Technology has been progressively improving financial market operations for decades. The kinds of platforms that have streamlined trading in public equities and other liquid asset classes are now proliferating in private markets.

The trend has been gaining momentum as young and growing companies increasingly tend to stay private longer, if not permanently. Global proceeds from initial public offerings declined 68% last year, Bloomberg reported in December.

IPO proceeds were essentially “frozen” in the U.S., where public company listings have fallen from 8.000 in 1996 to around 3,300, Shari Noonan, co-founder and CEO of Rialto Markets, has noted. She shares the view that private markets are a multitrillion-dollar asset class ripe for liquidity-enhancing ecosystem upgrades. Rialto, for instance, is a licensed broker-dealer in all 50 states and Puerto Rico with a “tech infrastructure [that] provides a single entry point for issuers and investors to all components necessary for private companies to raise capital and for investors to invest,” says the firm’s website.

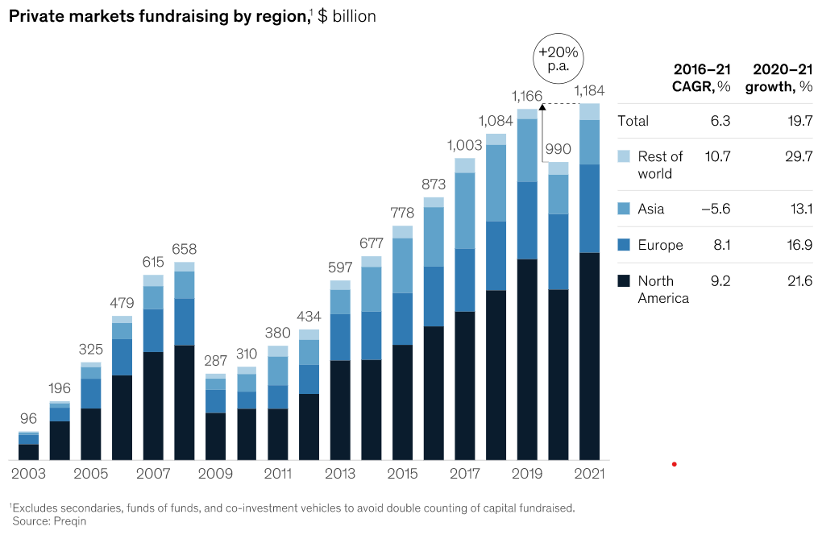

Source: McKinsey & Co. 2022 Global Private Markets Review

Nasdaq’s Private Positioning

Nasdaq tallied 156 IPOs in 2022 and boasted an 89% “win rate” over its U.S. competition, according to a December announcement. The New York Stock Exchange claimed the largest IPO, $1.7 billion Corebridge Financial, in “a quiet year for new listings due to market volatility and other factors.”

Nasdaq is also a mainstay in private markets. Its 2015 acquisition of SecondMarket, which started out in 2004 to support entrepreneurial companies’ private share issuance, cemented its position as a leading incumbent in a segment populated by both Wall Street institutions and new entrants with targeted products and services.

“Our mission is to bring liquidity to the private markets, which are very challenged” on that front, Tom Callahan, CEO of Nasdaq Private Market (NPM), into which SecondMarket merged, said in an interview.

Regarding the liquidity issue as “too big for one industry player” to face alone, Callahan said, NPM was spun off in 2021 into an independent joint venture of Nasdaq, Citi, Goldman Sachs, Morgan Stanley and SVB Financial Group, the parent of Silicon Valley Bank.

