The uncertainties of when and how successfully localities restore economic activity extends to structured finance transactions - and there are various scenarios. A national downturn would have to be deep and extended to affect those transactions' investment-grade bonds, but the coronavirus shock could weaken the complex transactions in a variety of ways.

“The extent of that weakening will depend on a number of factors, including a transaction's exposure to the borrowers or industries most vulnerable to the virus's effects, its exposure to vulnerable transaction parties, structural mechanisms in the transaction, and the impact of government support,” Moody's Investors Service said in a recent report.

Broadly syndicated collateralized loan obligations (BSCLOs), for example, securitize loans from highly leveraged companies most likely to default. Some may benefit from corporate stimulus in the CARES Act, passed in April, but the law prioritizes aid to companies with longer-term business prospects.

However, investors in investment-grade BSCLO bonds are in a strong position.

“If we assume our baseline recovery rate on the assets that do default, for the very senior bonds we're talking about default rates of 80% or 90%, even more, before those bonds would even lose any principal,” said Moody's senior analyst Peter McNally.

Even for bonds just a notch above non-investment grade, the default rate would have to reach upwards of 54%, assuming a 60% recovery rate on defaulted assets, according Moody's.

Variations Down the Stack

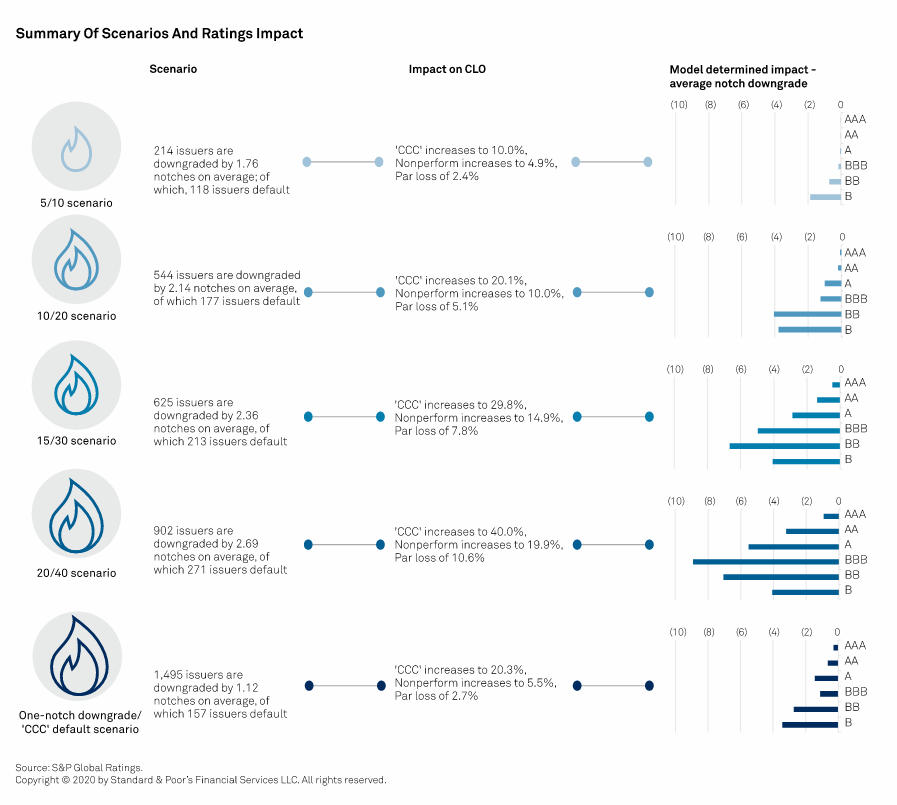

S&P Global Ratings recently generated five hypothetical stress scenarios gauging the impact of the coronavirus and the collapse in oil prices. In the fifth and most severe scenario, in which all issuer ratings are lowered by a notch and all CCC loan issuers default, S&P found that investors in CLO bonds rated single-A or higher could rest easy, at least for now.

“Outcomes for tranches further down the CLO capital stack depend upon the severity of the assumptions applied, but no tranches rated A or higher defaulted under any scenario” S&P said.

Still, it may be too early to breathe easy. CLOs benefit from having diversified exposure to the economy, but the recession is affecting the economy broadly, and “there are sectors very much exposed to the particular vagaries of the pandemic,” McNally said.

In a March 31 report, Moody's said 14.5% of the debt backing CLOs that it rates is in sectors highly vulnerable to “near-term baseline case credit negative effects of the coronavirus and oil price drop,” and 53.2% are moderately vulnerable.

As of April 26, S&P Global noted, more than a quarter of loans held by U.S. broadly syndicated CLOs had been downgraded or placed on Watch Negative.

