Less than a month before its historic collapse, Silicon Valley Bank (SVB) was named one of America’s best banks by Forbes. It just shows how quickly financial markets can change, particularly when proper risk management practices are not in place.

The reasons behind SVB’s downfall have, of course, been well-documented by the media. Rising interest rates that depleted the bank’s investment portfolios has been cited as the main culprit, and experts have generally agreed upon the following sequence of events: (1) misguided SVB investments in long-term mortgage instruments led to severe unrealized losses as interest rates spiked; (2) the bank failed to raise enough capital to fill the hole; and (3) their stock collapsed, and their depositors fled.

But there is one important factor to add to the post-mortem analysis: the tremendous growth in deposits and the decrease in loan initiation we witnessed during the COVID-19 pandemic. SVB invested the money from its increased deposits in Treasury bonds and mortgage-backed securities (MBS).

Alla Gil

Overall, the SVB failure looks like a classic asset-liability mismatch of short-term deposits with long-term assets. To understand how a sophisticated bank could possibly commit such a basic error, we need to consider its history and to pinpoint when and why its ill-conceived investments were made.

Until recently, SVB deposits were stable. The bank survived the early 2000s tech crisis. Moreover, it did not have significant deposit outflows during the global financial crisis (GFC), as it benefited from the "flight to safety" phenomenon. However, history is a poor predictor of the future.

Deposit runoffs can occur for a variety of reasons. Triggers could range from, for example, a cyberattack causing reputational damage to sharp increases in short-term rates causing instability in demand deposits. In the case of SVB, the bursting of the crypto bubble in 2022 and the subsequent drying up of venture-capital backing for startups led to a deposit exodus.

Sourcing the Failure

While matching duration and cash flows of assets and liabilities is a classic requirement, banks always try to improve their profitability, especially when the rates are close to zero and yield curves are upward sloping.

However, rather than trying to anticipate specific scenarios, banks should first seek to understand what motivates their depositors' behavior across different product types and market segments in a wide range of economic conditions. They can subsequently use this knowledge to identify in advance when they need to bolster their liquidity buffers and to determine what the composition of those buffers should look like.

Where could SVB’s risk miscalculation come from? When analyzing potential future scenarios, risk managers must evaluate the price sensitivity of the liquidity buffer. A simple linear duration-based sensitivity is not sufficient, especially when the portfolio contains assets (like MBS) with high convexity and greater price sensitivity to changes in interest rates than a comparable straight bond.

When interest rates fall, refinancing increases (because of embedded prepayment options), reducing the duration of the MBS. Conversely, when interest rates rise, prepayments may decrease, causing the duration of the MBS to increase. This variability in duration is what makes MBS highly convex and causes substantial losses in an environment of rising interest rates.

Consequently, the composition of SVB investment portfolio was very sensitive to inflation. If the bank had been able to hold its long-term investments to maturity, the unrealized losses of those instruments wouldn’t have disturbed the asset/liability status quo. But the ripple effects of the crypto demise and inflation forced SVB to start selling its investments at a loss, triggering its slide to default.

How did SVB not see this coming?

It seems that all stress scenarios of the past decade, including CCAR scenarios provided by the FRB, were focused on low (near-zero or even negative) interest rates, so SVB apparently never considered the inflationary scenario.

Nevertheless, when rates started increasing sharply, there was still room for taking proactive measures. So, what actions should the bank have taken?

Weigh All Potential Outcomes

It is crucial for risk managers to be proactive and to consider all scenarios.

As interest rates began to rise in 2022, for example, it would have been beneficial for SVB to start replacing its longer-term investments with shorter-term ones, even if this resulted in a small realized loss. SVB would have then been able to take advantage of the rising rates and potentially could have extended the duration of its shorter-term investments once the markets stabilized.

What’s more, as the crypto markets collapsed later in the year, deposit outflows should have been anticipated and SVB’s investments should have been reallocated to the most liquid securities. (Coincidentally, this would have generated more income in the inverted yield-curve environment.)

To maintain the confidence of its investors and depositors, SVB could have also preemptively raised capital before the cost of funds became too high. This would have likely enabled them to avoid a bank run and a subsequent default.

We know that SVB invested in bonds at a time when rates were miniscule, and that this eventually came back to bite the bank when rates spiked. But could the bank have employed a similar investment strategy that was not as risky?

