In 2017, Alfred Eskandar and Tony Barchetto drummed up a fresh idea to manage the volatility risk of investing in the U.S. stock market. Dubbed truBeta, their process uses risk analytics to build indexes that cater to different risk tolerances among investors.

Employing algorithms to sift through myriad intraday, monthly and yearly trading statistics for 200 of the 1,000 stocks and real estate investment trusts (REITs) in the Solactive U.S. Large & Mid Cap Index, the pair built two smaller indexes that each track 100 stocks at opposite ends of the volatility spectrum. Simply put, the 100 stocks in their Salt Low truBeta US Market Index moved the least in the most recent quarter, while the 100 in the Salt High truBeta US Market Index moved the most.

Eskandar and Barchetto in September 2017 formed Salt Financial, in Manhattan's flashy Flatiron district, to sell risk analytics under their truBeta brand. They even registered a couple of new exchange-traded funds with the U.S. Securities and Exchange Commission: the Salt High truBeta US Market ETF (symbol: SLT) and Salt Low truBeta US Market ETF (LSLT).

Why “Salt”?

“We are an enhancement,” Eskandar explains. “If you have a portfolio and you add a dash of Salt, it actually makes it better. It reduces volatility. It increases return potential. It gets that ratio of risk-reward back in line where it should be, meaning you are not taking unrewarded risk.”

Uncertainty Factors

The truBeta methodology was intended to compete with existing investment products that attempt to moderate volatility in low-cost structures including ETFs. These are increasingly in demand among investors who want to profit from the potential upside of uncertainty around the likes of U.K.'s exit from the European Union, conflict in the Middle East, and domestic politics and elections, while mitigating the downside risk.

Among the champions of this game are the iShares Edge MSCI Min Vol USA ETF (USMV), which manages $37.3 billion in global developed markets, and the Invesco S&P 500 Low Volatility ETF (SPLV), with $12.8 billion in the U.S. only. During the first nine months of 2019, 38 low-volatility ETFs tracked by Morningstar enjoyed a total monthly net flow of $20.1 billion. That was more than double the $9.6 billion in net flow for those funds in all 12 months of 2018, and more than five times the $3.9 billion in net flow in calendar year 2017.

“We have seen consistent flow linked to this interest in low volatility over the last year,” says Nick Kalivas, senior equity ETF strategist at Invesco. “It has been a function of the uncertainty that has been present. To the extent to which that uncertainty has manifested itself in a very choppy stock market, with bouts of increased volatility and concerns over the economic growth picture, those factors have played to the strength of low volatility.”

And why ETFs to target specific volatility levels in stocks?

That's where demand is highest among virtually all types of investors, from retail to pension funds, as BlackRock discovered when it launched a series of equity ETFs that targeted volatility levels from the MSCI more than three years ago. BlackRock now manages about $100 billion in assets in minimized volatility and risk-factor strategies, including $8 billion in minimized volatility ETFs and $1.9 billion in other risk-factor ETFs, according to Mark Carver, global head of factor index products at BlackRock.

“It's really about democratizing these exposures,” Carver says. “Bringing them in ETF form opens up an opportunity to a wide range of clients.”

Early Obstacles

In the process of introducing their fledgling product line, Eskandar, who is Salt Financial's president and chief operating officer, and Barchetto, chief investment officer, confronted a number of hurdles that have raised weighty questions on the nature of the money management industry. Among them: Just how tightly do investors who favor ETFs really want to intertwine the management of risk and investment? How can the barriers to entry to a protected industry be overcome? How is it possible to sell a new investment product that has neither significant assets under management nor a track record?

Eskandar and Barchetto are still struggling find the answers - with the success of truBeta hanging in the balance.

In hindsight, Salt's founders overlooked a couple of prerequisites that fund managers are expected to meet with a new product. One has more do with the economics of the money management industry than the effectiveness of a new entrant's risk analytics or investment strategy. This is the need for seed capital to build an asset base of hundreds of millions of dollars at the time of a product launch, as did BlackRock for its iShares ETFs and Invesco for PowerShares, according to senior managers at those companies.

“Maybe we were naive,” Eskandar admits. “We didn't feel that that was going to be necessary. This was our mistake.”