Global Baseline

Those warnings appear increasingly likely to become reality. On April 28, Moody's projected a 5.8% contraction in 2020 for the G-20 advanced economies. It saw the U.S. declining 5.7%, and a gradual recovery in the second half of this year being challenged by recurring and localized lockdowns in different countries. A recurring nationwide lockdown would be much worse.

“In such a scenario, we would expect severe harm to the real economy, with potential for the shock to quickly escalate into a deep financial crisis that would be far worse in scale and scope than the 2008-'09 global financial crisis,” Moody's said in its Global Macro Outlook 2020-'21 April update. “Moreover, any potential economic recovery would not only be delayed, it would be far weaker than our projections.”

Fitch Ratings said April 27 it was in the process of updating ratings under its baseline scenario, “which assumes a short but severe global recession with recovery beginning in the second half of the year,” and investment-grade ratings remaining “materially unaffected.” However, the structured finance analysis focused on a more severe downside scenario that includes a prolonged recurring health crisis resulting in depressed consumer demand and below-trend economic activity, delaying a meaningful recovery beyond 2021.

In such a scenario, which the rating agency said does not reflect its current expectations, CLOs were assigned a downside score of 4, or a medium to high impact on a scale of 1 to 5.

Gauging Impacts

“CLO portfolios globally have been assigned a downside score of 4,” Fitch said, “because they consist of highly levered and low-rated companies, and they are exposed to vulnerable industries that include aerospace and defense, automobiles, energy, oil and gas, gaming, leisure and entertainment, lodging and restaurants, metal and mining, retail and transportation and distribution.”

Across all structured finance asset classes globally, Fitch estimates that 75% of deals, numbering 4,497, would face medium-to-high impact in the downside scenario, with 14% (877) experiencing high impact. Another 10% of deals would face a medium impact, and 1% either mild-to-modest or virtually no impact.

Fitch sees consumer asset-backed securities fitting mostly into the medium and medium-to-high impact categories, with student loans and retail credit cards of more concern than prime credit cards and prime and subprime auto loans.

Nicky Dang, head of U.S. consumer asset-backed securities (ABS) at Moody's, said that consumer ABS is significantly affected in the current crisis because of unemployment and income loss, and it remains to be seen how federal government relief affects the securitizations' cash flows.

Dang noted said that March delinquencies were relatively flat year-over-year, likely due to the relief funding, although there were spikes in terms of extensions and deferrals among consumer loans, especially for auto loans. However, credit stress will almost certainly increase significantly in the months ahead, she said, especially for loans to subprime borrowers and other vulnerable populations.

Payment Priorities

Where asset classes stand in terms of payment priority will also come into play.

“People will prioritize bills for mobile phones, which have become crucial, then probably credit cards, because there's ongoing utility there, and they can keep the line of credit for purchase open as long as they continue making minimum payments,” Dang said.

She contrasted those assets with unsecured loans by the likes of LendingClub and Prosper.

“Consumers have already used that money for what they want to do, so that's probably at the bottom of the priority list,” Dang said, adding that her team is seeking to rank the risk both within each asset class and across the different types of debt.

She noted that Moody's recently rated prime and nonprime auto deals, increasing the projected loss numbers for the prime by 50% and the nonprime by 20%, compared to prior deals with similar collateral from the same issuer. While that seems counterintuitive, the prime deal's projected losses stem from a much lower base, and in absolute terms the nonprime projected losses are much greater.

“A lot of nonprime borrowers live through crises daily, even in the good times, because they live paycheck to paycheck and have to make ends meet,” Dang said. “So the volatility during a downturn is relatively less than prime and near-prime borrowers.”

Associated-Party Risks

Moody's said that although a structured transaction's assets and sponsor are legally uncoupled, in some cases creditworthiness is directly or indirectly tied to the sponsor's financial strength. Declining revenue for car rental companies will, for example, increase ABS risks, because the bonds are backed by a single lease, making their ratings heavily dependent on the financial strength of the rental-company lessee.

Dealer floorplan and credit card ABS have similar dynamics.

In addition, organizations servicing structured-finance-transaction assets may face financial challenges that inhibit their ability to make collections.

Similarly, Moody's said, “The performance of transactions that are actively managed, such as most CLOs, can also vary along with the proficiency of the manager; CLOs, for example, can benefit from a prudent manager with sufficient corporate resources that can mitigate credit erosion in the portfolio, especially during a downturn.”

Also, structured finance transactions have different features to allocate cash flow to bondholders that affect bonds' credit quality. For example, transactions whose bonds amortize in order of seniority may build up credit protection for senior bonds as they pay down, or triggers typical of CLO transactions can divert interest collections toward the sequential payment of bond principal.

Such features are important when markets are volatile, Moody's said, because they “will influence the timing and severity of credit impacts.”