Operational Resilience & 2025 Risk Outlook

December 2024

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

The GARP Benchmarking Initiative (GBI)® recently invited Financial Risk Managers (FRM®) globally to participate in a

survey designed to understand the perceived:

- Sources of Operational Disruption

- Firms’ Preparedness for Handling Operational Disruption

- Most Significant Risk Factors of 2024 and 2025

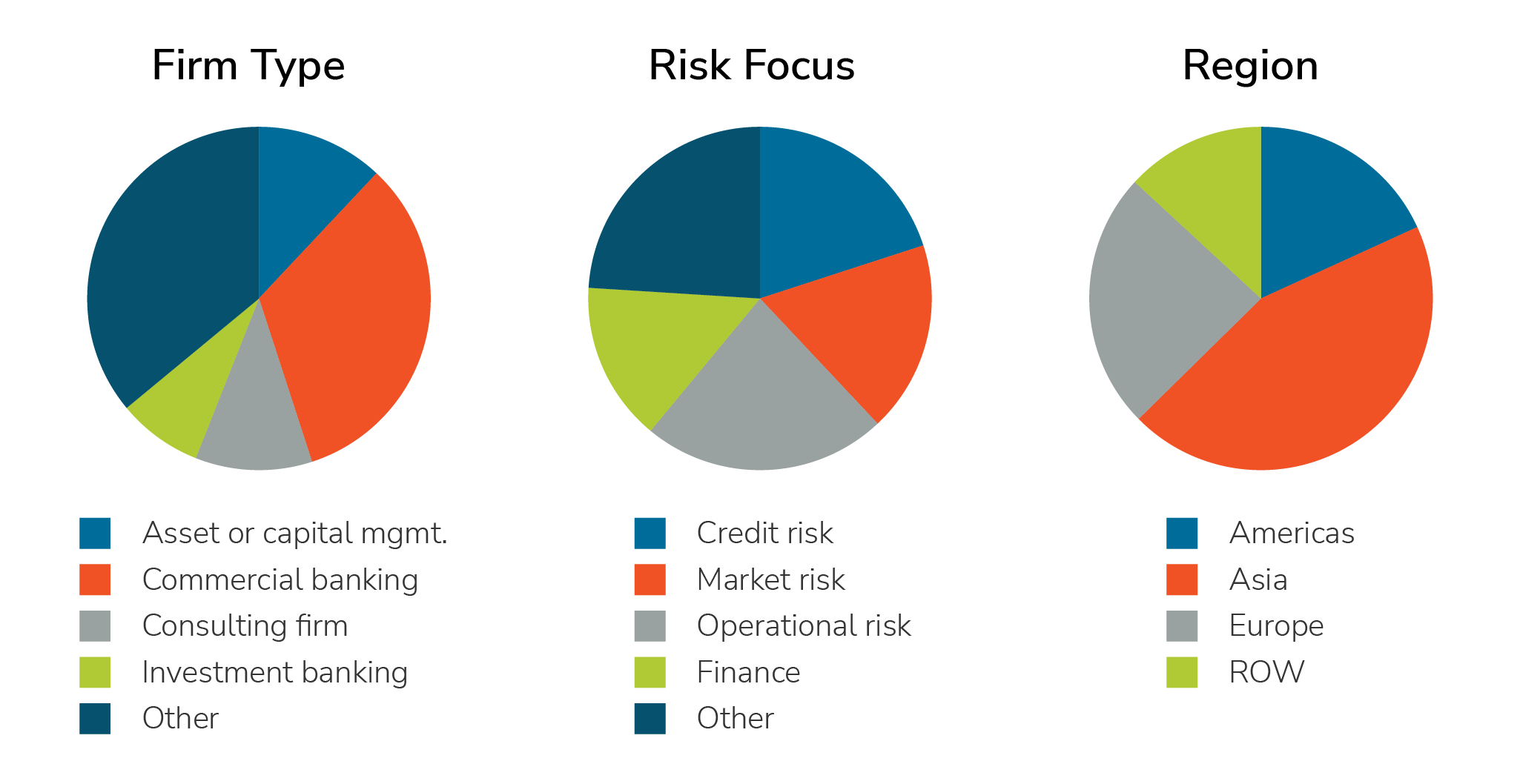

About 600 risk practitioners responded to the survey from a broad range of financial service firms and risk disciplines around the world. Roughly 61% of respondents work at large firms (over 1,000 employees) with more than 72% reporting at least five years of risk management experience.

