Traditional risk management methodologies have failed during the pandemic, prompting financial institutions to work diligently to improve their agility, resilience and adaptability. But in an era of great stress and uncertainty, meeting this goal is a tall task, particularly since risks are now so difficult to project.

The standard approach to strategy and planning has been based on historical trends and stable market assumptions. However, the pandemic has rendered those trends and assumptions unusable, making forecasting exceedingly challenging.

In this environment, firms may have to make unconventional decisions on tightening or relaxing risk limits. Historically-established limits don't fit the “new normal” of reality - but we cannot afford to wait until enough data is accumulated to proceed with traditional planning and risk management.

Risk managers must therefore answer critical questions right now, such as (1) How do we dynamically adjust risk appetite? (2) How do we decide (yes or no) when a business manager asks to increase limits? and (3) How do we ensure that such decisions don't backfire? The solution to this quandary is “forward-looking” testing.

This can be done through a multi-scenario approach that identifies baseline, opportunistic and adverse outcomes using reverse-scenario analysis. Institutions can employ such a strategy to discover early warning signals of an approaching adverse market environment - and to design mitigating contingent management actions that eliminate or reduce the risk.

But before implementing these plans, you need to stop and ask yourself whether you verified that the management actions you are taking will not inadvertently produce new - or hidden - risk exposures. Consider, also, what steps you'd need to take to flush them out.

Expected Risk: Unusual Suspects

Let's consider a specific example: a risk manager is asked by a lending officer to increase the line of business for a very solid obligor. A rigid risk policy would simply reject this request, but that is certainly not always the right answer. Rather, some firms prefer to take an agile risk management approach that assesses the marginal contribution of an additional loan to the overall risk distribution.

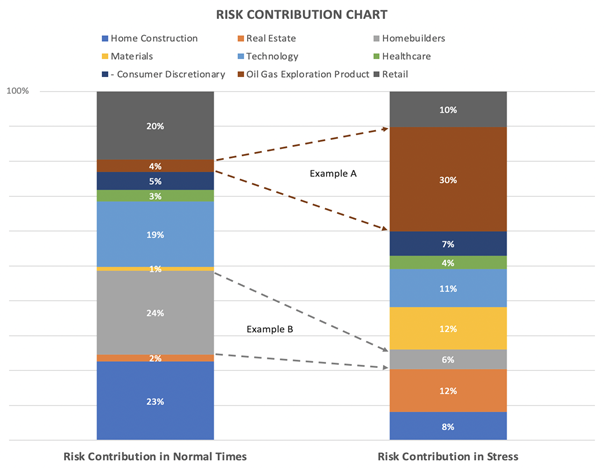

This might lead you to discover the biggest contributors to expected risk (the bell-shaped part of the risk distribution) are not the same obligors that represent the main part of the tail risk. (See Figure 1.)

Figure 1: Dynamic Correlations Cause Dynamic Risk Allocation

The redistribution of risk depicted in Figure 1 occurs because, in adverse conditions, smaller and riskier exposures might become highly correlated - and their combined exposure substantially exceeds the single name limit.

In our example, each one of our exposures is way below this limit - but in a stress scenario, they behave as one. Indeed, in stressful times, even loans at a mid-risk level might deteriorate simultaneously, substantially and unexpectedly.

In Figure 1, this behavior is depicted in both Example A - where the percent of risk contribution has risen due to increased correlation in the tail - and Example B - where the opposite has happened. These deteriorations do not occur due to increased exposure (in both examples, exposure remains flat), but rather because of the redistribution of risk in the tail.

Obviously, the total capital needed to cover losses went up in the stress scenario, and the percent contribution of different industry segments changed quite a bit.

Resiliency Advice

A resilient approach must take all of these factors into account. Yes - all of them.

To make a robust decision, risk managers must evaluate the full distribution of risk based on all future scenarios. Only then one can identify the true marginal contribution to risk - by comparing risk distributions with and without the proposed action (e.g., a loan risk-limit modification).

If the marginal risk increment is not contributing to the tail, the action is probably beneficial, as the risk/return tradeoff in this case is fairly obvious. Moreover, risks are usually well covered with income in the bell-shaped part of the distribution.

In contrast, if the tail risk is substantially increased by a proposed modification in risk limits, risk managers should probably deny the requested action. (Remember, tail risk isn't usually covered by expected revenues, and requires an additional capital cushion.)

The bottom line is that all potential management actions, risk mitigation plans and modifications in risk limits should be run through all future scenarios, with all critical key performance indicators (KPIs) measured on each scenario at each point in time. Only then can financial institutions confidently rely on their strategic and contingent plans.

One caveat is that this type of analysis can be too resource consuming, particularly if it's performed at a very detailed level. Instead, it should be done at a higher level, with balance sheet and income statements represented by uniform segments for risk/return.

