Geopolitical Risk

April 2024

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

The GARP Benchmarking Initiative (GBI)® recently invited Financial Risk Managers (FRM®) globally to participate in a survey designed to understand the perceived:

- Sources of geopolitical risk

- Impact of geopolitical risk on traditional risk measures

- Preparedness of firms to manage geopolitical risks

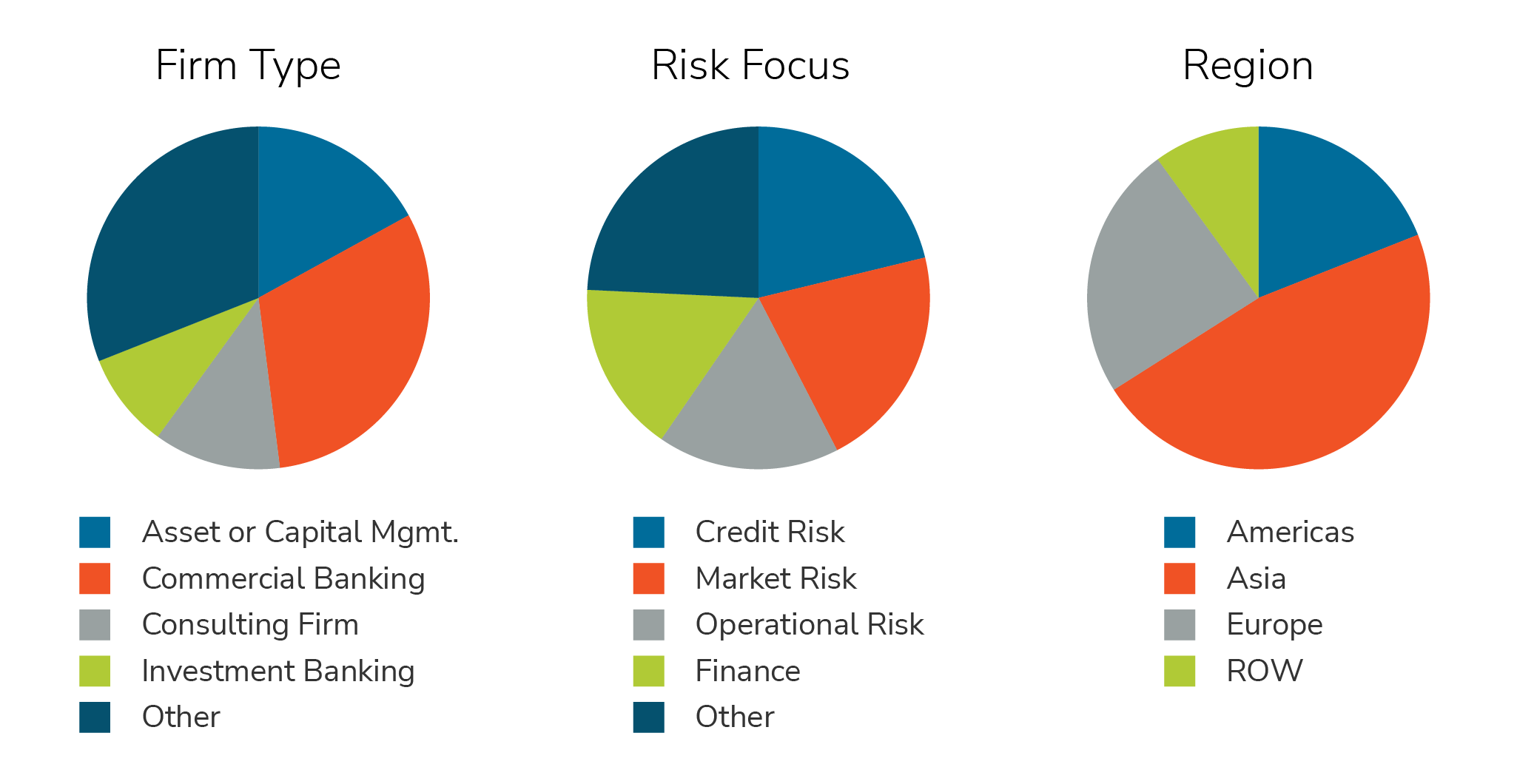

In March, over 500 risk practitioners responded to the survey from a broad range of financial service firms and risk disciplines around the world. Roughly 57% of respondents work at large firms (over 1,000 employees) with more than 73% reporting at least five years of risk management experience.

Read on for key insights derived from the survey results.