Read on for key insights derived from the survey results.

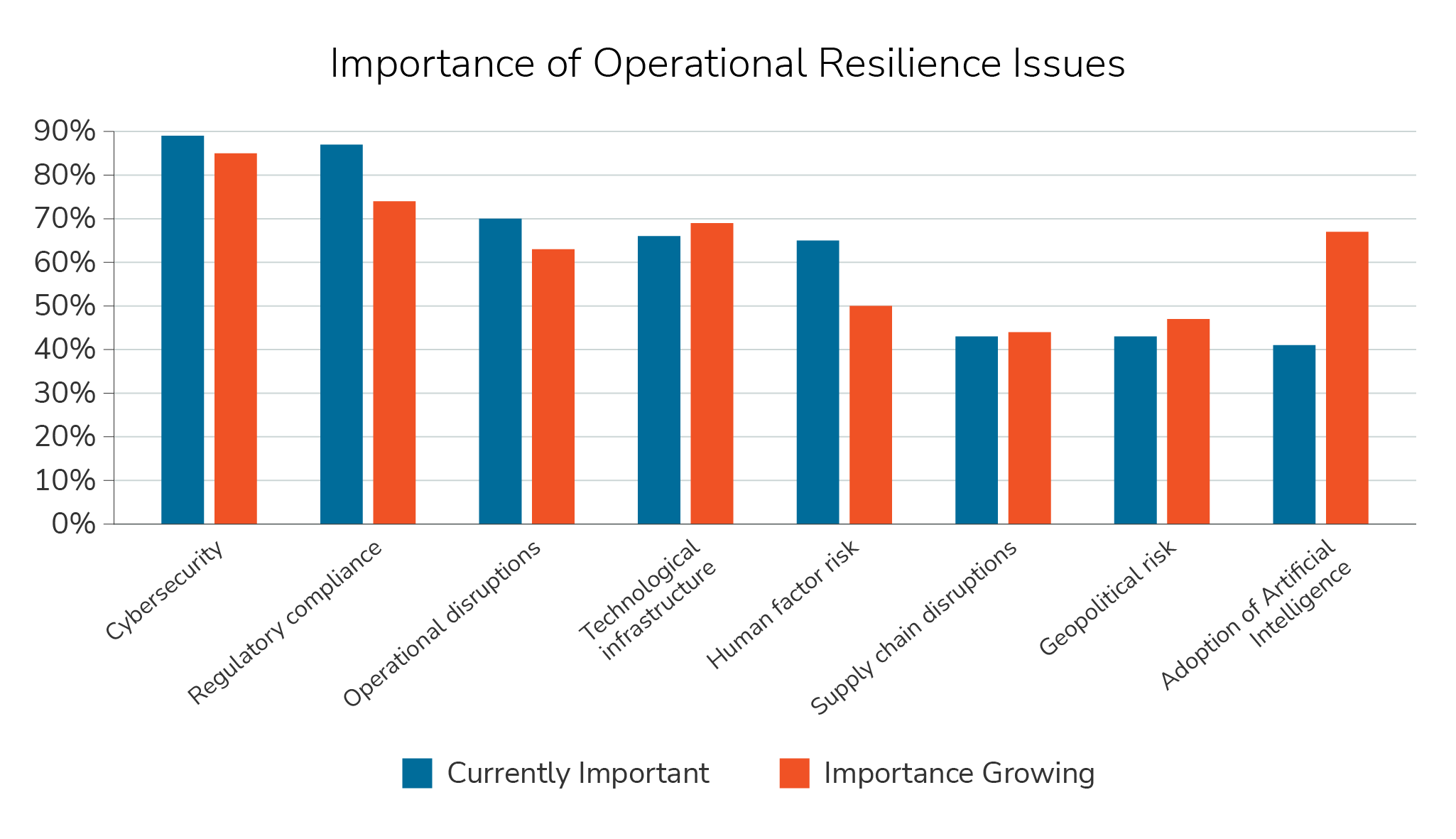

Insight #1 – Cybersecurity and Regulatory Compliance are currently the two most important operational resilience issues

Although only 41% of respondents named ‘Adoption and Integration of Artificial Intelligence’ as currently important, 67% said its importance is growing.

