An extended period of economic and political uncertainty has not dampened investment managers’ emerging-market convictions. While global debt levels and the struggles of low-income countries, compounded by natural disasters and military conflicts, alarm the International Monetary Fund and other official bodies, private investments in the bigger and faster-growing economies are riding on more positive indicators.

In June, for example, besides raising its Greater China sector outlook to “improving” from “neutral,” Fitch Ratings upgraded Emerging Europe and Asia-Pacific to “neutral” from “deteriorating,” and the agency had 13 emerging markets on “positive” outlook, up from eight in December 2022.

“The positive revisions mainly reflected the reopening of China’s economy, and the drop in European energy prices and abatement of supply-shortage risks,” Fitch said. “We now have four emerging-market regions with a ‘neutral’ outlook, one ‘improving’ and only one ‘deteriorating’ (sub-Saharan Africa).”

“Global investors should watch for widening gaps in monetary and economic growth trajectories to capitalize on,” said Christine Phillpotts, a portfolio manager and senior research analyst with Ariel Investments and its Emerging Markets Value fund. “We see a widening gap between EM [emerging market] and DM [developed market] growth – many EMs are well positioned to have economic growth acceleration in 2024 and beyond, supported by monetary easing as well as cyclical and structural factors.”

She sees divergence also in earnings growth, although there are risks posed by long-term dollar strengthening and monetary or fiscal policy missteps by EMs, not to mention how inflation and economic activity play out in the U.S.

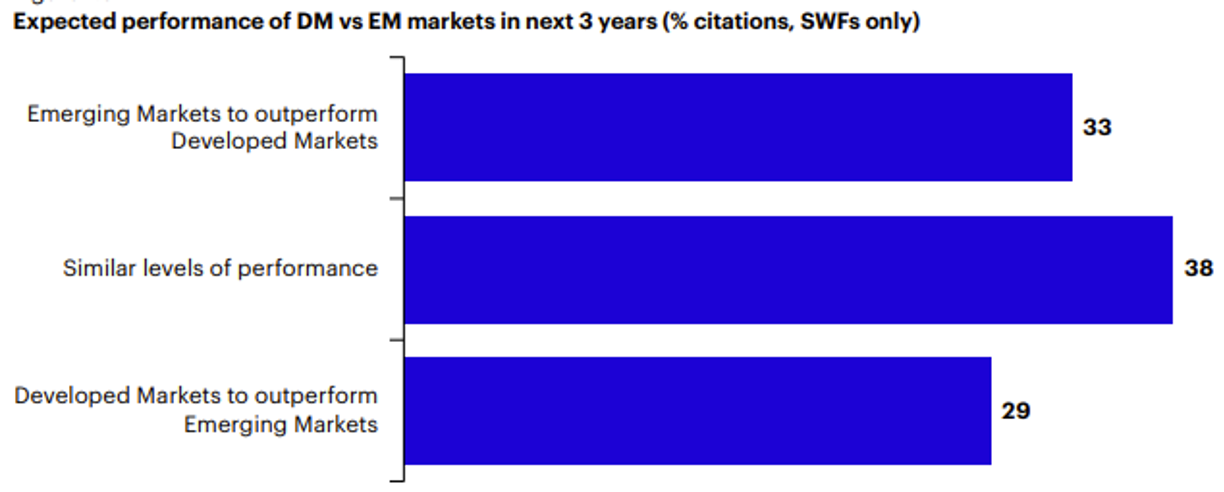

Source: Invesco survey of sovereign wealth funds

Brazilian Upswing

Signals in Brazil, meanwhile, point toward declining inflation and lower interest rates. The consumer price index rise peaked at 12% in April 2022 and was 4.6% as of this August. As in other EMs, Brazil’s inflation was driven by food and fuel, while in the U.S., labor costs were a bigger factor in inflation’s stickiness.

After being ahead of much of the world in hiking central bank interest rates, to a 13.75% peak, Brazil was well positioned to begin easing, which it did in August. “Such easing will provide additional tailwinds to an economy whose growth has already been recovering,” Phillpotts said. “Looser monetary policy supports growth and valuation improvement from trough levels.”

