Approaching a decade since Wall Street institutions began exploring blockchain, or distributed ledger technology (DLT), to replace legacy processing infrastructures, tangible progress remains spotty. But the potential is being talked up by industry leaders as prominent as BlackRock CEO Laurence Fink, who wrote in his annual chairman’s letter in March that “the tokenization of asset classes offers the prospect of driving efficiencies in capital markets, shortening value chains, and improving cost and access for investors.” BlackRock is eyeing “areas most relevant to our clients such as permissioned blockchains and tokenization of stocks and bonds.”

Emerging as a viable DLT-ecosystem use case is securities lending. A Citi GPS research report in March identified “the collateral/securities borrowing and lending market, or as it is colloquially called, the repo market” as a key segment “that faces significant operational friction and could derive immediate benefits from tokenization.”

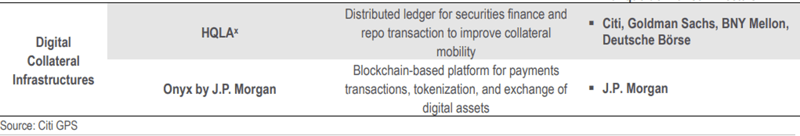

“Platforms such as HQLAᵡ, JPMorgan’s Onyx repo platform and Broadridge’s DLT Repo have begun to process billions in securities lending volumes already and have potential to scale up further,” the report said. “This would bring significant operational and capital savings to the industry.”

“Real-World Benefits”

HQLAᵡ and Onyx were among use cases “demonstrating early real-world benefits” identified in a May report from the Global Financial Markets Association, Boston Consulting Group, Clifford Chance and Cravath, Swaine & Moore on DLT in global capital markets.

HQLAᵡ enables “instant and simultaneous transfers” between platform participants – “so-called delivery versus delivery (DvD), swapping ownership of securities and avoiding the traditional custody chain and settlement cycle,” the report said. Designating precise times for the transactions “reduces intraday credit exposures and liquidity requirements to enable capital savings and minimize the scope for trade fails.”

The report described JPMorgan’s Digital Financing Application as “running on the Onyx Digital Assets DLT platform built on a private-permissioned DLT network, enabl[ing] true DvP [delivery versus payment] settlement for repurchase agreements. The platform enables the simultaneous exchange of tokenized deposits and collateral, and settled over $500 billion in transaction value by the end of 2022.”

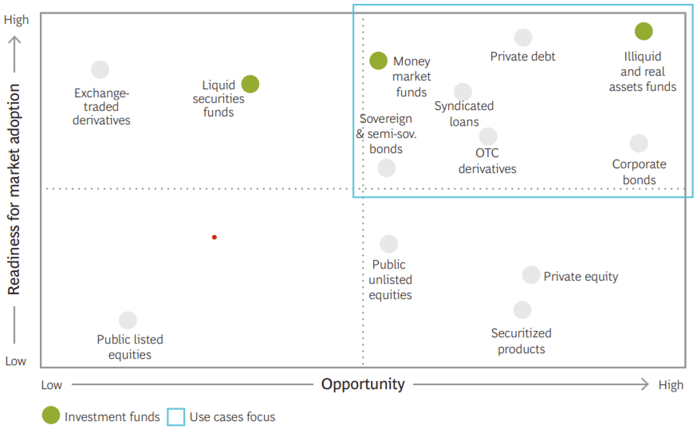

Suitability for DLT adoption is mapped in The Impact of Distributed Ledger Technology in Global Capital Markets.

Multiparty Demonstration

HQLAᵡ formed a partnership with Deutsche Börse (DB1) in 2018 to implement its securities finance and repo technology.

A proof of concept last December demonstrated “the first cross-chain repo swap” between Corda and Enterprise Ethereum, with participants including Banco Santander, Goldman Sachs, UBS and the Fnality payment system. Two months before that, HQLAᵡ, JPMorgan, Ownera and Wematch said they “successfully demonstrated the technical feasibility of executing a DvP repo transaction” across the HQLAᵡ and JPMorgan DLT platforms.

At earlier stages, OCC (Options Clearing Corp.) said in 2020 that it was looking into DLT for its longstanding stock lending program as part of its Renaissance transformation project. EquiLend announced this March that it had selected financial-market DLT pioneer Digital Asset as technology supplier for its 1Source initiative, promising to deliver “a single source of truth for securities finance transactions.”