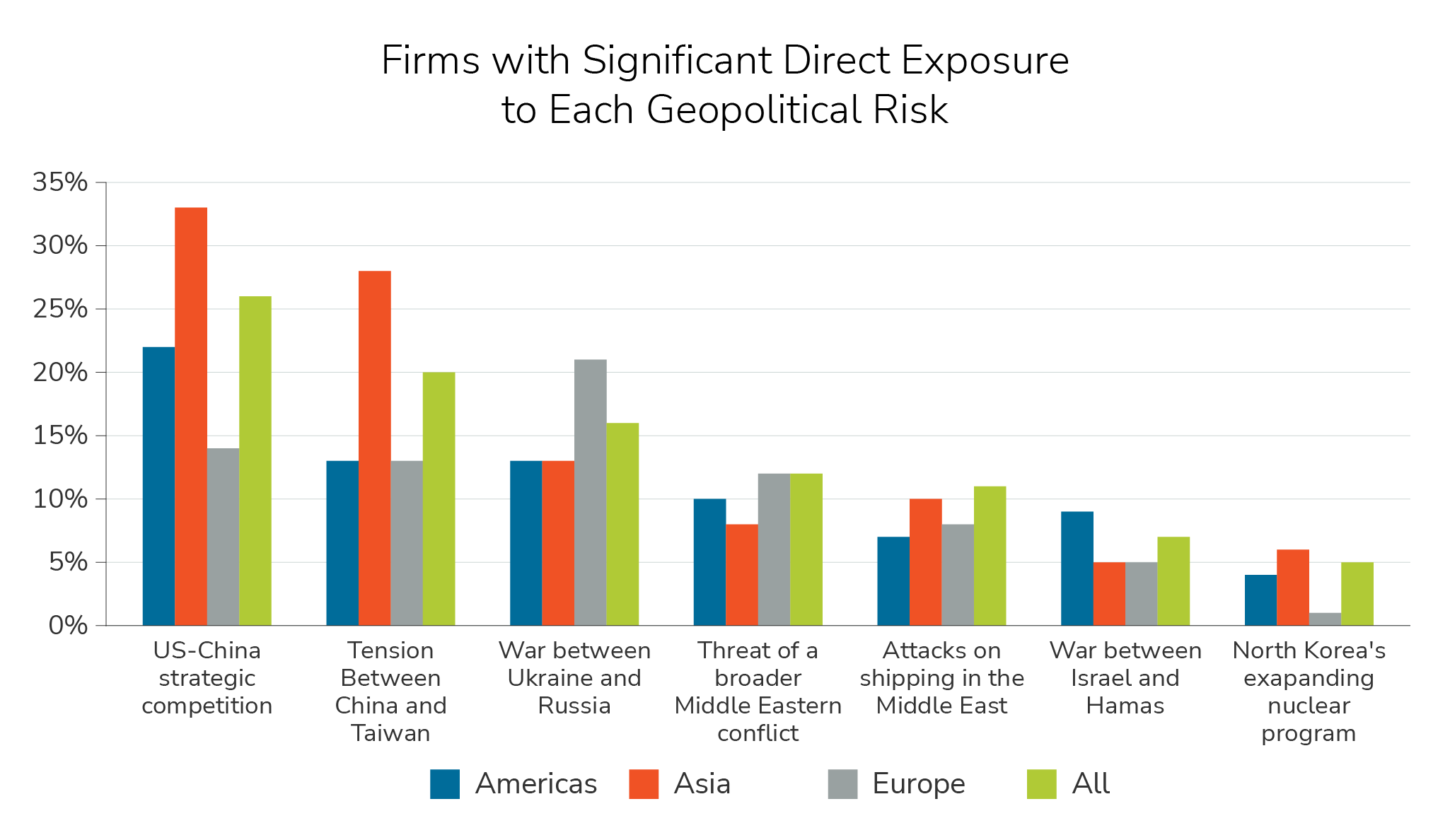

Insight #1 – Firms are most exposed to geopolitical risks relating to China and to Russia’s war in Ukraine

European respondents are most exposed to the Ukraine-Russia war, whereas other regions are most exposed to US-China strategic competition.

