When bitcoin climbed past $50,000 in mid-February, the digital-asset buzz was less about a new price spike than about the mainstreaming of cryptocurrencies and the institutionalization of the asset class. Tesla's disclosure of a $1.5 billion bitcoin purchase - two months after a $100 million allocation by MassMutual - may just be signaling a new growth cycle.

As long as a year ago, according to a survey by Fidelity Investments' Fidelity Digital Assets, 36% of nearly 800 institutional-investor respondents said they are investing in digital assets, and six out of 10 believe those assets have a place in their investment portfolio. Today, even asset management giant BlackRock has “started to dabble.”

Institutional-grade infrastructure buildouts - by crypto-native companies ranging from Coinbase and Gemini, to BitGo and Paxos, to Securitize and XBTO - are primed for more action. And BNY Mellon announced February 11 that it is developing what is “designed to be the industry's first multi-asset digital custody and administration platform for traditional and digital assets.”

It all adds up to a vibrant market not just for bitcoin, ethereum and other virtual currencies, but also for tools to manage and mitigate the risks. Although there are techniques - honed over many years in equity trading - for taking sizable crypto positions without causing a big price impact, hedging the volatility of these investments is difficult. It may stay that way until stronger regulatory guardrails are in place.

“The U.S. needs to come up with a more cohesive message across all the [regulatory] agencies relative to crypto,” says Sandra Ro, CEO of the Global Blockchain Business Council.

Price Swings

“We looked at bitcoin from when it became a tradable asset, and each year between 2013 and 2020 it has declined at least 25% and on average 40%,” noted Gavin Smith, CEO of Panxora Group, which manages a hedge fund that invests in cryptocurrencies and offers software to hedge the volatility of long cryptocurrency positions. (The firm's website is blocked from U.S. access for compliance reasons.)

There could be more wild rides ahead. “Bitcoin's ascent from $40,000 to $50,000 took six weeks, a relative snail's pace given its move from $20,000 to $40,000 happened in three weeks,” Antoni Trenchev, managing partner of cryptocurrency lender Nexo, told Yahoo Finance. He believes it is on its way to $100,000, while Simon Peters, crypto asset analyst at digital investment platform eToro, says, “There's no reason why $70,000 can't soon be the new normal.”

On February 23, four days after peaking at $58,000, bitcoin traded as low as $45,000. Then news of a $170 million investment by Square pushed the price back to $50,000.

Vytautas Zabulis, CEO of EU-regulated crypto infrastructure developer H-Finance, calls Tesla's gambit, including its willingness to be paid in bitcoin, “quite monumental.” He says the market has entered “the adoption stage, propelled by interest to hedge against devaluation of fiat currencies . . . Companies and individuals are looking for new asset classes to save their money from losing value. As such, there is rising interest from financial institutions to offer digital asset trading beside stock and ETF [exchange-traded fund] trading.”

Tools for Trading

Among those offering high-tech trading support is B2C2, a London-based institutional liquidity provider recently acquired by SBI Holdings of Japan. It says it provides “24/7 electronic execution in the major cryptocurrencies and fiat currency pairs” and offers “continuous pricing and execution, no matter the time of day or the volatility in the markets, as well as seamless post-trade settlement.”

Three-year-old Aquanow says on its website that its routing technology connects clients seeking best-available execution to “the most important cryptocurrency liquidity venues around the world,” adding, “Our suite of algorithms is designed to improve execution quality and speed.”

Blockfills facilitates execution of large cryptocurrency trades. It claims to be the first electronic, off-exchange, digital liquidity provider that uses an electronic communication network (ECN) model, which was pioneered in the equity market more than 20 years ago.

Retail and institutional brokerage Voyager Digital recently launched an over-the-counter (OTC) desk that uses Aquanow, Blockfills and other tools to fill customers orders. Voyager co-founder and CEO Stephen Ehrlich, who formerly headed E*TRADE Professional Trading, noted that those tools employ volume-weighted average price (VWAP), time-weighted average price (TWAP) and other longstanding execution strategies as well as more sophisticated algorithms, and today the technology tends to be used by OTC desks rather than investors directly.

“That's partially because the custody and back-side [of cryptocurrency trading] is a lot more complicated than trading securities, where trades can be executed in multiple locations and a prime broker can round them up to be cleared and settled,” Ehrlich explained.

Unlike in equities, there is no Depository Trust & Clearing Corp. to settle trades centrally, so broker settlements take place with the individual exchanges.

Panxora's hedge fund takes advantage of existing inefficiencies by employing an “active hedging model based on volatility.” It reduces exposure to cryptocurrencies when short- and long-term volatility measures fed into the model indicate rising volatility. The market is not certain to sell off when volatility increases, CEO Smith said, but its inefficiencies provide sufficient time to re-enter positions with limited price slippage.

“There's time for the model to adapt and control the risk accordingly,” he said, adding that during bitcoin's price drops, the hedge's value has fallen significantly less, and it has captured most if not all the upside.

ETPs and Derivatives

Data provider CryptoCompare has introduced a Bitcoin Volatility Index, said to be “the first benchmark index to quantify bitcoin implied volatility.” The index, developed with a team led by Carol Alexander at the University of Sussex Business School, “could be used as the settlement price for bitcoin volatility futures contracts and, if these futures become actively traded, their market prices may be used to construct indicative values for a diverse set of leveraged, direct and inverse bitcoin volatility ETFs and other exchange-traded products [ETPs],” according to a CryptoCompare newsletter.