The other prerequisite: a solid track record of at least three years. Eskandar's justification is that Salt's product is “a pure, plain vanilla, all equity, transparent ETF.” A three-year track record, he insists, is implied in the past performance of any of the 100 stocks in the truBeta portfolio in any given quarter.

Building Visibility

One reason that Salt has not attracted more attention despite an active awareness campaign, which included media appearances by Eskandar and Barchetto, is that its small family of ETFs is not perceived as adding anything new to the product mix already available from wire houses, financial advisers and other intermediaries. “What's the real 'why' that they would add Salt to their platforms? How unique is it?” asks Christian Belu, an analyst who covers capital markets at Sanford C. Bernstein.

Salt's ETFs are unique, Eskandar says, because they use intraday data to measure the volatility of changes in stock prices. In contrast, competitors such as BlackRock, Fidelity Investments and others that dominate the market for ETFs that track volatility simply measure the difference between opening and closing prices, effectively ignoring the intraday undulations. Salt thus draws on exponentially more information to measure, characterize and ultimately understand changes in stock prices.

“Intraday pricing is the secret ingredient that nobody else uses,” Eskandar asserts.

This distinction attracted the attention of CLS Investments in Omaha, Nebraska, which manages $9 billion and is among the largest ETF investors in the country. In September 2019, 15 months after the Salt High truBeta US Market ETF was launched, CLS invested $1.5 million, in addition to $500,000 in the Salt Low truBeta US Market ETF, CLS director of research Grant Engelbart said in an interview.

“We want to recognize that there is innovation in this space,” Engelbart says, “and we want to use the best product possible regardless of its size or what the name-brand is on it, as long as we believe in it.”

The reason for that belief: Regarding High truBeta specifically, “they figured out a better way to get at high beta securities,” says Engelbart. “Historically, some of the other high-beta indices rebalanced less frequently, calculated risk less frequently, so they are prone to that risk changing in between rebalances. Over time, there are periods when high beta does well, but it generally loses out.”

Risk and Investment Management

To be sure, it's hard to find fault with a methodology that represents as close a marriage of risk management with investment management that Wall Street has seen. This is illustrated by the key difference between Salt Financial's two indexes, which is the extent to which they limit the risk they take in the stock market in an attempt to maximize returns.

Counterintuitively, the formation of each of the indexes starts out the same way. Salt begins by identifying the most actively traded 500 stocks in the Solactive US Large & Mid Cap Index, which includes 1,000 of the largest common stocks and REITs, based on trading volume.

Then Salt's risk analytics kick in, employing far more precise pricing data to build the two 100-stock indexes.

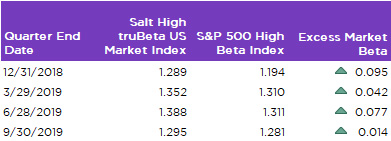

The Salt High truBeta US Market Index consists of the 100 stocks whose prices fluctuated the most in intraday, monthly and yearly trading over the last quarter, as measured by a truBeta score of 1.50 or higher. In other words, these are the most volatile stocks in the subset of 500 names. This methodology allows investors to take the added risk of investing in a basket of stocks that are at least 50% more sensitive to market moves than the rest of the index. At the end of the new quarter, the stocks that gained the most tend to comprise the bulk of the index in terms of face value.

By contrast, the Salt Low truBeta US Market Index uses the same risk metrics to select a different basket of 100 names from the same 500-stock subset. These are issues whose prices changed the least in intraday, monthly and yearly trading during the last quarter, as measured by a truBeta score of 1.0 or lower. In other words, the portfolio has below-average volatility: a 1.0 score represents an average intraday, monthly and yearly price change for the previous quarter. This process allows investors to dramatically lower the risk they would take by buying, for example, an S&P index fund, according to Barchetto.

Reining in the Risk

The indexes inherently diversify risk in a couple of simple ways.

First, each index spreads investors' risk equally among 100 stocks, ascribing a weight of only 1.0% to each stock at the beginning of the quarter. “There is risk mitigation,” says Barchetto. “If we are wrong in any one of them, we are not getting a huge bet.”

Second, the index limits exposure to any particular industry by capping the number of names in any one sector at 30. “We are not going to let our broad market fund be 80% technology,” as Barchetto puts it.