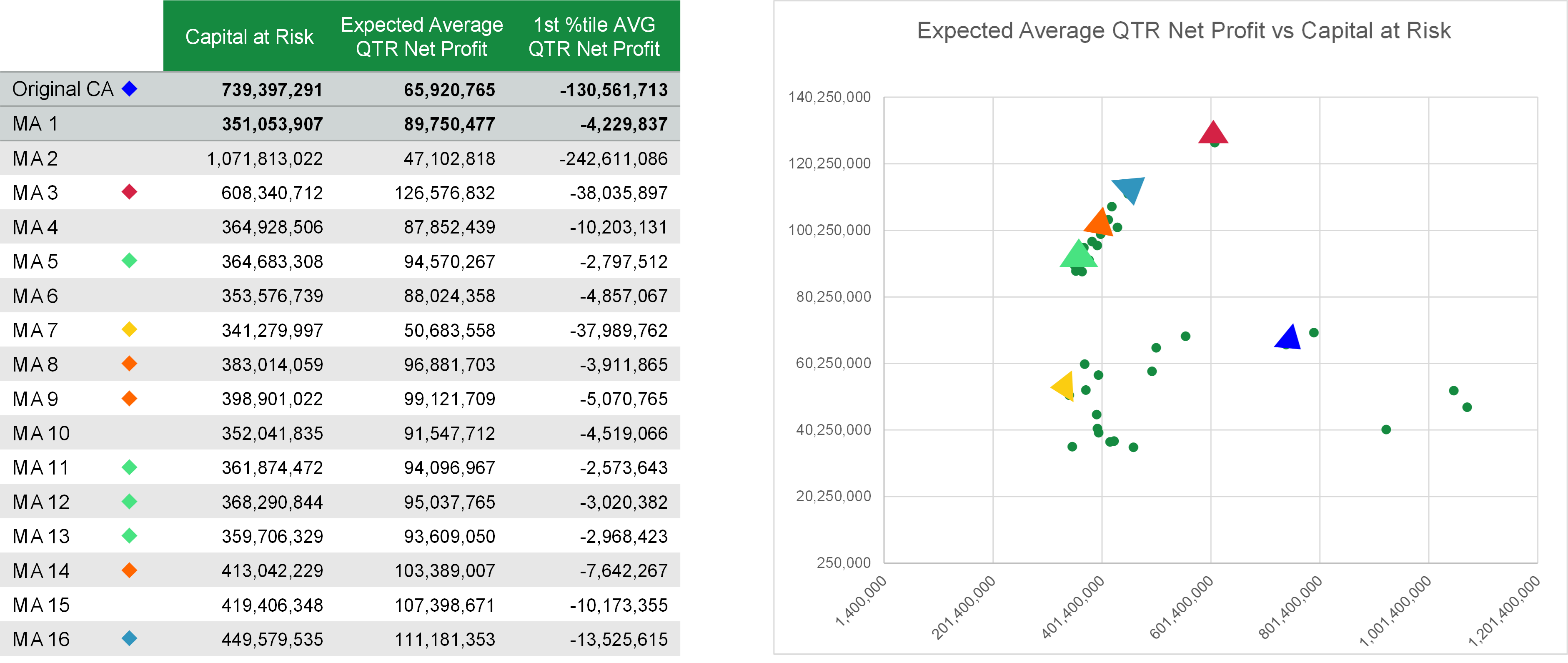

Consider an example illustrated (below) in Figure 2. Here, several potential management actions (MAs) were overlaid over the same scenarios that were used to analyze the original capital allocation (CA).

Figure 2: Comparing the Outcomes of Strategic Management Actions and Risk Decisions

Each row in the table in Figure 2 represents an alternative balance sheet driven by respective MAs - including changes in lending or funding strategy, hedging overlays and/or risk appetite adjustment. For each of these MAs, in each scenario, one can calculate expected credit loss (ECL), net profit and required capital at each point in time.

Aggregate KPIs can then be estimated across all scenarios for each proposed management action. As an example, in Figure 2, we're measuring three factors: capital-at-risk, or CaR (the difference between the expected and the 99th percentile worst-case capital); expected quarterly net profit, averaged over all quarters in the scenario time horizon; and the 99th percentile worst-case quarterly net profit, caused by a particular management action.

You can clearly see that in this example, the current CA (see the original CA in the table and the dark-blue triangle in the chart) is suboptimal. So, some risk limits should be modified to allow for an alternative lending strategy.

But in this two-dimensional risk frontier, it is hard to decide which alternative management action to select - e.g., do you choose based on the maximum possible profit or the lowest possible risk (smallest CaR)?

The additional KPIs might help to clarify what decision is the most appropriate for a particular institution. In our example, one would probably select MAs 11-13, as they tremendously reduce both capital risk and the risk of the net profit - while simultaneously improving the expected profit substantially.

Parting Thoughts

As we have demonstrated, an agile and resilient risk policy must be able to approve and verify risk limits dynamically, based on changing market conditions. What's more, it must ensure that proposed risk mitigation strategies and contingency plans do not produce hidden pockets of risk.

To meet all of these objectives, a financial institution needs the full distribution of outcomes for multiple KPIs, generated consistently on the same set of scenarios.

Optimal risk decisions can only come from simultaneous consideration of all critical KPIs. This is how risk managers can most effectively contribute to strategic decision-making.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.