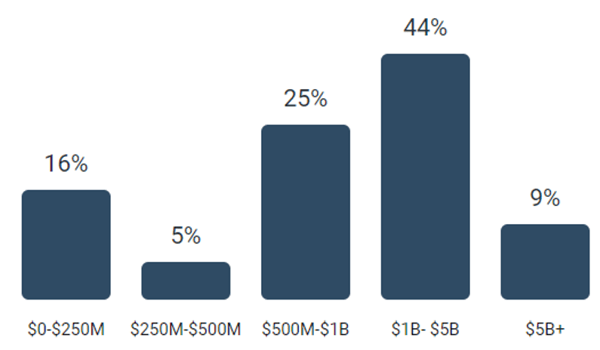

Valuation of companies in Nasdaq Private Market

Some of the more recent action reflects efforts to “democratize” private investing for retail clients. Established firms have acquired or partnered with upstarts, and some that have long catered to institutional investors have launched their own digital platforms to facilitate institutions’ access to a variety of alternative investments including private issues.

The Liquidity Hurdle

In any market, liquidity begets liquidity, and “that’s what people are trying to solve right now,” said Todd Skacan, private equity capital markets manager, T. Rowe Price. From an institutional standpoint, he said, private-investment secondary markets are in need of price discovery and liquidity. When they are limited, buyers must either cobble together numerous trades over a period of time to reach the volume they require, or work toward a secondary purchase through a tender offer or similar transaction.

Better liquidity would make adjusting positions more efficient, and bids and offers on screens would be a boon to price discovery. Although a “critical mass of volume” is a prerequisite for a deep and liquid market, Skacan added, “Counterintuitively, you almost don’t want too many players, because it limits the amount of activity.” Instead, a solution may be aggregating liquidity along the lines of public stock exchanges before electronic trading.

“Right now it’s a very gray market. It’s very manual and not dependable,” Skacan said.

Big-Name Entrants

Among Wall Street institutional players, JPMorgan Chase & Co. launched Capital Connect in October to match investors with startup companies.

Instinet, the venerable electronic brokerage now owned by Nomura, last June announced the European launch of DealMatch, “designed to unlock efficiencies, speed up time to market and broaden access to a much wider array of institutional investors than previously possible . . . by using a digital platform as a hub for a range of transaction processes.”

Also last year, London Stock Exchange Group made a strategic investment in, and began a private-markets partnership with, Floww, which had “7,000 company profiles and 70 venture capital firms” on its platform, “enabling ambitious companies to access capital while providing greater opportunities for investors.”

Major market infrastructure operators have also gotten into the game. Post-trade giant Depository Trust & Clearing Corp. (DTCC) characterized its initiative in a late 2021 report as “bringing private markets infrastructure into the 21st century.” Euroclear in December said it acquired Goji, planning to combine “Euroclear’s open infrastructure and Goji’s innovative technology [to] provide a digital platform enabling end to end access to the private fund market.”

Alternatives-focused iCapital (formally Institutional Capital Network) trades a range of investments and over the last decade has aggressively acquired sources of liquidity, such as private wealth feeder operations from Bank of America and Morgan Stanley. In August, it acquired a UBS fund feeder platform as well as SIMON Markets, which provides access to structured investments, annuities and risk management solutions.

Investment Strategies and Minimums

Brand-new last year was London-based Private Markets Alpha (PM Alpha), a digital marketplace for wealth managers, seeking to build volume by offering private investments including alternative credit, venture and growth capital, private equity and real assets.

Alexis Weber of PM Alpha

Commenting on 2023 investment opportunities, PM Alpha founder and chief investment officer Alexis Weber said, “First, private markets are much broader than public markets, meaning that the depth of available opportunities is therefore greater. Second, it can be clearly demonstrated that allocating to markets at times of recession and public market volatility leads to the some of the best investment returns that private markets have to offer. Finally, as committed capital is spent by private-markets managers more gradually and is locked up for a period of time, it increases the ability of those managers to exploit market dislocations and select the best potential growth opportunities.”

Platforms such as Allocate, CartaX, Equi and Caplight Technologies are among 22 that aim to serve institutional investors and have investment minimums over $1,000, according to a report by Opimas. Three – CartaX, JPMorgan Capital Connect and Nasdaq Private Market – require at least $1 million, Equi and Forge Global at least $100,000.

