The failure to adequately model interrelations between capital and liquidity needs could lead to a dramatic underestimation of an institution’s vulnerability. This is particularly true in the current environment of heightened geopolitical, macroeconomic and market uncertainty.

Lamentably, liquidity stress tests introduced soon after the global financial crisis (GFC) are still being developed and implemented independently from capital stress tests – which now use multi-period, forward-looking scenarios to incorporate macro and market shocks.

The selection of stress scenarios relevant for both capital and liquidity is itself a daunting task. Clearly, an integrated stress testing approach for capital and liquidity is needed, but how can this be achieved?

Alla Gil

The key to addressing this challenge is to use full-range scenario analysis that includes all the variables needed for assessing capital and liquidity buffers. Reverse scenario analysis can be used subsequently to identify the appropriate and adequate stress tests for integration across capital and liquidity.

Before diving into an example of an integrated stress testing approach, let’s first consider the deleterious impacts of capital and liquidity disengagement.

Ripple Effects of Capital and Liquidity Separation

External and idiosyncratic shocks may affect both capital and liquidity positions (e.g., via depleting deposits and increasing funding costs), both immediately and through a subsequent ripple effect, amplifying market and credit losses.

Adverse macroeconomic conditions, which increase the probability of an error in lending or in the trading book, offer one example of a potential ripple effect. They can cause an accelerated runoff of deposit volumes and produce the need for a short-term capital infusion at the time when credit spreads and the cost of capital are high.

An institution’s credit rating might, in turn, be downgraded, increasing its reputational risk and causing a substantial rise in the collateral required by bilateral agreements, with a simultaneous reduction in volume of new deals and associated revenues.

This example of a ripple effect from a combination of plausible shocks demonstrates the interconnectivity of capital and liquidity, and shows the necessity to discover scenarios that adversely affect both.

An Integration Example

How would an integrated stress testing approach work in practice? Let’s consider an example of a bank with an initial healthy total capital ratio of 13% and a liquidity coverage ratio (LCR) of 110%. We can then calculate both capital and liquidity ratios on the full range of scenarios that incorporate various combinations of geopolitical, macroeconomic and market shocks, taking into account their ripple effects.

Under these circumstances, the distribution of the total capital ratio shows that it never falls below 9.7%, which is still above the required minimum. But the distribution of LCR over exactly the same set of scenarios shows much more dangerous tail risk; indeed, the 99th percentile of this distribution can be as low as 60%.

Since both capital and liquidity outcomes are calculated consistently on the same scenarios in our example, we can see that majority of scenarios with low capital ratios have adequate liquidity buffers – and vice versa.

An integrated stress testing methodology also allows us to perform reverse scenario analysis, through which we can identify a cluster of scenarios where both capital and liquidity ratios are underperforming together. These scenarios represent 90th percentile for capital (with the total capital ratio of around 10.5%) and 95th percentile for liquidity (with LCR of around 80%). When they happen together, they could be quite dangerous for an organization.

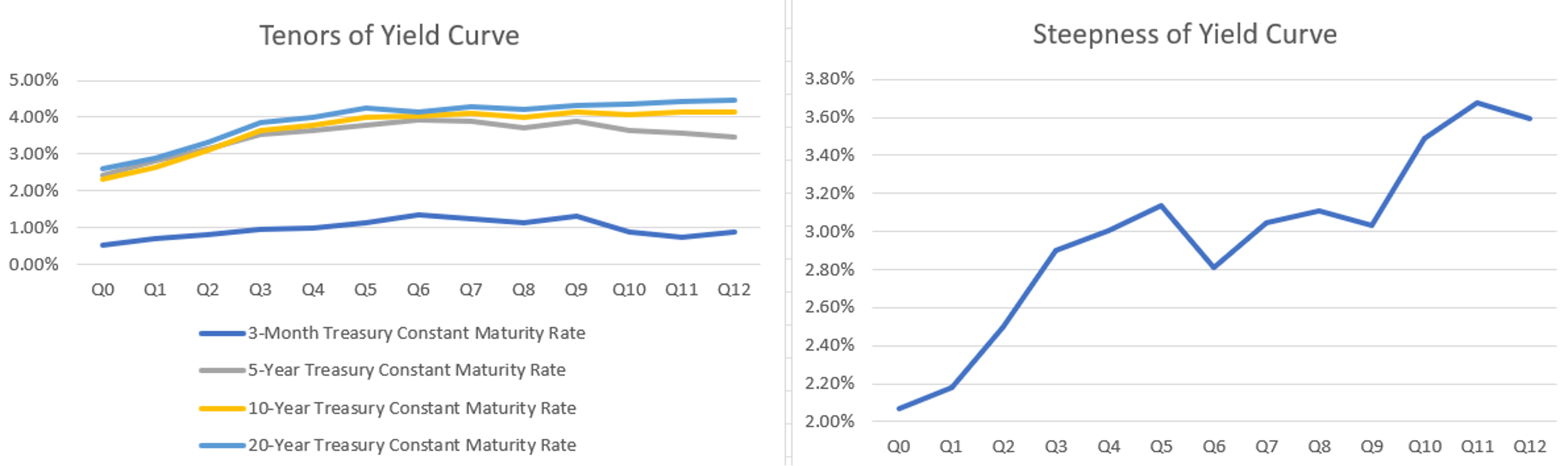

The same reverse scenario analysis enables the discovery of the underlying economic environment associated with this cluster. In our example, its main features are rising interest rates and simultaneous steepening of yield curves, as depicted in Figure 1.

Figure 1: An Example of Discovery via Reverse Scenario Analysis

Source: Straterix

Yield curves usually steepen when interest rates decline and flatten when they rise, so the scenario depicted in Figure 1 would not typically be considered in stress testing. However, when discovered through reverse stress testing, the yield-curve steepening issue can be mitigated with fairly low-cost hedging strategies.

Parting Thoughts

The idea of developing an integrated stress testing approach for capital and liquidity has the backing of significant regulators.

A 2020 IMF paper proposed to model liquidity and solvency risk in a coherent framework, using a coarse-grained representation of the balance sheet and income statement. The Basel Committee on Banking Supervision, meanwhile, has long emphasized the need for integrated liquidity and solvency stress tests. What’s more, the challenges around implementation of such integrated frameworks have been analyzed, not only for their static and dynamic balance sheet effects but also for their system-wide impact.

There are two risk measurement techniques that can help with the integration of stress testing for capital and liquidity: capital-at-risk (CaR) and liquidity-at-risk (LaR). CaR and LaR assess the longer-term risk horizon and represent an extension of standard value-at-risk (VaR) measure.

Unlike backward-looking VAR, these measures must be forward-looking to capture unprecedented market events and their respective capital and liquidity outcomes. Combined, they produce an adequate picture of the real risks facing an institution.

The integrated, forward-looking approach to stress testing described in this article enables easy calculations of measures of CaR and LaR, and offers valuable insights on the difference between expected and tail-risk outcomes for capital and liquidity.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.

Topics: Metrics