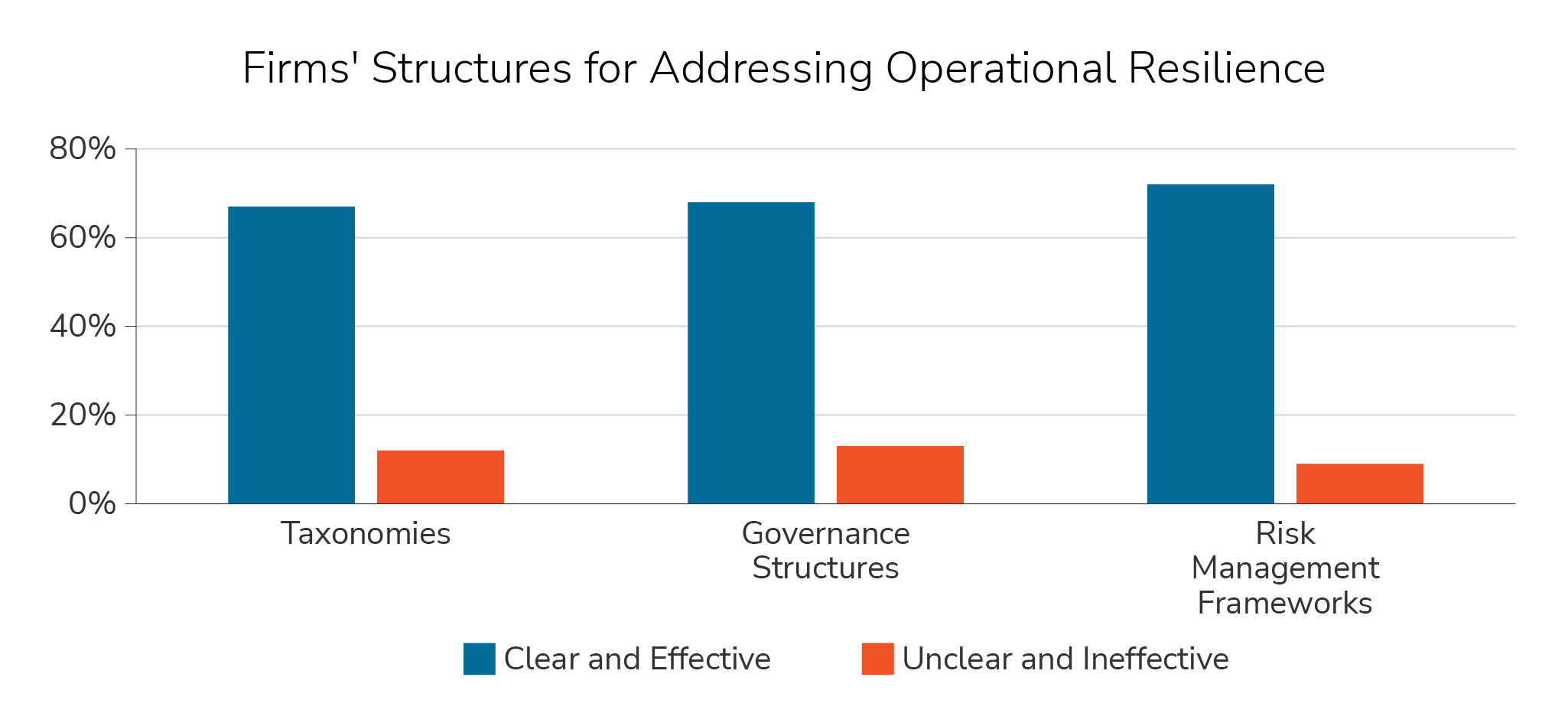

Insight #2 – Respondents have an optimistic view of their firms’ ability to address operational resilience issues

The percent of respondents with a positive view of their firms’ structures and procedures is notably higher in the Asia and Rest of World regions (72% and 80%) than in the Americas and Europe (61% and 63%).

A large majority of respondents see improvements over the past 3 years in their firms’ ability to respond to operational disruptions (78%) and in firms’ culture of employee awareness and training (64%).