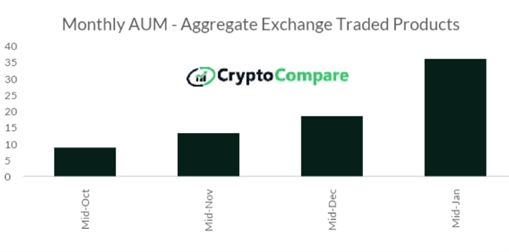

The firm maintains that “ETP activity is perhaps the best bellwether of institutional investor demand, as these products are often the only way highly regulated investors can gain exposure to digital assets.” With assets under management across all ETPs increasing 95%, to a record $35.96 billion, between December and January, and aggregate daily ETP volumes almost tripling, to $837 million, “the data paints a clear picture of surging institutional investor demand [which] supports the widely believed narrative that this bull market is largely institutional investor-led, as opposed to the retail-driven 2017 bull market.”

The aggregate ETP asset figure rose yet again, to $43.9 billion, as of February 21.

Voyager Digital said February 16 that its assets under management totaled $1.15 billion, a five-fold increase from the end of December.

Panxora uses forward and futures contracts to enable clients to avoid cryptocurrency markets' sharp selloffs. The risk models identify periods where risk of a downturn is heightened, and an execution model then implements staged selling of futures or forwards to reduce the overall exposure during these periods.

When market volatility subsides, these derivative positions are closed, moving the client back to full exposure. Most clients are private holders of significant quantities of cryptocurrency, Smith said, and Panxora is in the process of implementing the strategy for a corporate customer.

“It's almost like someone turned on a switch at the end of 2020, because we've been fielding a lot of calls from corporates looking at the space,” Smith said.

“New Concept”

The Panxora chief described hedging as still a “very new concept” in the crypto markets. He expects it to become more prevalent as more professional traders enter the market. For now, though, “It's very difficult to find a decent, affordable options market to hedge exposures.”

Benjamin Tsai, president and managing partner of Wave Financial, a digital-asset investment product and wealth management provider, said the market for hedging tools is growing, but volatility makes options and other volatility-based derivatives very expensive.

“People are starting to trade options to buy and sell volatility and capture returns on the upside, and some are using them for a downside hedge, maybe doing spread trades and the like,” Tsai said, but they tend to be professional traders, rather than investors seeking to hedge long positions.

Smith said he expects that over the next three years at Panxora, “our use of hedging will start to encompass more optionality, because as inefficiency becomes less in the underlying market, I suspect the options market will become deeper.” As a result, “we'll be able to switch from some of our current hedging strategies to the use of options in a way we can't today.”

Establishment Acceptance

In the meantime, the financial services establishment appears to be concluding that crypto is here to stay. Aside from BNY Mellon's digital asset initiative, Mastercard and PayPal have announced cryptocurrency strategies. JPMorgan Chase & Co. co-president Daniel Pinto recently said that institutional client demand for bitcoin remained weak but would likely change. Earlier this year, JPMorgan strategists forecast a long-term bitcoin price target of $146,000, conditioned in part on lower volatility to attract institutional interest.

MassMutual made a $5 million strategic investment in NYDIG, an institutional-market-facing subsidiary of Stone Ridge Holding Group that facilitated the insurer's $100 million bitcoin purchase. “MassMutual's investment of bitcoin into its general investment account [GIA] reflects our broader strategy to capitalize on evolving opportunities while remaining diversified across a variety of asset classes,” said MassMutual spokeswoman Chelsea Haraty, adding that the bitcoin investment represents only 0.04% of the GIA.

Sandra Ro of the Geneva-based Global Blockchain Business Council says the market needs more regulatory clarity.

Ro, who was executive director of digitization at the CME Group when it was developing its bitcoin benchmarks and futures, said U.S. regulators have taken some positive steps, such as the Office of the Comptroller of the Currency's approval of a national trust charter for Anchorage Digital Bank. The Securities and Exchange Commission has yet to approve a bitcoin ETF - NYDIG has made an application - and Ro is hopeful that Gary Gensler, who has been nominated to chair the commission and is well versed on blockchain and cryptocurrency, will change course. (North America's first bitcoin ETF debuted in Canada on February 18.)

“We need common definitions and taxonomy, and it must be clear on what each regulatory body is overseeing,” Ro said. “There's no need for a new regulatory framework, but the regulators must be very clear what they are covering.”

In view of the increasing interest in digital currencies, Deloitte has published a report covering corporate treasury-related issues such as tax treatment, accounting for digital assets, and complications when using cryptocurrencies to engage in cross-border transactions. It emphasizes the need to understand the differences in cryptocurrencies' underlying technology, which impacts how transactions are processed and the resilience of a coin network. Regarding governance, it says top executives and boards of directors must have a clear assessment and understanding of digital assets' risk profile in relation to the company's tolerance for risk.

“In 2020, more operating companies began allocating cash to digital assets and cryptocurrencies. This is a new dynamic and a departure from more conventional investing by funds and others in this space,” says Deloitte's introduction, which mentions as a “telling example” the December announcement by MicroStrategy of a billion-dollar bitcoin purchase.

“Some companies have followed suit,” the report says, “and others may now be wondering how to invest in bitcoin and other digital assets. There are a variety of reasons for adding digital assets to a company's balance sheet, whether it's seeking asymmetric risk return observed over previous years or as a natural hedge against fluctuating fiat currencies; whether it's part of a corporate strategy to embrace modern, open technologies; or as a complement to an operational strategy that includes accepting digital assets as payments.”