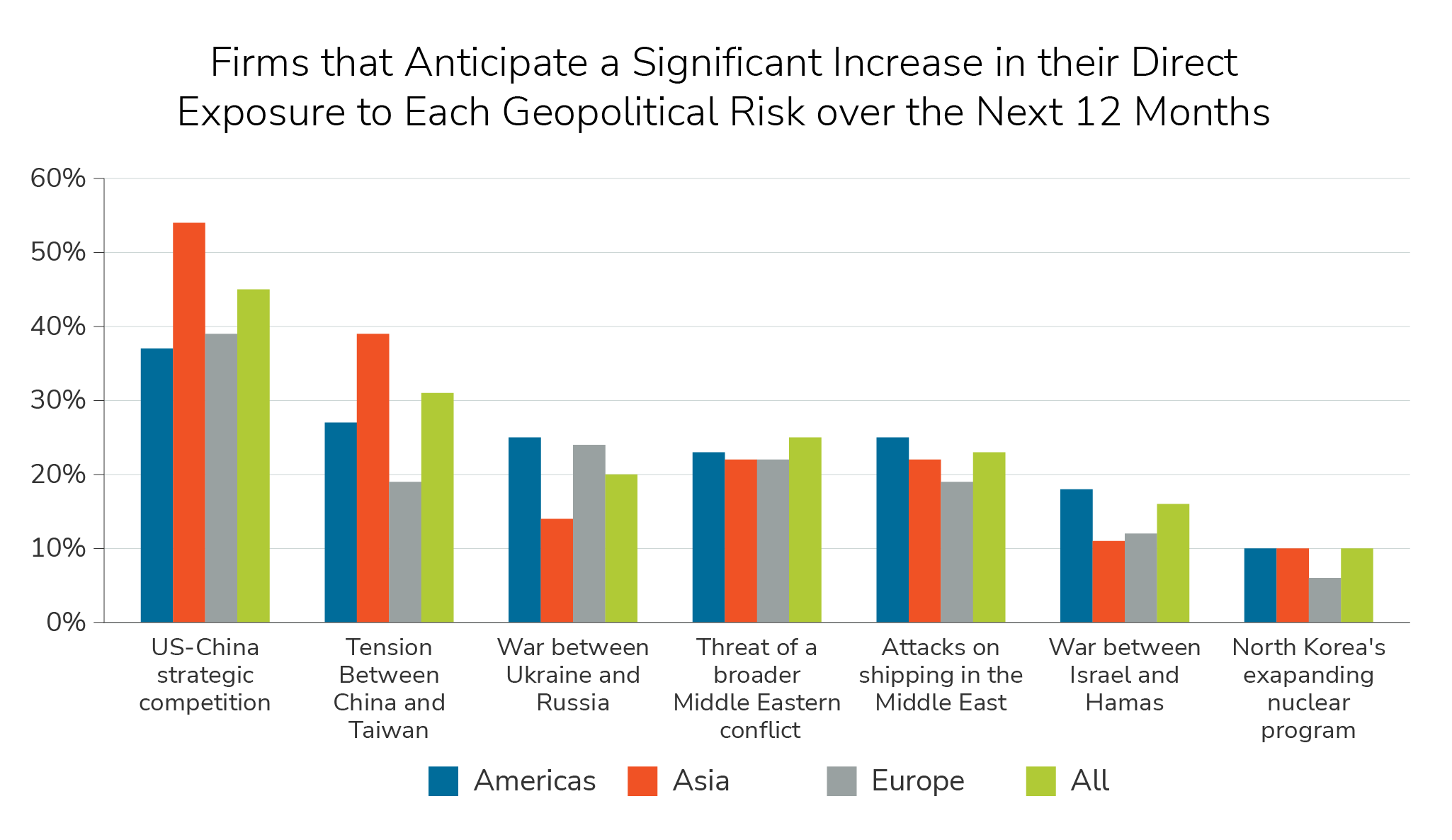

Insight #2 – Firms anticipate increasing exposure to geopolitical risks relating to China and the Middle East in the coming year

US-China strategic competition and China-Taiwan tensions were the most commonly cited geopolitical risk exposures respondents expect to see increase over the next 12 months.