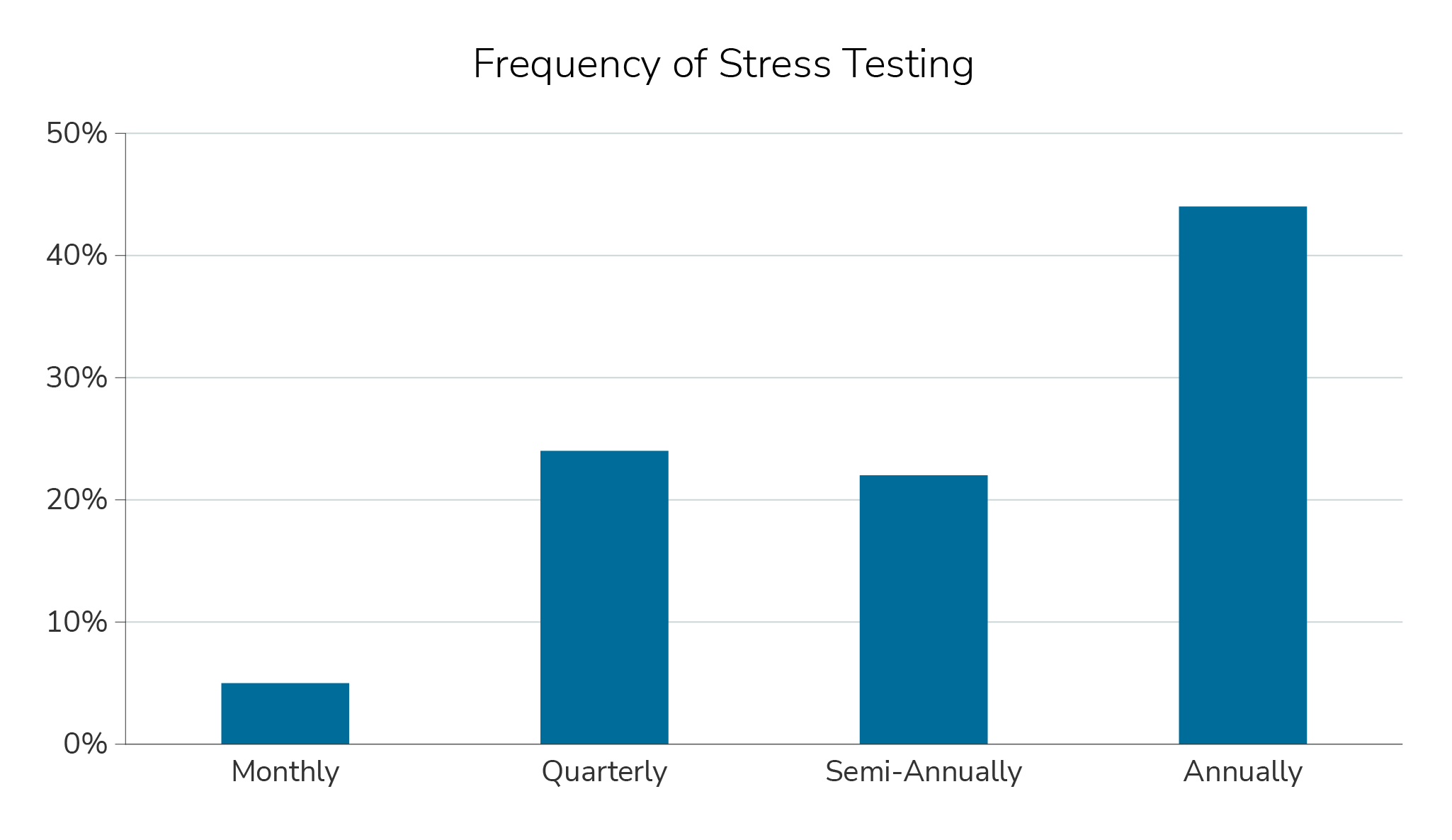

Insight #3 – Most firms conduct resilience stress testing no more than semi-annually

Only 5% of respondents indicated their firms conduct monthly stress testing, with an additional 24% indicating quarterly stress testing.

