Financial Services in a Post-LIBOR World

December 9, 2021

The Risk Snapshot Series highlights key insights from GARP’s quarterly survey of Financial Risk Managers (FRM®) about critical risk issues global risk managers and their organizations are navigating.

With the London Interbank Offered Rate (LIBOR) used as a key benchmark in risk management models, mortgages, corporate bonds, and interest rate and currency swaps, there is concern the LIBOR cessation and move to alternative risk-free rates (RFRs) to limit market manipulation will create disruption at top financial firms. To gauge how risk managers perceive the transition to a post-LIBOR world, GARP surveyed nearly 600 Certified Financial Risk Managers (FRM®) across the globe for their immediate outlook.

FRMS UNSURE ABOUT THE PREPAREDNESS OF THEIR FIRM, FINANCE INDUSTRY OVERALL

-

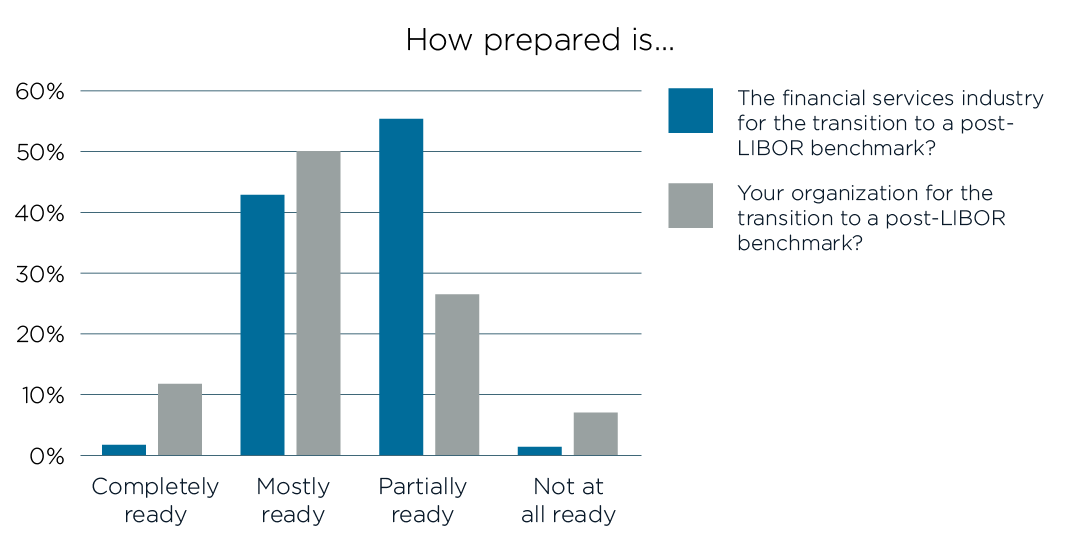

Fewer than 50% of respondents believe the financial services industry overall is “completely” or “mostly” ready for the transition to a post-LIBOR benchmark.

-

Although respondents were overall more positive about the readiness of their own firms, only around 10% of FRMs believe their firm is “completely” ready for a post-LIBOR benchmark.

-

Respondents from government/regulators (75%) and consulting firms (71%) were most sanguine about their company’s preparedness for the LIBOR transition, while those from insurance (58%) and accounting/auditing (50%) were least optimistic.

-

Overall, respondents reported that less than half of the relevant people in their organization understand the mechanism for setting the new RFR most relevant to their firm. Almost one-third of respondents, moreover, reported that the mechanism is understood by 25% or less of key employees.

