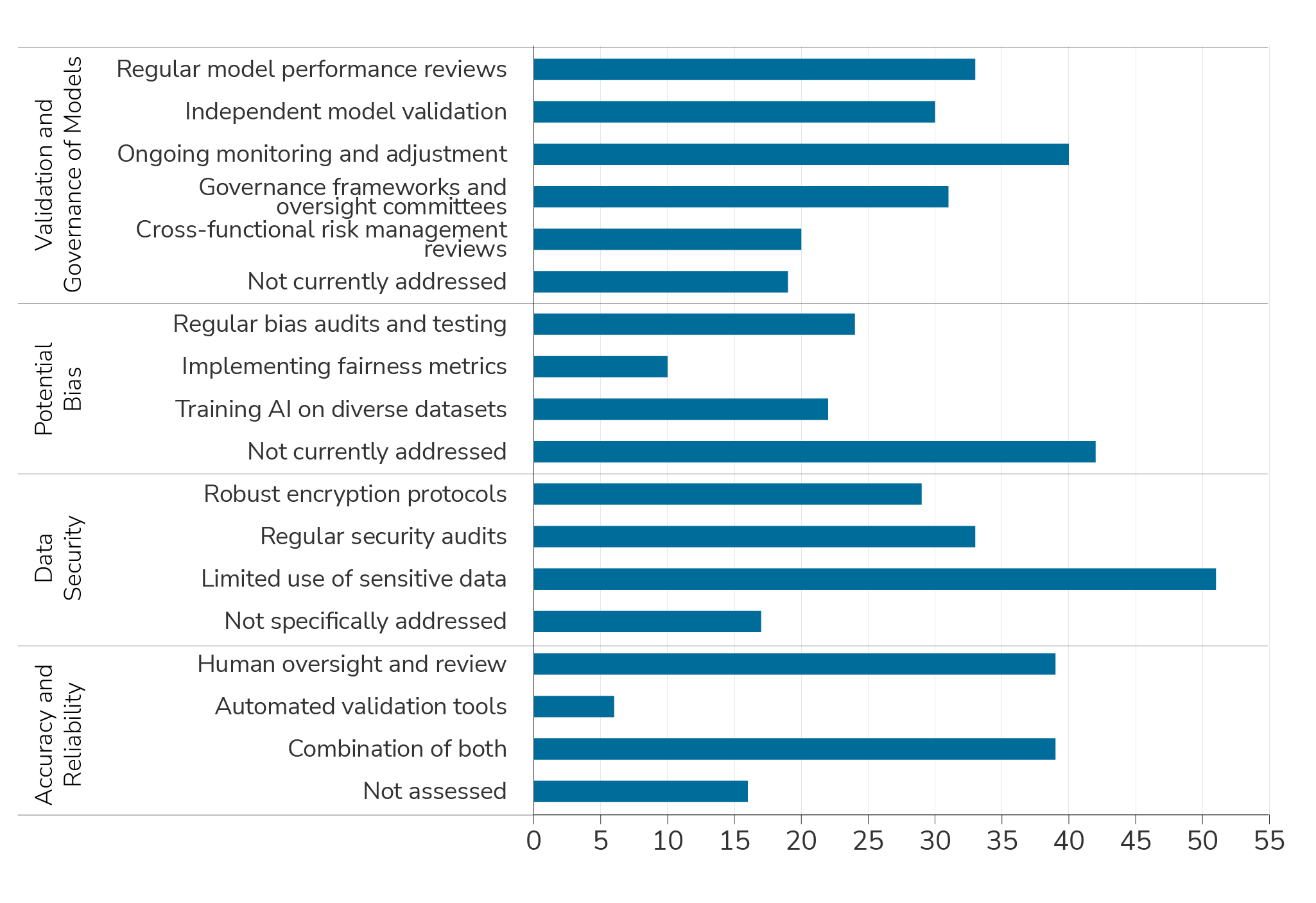

Insight #4 – Firms are exploring many approaches to address issues with using GenAI

For the issues associated with the use of GenAI, firms are addressing them with a variety of approaches.

- Validation and Governance of Models: on-going monitoring and adjustment is the most cited approach.

- Potential Bias (including ‘hallucination’): interestingly, over 40% of respondents reported that this is not currently addressed by their firm.

