Liquidity Risk

December, 2022

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

Throughout 2022, measures of market liquidity have increased concern about market instability. This was evidenced by the recent stress in the UK’s government bond market, which required the Bank of England to intervene. The impact on financial risk managers has been a range of challenges related to liquidity risk management.

To understand how the current market environment has affected liquidity risk management for risk managers and their firms, the GARP Benchmarking Initiative (GBI) surveyed Financial Risk Managers (FRM®) in mid-November.

Almost 400 FRMs responded to the survey, representing a broad range of risk managers across the globe, financial services firms, and risk disciplines. Roughly two-thirds of respondents work at large firms (over 1,000 employees) and more than 80% have more than 5 years of risk management experience.

In this post, we report the key insights from the survey results.

Insight #1 – Liquidity Risk Is Increasing

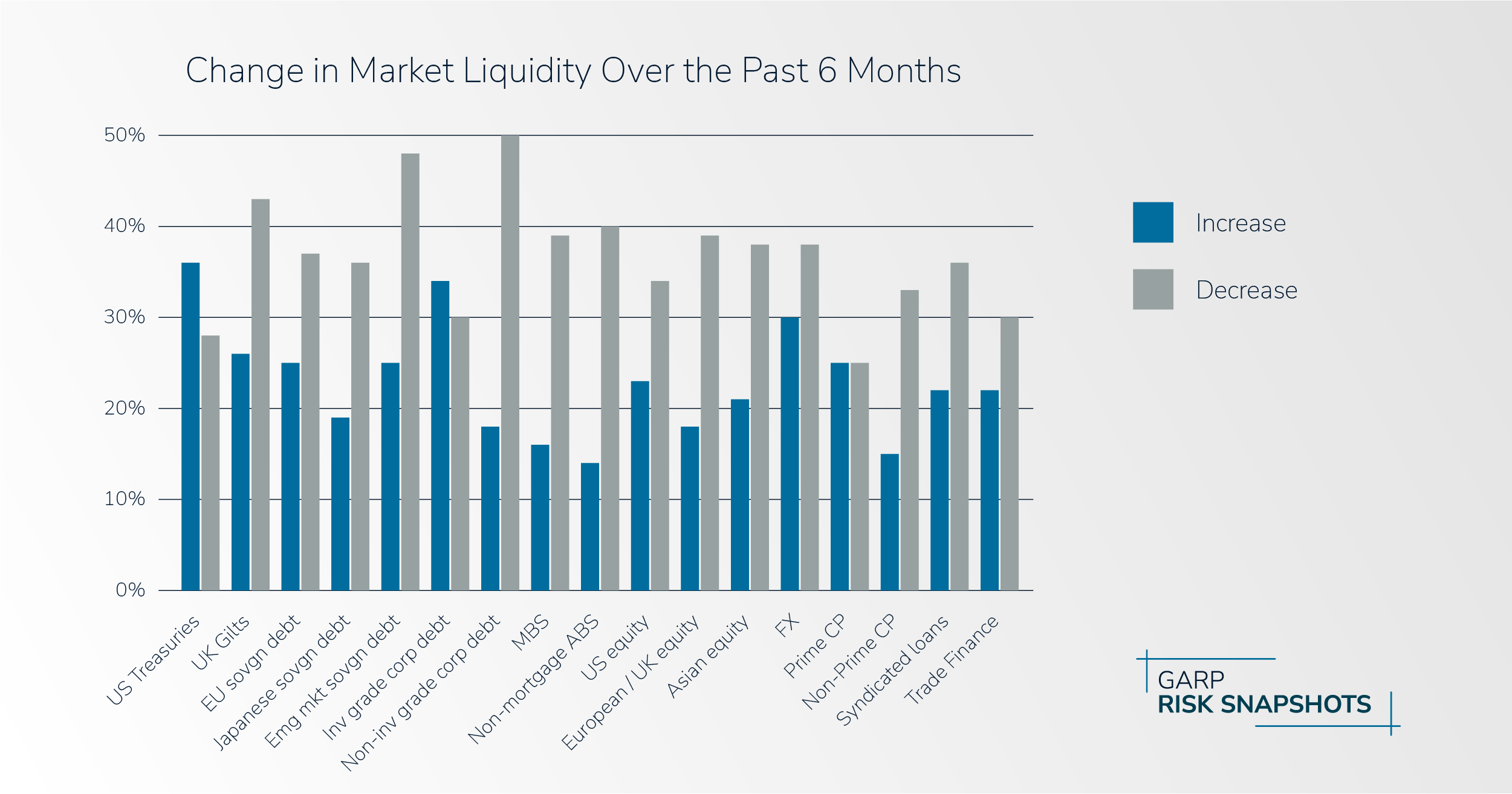

Risk managers were asked to describe any change in market liquidity for a variety of asset classes over the past 6 months. Responses indicate that the sentiment is that market liquidity has declined across many major asset classes over the past 6 months, while a modest “flight to quality” can be seen in rising liquidity in the US Treasury, investment-grade corporate debt, and prime commercial paper markets.

