Fueled by widespread economic volatility, geopolitical uncertainty, and an increasingly hawkish Fed in the face of inflation, the U.S. dollar has been at its highest levels in 20 years. After companies became familiar with the EUR-USD exchange rate in the 1.20s, the currency pair plunged to below parity.

Dollar strength broadly impacts U.S. companies by devaluing non-USD revenues from foreign subsidiaries, thus reducing earnings. Corporate finance teams are therefore increasingly focused on managing foreign currency risk and mitigating its impact on forecasting and strategic planning.

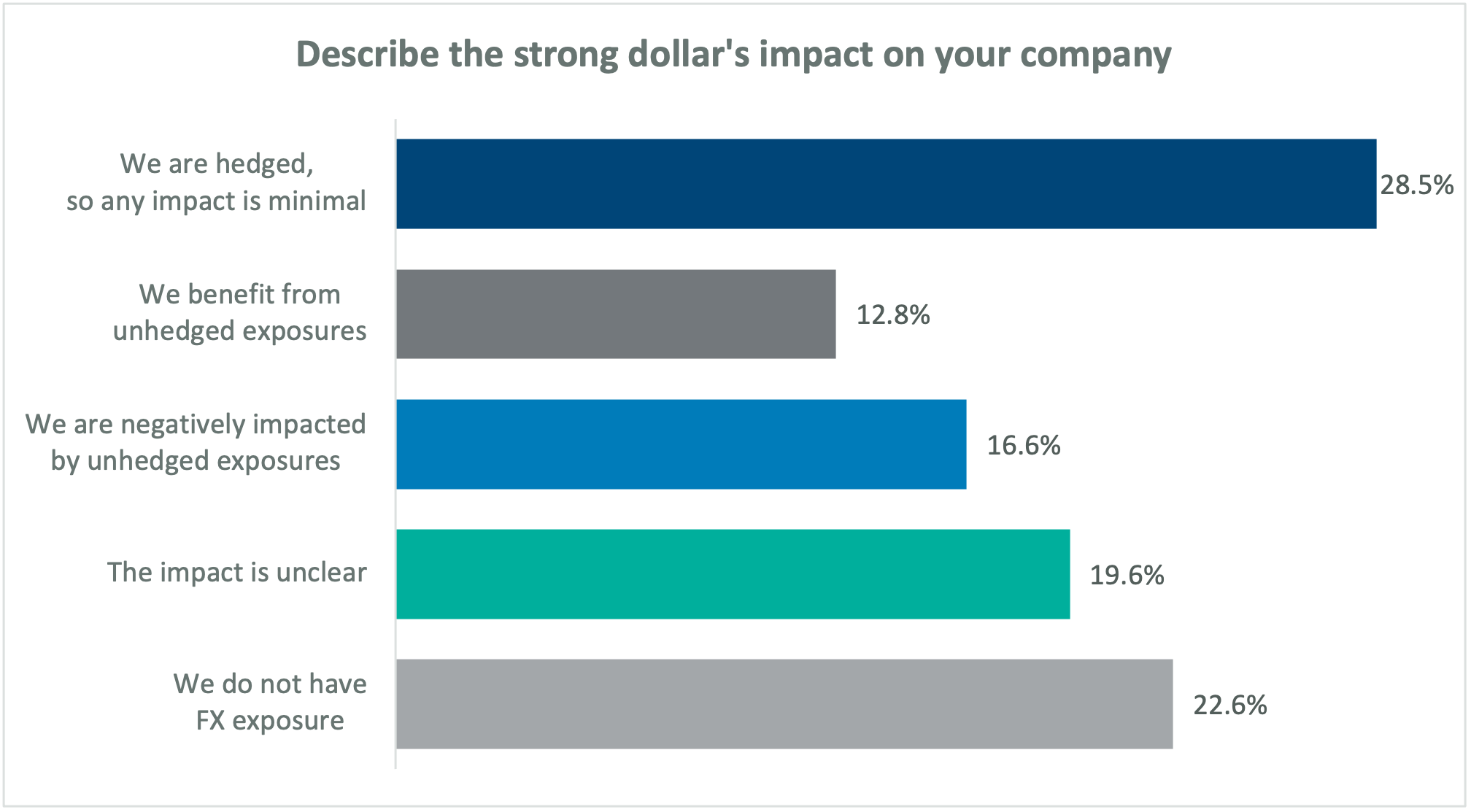

Poll data from 235 corporate treasury and accounting professionals reflects a variety of FX exposure profiles. Among respondents with FX exposure, those currently hedged find the impact is minimal. Others believe they benefit from unhedged exposures, while a significant contingent are either unclear on the impact of the strengthening dollar on their unhedged exposure or don’t have current FX exposure.

If your organization is concerned about FX risk, you likely fall in one of three categories. Below, we define the three most common categories companies find themselves in, and provide recommendations for proceeding in today’s environment.