MANY FIRMS REPORT A LATE START TO PREPARATION

-

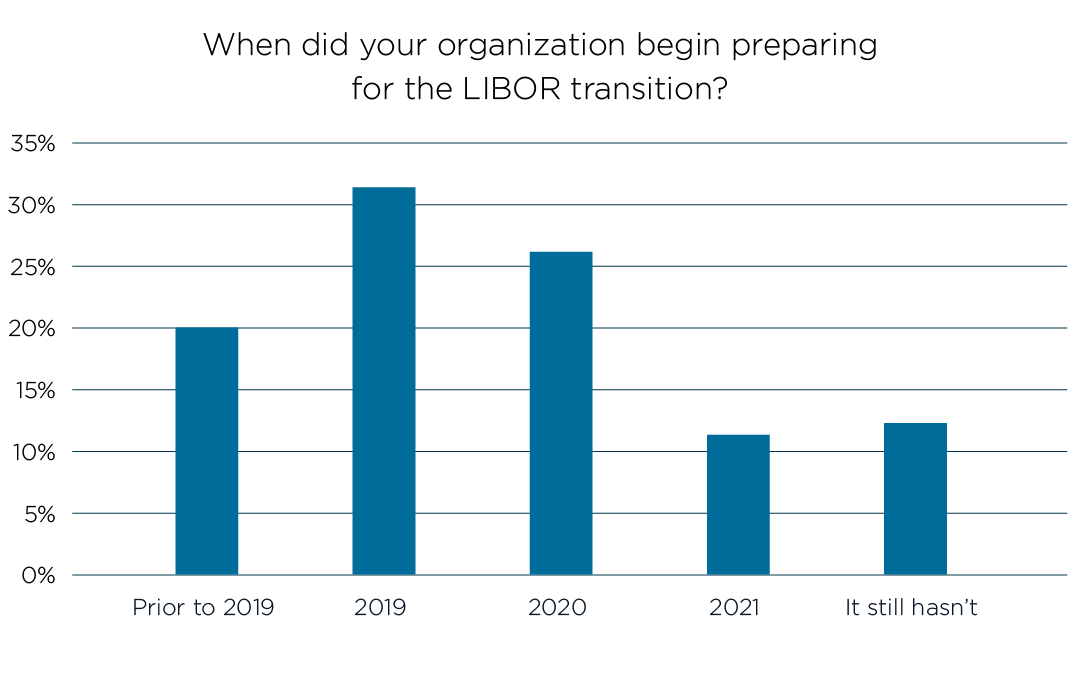

While many respondents say their firms began preparing for the LIBOR transition in 2020 or before, almost 25% did not begin until this year, or have not begun at all. Only 20% started to get ready for the transition prior to 2019.

-

This “late start” was reported most at asset or capital management firms (37%) and least at commercial banking firms (15%). Firm size also seemed to play a role, as a greater number of larger firms were reported to have started preparing earlier for the transition relative to smaller ones.

