European Union capital rules, to be implemented starting in 2025, are expected to dramatically increase bank capital requirements for securities lending and institutional-investor counterparties’ trading costs. According to a September Credit Benchmark report, that will depress securities financing activity and in turn reduce market liquidity and widen bid-offer spreads, potentially driving up trading costs by €20 billion to €40 billion annually.

Although directly affecting EU markets, the rule may have a wider impact because securities lending is used as a tool to transform assets for portfolio-performance optimization.

“If that becomes too expensive, then it puts costs on other parts of the financial markets and makes those trades less viable as well,” said Matt Chessum, director of securities finance at S&P Global Market Intelligence.

The EU is implementing global capital reforms, focusing on factors comprising the denominator of financial institution capital ratios. The U.K. and U.S are anticipated to issue their own regulations interpreting the so-called Basel IV reforms late this year or early in 2023.

Assessing Impact

Capital requirements imposed by the Dodd-Frank Act of 2010 largely reflect Basel IV. Major banks and buy-side investors in the U.S. securities lending business may thus be less affected domestically. They may even find benefits compared to current requirements. Nevertheless, financial markets worldwide are increasingly interlinked.

“It’s not clear that [the EU rules] would necessarily impact securities lending in other jurisdictions,” Thomas Aubrey, CEO of Credit Capital Advisory and Credit Benchmark adviser and author of the recent article, said in an email. “However, any significant disruption to the European capital markets might well result in other effects for global markets, given the linkages.”