The research firm counts 25 platforms that can give non-accredited retail investors exposure to private financial investments as well as assets such as rare wines, art and collectibles. Several private platforms have achieved “unicorn” valuations above $1 billion, including CartaX, iCapital, AngelList Venture, Roofstock, Masterworks and CAIS.

As the automated platforms seek to meet liquidity needs, Opimas says, liquidating private investments often still requires human intervention to match orders.

A Regulatory Solution?

“We think the liquidity problem could be there until regulators require privately held companies to provide their financial information more publicly,” said Suzannah Balluffi, author of the Opimas report. Market forces could also help: “Privately held companies looking to raise capital may begin to share financial information more freely if it allows them greater access to funding.”

In addition, the high-risk, high-reward aspect of the market is magnified by limited data and could be assuaged by greater transparency as with public shares.

Skacan said T. Rowe Price typically invests only in private companies whose management it already has a relationship with, and so it would mostly turn to private-investment platforms to adjust existing holdings.

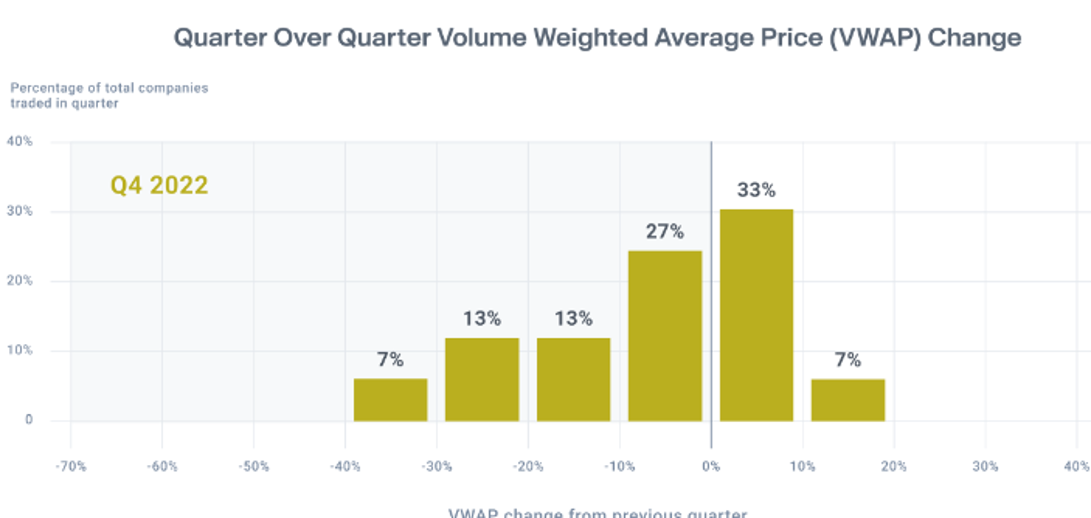

Forge Global data as of November 30

Up Against Headwinds

Private share marketplace Forge Global Holdings went public via a SPAC sponsored by Motive Partners last March. Opimas said it is concerning “that after being traded across the public markets, which are arguably more efficient at determining the present value of a company, [Forge Global’s] valuation sank considerably.”

The company’s third-quarter 2022 trading volume of $226.2 million was down 32% quarter-over-quarter and 66% year-over-year. Its quarterly net loss of $16.2 million grew from $5.1 million in both the June 2022 and September 2021 quarters. In September, Forge Global announced its expansion into Europe with strategic partner Deutsche Börse.

“As macroeconomic headwinds persist, we’ve kept our focus on building for the future,” CEO Kelly Rodriques said in November. “We made progress in Q3 toward our goal of building a global business at the center of the private market ecosystem – debuting our first lending product to unlock new sell-side inventory and for the first time offering custody services of private shares for our trading clients to drive efficiency across the trading process and accelerate the network effects of our unique model.”

Topics: Financial Markets