A critical uncertainty hanging over cryptocurrencies is whether they are to be regulated as securities or commodities. Another, more traditional asset class is undergoing a legal test of its own: Are leveraged loans securities?

Kirschner v. JPMorgan Chase Bank, a case before the U.S. Court of Appeals for the Second Circuit, is a test of whether loans syndicated to institutional investors should be treated as securities. A “yes” would abruptly impact how the debt is underwritten and distributed, potentially disrupting the leveraged loan and collateralized loan obligation (CLO) markets.

The lawsuit was filed in August 2017 in U.S. District Court for the Southern District of New York by Marc Kirschner, a trustee representing beneficiaries comprising roughly 400 mutual funds, hedge funds and other institutional investors. They invested in a $1.75 billion loan syndicated in April 2014 for Millennium Laboratories, which filed for bankruptcy in November 2015. The complaint alleged that JPMorgan and other entities that distributed the loan were “liable for negligent misrepresentation and violating state blue sky laws,” the state equivalent of federal securities laws.

The district court in May 2022 granted a motion to dismiss the claims, and Kirschner appealed. Also taking the banks’ side, by way of a May 2019 amicus curiae brief, were the Loan Securities and Trading Association (LSTA) and Bank Policy Institute.

Oral arguments were heard at the appellate court in March this year, and the court asked the Securities and Exchange Commission for its view on whether the loan should be treated as a security under Reves v. Ernst & Young, a 1990 Supreme Court decision. The SEC’s input was expected by June 27, and the principals in the case each requested 30 days to respond to that.

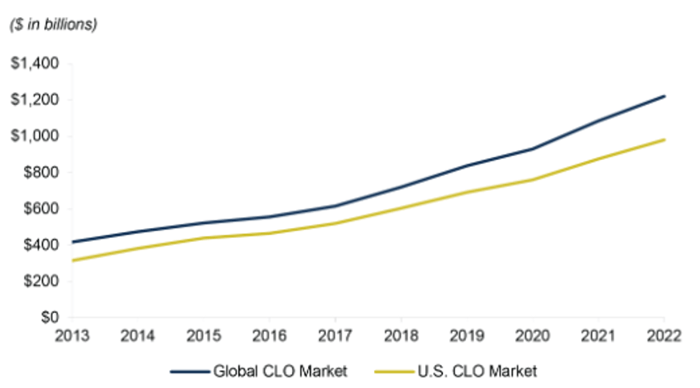

The collateralized loan obligation market. Source: Oaktree Capital Management (JPMorgan data)

“Vital to the Economy”

In a note posted in March, LSTA said a reversal, favoring the plaintiff, could “jeopardize a trillion-dollar market that is vital to the economy.” It noted that loan market participants would then have to comply with state and federal securities laws and rules from self-regulatory organizations such as FINRA. In addition, syndications and trading activity would have to be conducted through a registered broker-dealer, the association said, comparing securities transactions’ two-day settlement cycle to 10 days for loans traded in the secondary market.

“If syndicated term loans were securities, their extended settlement cycle would impact margin, net capital, and other rules that apply to settlement of securities transactions,” LSTA said, adding that “imposition of these rules would complicate loan transactions and burden market participants with additional costs.”

Still, so-called “term loan B” credits have morphed over the years to look increasingly like senior secured bonds, adopting “cov[enant]-lite” structures that reduce lenders’ protections and early warnings, and trading more frequently among an ever-broader variety of investors.

Elliot Ganz of the LSTA

Elliot Ganz, LSTA co-head of public policy, said significant differences remain between the markets that are important to both lenders and borrowers, such as greater ability to amend loans, the speed at which loans can be completed compared to bonds, and borrowers’ control over the syndicate of lenders as compared to a bond.

Those differences, which Ganz termed “important to borrowers when they choose between loans and securities,” can be stipulated in a loan’s contractual language, according to Greenberg Glusker partner Schuyler Moore.

“It’s a contractual question, not a securities question,” Moore said. Loans treated as securities would require disclosing material facts under Rule 10b5-1, which applies to trading by major shareholders, “but is that so bad? It comes down to banks not wanting the liability for not disclosing certain information.”

Reves and Howey Tests

In the March hearing, according to LSTA’s account, the three-judge appellate panel inquired at length about the Reves decision’s four-factor test to identify a security. Moore described those factors as: the parties’ motivation, the distribution plan, the investing public’s expectations, and the availability of an alternative regulatory regime.

He said they resemble the four factors set out in an earlier case, SEC v. W.J. Howey Co., now often cited in discussions among the SEC, Commodity Futures Trading Commission and members of Congress regarding cryptocurrency regulation and jurisdiction.

Professor James Angel

“The SEC is in a tough place, as it is arguing that most cryptos are securities, and I would thus expect them to be consistent and say that syndicated loans are securities,” said James Angel, associate professor, McDonough School of Business, Georgetown University.

He added, however, that the SEC could also say it is in the public interest to maintain the status quo. Or it could state that it will take no action against issuers and traders under specified conditions that ensure a loan exempted from public securities requirements is never sold to retail investors. Further, a no-action letter could serve to prevent market participants from tweaking securities offerings to look like loans with the intention of avoiding securities requirements.

Slower-Paced Rulemaking?

According to the LSTA, Congress and the SEC have consistently recognized differences between loans and securities over the past 30 years, including with language in the 2010 Dodd-Frank Act.

Ganz maintained there are strong legal arguments for keeping the status quo, while emphasizing the potential disruption caused by having to treat some $1.4 trillion in syndicated leveraged loans as securities.

"The bigger the class of affected markets, the more important it is to get this right,” said Stanford University Graduate School of Business professor Darrell Duffie. But if the protection afforded by treating loans as securities is judged to be minor, while the disruption it causes is major, “then the courts would probably rightly let sleeping dogs lie.”

Ganz said the issue “could be addressed in a more thoughtful way,” through the regulatory rulemaking process that allows market participants to submit comments and gives them time to prepare for changes. That wouldn’t “suddenly upend the market and create chaos at a time when that’s the last thing you want.”

Topics: Financial Markets