Almost three years since widespread selling of U.S. Treasury bonds exposed weaknesses in that essential market’s operational resilience and prompted an unprecedented Federal Reserve response to restore liquidity, reform proposals are moving ahead while some market participants warn of regulatory overkill.

The issues, which were particularly acute at the start of the COVID pandemic, have resonated at the highest levels. The Financial Stability Oversight Council (FSOC), a committee of regulatory agency heads that is coordinated by the Treasury Department, in its 2022 annual report described Treasury market resilience as one of four key priorities – along with nonbank financial intermediation, climate-related financial risk and digital assets – “to address risks and vulnerabilities in the financial system.”

Even after market-structure improvements last year, there need to be “continual improvements . . . to keep pace with changing technology and trading patterns to ensure that the Treasury market continues to fulfill these vital purposes [of financing the government, supporting the financial system and implementing monetary policy],” the report stated. “The council supports efforts by Treasury to improve transparency in post-trade transactions in the cash market for Treasury securities.”

Looming over the market is the potential for ever greater volume spikes during periods of stress. Research firm Coalition Greenwich pointed out in a November report that average daily U.S Treasuries (UST) trading volume more than doubled, to $600 billion, between 2001 and 2021, and reached $1 trillion one day in September 2022.

The FSOC noted factors including current increases in interest rates, raising government financing costs and causing losses for some investors, and said, “Technological changes in trading also continue to present new risks that need to be monitored and understood.”

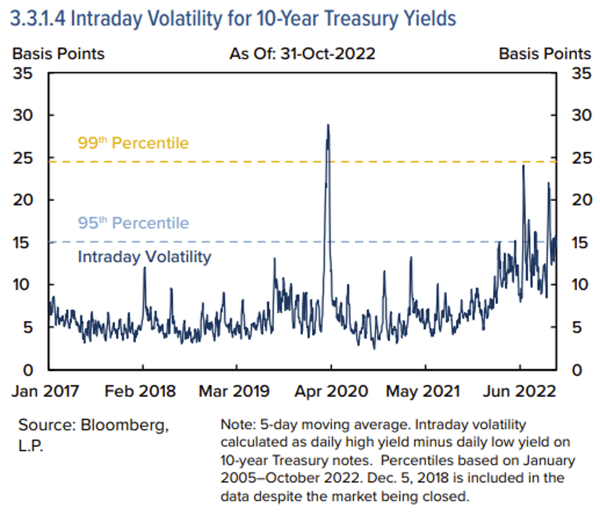

Volatility data in the FSOC Annual Report reflects economic, policy and geopolitical uncertainties that affected Treasury market liquidity.

The council also pointed to objectives set by the Inter-Agency Working Group (IAWG) for Treasury Market Surveillance, according to a November progress report, that include bolstering UST intermediaries such as market makers; improving data quality and availability; evaluating expanded central clearing; and enhancing trading venue transparency and oversight.

SEC Issues Proposals

The Securities and Exchange Commission has taken on a key rulemaking role, issuing three proposals in 2022. The most recent, in September, addressed central counterparty (CCP) clearing of UST secondary-market trades, including Treasury repurchase agreements (repos) and reverse repos.

“While central clearing does not eliminate all risk, it certainly does lower it,” said SEC Chair Gary Gensler.

The SEC pointed to a Treasury Market Practices Group finding that a majority of secondary trades now clear bilaterally, with potential contagion risk to a UST covered clearing agency (CCA), of which there is currently only one: the Depository Trust & Clearing Corp.’s Fixed Income Clearing Corp. (FICC). If it were unable to perform its CCP function, “then this could have a broad and severe impact on the overall U.S. economy,” the SEC maintained.

Earlier in 2022, the SEC issued proposals pertaining to other IAWG recommendations: enhancing oversight of Treasury trading platforms under Regulation ATS, and requiring UST liquidity providers to register as dealers.

The latter, Gensler said, “reflects Congress’ statutory intent that firms engaging in important liquidity-providing roles in the securities markets, including in the U.S. Treasury market, be registered with the commission. Further, requiring all firms that regularly make markets, or otherwise perform important liquidity-providing roles, to register as dealers or government securities dealers also could help level the playing field among firms and enhance the resiliency of our markets.”

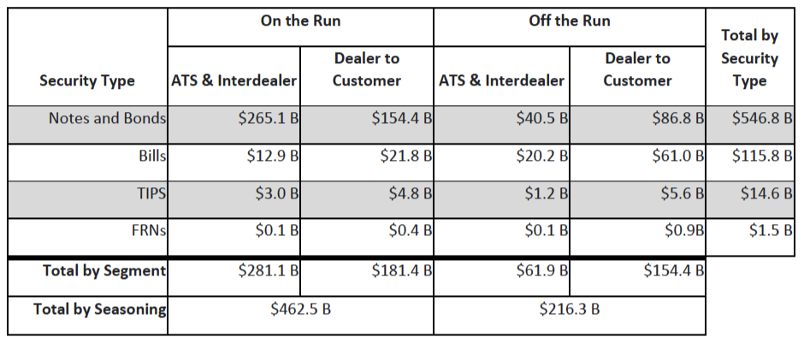

First-half 2022 average daily trading volume of Treasury securities. Source: Federal Reserve Bank of New York, based on FINRA TRACE data.