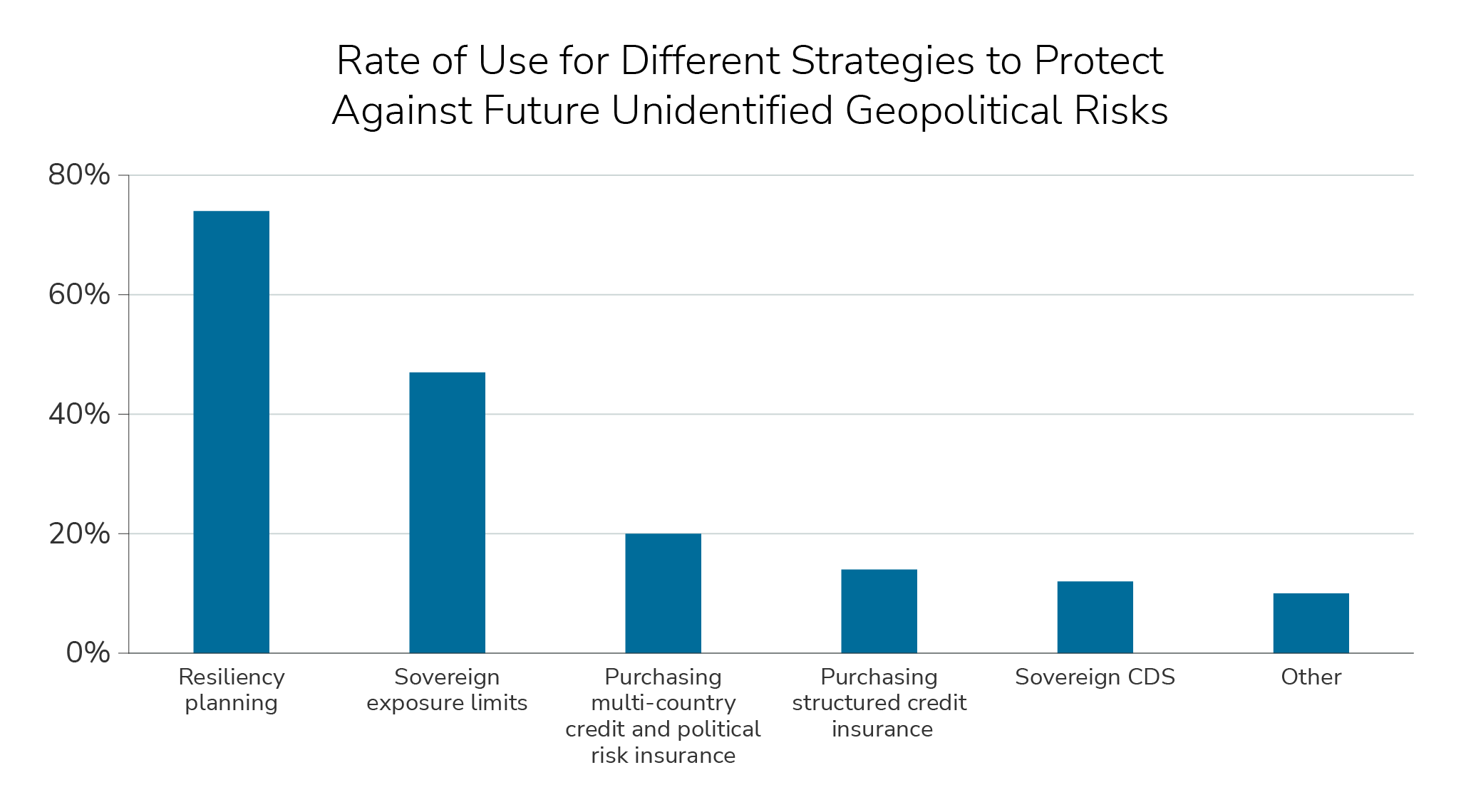

Insight #3 – Respondents most use resiliency planning and sovereign exposure limits to manage yet-to-be-identified geopolitical risks

Resiliency planning and sovereign exposure limits were the most common strategies employed to protect against yet-to-be-identified geopolitical risks, far outpacing insurance products or CDS instruments.