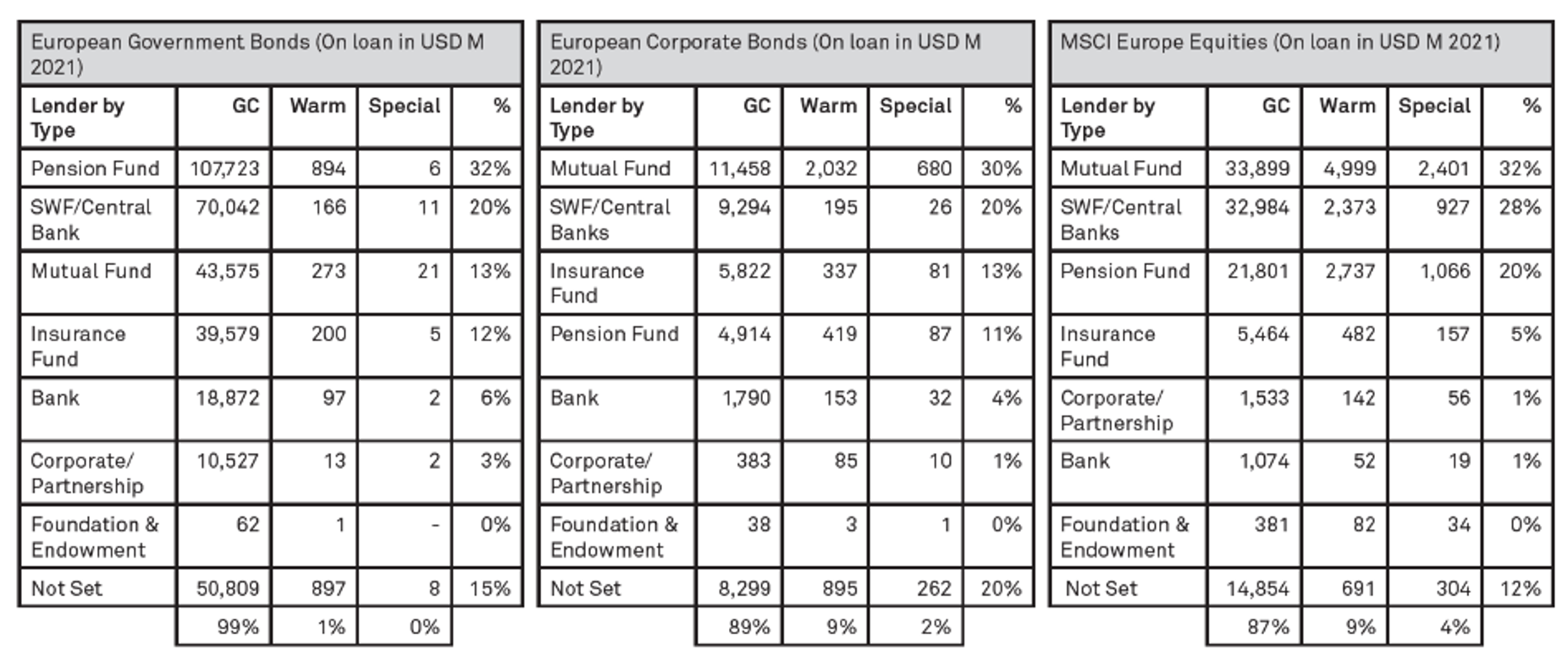

European institutions in 2021 earned around $1.4 billion, or €1.2 billion, by lending out securities. (Data from S&P Global via Credit Benchmark.)

The biggest EU market change stemming from Basel IV, according to Chen Xu, corporate counsel at Debevoise & Plimpton and a member of its financial institutions group, is the introduction of an “output floor.” Under the Basel framework, financial firms generally can calculate capital requirements one of two ways: a standardized approach, typically employed by smaller institutions and more punitive from a capital perspective; and the advanced, model-based approach. In the latter, firms make internal assessments that are monitored by regulators to set capital requirements more granularly, based on historical data – and that can significantly lower capital requirements.

U.S. institutions using the advanced approach must also calculate capital requirements according to the standardized model and then manage to the higher of the two results – the floor. In Europe, banks have not been subject to a floor, a significant advantage to those applying advanced approaches, but the EU’s legislative package of October 2021 changes that.

The Basel timetable calls for reforms to be implemented by January 1, 2023, but the EU first applies its regulation two years later, followed by a five-year transition period. The regulation requires banks to multiply at a consolidated level the result of their standardized-model calculation by 72.5%, which would serve as a floor for the advanced, internal-models approach.

Effects of the Floor

However, that new output floor will result in a dramatic increase in capital requirements. That is due partly to the risk weighting for unrated corporates, which Basel defines to include also highly rated funds, jumping to 100% from much lower percentages today.

The European Commission has responded to those concerns by recommending a transitional 65% risk weight for unrated exposures, assuming their probability of default is less than or equal to 0.5%, consistent with an investment-grade rating. But that could still result in capital requirements that are multiples of today’s.

“The cost of capital for banks undertaking securities financing activity with pension and mutual funds could rise as much as five-fold due to the new rules, making much of this activity unprofitable,” Aubrey’s report says.

For participants in the U.S. securities lending market, already accustomed to an output floor and higher capital requirements, the new Basel rules may provide some benefits. Xu said that a widely recognized issue with the Basel Committee on Banking Supervision’s prior standardized approach is that it inadequately incorporates correlations between long and short positions and the benefits of portfolio diversification.

