How helpful are existing models in identifying and preempting hidden risks? That’s an important question that has arisen in the aftermath of a stream of unexpected risk shocks over the past few years. Models, after all, didn’t prevent the recent bank failures – and neither did traditional stress tests nor audits.

Several suggestions have been made on how to resolve these problems: there have been calls, for example, for updated regulations, a greater focus on idiosyncratic risks, and further simplification of the models. Yet each of these recommendations has its own drawbacks.

While there is an urgent need for revised rules, as existing ones failed to provide proper warnings about pending disasters, they might put additional pressure on capital and resources – particularly for regional banks, community banks and credit unions.

Clearly, the recent bank failures were the result of idiosyncratic risk positions and flawed governance – but they were also triggered by systemic shocks like inflation and the downturn of venture capital (VC) markets.

What’s more, while it's important to enhance existing models to produce more constructive and actionable outcomes, some simplifications may lead to underestimation of the tail risks.

The Modeling Conundrum

When it comes to modeling and assessing extreme risks, there is always a dilemma: the choice between employing complex, nonlinear tail models or simpler, more intuitive ones.

Standard models for extreme risk events, like extreme value theory (EVT), attempt to calibrate the tails of risk separately from the normal bell-shaped part of risk distribution. Unfortunately, this approach doesn’t work for financial institutions, because EVT’s main assumption – that tail risks develop independently of other risks – is not valid.

Risk managers must instead consistently incorporate extreme events into regular, business-as-usual risk analysis. It's key to not only establish a balance between analyzing normal and stressful market environments but also to assess the impact of these conditions on idiosyncratic exposures.

In the past, conventional thinking called for banks to choose between the nonlinear black-box models for extreme events and the simpler, more transparent methodologies that address a specific bank’s exposures. The problem with the more straightforward models, of course, is that they could potentially miss some tail risks.

Alla Gil

It seems, then, that some type of sacrifice must be made when attempting to account for all possible idiosyncratic and system risks. But risk managers don’t need to compromise.

The Road to Comprehensive Risk Assessment

The bottom line is the financial services industry is faced with a very complex problem: namely, how to be prepared for unprecedented outcomes, both for individual institutions and on a systemic level. However, by using a balanced approach that covers a full range of scenarios, risk managers can provide more accurate forecasts for both tail risks and the risks that occur during stable market conditions.

When trying to project the full spectrum of risks, there is no simple answer. The two potential approaches are (1) employ a very sophisticated but opaque model; or (2) break big problems into a few smaller ones and address them in sequence.

The first approach – a gigantic and complicated black box – is not appropriate for strategic decision making or regulatory supervision. The second one, which follows a sequence of simple and intuitive steps, is much more acceptable.

As the problem at hand is very difficult, sequencing can get quite long. It’s therefore important to make every single step along the way transparent, with clearly defined inputs and outputs and an intuitive explanation of how these inputs influence the respective outputs.

These steps must include: (1) comprehensive scenario generation that not only accounts for extreme-event interruptions of stable markets but also projects their ripple effects; (2) integration of balance sheet and income statement segments (uniform in risk and behavioral patterns) with these scenarios; and (3) projecting institutions’ capital and liquidity ratios, needs and costs on all scenarios at monthly or quarterly intervals. (The latter two steps can even be done using publicly available call report data.)

By following these three steps, financial institutions, regulators and investors (along with research analysts and rating agencies) can compare organizations in the same peer group consistently – even at a systemic level. Moreover, outliers can be identified and market conditions that lead to both idiosyncratic risk and tail risk outcomes can be discovered.

Ultimately, firms can use the balanced model to gain a more holistic understanding of their potential risks.