Although there is no pronounced exodus from China, there are also tilts toward India. In its 2023 Global Sovereign Asset Management report, Invesco declared that India has overtaken China as the most attractive emerging market “for investing in emerging market debt,” with one investor saying, “India is a better story now in terms of business and political stability.”

Aubrey Capital Management of the U.K. had approximately a third of its GEM [Global Emerging Markets] fund invested in India since the Modi government took charge in 2014, “and currently it is above that level and our largest country weighting,” fund manager Rob Brewis said in an interview. “While the realization that India is the most attractive emerging economy is now dawning on many more people, there are still plenty of investment flows to come as portfolios catch up with this realization.”

With companies such as Apple manufacturer Foxconn of China, auto producers and others building capacity in India, the country is not seen as a short-term play. “This will be positive for industry, suppliers’ development, formal employment, and increasing skills of the workforce,” Brewis stated.

Rob Brewis of Aubrey Capital Management

“We focus on the consumer, which we believe will continue to be the best way to invest in the Indian story,” Brewis commented in late September. “Partly as a result, our portfolio is at a premium valuation to the broader market, as it has always been. But this has not prevented the Indian portion of our GEM portfolio returning well over 2x the MSCI India return since inception in 2012.”

Geopolitical Repercussions

The lingering Russia-Ukraine conflict stands out, but does not stand alone, among geopolitical risks requiring investor vigilance.

“We are watching the deterioration in geopolitical balance between China and the U.S.,” Phillpotts said. “A potential Taiwan invasion is a tail risk, while worsening relations and increased political posturing drives disruptions and bifurcations in key supply chains that could further increase inflationary pressures across the globe.”

This risk, however, represents opportunities for other export-driven countries serving as alternate sources of supply, such as Vietnam and Mexico. U.S. Inflation Reduction Act initiatives and other policy incentives can work to reduce reliance on China. Phillpotts describes these as “new legs of growth” for the likes of Korean auto makers and “the electronic vehicle value chain.”

Christine Phillpotts of Ariel Investments

The need to diversify supply chains was a lesson learned from the COVID-19 pandemic, though even before that, China’s rising labor costs and declining working population had prompted some rethinking. Phillpotts noted that Ariel is “leaning into EMs that are in a much better position today than in previous cycles. We look for lower leverage, particularly lower external debt mix, and better external balances.”

She stresses that there are “strong opportunities for active management” across the EM sector, a point echoed by Aubrey Capital Management, whose head of distribution, Mark Martyrossian, wrote in July: “On balance, we believe that the broadening of the asset class and the smaller proportion of cyclical stocks is a good thing for investors.”

“Many of you have asked how we manage to avoid the likes of South Africa, Turkey and Russia,” said Martyrossian’s note. “Being bottom-up stock pickers, our fundamental analytics very often do the country selection for us. Quite simply, there are better stocks elsewhere. We have companies from South Africa and Turkey on our Watchlist, but they have not figured in our portfolio for several years. They just did not make the cut.”

“It is important to note that we invest in companies, not countries,” Aubrey Capital portfolio manager John Ewart explained in a September Q&A interview. “Our Indian exposure is high [then 40%] because we have found companies there that meet our strict investment metrics. Similarly, we have more caution toward China at present, but we invest in excellent companies with significant cash generation and growth prospects rather than targeting a slightly underweight position in China.”

Opportunities Amid the Risks

“Greater contagion and systemic risks arising from the Chinese real estate sector could impact not only growth in China, but also other sectors like commodities,” Phillpotts said.

According to a Franklin Templeton Emerging Markets Insights note in September, interest-rate cutting was building momentum, examples including Chile, Hungary and Peru. “However, we are cognizant that there is no uniform trajectory for the direction of interest rates across EMs.”

Monetary easing can negatively impact banks’ net interest margins (NIMs). “Banks in EMs are experiencing strong credit demand, and a corresponding decrease in interest rates will not result in a dramatic squeeze on NIMs,” and banks could end up benefiting from reduced loss provisions.