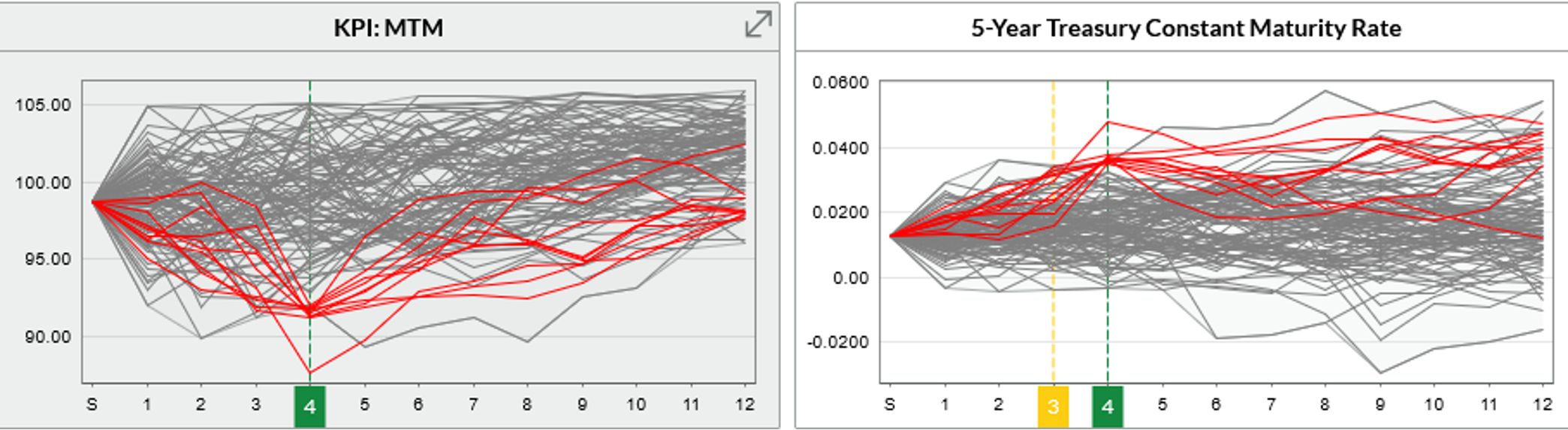

Let’s consider a portfolio invested in 5-year treasury bonds at the end of 2021, when rates were still low. Figure 1 shows the distribution of such a portfolio’s MTM at that time on a one-year horizon.

Figure 1: Full-Range Scenario Analysis of MTM and Risk Drivers (2021-22)

Source: Straterix. Time horizon in quarters.

The grey lines in the Figure 1 charts represent all considered scenarios, while the red lines depict scenarios around the 99th worst-case percentile in Q4 2022 – four quarters after the initial allocation.

One can clearly see that this example portfolio would lose 8% of initial value when 5-year rate approaches 4%. The reverse analysis of these red scenarios, moreover, shows that most of them would have experienced two shocks within the first year. The expected annual income of such a portfolio would be around 1.3%.

Would it have been possible to achieve similar income results with less risk? Yes!

By analyzing various combinations of different bonds across the same set of these full-range scenarios, one could achieve any of the following outcomes: (1) exactly the same expected income with only 6.5% worst-case loss of principal, via reallocating 30% of the portfolio into 3-year bonds; (2) 1.29% expected income (one basis point lower) and only 3.8% worst-case loss of principal when 98% of the portfolio is in 3-year bonds and the rest is split between 3-month and 6-month bills; or (3) 1.1% expected return with 2.7% worst-case loss of principal if 30% of investments are in 6-month bills and the rest in 3-year bonds.

The analysis in our example portfolio clearly shows both the real risk of what ultimately happened at SVB and numerous superior alternative portfolio compositions and strategies that should have been recommended at the time.

In short, there were many options for SVB to consider that would have been more beneficial and less risky.

Parting Thoughts

As a result of the two-shock combination of interest-rate-driven inflation and VC funding withdrawal, the 16th largest U.S. bank collapsed at rocket speed. It would still be alive, however, had it considered the full range of scenarios with all combinations of potential shocks.

To prevent the spread of a financial pandemic, risk managers in the financial services industry must now take a leadership position. This starts with a review of their institutions’ liquidity buffers, potential funding needs and overall balance sheet resilience.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.

Topics: Financial Markets