But such attempts at diversification can have unintended consequences. The 30-stock limit, for example, can potentially snap back on investors in a sudden downturn, where most of the assets are spread out in industries that get dragged down, while one or two industries actually outperform.“Putting on that sector constraint can add to your risk, and being nimble and not being constrained can actually reduce your risk,” Invesco's Kalivas says. That's one reason why the Invesco S&P 500 Low Volatility ETF does not set sector limits, he adds.

The stocks selected for the truBeta indexes comprise the portfolios of Salt's two funds: the Salt High truBeta US Market ETF and the Salt Low truBeta US Market ETF, respectively. “One is targeting a low-volatility, staid conservative exposure,” says Eskandar. “The other is aggressive.”

Performance Comparison

It's hard to find fault with the performance of Salt's ETFs compared with its competitors'.

CLS's Engelbart points out that from its inception to January 10, 2020, the Salt High truBeta US Market ETF was up 12.19%, compared with the Invesco S&P 500 High Beta ETF's (SPHB) 7.92%, according to Morningstar data. One reason for the disparity is that the two funds don't own very many of the same stocks, largely due to Salt's use of intraday trading data to measure volatility and select stocks. “There are pretty big differences in just how they are constructed overall,” Engelbart says.

Increased Market Sensitivity of High Beta Portfolios

Of course, it's the share prices of stocks in a fund's portfolio that ultimately drive performance. Although Salt keeps its algorithms close to the vest, its risk metrics seem to succeed in identifying stocks that are on the rise. The largest holding in the Salt High truBeta US Market ETF is chip maker Western Digital Corp. (NASDAQ: WDC), which comprised 1.23% of the fund as of January 8. In other words, the stock is nearly one-quarter overweight, reflecting its increase in face value compared with others in the portfolio. Since the ETF first bought Western Digital on June 24, 2019, the stock surged 65.59% by January 8, while the ETF itself was gaining only 11.67%.

Performance metrics aside, Eskandar says barriers to entry remain in place at wire houses, financial advisers and other intermediaries. A client of a company that Eskandar declines to identify sent him a screenshot that showed the words “blocked” and “trading prohibited” after entry of the ticker SLT for the Salt Low truBeta US Market ETF.

“A lot of it comes down to suitability and economics,” observes Bernstein's Belu. “The platform has to get paid for distribution.”

“You have got to have something that the market makers can deal with,” says Klivas. “Part of the creation-redemption process is you need to have some level of liquidity present.” Invesco, he says, was “working with different business partners to seed” its S&P 500 Low Volatility ETF when it was launched in 2011.

Legal and Marketing Channels

Salt filed a complaint on January 10, 2019, with the Federal Trade Commission. Citing “a series of 'platforms' that restrict access for new funds until certain requirements are met,” the complaint stated that “'gatekeepers' act to uphold the status quo and reduce competition” because “new entrants are limited in the number of customers that can be targeted from day one.”

To be sure, Salt's criticism does not apply to every massive money management institution - not all have attempted to block trades of truBeta ETFs. Vanguard, for one, openly allows individual investors with brokerage accounts to buy either of Salt's ETFs without paying a fee. “SLT and LSLT can be traded on the Vanguard brokerage platform without restrictions,” Charles Kurtz, a Vanguard spokesman, confirms.

Salt's attack on the bastion sprung from a plan that was “whiteboarded” in its Madison Avenue office. Months before they launched the Low truBeta US Market ETF, “We challenged ourselves,” Eskandar recalls. “How can we come up with a marketing strategy that is as bold as our investment strategy?”

He and Barchetto decided to make history, literally, by paying investors to buy their second product, the Salt Low truBeta US Market ETF, when it launched on March 11, 2019. Investors were charged an expense ratio of negative 5 basis points. In other words, they were paid 50 cents for every $1,000 invested - a temporary incentive until the fund gathers $100 million in assets, when investors will pay $2.90 per $1,000. (The Salt Low truBeta US Market ETF has an expense ratio of 29 basis points; the Invesco S&P 500 Low Volatility ETF has an expense ratio of 25 basis points.)

Just a Gimmick?

