Federal Reserve aggregate reserve balances fell from a record high in late 2021 and may hit levels this year that increase the likelihood of interest rate spikes and necessitate central bank intervention to avoid financial market disruptions.

As detailed in a November 2022 Federal Reserve Bank of New York staff report, large banks critical to the global payment system rely heavily on incoming payments to fund their outgoing payments. The paper notes that before the era of large central bank balance sheets, that dependence served to deplete individual banks’ reserve balances.

Conventional wisdom suggests that reserve balances at historically high levels should be lessening that dependence between incoming and outgoing payments, but the researchers found it to be continuing.

“The close coupling of interbank payments that we find suggests that banks act as though their intraday reserve balances are a scarce resource, even when total reserve balances in the U.S. banking system are well over $1 trillion, far in excess of aggregate reserve balances before the Global Financial Crisis (GFC) of 2009-2009,” wrote authors including Gara Afonso of the New York Fed and Darrell Duffie of Stanford University.

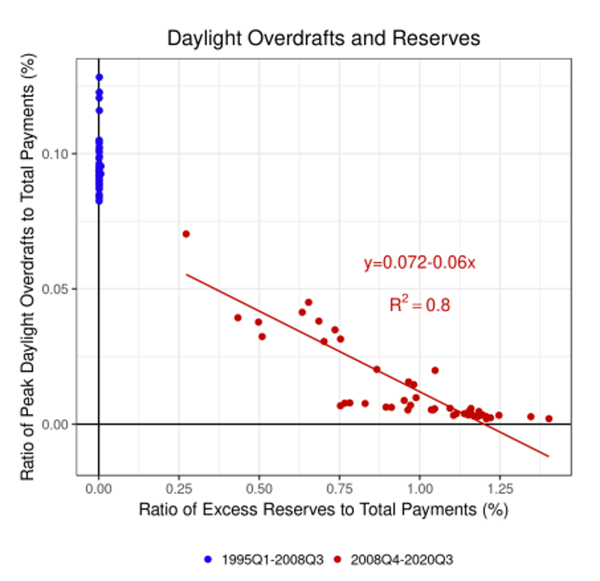

The red dots show a strongly negative relationship between daylight overdrafts and excess reserves since the Global Financial Crisis. Source: Federal Reserve, FRED and Fedwire Funds Services (graph from Federal Reserve Bank of New York staff report, How Abundant Are Reserves?, November 2022)

Reactions to Interventions

Citing market stresses in 2019 and 2020, the latter at the onset of the COVID pandemic, the economists saw the potential for “strategic cash hoarding [by banks] when reserve balances get sufficiently low. Indeed, this happened in mid-September 2019 and mid-March 2020, when large banks suddenly negotiated very high interest rates for providing overnight liquidity in the Treasury repo market.”

An earlier paper (Reserves Were Not So Ample After All), originally published in July 2021 and still in progress, asserted, “Low balances held at the Fed can lead to intraday cash hoarding by banks, raising concerns over market liquidity and sometimes even threatening financial stability.”

That report goes into how post-GFC regulatory restrictions and the Fed’s efforts to normalize, or reduce, its balance sheet can stress large bank holding companies’ (BHCs) intraday management of their reserve balances at the Fed. Before Lehman Brothers’ 2008 collapse, banks’ aggregate supply of reserve balances was typically under $50 billion, sufficient for managing trillions of dollars of daily payments and the efficient functioning of overnight funding markets.

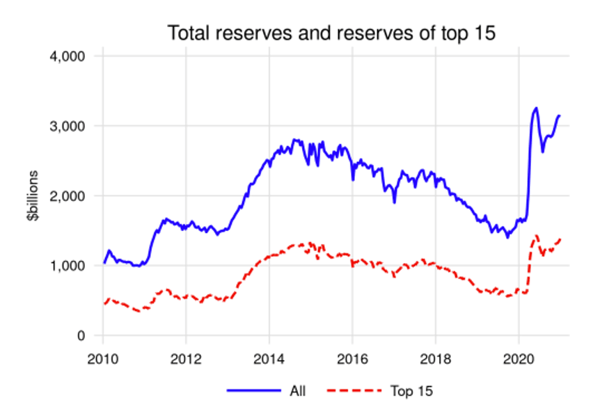

Subsequent quantitative easing (QE) by the Fed pushed reserve balances up to nearly $3 trillion by 2014, and the normalization that began in late 2017 reduced that figure to $1.4 trillion by September 2019. A “battery of new liquidity requirements,” the 2021 paper says, encouraged BHCs to maintain sizable balances at the Fed and discouraged potentially liquidity-providing daylight overdrafts on those reserve accounts.

Delays Upon Delays

Those measures resulted in significantly delayed payments to BHCs active in the repurchase agreement (repo) markets, and the banks in turn quoting higher rates for the overnight funding. The paper argues that higher rates occurred when the banks’ reserve balances fell below a certain level, and when a bank expects others to delay payments, it may do the same to conserve intraday balances, exacerbating the situation.

Aggregate reserve balances of U.S. depository institutions and of the 15 largest entities as defined by average daily total dollar value of payments sent. Source: Federal Reserve Bank of New York, How Abundant Are Reserves?

The current aggregate level of reserves should provide sufficient liquidity to limit interest-rate spikes. However, the Fed’s quantitative tightening (QT) has reduced the reserves from $4.2 trillion in early 2022 to about $3 trillion.

“That’s still more than enough, but it’s going down about $1 trillion a year, and if that continues, it means we’ll be close to riskier territory in about a year,” says Duffie, a finance professor at the Stanford Graduate School of Business and a co-author of both papers. “It would be prudent,” he adds, to examine reserve levels at that point, when the Fed’s reserves approach $2 trillion, especially those of the largest banks supplying funding to the repo market.

Precisely when reserve levels enter riskier territory is unclear. One indicator may be unusually elevated interest rates in the funding markets, although such increases are often short-lived.

Timing as an Indicator

Payments arriving late in the day may also indicate potential problems. The 2022 paper says that high reserve balances are correlated with payments arriving in the morning, while payments arriving later can lead to banks hoarding cash instead of making payments, lowering reserve balances.

The Fed could simply maintain a high reserve balance like the current one, providing sufficient liquidity to reduce if not eliminate the risk of individual banks’ reserve balances falling to precarious levels.

The earlier paper lists other ways the Fed could reduce the risk of declining bank reserves and cash hoarding. One is a standing repo facility (SRF) that offers financing to designated repo-market participants at a rate slightly above what the Fed pays on reserve balances, expanding its balance sheet only as needed to address temporary liquidity crunches.

Fear of a Red Flag

The Federal Open Market Committee established an SRF in July 2021, Duffie says, but banks have expressed reservations about using it, because other financial institutions might interpret that as a sign of problems. Whether the facility effectively mitigates the risk of insufficient bank liquidity remains unclear, the Stanford professor continues, “because nobody has used it yet.”

The 2021 paper says another risk-mitigating tactic would be to relax the post-crisis liquidity rules and supervision that prompt large banks to maintain big intraday reserve buffers that reduce their flexibility to provide intraday liquidity when needed. The Fed could also offer greater incentives for banks to tap the discount window, which, like SRFs, they have been reluctant to do because of potential reputational risk.

The Fed, however, has yet to communicate its policy for determining if reserve levels have dropped to potentially risky levels, nor specifically how it would address the issue – “only general guidance,” Duffie says.

Topics: Financial Markets