- Data Security: the most common approach is simply limiting the use of sensitive data.

- Accuracy and Reliability: less than 10% of firms rely solely on automated validation tools; over 75% use human oversight and review.

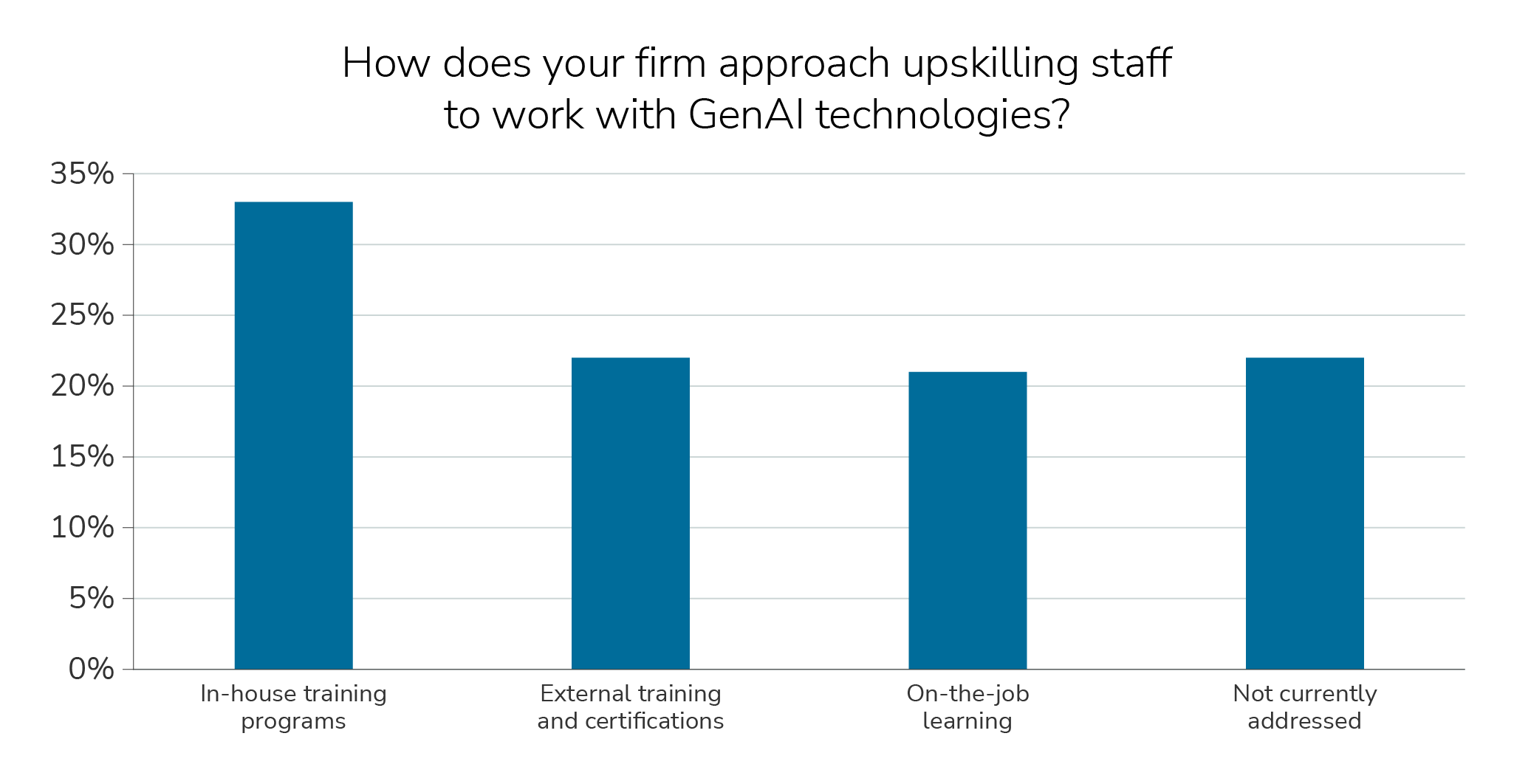

Insight #5 – Firms are using a variety of approaches to train employees to work with GenAI

To upskill employees to work with GenAI technology, over 50% of firms are using internal and external training programs.