“I thought this was a gimmick that would work because investors are extremely cost conscious,” Todd Rosenbluth, senior director of ETF and mutual fund research at CFRA, says of the fee gambit. “I give Salt credit for deciding that instead of launching a product that has a different approach and hoping investors fall in love with it, they are putting their money where their mouth is.”

The stunt ran the risk of making Salt appear as if it couldn't give its products away. By December 31, 2019, the Low truBeta US Market ETF had accumulated only $9.3 million in assets through a combination of performance and investor deposits, and the High truBeta US Market ETF had $15.4 million, according to Morningstar.

One explanation could be the lackluster performance expectations associated with low-volatility ETFs.

“Taking less risk than the market, you should not expect higher returns than the market,” says Alex Bryan, a Morningstar analyst who covers ETFs. The Salt Low truBeta US Market ETF was up 13.2% from its March 11 launch to December 30, 2019. However, it trailed the S&P 500's 14.1% rise during that period.

The Salt Low truBeta US Market ETF's largest holding is Eli Lilly and Co. (NYSE: LLY), which comprises 1.11% of the portfolio. Since the fund first bought Eli Lilly on March 13, 2019, the stock was up only 7.56% through January 8, well below the ETF's 13.38% return during that period.

Revealing Only So Much

Another marketing tactic that resulted from the whiteboarding sessions was a white paper that went into the truBeta process in lengthy detail, though without explaining in mathematical terms how Salt calculates volatility levels in intraday trading. “We do not publish the algorithm that we use to calculate truBeta,” says Eskandar.

CLS has its own conclusion as to why. “If they reveal too much, if 100% of the formula is out there, and the fund were sizable enough, a hedge fund could easily figure out what stocks are going into the next rebalance, get ahead of it, and essentially erode away their returns potentially over time,” Engelbart says.

A lack of transparency, necessary though it may be for Salt, may not impress investors.

“When they were in our office, we tried to get as far as we could, but there was just enough that we couldn't quite replicate it ourselves,” recalls Engelbart. “We never saw an algorithm or formula.”

Additional Business Line

Eskandar and Barchetto are hoping to grow the related business of selling risk analytics to financial institutions.

In July 2019, Benzinga, which provides data feeds to traders, announced that it would deliver Salt's truBeta ETF Risk Matrix and truBeta Equities/ETF feeds to hedge funds, financial advisers and other financial institutions.

Leading Salt's selection of “heating up” stocks at the end of December - a list updated on its website - was database software company MongoDB (NASDAQ: MDB), whose share price was up 64.6% from a low closing price of $79.95 January 2, 2019, to a higher closing price of $131.61 on December 31. Salt assigned MongoDB a truBeta score of 2.04, making it the most volatile stock in the U.S. by its measure.

Eskandar points out that “traditional” beta measures not taking intraday pricing into account would show MongoDB moving only 0.77% - and that's if the market moved 1%.

Salt's website also identifies stocks with “decreasing sensitivity” to the market, led on December 31 by Acadia Pharmaceuticals Inc. (ACAD). Its price was up 156.9% for the 12 months through December 31, when it closed at $42.78 and had a truBeta score of 1.0.

Wall Street Credentials

Regardless of the prospects for risk analytics, it is difficult to predict the truBeta ETFs' staying power. There were no expectations that this would be a fly-by-night operation. With a BBA degree in finance and economics from Baruch College, Eskandar has a track record of leading successful businesses on Wall Street. From February 2012 to August 2017, he was CEO of trading technology company Portware, overseeing its acquisition of assets from Aritas Group and transforming the business model with artificial intelligence software. FactSet Research Systems acquired Portware in 2015.

Earlier, Eskandar was global head of corporate strategy at Liquidnet Holdings, a pioneering institutional block trading network.

Barchetto has served in senior positions at Liquidnet as well as Bats Global Markets (now Cboe Global Markets, where Salt's ETFs trade); Lava Trading, which was acquired by Citibank; and market maker Knight Capital Group. He holds a BS in international economics from Georgetown University.

Eskandar believes their backgrounds prepared them for Salt's growing pains.

“If it wasn't for our past experience in dealing with entrenched large interests - oligopoly - I don't think we would have the creativity or the courage to do what we're doing right now,” Salt's COO says. With that, they can continue to attract the attention of institutional investors like CLS.