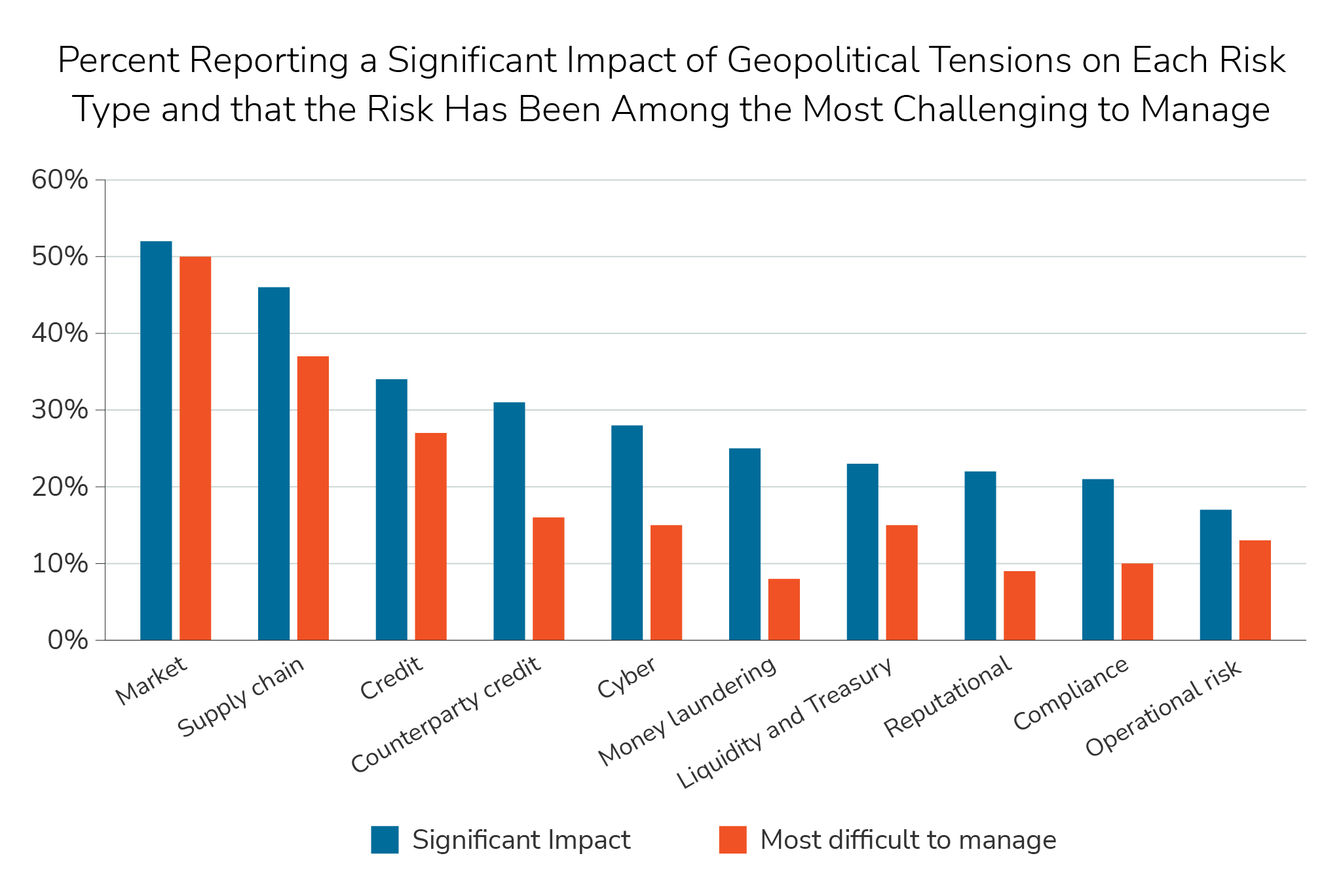

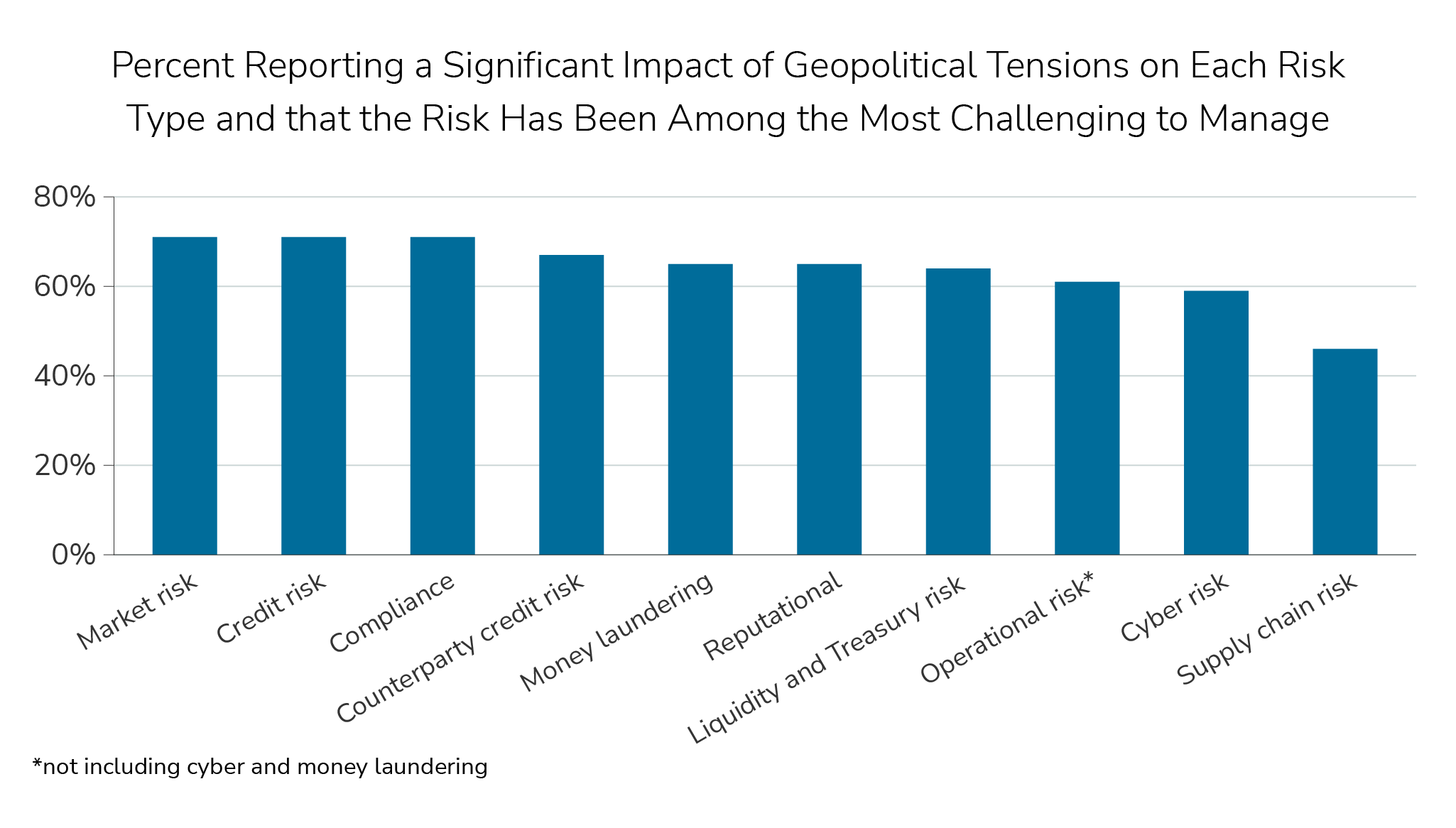

Insight #4 – Respondents found market risk and supply chain risk to be the most impacted and most difficult to manage due to geopolitical tensions