Considering a New Hedging Program

If you don’t currently manage your foreign currency exposures, the financial headwinds created by dollar strength may have prompted consideration of a new FX hedging program. Rather than executing hedges as a knee-jerk reaction, use this wake-up call as an opportunity to develop a robust, thoughtful program that can benefit your organization long term.

Consider fundamental questions, such as “Should we be hedging?”, “How should we be hedging?”, and “Where does hedging fit in our organizational activities?” A thoughtful approach to answering these questions leads to a more resilient and effective program that you can adapt as your organization continues to evolve.

Adding a Cash-Flow Hedging Program

If you currently maintain a balance-sheet hedging program, you may be considering adding a cash-flow hedging program to address fundamental mismatches between revenues and expenses brought on by currency fluctuations. These impacts can be especially painful because they are reported under gross margin, which appears higher in the income statement than other income and expense.

Because it can be difficult to forecast costs and revenue, especially in a foreign currency, implementing these programs can be challenging. However, a well-constructed program can deliver significant benefits, such as adding certainty to forecasted revenue and expense and avoiding wide swings in earnings.

Reassessing Existing Hedging Programs

Even if you have maintained an FX hedging program for years, today’s market may make you wonder whether your program is still functioning as intended. Perhaps underlying business changes, such as M&A or spin-offs, have altered your risk profile and challenged assumptions on which your program is based. Objectives can also shift based on external factors, such as the competitive landscape, changes to your global risk footprint, or risk tolerance levels.

Internal factors may also play a role, including changes in key personnel, initiatives to drive automation, or cost management. In this case, performing a holistic review of the FX hedging program can help determine whether making strategic or tactical changes will improve program performance or reduce your cost of hedging.

The Cost of Hedge Instruments

After weathering massive, unexpected changes to foreign currency exposures, many treasury and accounting teams are evaluating whether their programs still manage risk effectively and cost-efficiently.

For FX hedging, it often makes sense to reassess which currencies represent the highest risk and prioritize them for hedging. This can significantly reduce your risk profile without hedging every currency to which you’re exposed. Understanding that you don’t need to reduce every risk to zero, but rather narrow your band of outcomes to a manageable level, can provide both adequate risk protection and meaningful cost savings.

With a variety of financial instruments to choose from, including forward contracts, traditional options and knock-ins/knock-outs, the volatile market can also change the cost – and therefore the value – of one instrument over another. For example, if your organization has euro exposure, option volatility, which drives option pricing, is at its highest point in five years on the EUR-USD. While this may make sense if you need to protect against a worst-case scenario, such as a cross-border acquisition that doesn’t close, it may be less attractive if you aim to create predictability for future earnings.

Reviewing and adjusting the tenor and horizon of hedges can also enable you to adjust for a changing market environment and improve the cost-benefit equation. Additionally, investments in people, systems, and work hours can represent a substantial portion of your program’s overall costs. Doing the work to quantify and manage these operational costs is a critical area for every treasury and accounting team to address.

Monitor FX Exposure

No matter which category your organization falls into, you can take steps to better manage FX risk. Once all stakeholders are aligned on the program’s goals and objectives, focus on quantifying your FX exposure and defining your risk tolerance levels and priorities.

For exposure-gathering purposes, the integration of ERP systems and treasury platforms allows your treasury team to gather and consolidate balance sheet and cash flow exposures from ERPs at the local business level and streamline decentralized data gathering through system integrations. The automatic feed of exposure data from ERP systems enables your organization to make appropriate hedging decisions aligned with your objectives.

Adopt a Reporting Rhythm

Market volatility has shined a spotlight on many companies’ FX exposure, leaving corporate treasurers to face tough questions from stakeholders both internal and external. To facilitate the process of informing those stakeholders in a concise and consistent manner, many companies are adopting automated reporting dashboards to provide periodic summaries. Such reports – often linked to internal data sources – can provide insight into hedge efficacy, counterparty exposure, hedge costs, MTM values, etc. These reports can also serve to streamline other post-trade processes such as hedge accounting.

A sound practice in any market, reviewing an FX hedging program to ensure it still meets its objectives is critical in a strong-dollar environment. Although any organization has its own unique set of challenges and constraints, aligning strategic and tactical decisions with the organization’s overall objectives and accessing the necessary knowledge and tools to execute a successful hedging program is a key success factor for every treasury team.

Kevin Jones leads Chatham Financial’s Corporate Hedging Advisory team. With expertise spanning risk quantification and analysis, hedging strategy development, market dynamics and trade execution, he serves corporate clients in interest rate and foreign currency hedging advisory. Jones was previously at the Federal Reserve Bank of New York, where he specialized in foreign central bank FX reserve and Treasury market activity. He earned a bachelor’s degree in international business from James Madison University and a master’s in economics from Virginia Commonwealth University.

Topics: Financial Markets