September 1 was the deadline for the sixth and final group of financial firms to be in compliance with initial margin (IM) requirements for over-the-counter derivatives. But an issue raised by the U.K. Prudential Regulation Authority left a cloud hanging over the end of the uncleared margin rules (UMR) timeline.

The PRA raised questions about the adequacy of the Standard Initial Margin Model (SIMM), the methodology promulgated by the International Swaps and Derivatives Association (ISDA), particularly as it applies to hedge funds and other smaller counterparties in the UMR phase 6 contingent.

As laid out in a June 28 letter, the regulator by December wants to see evidence that risks of under-margining are being addressed and that relevant findings are reported to supervisors.

To ensure adequate margining, especially when portfolios are “materially different” from those to which SIMM has historically been applied, PRA expects firms to self-assess their implementation of UMR against relevant regulations in the context of their portfolios’ risk profiles and the UMR margin trigger threshold. The agency also calls on firms to address the “role played by P&L back-testing” in their SIMM model governance, and to provide a plan to close any gaps identified.

ISDA’s Defense

In an August 2 response headlined SIMM Consistency Is Vital, ISDA chief executive officer Scott O’Malia pointed out that since IM requirements took effect in 2016, “hundreds of derivatives users in scope of the rules have collectively exchanged billions of dollars of IM,” and at year-end 2021, “the largest 20 market participants had collected more than $280 billion of IM for their non-cleared derivatives transactions” – virtually all calculated using SIMM.

Scott O’Malia, ISDA

O’Malia underscored the SIMM standard’s contribution to smooth market functioning, and the fact that the framework has proven “appropriate and fit for purpose” and “resilient during the extreme volatility caused by Russia’s invasion of Ukraine, with no widespread and material instances of under margining reported by users.”

“It’s important to note,” O’Malia asserted, “that ISDA conducts regular reviews of the ISDA SIMM methodology and governance, and the methods used to assess model performance have met requirements across regulatory jurisdictions.”

Ilene Froom, partner in Katten Muchin Rosenman’s Financial Markets and Funds practice, stressed the importance of market participants using a standard IM calculation model, rather than being subject to different remediation requirements and considerations. She said that different jurisdictions have rules allowing use of a grid or a dealer’s own model with its regulator’s approval. Grids, however, can result in higher initial margin requirements, and internal models can be harder to manage and create an unlevel playing field.

“That ISDA, in conjunction with market participants, developed SIMM has been a huge benefit to the derivative market,” Froom said.

Scrutinizing a Metric

The PRA homed in on the so-called 3+1 back-testing metric. Because it is based on data generated from the portfolio models the SIMM model currently tests, PRA said, it may be less accurate for phase 6 firms using different models and/or non-modeled risk factors.

“To the extent the 3+1 performance measure is in some instances inadequate,” according to the letter, “the resulting IM may not be sufficient to cover for risks at the 99% confidence level as required by [U.K. regulations] for some counterparties.”

The PRA added that the U.K. also requires actual P&L back-testing, which serves to fill potential gaps stemming from 3+1 back-testing, and it requests firms to assess its role in their SIMM model governance. The PRA did not advocate prioritizing P&L back-testing or another methodology over SIMM.

As O’Malia explained it: “The approach for assessing ISDA SIMM performance employs both a one-plus-three back test (based on the most recent three years and one year of stress) and an actual P&L test. The one-plus-three back test acts as the basis for resolving any IM shortfall above a certain threshold, while the actual P&L test provides an additional check for any risks not modeled in the SIMM that are driving material and widespread under-margining.”

ISDA’s CEO went on to argue that prioritizing an alternative test, such as actual P&L “as the primary basis for bilateral remediation of IM shortfalls, could have significant implications. For one thing, actual P&L is more procyclical than the one-plus-three back test, potentially resulting in unforeseen margin increases during stress events. For another, it can produce out-of-date signals, meaning problems could be flagged that have already been resolved.