To ensure the ethical use of GenAI, 44% of firms are training employees; less than one-quarter of firms are not currently addressing the ethical use of GenAI.

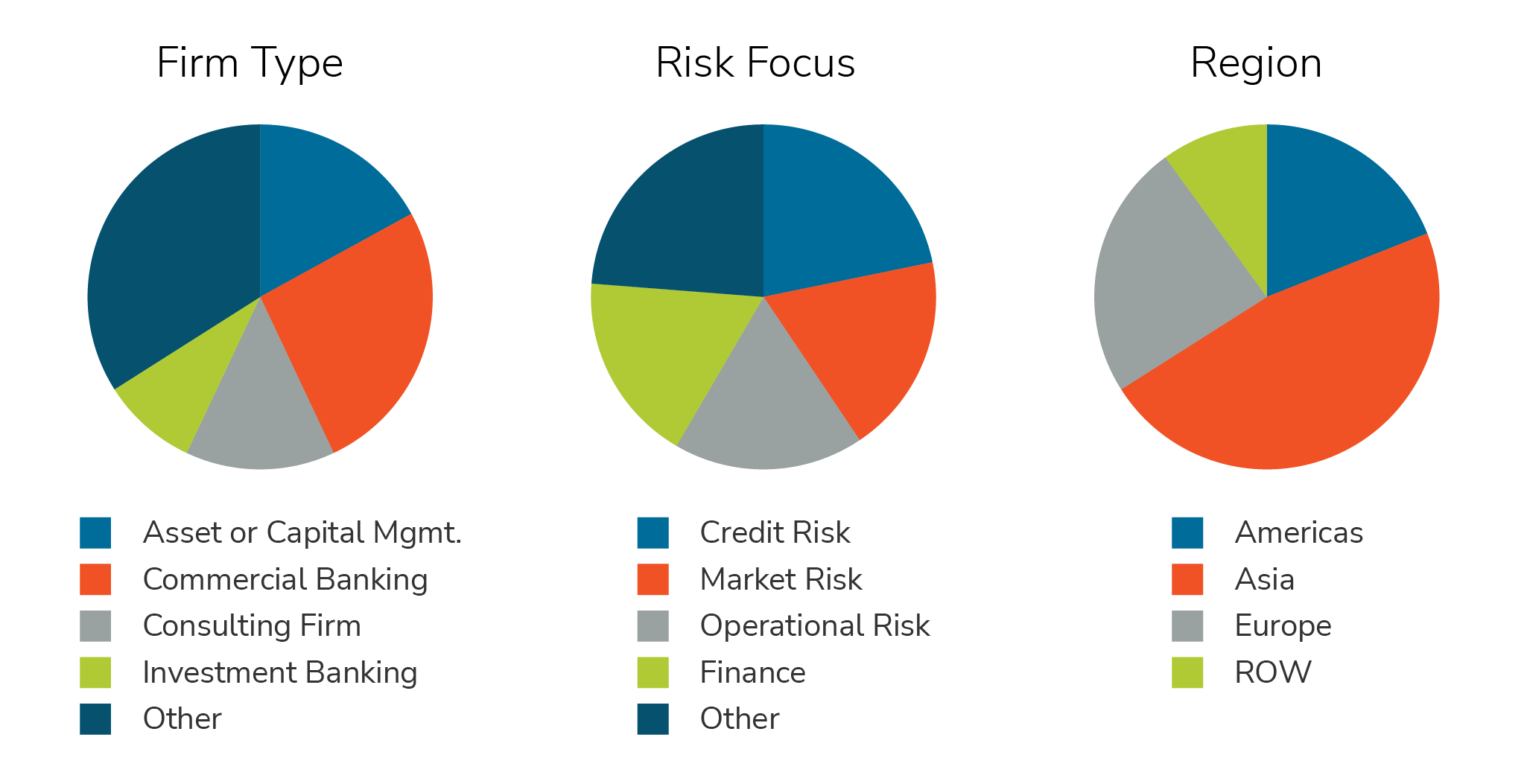

Survey Demographics

Over 850 FRM-Certified professionals participated in this survey. They represent a broad swath of financial services firms and risk disciplines across the globe as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

Want to read more?

Download the full report now!