How to Assess Individual and Systemic Threats

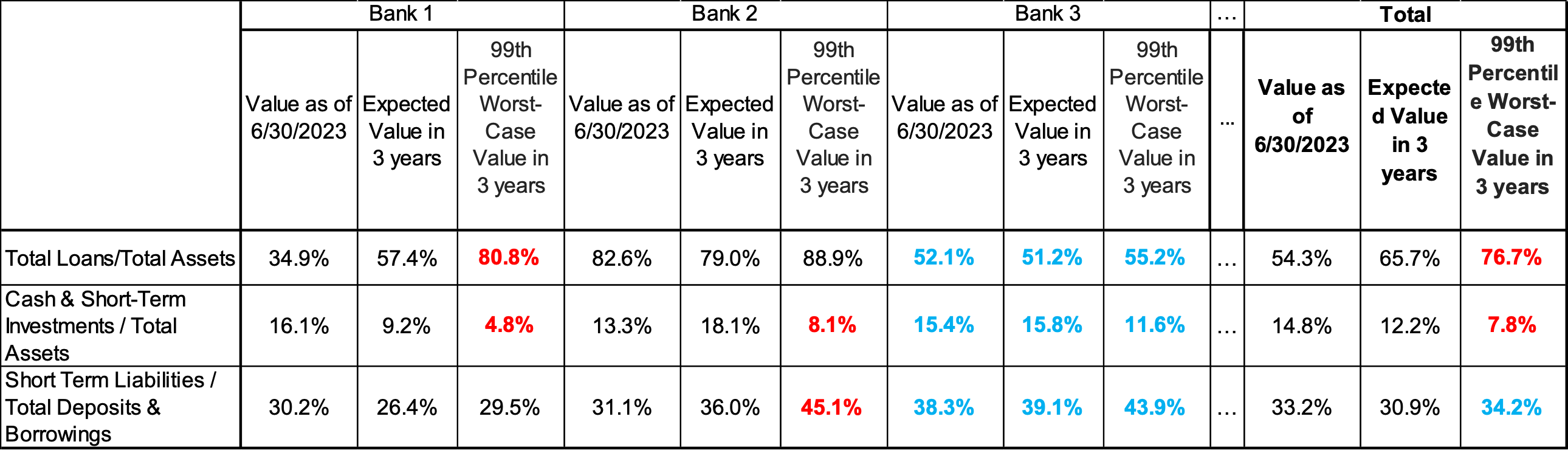

Table 1 offers an example of the holistic approach that is needed for risk analysis. Publicly-available historical data was extracted (from sources like FFIEC, FDIC or SNL databases) for a select group of banks – segmented by types of loans and deposits, investments and borrowings.

Table 1: Benchmarking Idiosyncratic and Systemic Risks

Source: Straterix

The segments cited in Table 1 were linked to specific macroeconomic and market scenarios, via machine-learning-driven, automatically-generated regression equations. These equations are superior to standard regression analysis, partly because they can select the key variables that better explain stress-driven behavioral outliers.

To provide added transparency and to give modelers more control, these equations can be reviewed – and unexplainable variables can be rejected. If such rejection significantly increases cross-validation error, this gives modelers food for thought, potentially expanding their intuition beyond existing experience.

In Table 1, after all segments for each bank were projected on the scenarios, the three sample liquidity ratios were calculated – both for their initial values and for their expected values and tail outcomes, sampled from the full distribution, over a three-year horizon.

Liquidity Risk Lessons

What did we learn from our example holistic approach to risk modeling? Well, for one thing, asset-side liquidity is at risk when the ratio of loans to total assets goes up while the proportion of liquid assets (like cash and short-term investments) goes down. Funding-side liquidity, meanwhile, might be in danger when there is an increase in the ratio of short-term liabilities to the total of deposits and wholesale borrowing.

For each bank, using the holistic approach, these and other ratios should be analyzed, together with the conditions that lead to these adverse outcomes. Moreover, ratios for the entire group of banks (as shown in the "total” column in Table 1) can be created, after one sums up all numerators and denominators of the ratios for each scenario, across all banks.

A key advantage to this integrated strategy is that one doesn’t have to worry about the correlations between idiosyncratic exposures of these individual banks. All correlation dynamics are already captured in the scenario generation process, simplifying the aggregation of additive exposures.

Another benefit of this versatile approach is that it can be used for both systemic and idiosyncratic risk assessment, allowing for more robust risk management that considers a wide range of possibilities.

Parting Thoughts

Comprehensive, integrated risk management is not a matter of selecting one path or another. Successful firms, rather, combine multiple perspectives and methodologies.

To assess and mitigate the full spectrum of risks, a firm must prepare for a variety of scenarios, using an array of modeling techniques. Risk managers who follow this balanced approach can navigate the complex landscape of uncertainty with greater confidence and resilience.

Alla Gil is co-founder and CEO of Straterix, which provides unique scenario tools for strategic planning and risk management. Prior to forming Straterix, Gil was the global head of Strategic Advisory at Goldman Sachs, Citigroup, and Nomura, where she advised financial institutions and corporations on stress testing, economic capital, ALM, long-term risk projections and optimal capital allocation.

Article Updated: May 20, 2024

Topics: Metrics