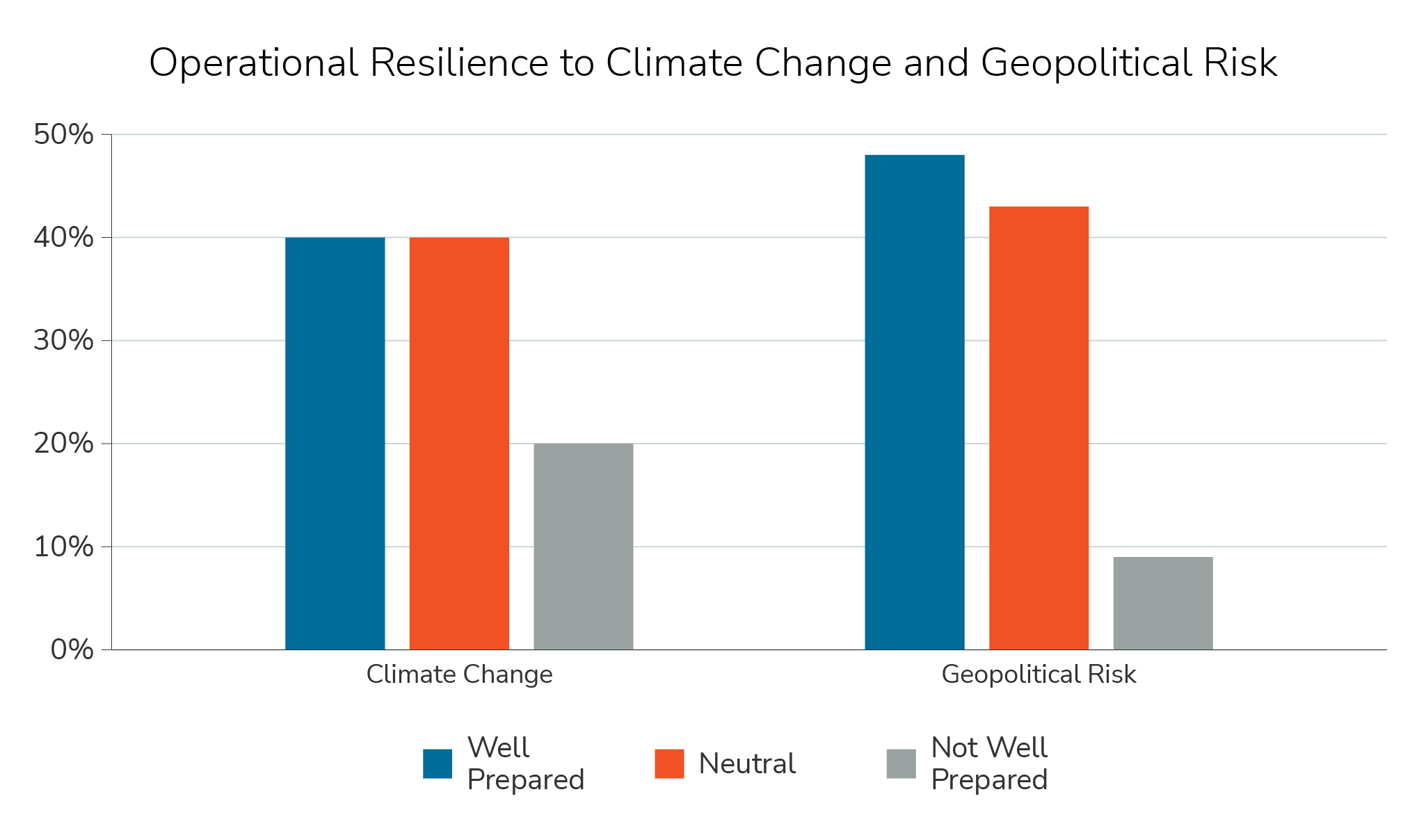

Insight #4 – Just under half of respondents say their firms are well prepared to handle operational disruptions from climate change or geopolitical risk

About twice as many respondents indicated their firms are not well prepared to handle disruptions from climate change (20%) than from geopolitical risk (9%).