India’s private-sector banks with deposit franchises “will enjoy improved pricing power and look poised to gain market share,” the Franklin Templeton group predicted, while in China, regulatory guidance is likely “to continue to pressure interest rates down, but banks may also lower deposit rates to preserve NIMs.”

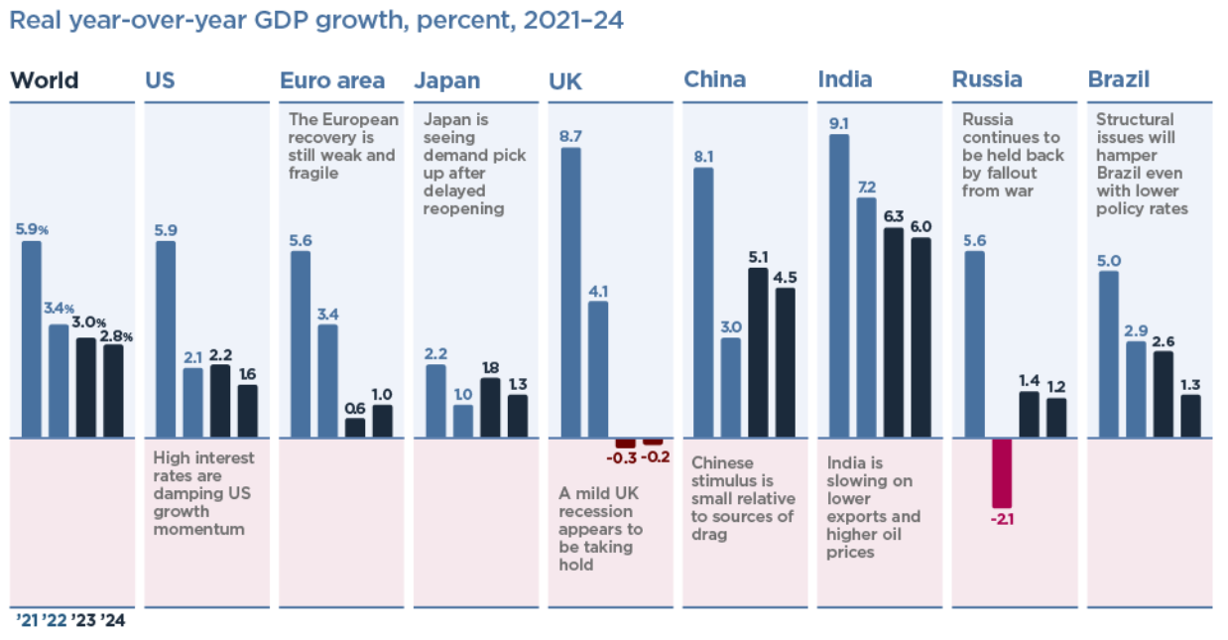

Source: Karen Dynan, Peterson Institute for International Economics

With the October 10 release of the International Monetary Fund’s World Economic Outlook, chief economist Pierre-Olivier Gourinchas stated, “If China’s real estate prices decline too rapidly, the balance sheets of banks and households will worsen, with the potential for serious financial amplification,” and that economy “must pivot away from growth that relies on credit for the real estate sector.”

Gourinchas also wrote that “despite tightening monetary policy, financial conditions have eased in many countries, as detailed in the latest Global Financial Stability Report. The danger is of a sharp repricing of risk, especially for emerging markets, that would further strengthen the U.S. dollar, trigger capital outflows and increase borrowing costs and debt distress.”

Commodity prices “could become more volatile amid climate and geopolitical shocks, a serious risk to disinflation,” Gourinchas said. “Between June and late September, oil prices had increased by about 25% . . . before falling back by about 11%.

“Food prices remain elevated and could be further disrupted by an escalation of the war in Ukraine, inflicting greater hardship on many low-income countries. Geoeconomic fragmentation has also led to a sharp increase in the dispersion in commodity prices across regions, including critical minerals. This could pose serious macroeconomic risks, including to the climate transition.”

Topics: Investment Management