Predicting Obsolescence

HQLAᵡ solutions architect Martin O’Connell predicted in a January DerivSource podcast that legacy securities lending processes will go into decline and 2024 “will mark the beginning of the end” for some, even as DLT’s commercial viability is yet to be proven.

“There are real benefits to the technology, but mapping the payback period after the cost of adoption is not clear,” said Vinod Jain, a strategic advisor at research firm Aite-Novarica.

HQLAᵡ says it seeks to enable “market participants to transfer ownership of securities seamlessly across disparate collateral pools at precise moments in time,” optimizing liquidity and collateral management activities and “thereby generating operational efficiency gains and capital cost savings.”

The Luxembourg-headquartered company’s “new atomic delivery vs. delivery practice” enables the simultaneous exchange of securities baskets at a precise pre-determined point in time, and a digital collateral registry (DCR) records basket ownership while the underlying securities remain in the custody location of both collateral givers. The transfers are executed across triparty agents and custodians connected to the platform.

Global Ambitions

Before partnering with HQLAᵡ, Deutsche Börse was working with market infrastructures outside Europe to resolve the collateral fragmentation issue, with securities siloed in different domestic markets. When HQLAᵡ proposed using DLT to digitize ownership of collateral under DCRs and enable ownership transfers without the need for cross-border settlement, “we saw that this was exactly the same direction we were going,” said Fabrice Tomenko, head of digital trust and strategic partnerships at Deutsche Börse’s Clearstream post-trade arm.

As the platform is already used by participants in DB1’s Eurex derivatives market engaged in upgrade and downgrade trades, Tomenko said, it is looking to integrate Japanese government and U.S. Treasury bonds on the way to opening to other marketplaces globally. As Tomenko put it, “we are connecting the old world of settlement and custodians to the new world of exchanging ownership” on a distributed ledger.

He added that the platform can conceivably support the exchange of virtually any collateral. After agreeing on the types of securities and the precise timing, counterparties could transfer their respective securities to a trusted third party such as DB1’s Clearstream International, which holds accounts at various triparty agents and custodians. After confirming DCRs hold the eligible securities, HQLAᵡ manages the transfer of counterparties’ securities between custodians, but not the securities themselves, eliminating the need for settlement.

The simultaneous exchange “eliminates the need for the counterparties to put up cash collateral, thus reducing capital cost, intraday liquidity requirements, and operational risk,” Tomenko said. “And this is really the added value of the platform.”

The technology also promises to eliminate manual errors and enable firms to consolidate their collateral inventories across custodians and trading-platform silos. “This is a longstanding issue for both the securities lending and repurchase-agreement markets, where post-trade reconciliation can take a lot of time and cost firms more money than the actual trade is worth,” explained Josh Galper, principal at Finadium.

More Transaction Types

HQLAᵡ and DB1 plan to introduce more transaction types this year, Tomenko said. Banks will be the primary participants on the platform initially, he added, and some asset managers are analyzing whether it could facilitate variation margin for derivative transactions.

Eurex is currently the only marketplace live with HQLAᵡ. Ten banks are listed as users, including BNP Paribas, ING, BNY Mellon, Goldman Sachs, JPMorgan, CIBC and UBS as stakeholders. Additional marketplaces joining the platform would enable those financial institutions and others to more efficiently transact across borders.

Despite the industry support, HQLAᵡ has completed relatively few transactions since the first one in 2018. Its first agency transaction took place last July, and in September it reached a “new volume milestone” after executing a series of 35-day transactions totaling €1 billion between two stakeholder banks.

The platform has yet to be “used by the industry in a consistent way for live trading,” Galper commented.

O’Connell said he sees firms moving beyond proofs of concept, and “we will start to see scale build in 2023.”

Still, said Jain, “Nobody has come out and quantified the benefits of increased revenues or cost savings. After the initial announcement of one-off transactions, there is a need to ensure that the depth of use cases goes to the next level and keeps happening on a regular basis.”

The Aite-Novarica analyst said tokenizing securities is “fantastic . . . There’s definitely an interest in the market around this type of solution, but getting it operational on a day-to-day basis is the challenge.”

Topics: Financial Markets