“It’s also operationally much more complex to implement and to reconcile the outputs of the test with a counterparty – a big problem, seeing as the ISDA SIMM was designed to be used by all.”

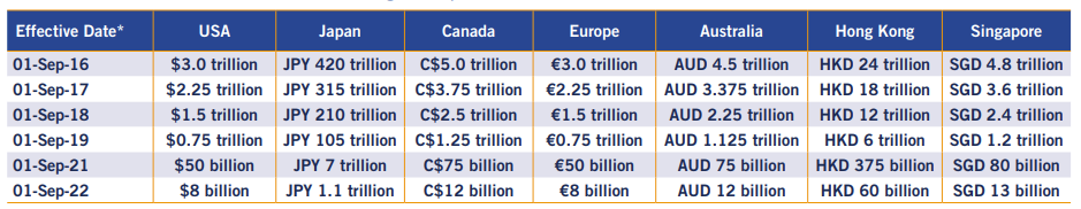

The six Uncleared Margin Rule phases and Average Aggregate Notional Amount (AANA) thresholds. (*Effective dates are for U.S. and Japan. Initial dates for Europe, Australia, Hong Kong and Singapore were in February and March 2017 and then aligned with the others.) Source: ISDA Year-End 2021 Margin Survey

The six Uncleared Margin Rule phases and Average Aggregate Notional Amount (AANA) thresholds. (*Effective dates are for U.S. and Japan. Initial dates for Europe, Australia, Hong Kong and Singapore were in February and March 2017 and then aligned with the others.) Source: ISDA Year-End 2021 Margin Survey

Standing Up to Volatility

In a July analysis, derivatives-market software provider Cassini Systems found that SIMM held up well through the COVID-19 period and is robust enough to deal with periods of unexpected volatility. On a standalone interest rate overnight-index-swap trade, SIMM margin was almost 50% higher than comparable central counterparty margin.

“Further, SIMM has a more comprehensive risk coverage for bespoke strategies in comparison with house margin that Tier 1 banks charge,” Cassini said. “When looking at SIMM margin against house margin charged for bespoke hedge fund strategies, we have found SIMM to be more conservative.”

O’Malia said, “It’s important to stress that the ISDA SIMM has functioned effectively for more than five years, providing a globally consistent standard that creates a level playing field and allows firms to quickly agree the amount of IM that needs to be exchanged, reducing the potential for logjams and messy disputes. It’s by no means certain that alternative approaches would result in the same model performance, stability and operational efficiency.”

Ilene Froom, Partner, Katten

Attorney Froom expects ISDA will work to resolve issues with the PRA and other regulators as appropriate. She added that changes that may be required to meet the PRA’s concerns will impact not only phase 6 firms, but also those in the earlier phases that have been using SIMM for UMR compliance.

O’Malia said ISDA looks forward “to working with the PRA to discuss its concerns in order to help ensure a smooth, consistent implementation of the IM requirements for the sixth and final phase, and to avoid any doubt in the minds of phase 6 entities that could slow their compliance efforts at this critical time.”

Longer-Term Consequences

One possible ramification, if a resolution remains elusive, relates to the minimum threshold of $50 million that most jurisdictions set before initial margin must be collected or delivered. A number of financial firms, Froom said, are monitoring that threshold with their counterparties to defer the typically time-consuming documentation process. They may start negotiating the documentation and putting the infrastructure in place for initial margin under UMR when the relevant exposure reaches a certain level, such as $25 million.

“If there are changes to how parties have to apply SIMM or account for and determine shortfalls, those exposures can ratchet up and may result in liquidity drains during times of stress, and counterparties may have to begin the documentation process sooner rather than later,” she said.

And if the PRA pursues its own path in terms of prioritizing a test besides SIMM, or requiring additional tests to supplement SIMM, it could be problematic for firms it oversees.

“A hedge fund not directly subject to U.K. margin rules that can choose a counterparty with which it has to post less onerous margin may opt to trade with that firm instead, potentially hurting U.K. dealers,” Froom said.

Topics: Financial Markets