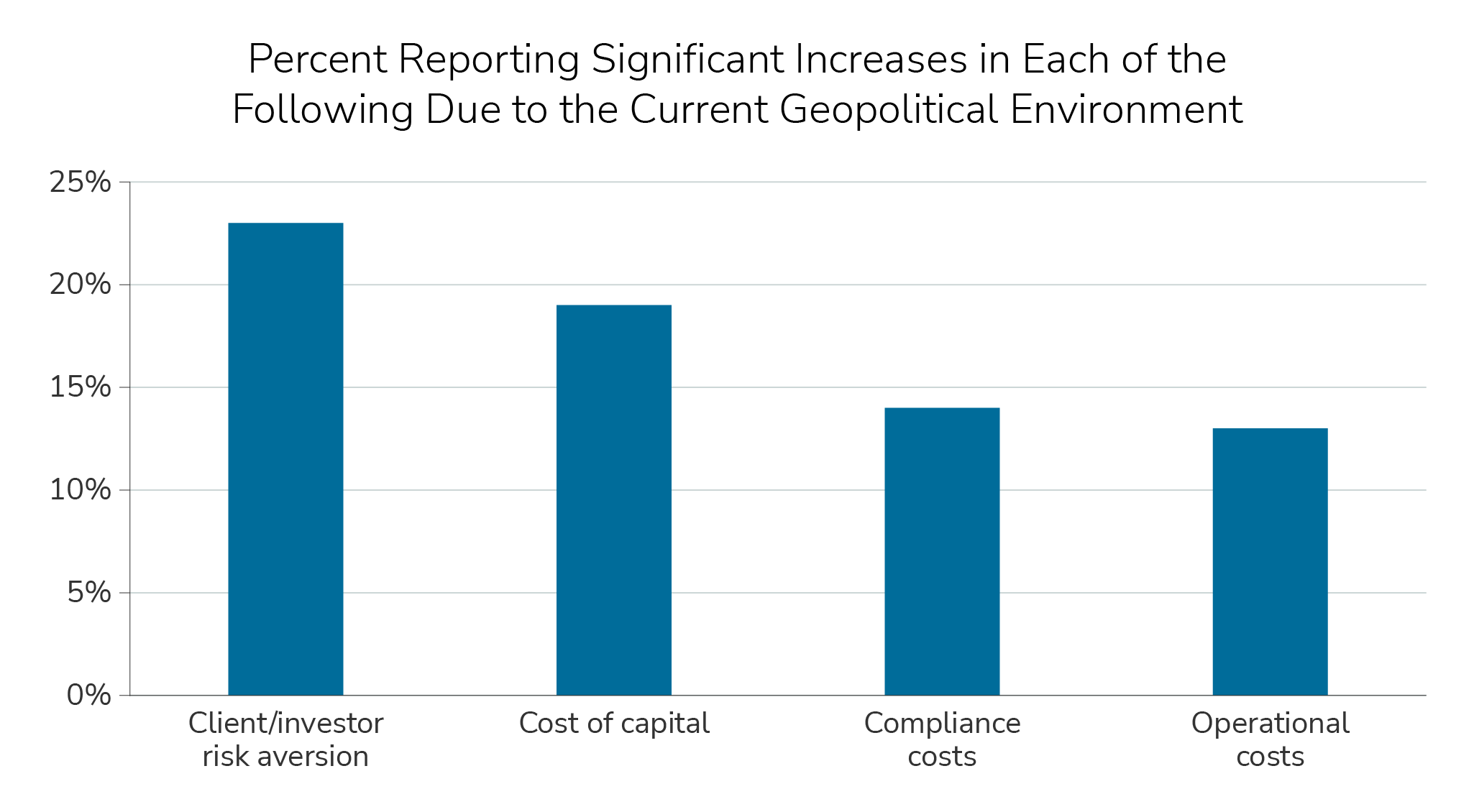

Insight #5 – Most respondents have not yet seen a significant increase in costs due to geopolitical risk

Respondents reported that the impact of geopolitical tensions and risk has so far had a greater impact on client/investor risk aversion and firm cost of capital than on operational or compliance costs.