First-half 2022 average daily trading volume of Treasury securities. Source: Federal Reserve Bank of New York, based on FINRA TRACE data.

Series of Actions

Other “significant steps” related to liquidity and resilience, recounted by the FSOC, included an October 2022 Federal Reserve Bank of New York staff report on all-to-all trading; the Federal Reserve’s addition of depository-institution counterparties to its standing repo facility, which was previously restricted to primary dealers; a requirement that UST and agency securities transactions be reported to the Financial Industry Regulatory Authority’s (FINRA) Trade Reporting and Compliance Engine (TRACE); and FINRA’s move in December to shorten the timeframe, improve execution timestamps, and increase the frequency of, and information included in, aggregate public data releases.

The SEC’s proposed rules “make sense,” said Kevin McPartland, head of research, market structure and technology at Coalition Greenwich, such as updating outdated oversight rules of today’s electronic trading platforms, and heightening scrutiny of critical market makers. In terms of expanding clearing requirements, McPartland said, “If standardized interest-rate swaps are cleared today, then expanding [UST clearing] feels inevitable.”

McPartland cautioned, however, that more UST clearing faces different challenges. For one, the financial crisis elucidated the importance of clearing OTC swaps, but there is no similar event fueling expanded UST clearing. And in contrast to the several entities that were prepared to clear swaps, only one is now clearing Treasury trades, so “it will be interesting to see if competition to the FICC comes online,” McPartland said.

Market Participants React

Responses to the SEC proposals are mixed.

“We believe the first priority among these efforts should be to expand the availability of central clearing” for bilateral repo and reverse repo transactions, if not triparty repo or cash UST transactions, said the Managed Funds Association’s letter.

It also characterized as “unjustified overreach” to require already registered private funds to register also as dealers.

“When you talk to the hedge fund and asset management community, McPartland observed, “the registration requirement is quite a big issue.”

The International Swaps and Derivatives Association cited a membership survey revealing support for clearing, if not the broad clearing mandate proposed by the SEC that “could result in some participants reducing their activity or withdrawing from the market, potentially reducing liquidity.”

The Securities Industry and Financial Markets Association and Institute of International Bankers jointly expressed similar reservations: “Given the importance of the Treasury market, other reforms already proposed that are intended to strengthen the Treasury market and [other risks that they identified], we recommend the commission follow a more incremental and calibrated process.”

Dallas Fed senior vice president Sam Schulhofer-Wohl, co-author, Expanded Central Clearing Would Increase Treasury Market Resilience.

The two trade groups suggested that the SEC first seek to improve clearing of Treasury bonds within existing regulations and market infrastructure, and then analyze the impact of those changes before setting any targeted clearing requirement. SIFMA officials have been advocating a phased approach to mandatory clearing, starting with cash transactions and allowing time for study and evaluation.

In December, Matthew McCormick and Sam Schulhofer-Wohl of the Federal Reserve Bank of Dallas concluded that broadening central clearing “comes with potential benefits and costs. Although no one reform can address all vulnerabilities in the Treasury market, the SEC proposal has the potential to significantly enhance the market’s resilience. Further, some costs to private market participants would be offset by benefits to the broader market and to the public.”

Critiques from the Buy Side

The Investment Company institute commended the proposed exemption of funds’ cash UST transactions from clearing, but said it is “premature” for the SEC to mandate clearing of their Treasury repo and reverse repo transactions. The buy-side group recommended regulatory, structural and operational changes instead.

“We believe that many of the benefits that the SEC seeks from Treasury repo central clearing may be gained from increased voluntary clearing, especially once these necessary changes are made to the clearing infrastructure,” the ICI letter stated.

In an analysis published online in September, fixed-income giant PIMCO said it sees little benefit to extending central clearing to cash transactions that have little “meaningful counterparty risk.” It added that accounting treatment today allows banks to net on their balance sheets to free up capital.

“Overall, while clearing Treasuries could improve certain facets of the market, we don’t think requiring it would improve market liquidity,” PIMCO said.

The firm was critical of post-trade reporting, such as to TRACE, because while “theoretically beneficial,” it could potentially reduce liquidity. With bonds mostly traded through a dealer at a negotiated price, “immediately disclosing” price data could lead to front-running and decrease dealers’ ability to offload that risk.

PIMCO advocates broadening access to the Fed’s liquidity-providing programs, especially in times of market stress; advancing all-to-all trading; and “tweaking” bank regulations to incentivize more market making.

The firm would make permanent the temporary changes the Fed imposed early in the pandemic, when it excluded USTs and reserves from the supplementary-leverage-ratio calculation. Such a change “does not compromise the stability and soundness of the banking system, but would allow banks to make markets more easily, especially in times of crisis,“ said the PIMCO document.

Topics: Financial Markets