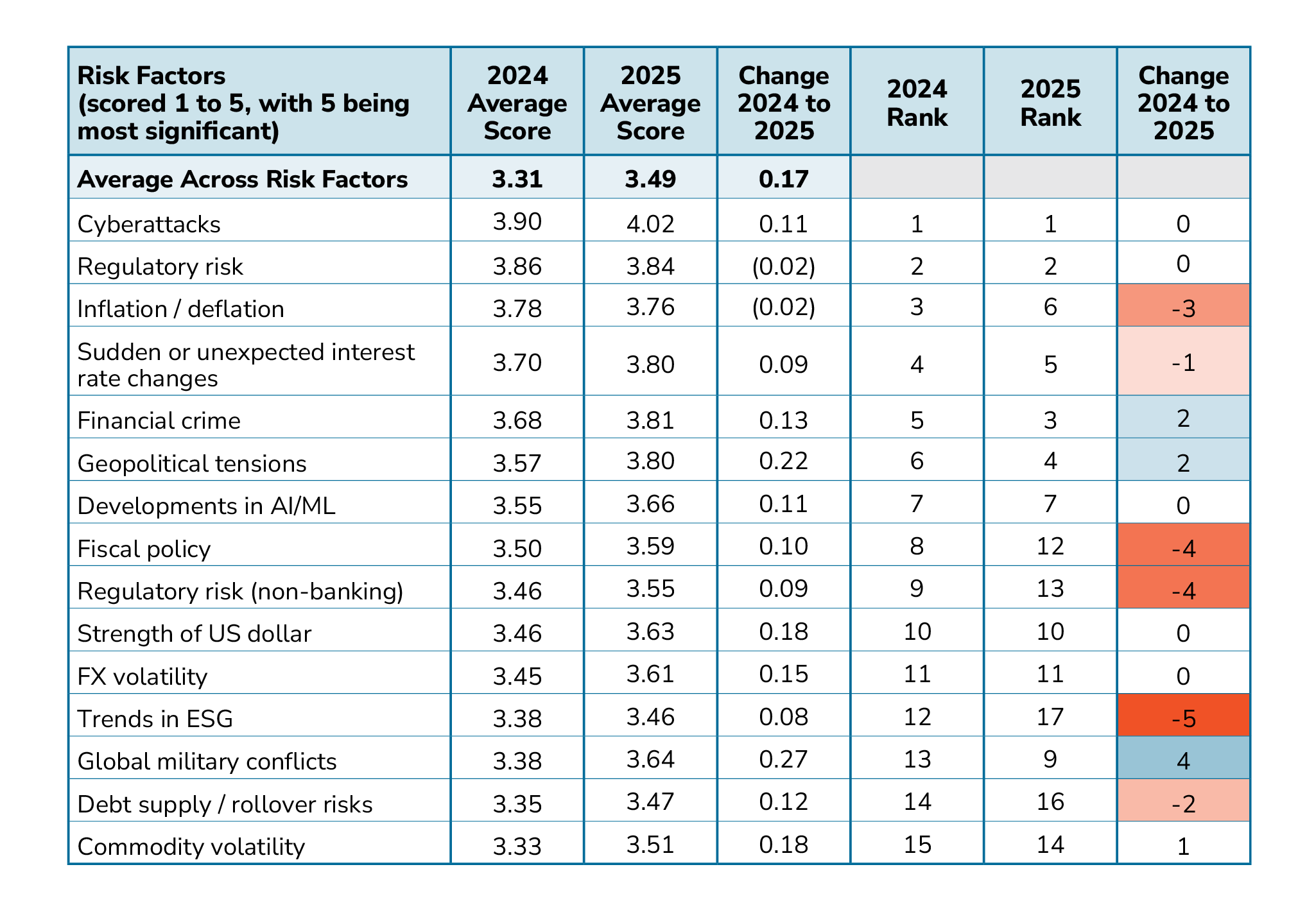

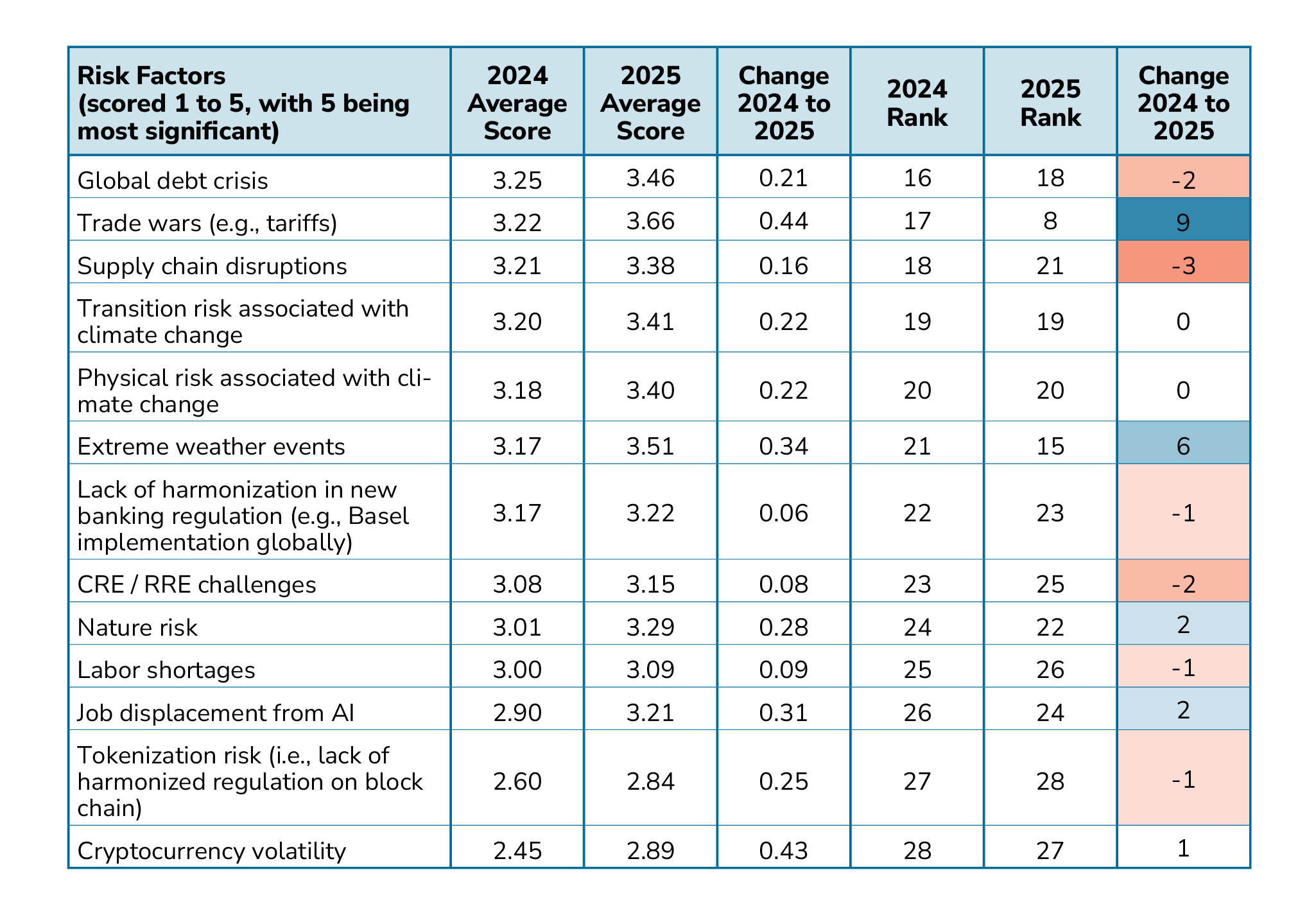

Insight #5 – Cyberattacks and Regulatory Risk are expected to remain the top risk factors in 2025, while Geopolitical Risk and Financial Crime are expected to become more significant

The average score across all risk factors increases by about 5% in 2025.

Inflation / Deflation, Fiscal Policy, Non-Banking Regulatory Risk, Trends in ESG, and Supply Chain Disruptions all move down 3 or more places in the 2025 ranking.

Global Military Conflicts, Trade Wars (e.g, Tariffs), and Extreme Weather events all move up 4 or more places in the 2025 ranking, with Trade Wars increasing the most, from 17th place in 2024 to 8th place in 2025.

Survey Demographics

About 600 risk professionals participated in this survey. They represent a broad swath of financial services firms and risk disciplines across the globe as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

Want to read more?

Download the full report now!