THE NEW RFR WILL CREATE FRESH CHALLENGES, RISKS

-

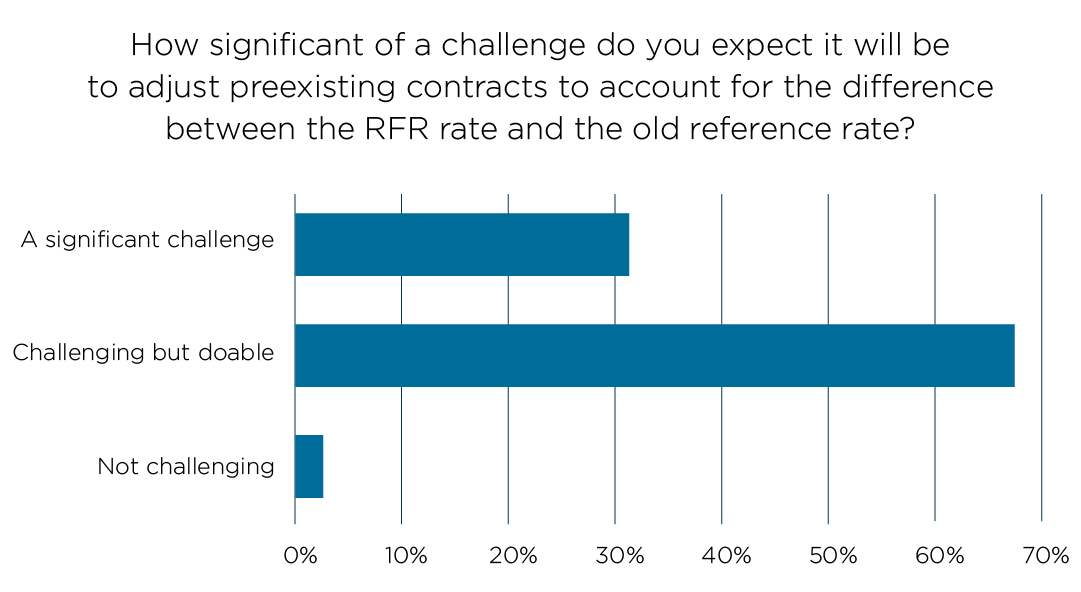

Though most respondents expressed confidence that adjusting preexisting contracts to account for the transition to new RFR could be done successfully, 30% thought it would present a “significant challenge.”

-

Over 33% of respondents identified the lack of a robust term-structure as a significant short coming of the new RFR, while around 60% found the lack of historical data to be its most pressing issue.

-

Nearly 70% of respondents think there are still some term-structure issues that need to be worked out before LIBOR replacement rates can be deemed satisfactory from a term structure perspective.

MARKET MANIPULATION WILL BE MORE DIFFICULT

-

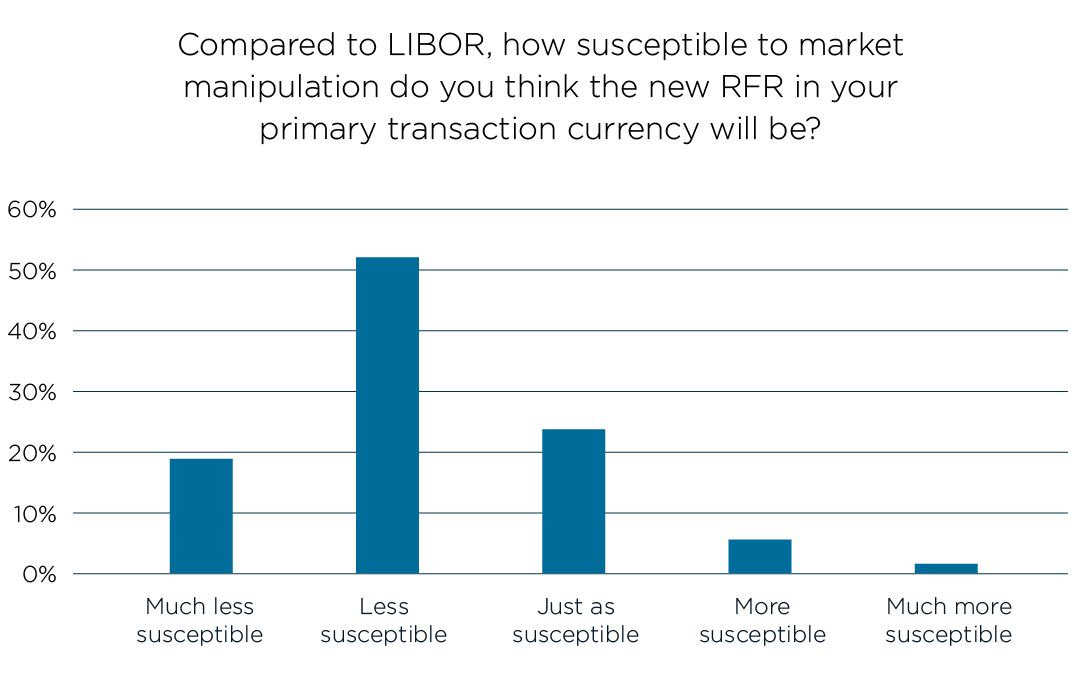

As concern over market manipulation was one of the drivers to replace LIBOR, it is important to note that, while some remain skeptical, slightly over 70% of respondents believe the new RFRs will be less susceptible to market manipulation than LIBOR.

Want to read more?

Download the full report now!