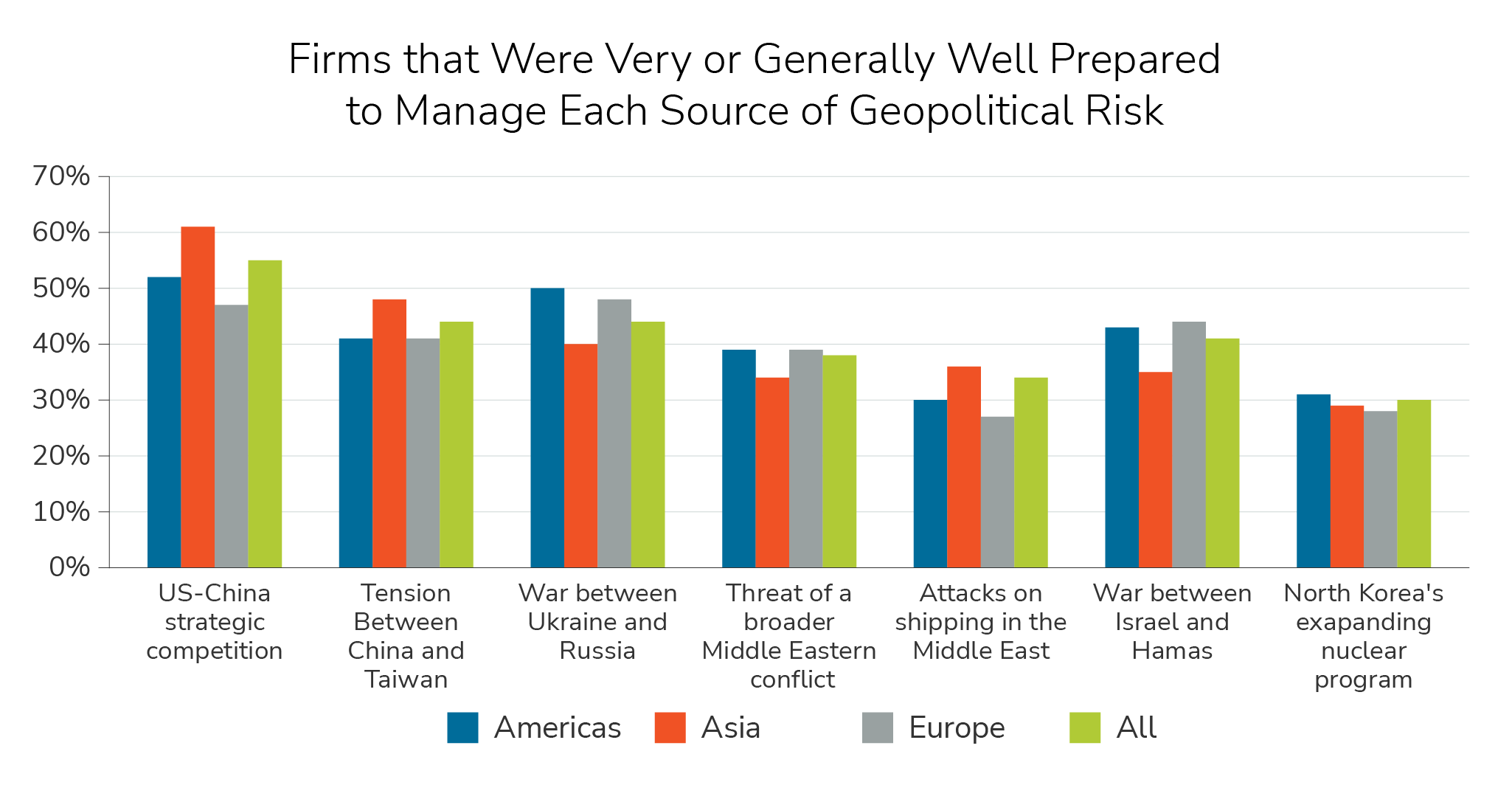

Insight #6 – Firms have generally been more prepared for geopolitical risks relating to China than those relating to other regions

While a majority of respondents reported that their firms were generally or very well prepared to handle the geopolitical risk from US-China strategic competition, less than half reported the same level of preparedness for other sources of geopolitical risk, including only a third reporting that level of preparedness for attacks on shipping in the Middle East.

Insight #7 – Supply chain risk has been the area firms were least prepared to manage

While over 70% of respondents reported that their firms were generally or very well prepared to handle the market risk repercussions from the current geopolitical risk environment, less than half reported a similar level of preparedness to handle supply chain risk.