Insight #2 – Firms are Paying Closer Attention to Liquidity Risk

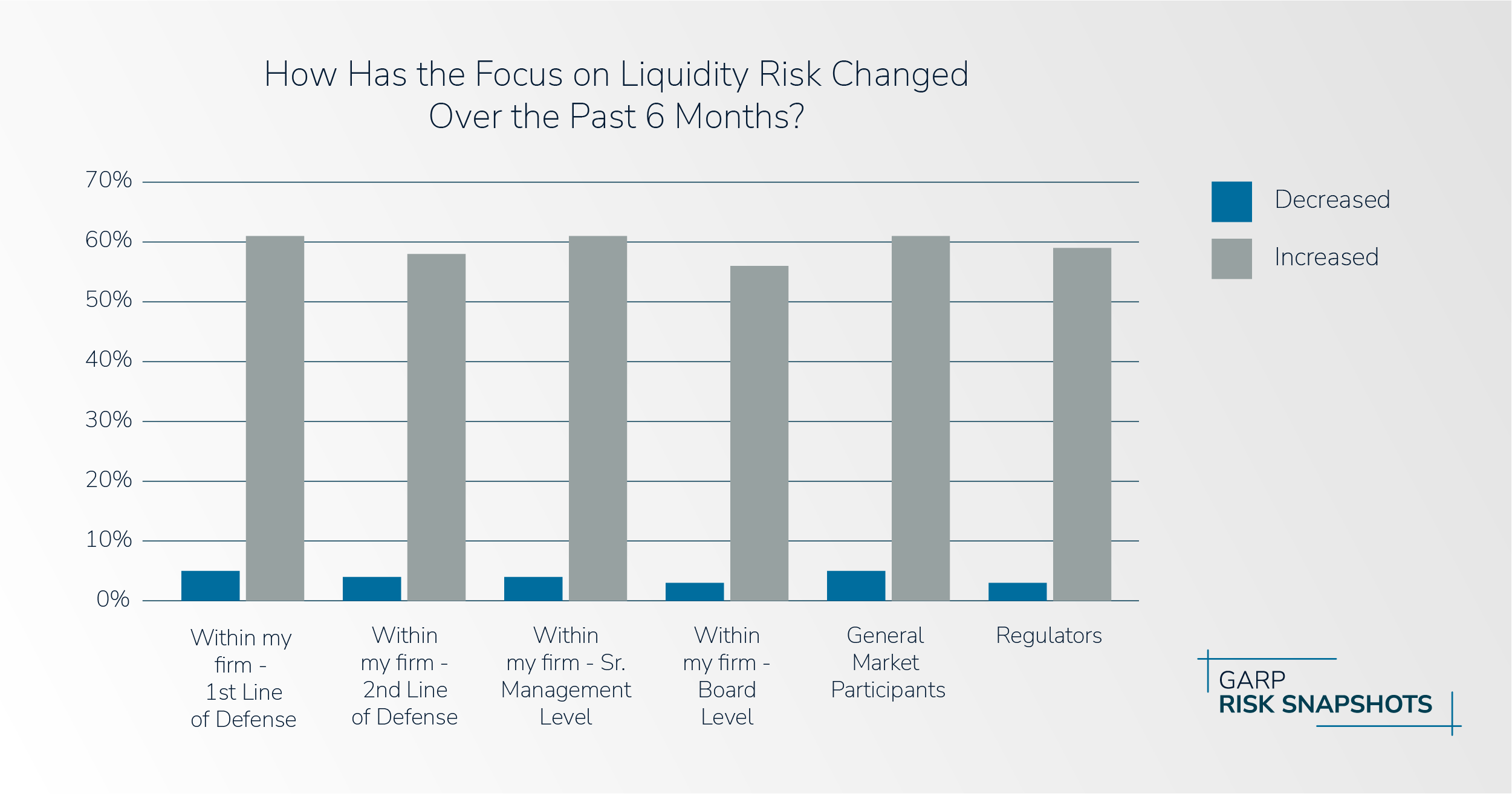

Respondents were asked about their impression of how the focus on liquidity risk has changed in the past 6 months. From all perspectives (internally, market, regulatory), almost 60% of respondents indicated that the focus on liquidity risk had increased, while less than 5% felt it had decreased; roughly one-third of respondents felt the focus had remained the same. In addition,

- 41% reported that the frequency of liquidity stress testing has increased at their firms.

- 59% reported that the range of liquidity risk stress test scenarios employed has expanded. Interest rate spikes and geopolitical tensions were the most frequently reported drivers of newly added scenarios.