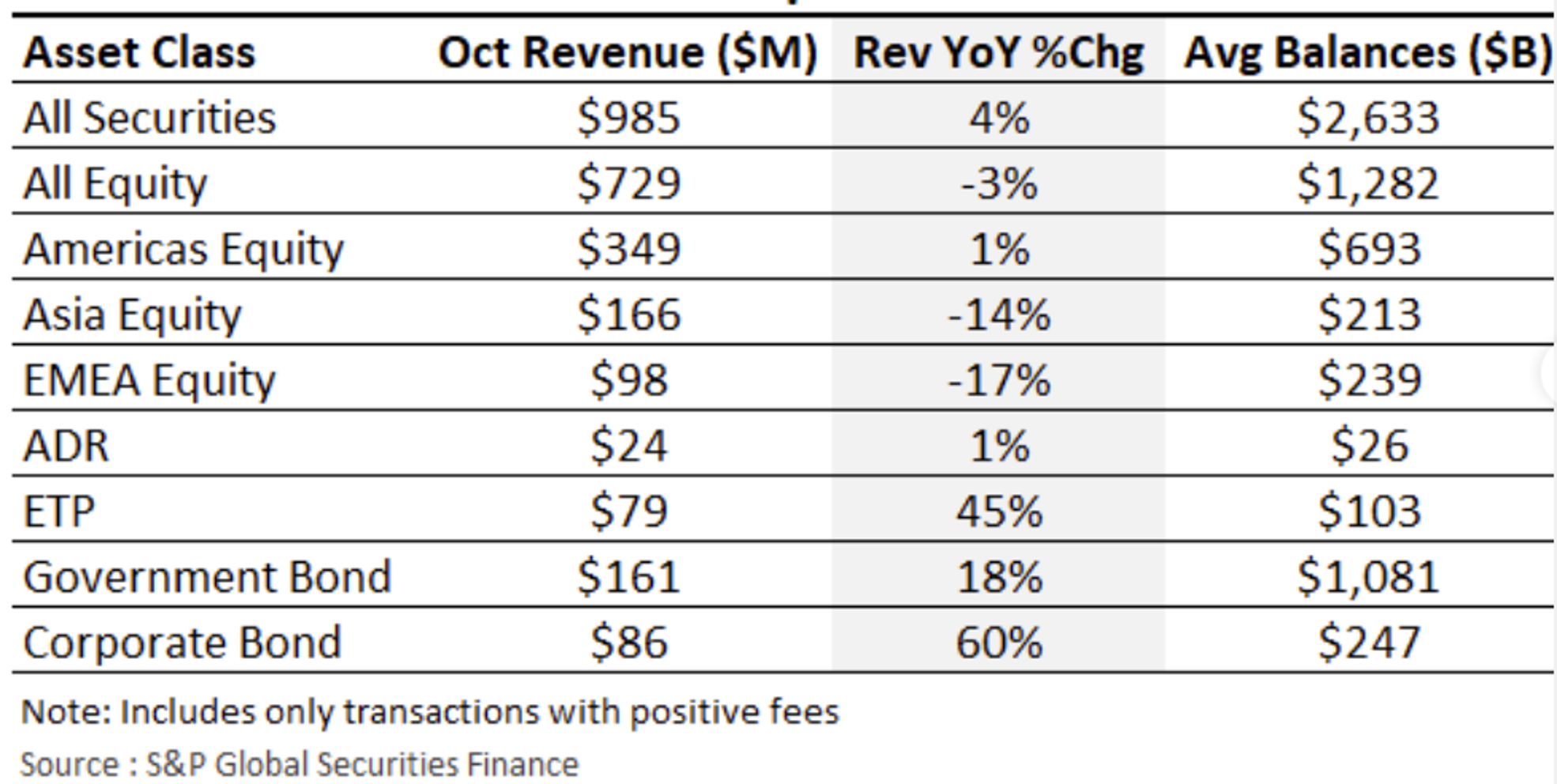

Total global securities finance revenue rose year-over-year in October but was below $1 billion for the first time in seven months.

Advantage in the U.S.

The anticipated U.S. Basel IV proposals are expected to provide for greater correlation and diversification benefits. “It probably significantly lowers the exposure calculation and therefore the capital requirements for securities financing transactions under the standardized approach,” Xu said.

Another benefit under the new Basel framework, especially in the U.S., is a method to gauge corporate creditworthiness without relying on external ratings. Given the dubious performance of credit rating agencies leading up to the financial crisis, the Dodd-Frank Act essentially banned use of external ratings in the calculation of capital requirements. Under the current standardized approach in the U.S., all corporate credits were given a 100% risk weighting.

The expectation for Basel IV and its U.S. implementation is to replace external ratings to gauge capital requirements with a variety of qualitative criteria to determine whether a credit is investment-grade and thus qualifying for a lower risk weighting.

U.S. market participants “expect this to provide a big benefit to securities lending because the credits of the borrowers in the securities lending market tend to be financial institutions and much stronger,” Xu said.

Changing Practices

The Basel IV rules as currently written for the EU will likely result in different ways to lend securities. S&P’s Chessum said there are “a number of bits and pieces already in play but not yet widely used.” One is to “pledge” collateral rather than transferring the title. That lowers the transaction’s risk weighting and the amount of collateral a bank must hold, since the collateral has not legally changed hands.

Chessum said that central counterparties may also be reconsidered. Eurex, he noted, attempted to institute a CCP structure for securities lending in the wake of the financial crisis, but it was overly complex and not well received by the market. In the U.S., Options Clearing Corp.’s CCP saw total securities lending transactions of 184,795 in October, 11.6% more than 165,581 a year earlier.

“The way that people do business is going to have to change if they want to carry on lending as many securities as they have done in the past,” Chessum said.

Topics: Financial Markets