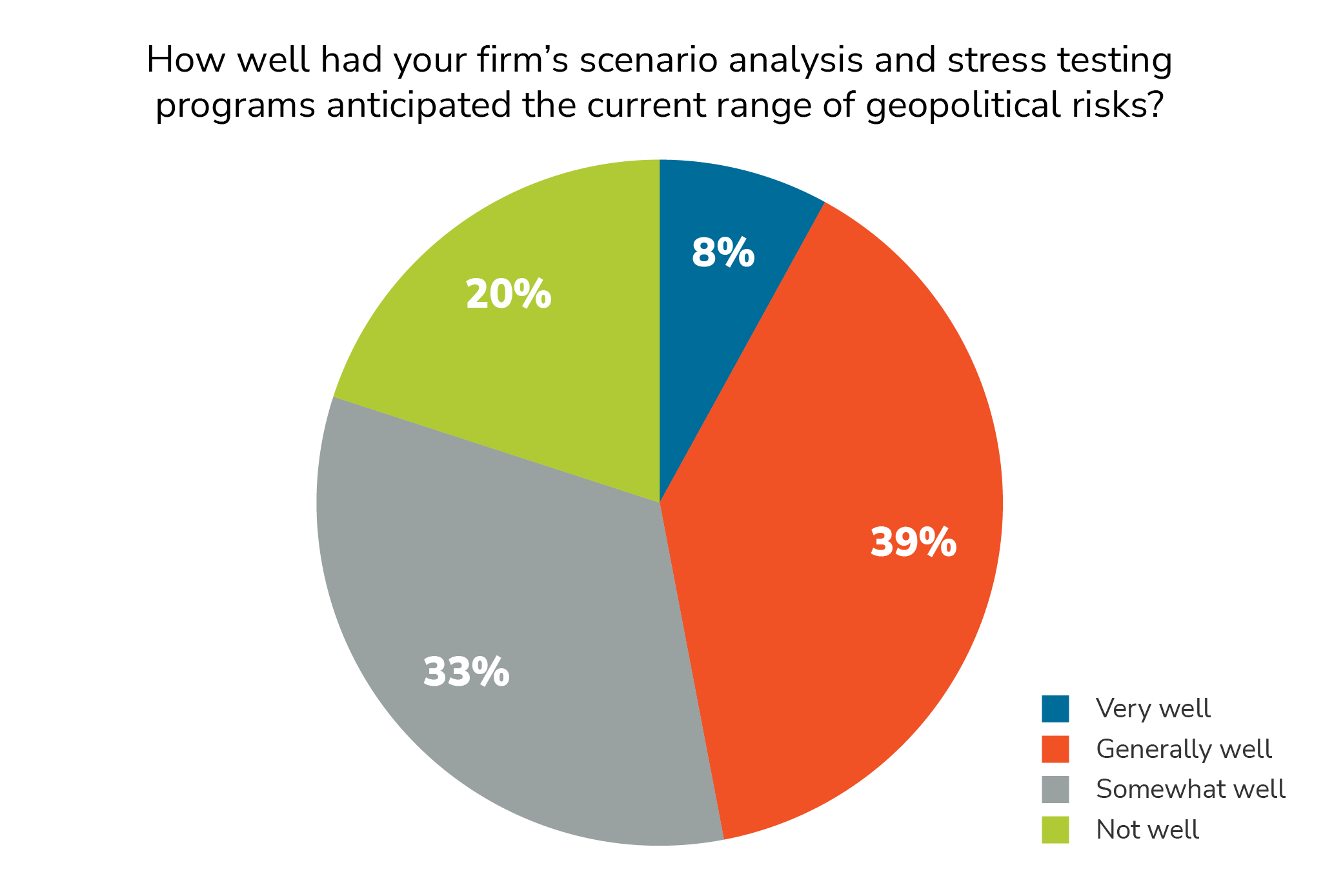

Insight #8 – Less than 40% of respondents’ firms’ scenario analysis and stress testing anticipated the current geopolitical risks generally or very well

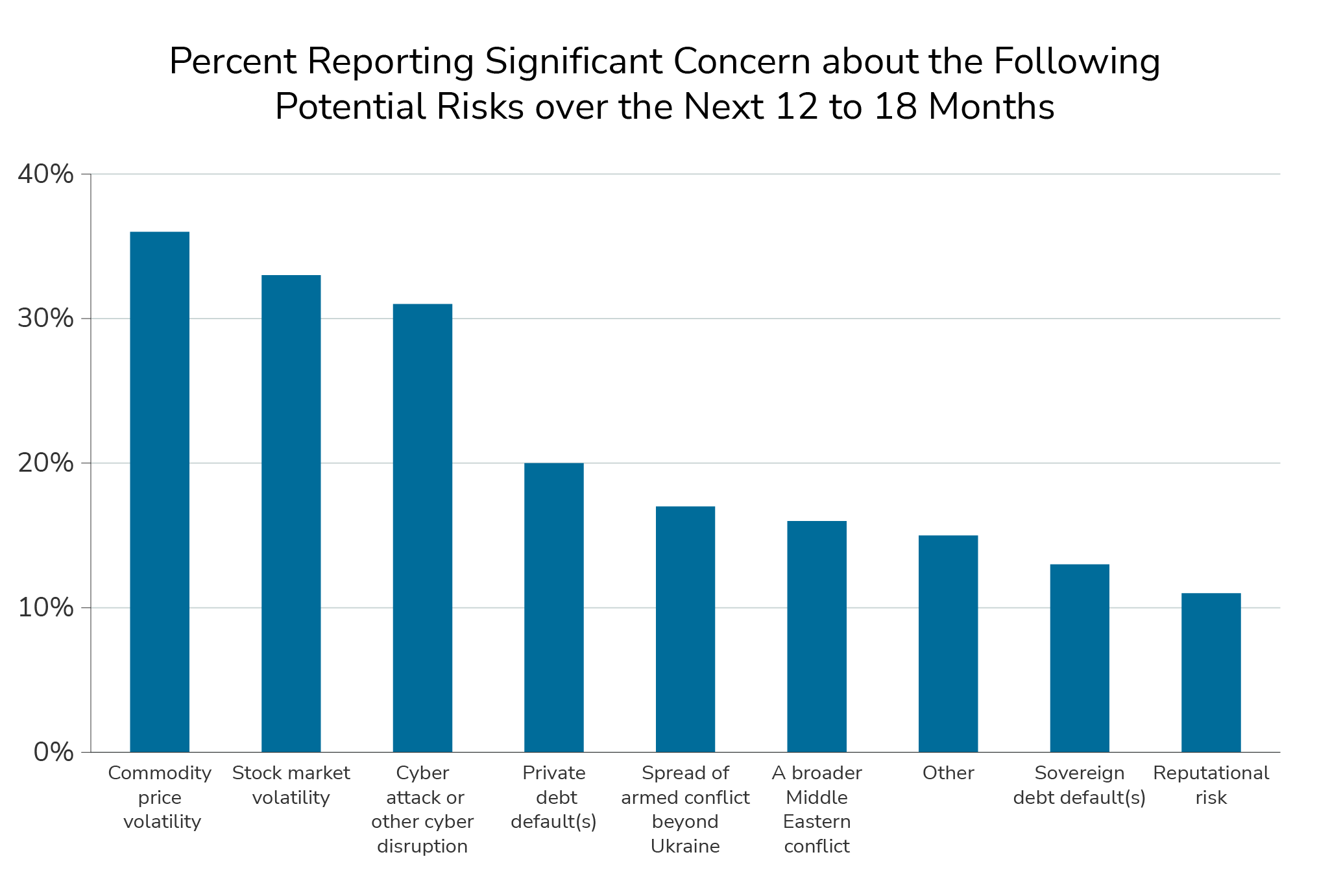

Insight #9 – Respondents expressed greatest concern for commodity and stock market volatility and for cyber risk, over the next 12-18 months

Survey Demographics

Over 500 FRM-Certified professionals participated in this survey. They represent a broad swath of financial services firms and risk disciplines across the globe as shown in the respondent breakdowns by region, firm type, and primary risk area in the charts below.

Want to read more?

Download the full report now!