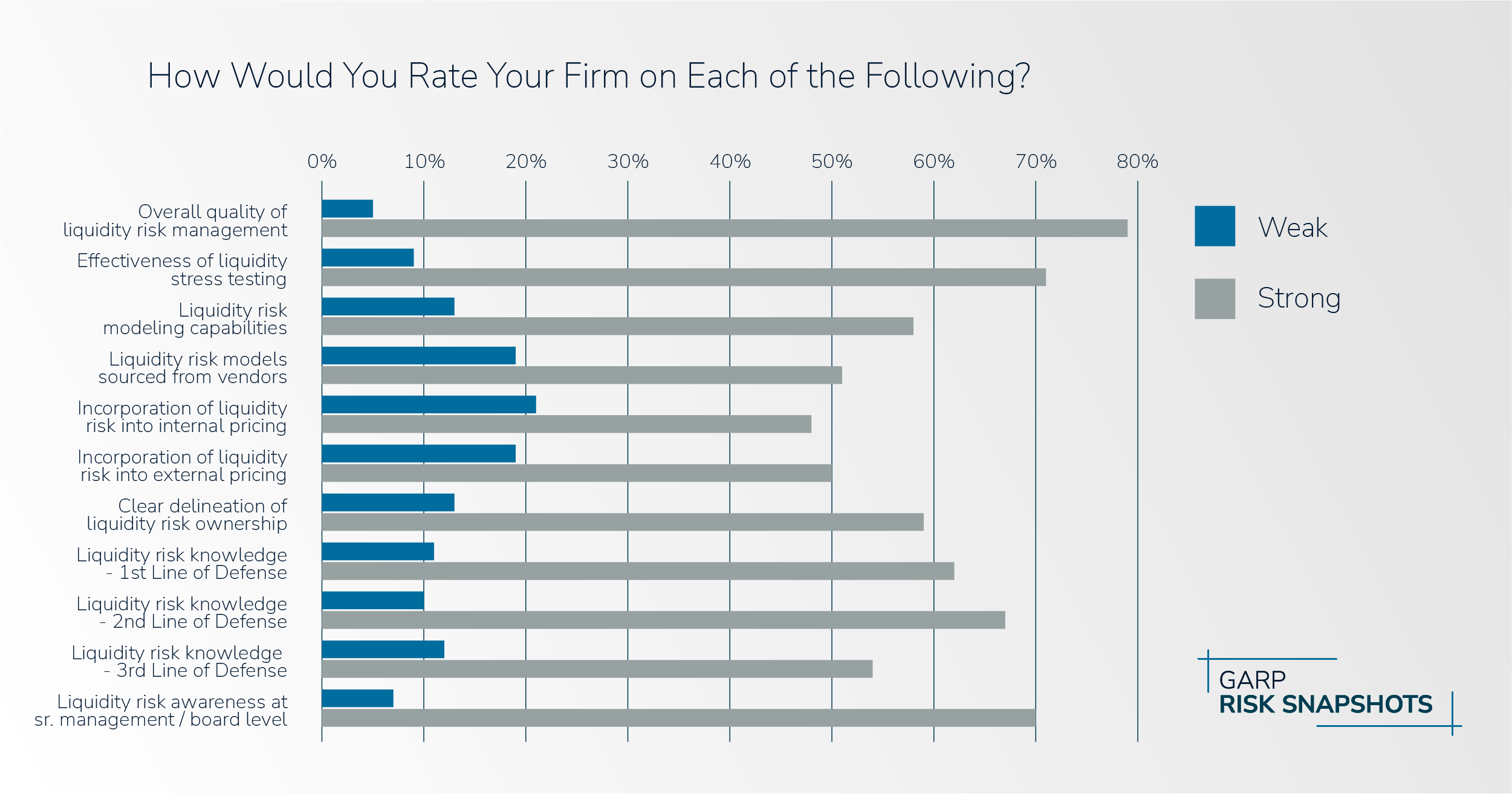

Insight #3 – Most Risk Managers Have a Favorable View of Firm Liquidity Risk Management

Although respondents indicated that there are significant liquidity risk challenges ahead, they also rated their firm’s liquidity risk management highly, both in general and across many specific dimensions. Almost 80% of respondents gave the overall quality of their firm’s liquidity risk management a strong or very strong rating, while only 5% gave it a weak or very weak rating. On more specific dimensions of liquidity risk management (i.e., across different lines of defense, incorporation in pricing), strong ratings outnumbered weak ratings by an average margin of five-to-one.

For respondents from commercial and investment banks, the highest rated liquidity risk metrics were the liquidity coverage ratio (LCR), the net stable funding ratio (NSFR) and net cash outflows. For respondents from asset management firms, the highest rated metrics were net cash outflows, days to liquidate, and average daily trading volume.

