From fine art to cryptocurrencies, alternative investments are all the rage these days. Asset managers, insurance companies and pension funds are looking to alternative investments to boost returns, particularly with interest rates still at rock-bottom.

Reducing investment risk, through diversification, is another possible upside. However, selecting appropriate alternative assets is tricky and requires a holistic view of the portfolio.

Alternative investments are typically illiquid, opaque and difficult to hedge. Moreover, there may be no reliable historical data on their performance.

Complicating matters further, their correlations with traditional investments may change dramatically, depending on market conditions. For this reason, many regulatory regimes impose higher capital charges on alternative investments.

Alla Gil

On the plus side, the higher yields of alternative investments can help asset managers match insurance and pension liabilities and meet performance benchmarks.

To maximize the advantage of incorporating alternative assets, portfolio managers must analyze the full distribution of risk in conjunction with their current investments. And that’s not easy. Indeed, consistently analyzing such integrated risk in stable and stressed environments can be incredibly challenging.

Evolution, Benefits and Current Challenges

For institutional investors, alternative investments tend to include assets like private equity, real estate, CLO tranches and hedge funds – i.e., anything that’s not publicly-traded stocks or fixed income.

Over the past two decades, there has a been a significant uptick in alternative investments. In fact, since 2000, many institutional portfolios have increased their alternative investments – from around 5% to 30% or more. They’ve done so to address the risks associated with an uncertain geopolitical environment, rising inflation and volatile financial markets.

For the most part, returns on alternative assets exceed those of traditional ones, compensating for illiquidity and non-transparency. However, there are limits to their diversification benefits.

In times of crisis, remember, everything can crash simultaneously. We saw this during the financial crisis, when funds-of-funds that were supposed to provide diversification collapsed, together with many hedge funds and other assets. Indeed, when markets are in turmoil, alternative assets that are fairly liquid during normal periods tend to become practically unsellable.

So, what steps can one take to evaluate whether the potential return of an alternative investment is worth its risk?

Risks vs. Opportunities: How to Optimize Alternative Assets

The only real way to verify whether an alternative investment will serve as an optimal addition to an existing asset allocation strategy is to consider how it will behave under the full range of potential future scenarios. It’s critical to ensure the extra yield from these alternatives will cover both regular and tail risks.

Each type of alternative investments requires its own approach to be consistently incorporated into a holistic portfolio view. Many alternative assets, however, are allocated to external money managers, which makes them even less transparent and harder to get data for the supporting analysis.

What’s more, if allocation to a particular strategy is fairly lumpy – i.e., if an alternative investment accounts for more than 1% of the total portfolio – disclosures must be more transparent. For a very fine allocation (when the exposure to a particular strategy is less than 1%), a traditional, high-level ETF benchmark (or other appropriate index) is suitable for disclosure purposes.

Alternative investment managers understand this need and recently became more open to disclosing high-level allocations within their funds. Even these minimal disclosures can be enough to discover hidden risk concentrations, and can help portfolio managers identify what would provide the true yield enhancement and risk diversification of the current portfolio.

A Practical Example

Let’s consider the example of a CLO tranche. Even if it’s publicly rated, the rating itself is still not enough to understand whether the tranche is a good addition to your investment portfolio. Keep in mind, with a CLO tranche, a single shock event that increases correlations between underlying loans can immediately increase the probability of default, pushing it down to a B-rating. At the same time, it is very unlikely that an AA-rated bond will become a junk bond overnight.

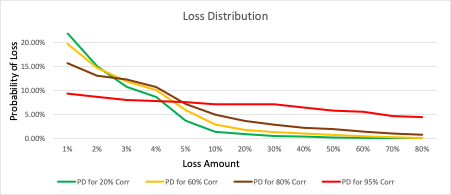

In Figure 1, we consider a pool of 100 BBB/BB-rated loans. The chart shows how the potential overall loss is distributed between different tranches, depending on the correlations between the loans in the underlying collateral pool.

Figure 1: Loss Distribution in a CLO Pool, Depending on Correlation

When the correlations in our example are low (around 20%), you have a high probability of low losses and low probability of high losses. This means that at least one loan can default with fairly high probability – but the probability of two, three and more defaults drops very quickly.

As correlation increases, the probability of a single default (without other defaults) goes down, while the probability of multiple defaults and higher losses goes up. In the extreme case of 95% correlation, the probability of the first loss is nearly the same as the probability of losing everything; if one loan goes down, with this close relationship between the loans, the chances are that many of them will default.

Even if, say, a CLO tranche has a public rating, it can’t help you see the chances of a drastic increase in correlations within the collateral pool. A public rating indicates the current probability of default, but it doesn’t fairly reflect the future probability of tranche downgrades and defaults. The latter is critical for selecting an appropriate alternative investment because, most of the time, you will not get an acceptable price if you absolutely have to sell an alternative asset.

The selection process for alternative assets, of course, can’t be done on a standalone basis. To understand whether an asset is appropriate for a particular portfolio, you must analyze its changing dependencies with other existing and potential assets in that portfolio.

By generating the full range of scenarios that incorporate changing correlations between interest rates, credit spreads, equity markets and currencies, we can project the cash flows and prices of all current assets in the portfolio – together with all loans in the collateral pools underlying the CLO tranches. We can also record the defaults in their respective pools and observe the scenarios where respective tranches were impacted.

This is the only way to (1) adequately capture the impact of dynamically-changing correlations; (2) allocate appropriate capital reserves; and (3) identify the composition of underlying pools of assets that deliver the best risk-return tradeoff. What’s more, with this methodology, one can identify attachment/detachment points of the tranche, rather than relying on its rating.

Other types of alternative investments – like lumpy private loans, infrastructure projects and real estate – can be modeled consistently with the existing portfolio by linking their revenue segments to the same scenarios. If a particular investment doesn’t have enough historical data or if it’s unavailable (e.g., if the investment was made through an external manager), one can use the revenue data of the relevant peer group to model it properly.

Parting Thoughts

Alternative investments are similar to nuclear energy: when they are handled with care, they can be very efficient – but they can also blow up in your face if you don’t take all necessary precautions.

No matter how sophisticated alternative investment managers are, they don’t know all the details of your portfolio. So, it’s important to consider the full range of future uncertainty of illiquid assets when you ponder adding alternative assets to your current portfolio. This type of comprehensive scenario analysis can increase the transparency of your portfolio, potentially reducing your capital requirements.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.