Bonus Insight – Looking Back and Looking Ahead

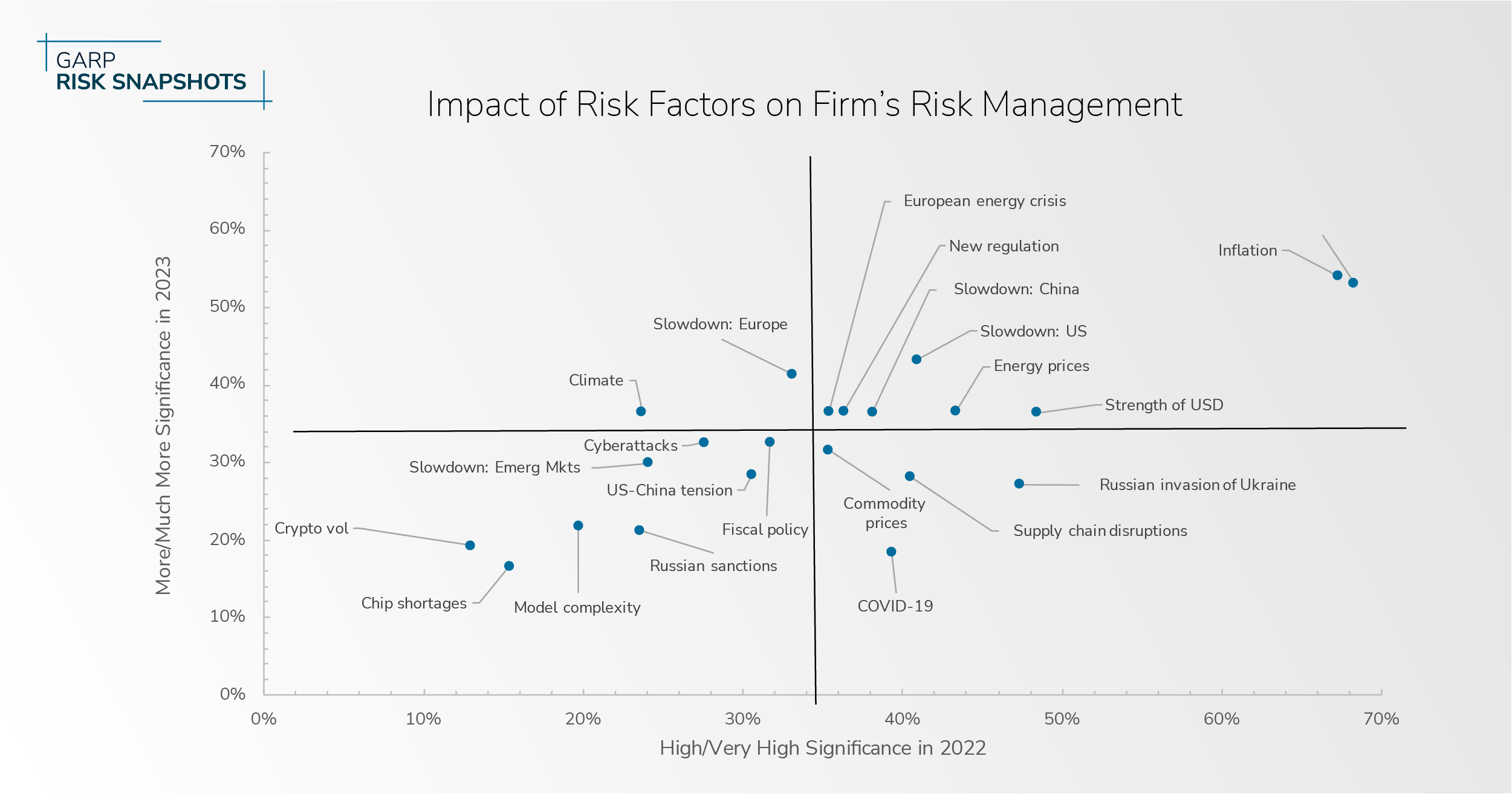

Respondents were also asked about the significance of various risk factors on risk measurement in 2022 as well as how their impact is expected to change in 2023. Rising interest rates and inflation were identified as risk factors that had a big impact in 2022 and whose impact was expected to increase in 2023. These were joined by an economic slowdown in Europe, a European energy crisis, energy prices in general, economic slowdowns in China and the US, the strength of the US dollar, and new regulations as being above average in terms of respondents scoring of these risk factors’ impact in 2022 and expected impact in 2023.

In contrast, several risk factors were identified as being above average in terms of respondents scoring of these risk factors’ impact in 2022 but below average in terms of expected impact in 2023. These included COVID-19, commodity prices, supply chain disruptions, and the Russian invasion of Ukraine.

Want to read more?

Download the full report now!