How effective have Basel III reforms truly been? A December 2022 report by the Basel Committee on Banking Supervision (BCBS) takes a self-congratulatory tone. However, while banks are certainly better capitalized than they were prior to the global financial crisis (thanks at least in part to Basel III), the recent BCBS analysis did not consider forward-looking scenarios. Instead, it primarily focused on historical data from a time period that was largely benign from a macroeconomic perspective.

So, while Basel III deserves kudos, it’s fair to ponder how it will hold up under more volatile conditions, particularly if inflation and interest rates continue to rise and if geopolitical risk, spurred by the Russia-Ukraine war, continues to escalate. We can’t say for sure yet whether these conditions will ultimately lead to a 2023 recession, but, under an extremely adverse scenario, could Basel III requirements actually result in banks contracting their lending?

Marco Folpmers

In fairness, we will likely not have a complete picture of the efficacy of Basel III for at least a couple of years. Remember, the implementation of several aspects of the key reforms first agreed to in 2017 – including revisions to the standardized approaches to credit risk and market risk; changes to the credit valuation adjustment framework and the internal ratings-based approach for credit risk; the adoption of a leverage ratio framework; and the buffer for global systemically important banks (G-SIBs) – only took effect in January 2023. What’s more, Basel III’s revised market risk framework and Pillar 3 disclosure requirements were also set to go live this month.

That said, we can dissect the BCBS’s self-analysis of the success of Basel III to date, the details of which can be seen in its December 2022 report: “Evaluation of the Impact and Efficacy of the Basel III Reforms.”

Before breaking down this report, let’s quickly examine the impetus behind Basel III – and its evolution.

The Winding Road to Reforms

The need for large banks to hold more capital and to become more resilient became evident in the wake of the 2008-09 GFC. Basel III standards were designed shortly after that disaster ended; the initial set of reforms were created in 2010, but it took another seven years for the full package to come to light.

Revised definitions of capital and the calculation of the minimum risk-weighted capital requirements headlined the initial wave of Basel III reforms, which placed an emphasis on Common Equity Tier 1 (CET1) capital. To backstop the new requirements, and to ensure that banks could not take any shortcuts with regard to capital reductions, a non-risk-weighted leverage ratio was also created.

Basel III, moreover, called for changes in risk-weighted assets (RWA) calculation (especially in credit risk and market risk, where computational complexity was enhanced), as well as the creation of an output floor that ensured that banks’ capital did not fall below 72.5% of the amount required by the standardized approach.

Mindful of the liquidity distress banks faced due to withdrawals of savings and other restrictions to short-term funding amid the GFC, two new liquidity ratios were also introduced: the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR).

What’s more, spurred by the collapse of Lehman Brothers (in September 2008) and other large financial institutions, the “too big to fail” doctrine was born, and an additional buffer requirement was created for global systemically important banks (G-SIBs). This was on top of the Basel III countercyclical capital buffer that was intended to ensure the banking sector capital requirements take account of the macroeconomic environment.

Breaking Down the Report: Methodology and Results

When analyzing the December 2022 BCBS report, it’s important to keep in mind that only a handful of reforms were in place during the period that the BCBS analyzed. Specifically, the report took into account revised definitions of capital and minimum risk-based capital requirements; the minimum leverage ratio requirement (which complements the risk-based capital requirements); and the two liquidity requirements: LSR and NFSR.

As part of its analysis, the BCBS sought to establish a statistical relationship between input variables – i.e., the individual measures of the Basel III reforms – and output variables – such as resilience measures, lending growth and cost of capital. Importantly, the report examined not only the impact of Basel III resilience measures (e.g., whether banks have indeed raised their CET1 capital) but also its macroeconomic consequences – e.g., does the increase of capital buffers come at the cost of a reduced level of lending to the real economy?

The statistical analysis was applied to two sets of international banks: (1) larger, internationally active banks with a Tier 1 capital of more than €3 billion (Group 1); and (2) a mix of larger and smaller banks (Group 2).

The results of the December BCBS analysis were, without exception, positive. Let’s look, for example, at capitalization levels. The report states that capitalization at the world’s largest and most systemically important banks drastically improved between 2011 and 2021.

More specifically, during this time period, the weighted average CET1 ratio for the Group 1 banks increased from 7% to 13%, while their leverage ratio improved from 3.5% to 6.5%. What’s more, the BCBS found that these improvements did not lead to higher costs of capital – as measured by the weighted average cost of capital (WACC).

The BCBS also made an effort to quantify the complexity of bank regulation, using three methodologies to measure regulatory complexity of Basel III: analysis based on survey results, linguistic analysis, and the estimated number of steps each calculation takes.

Market and credit risk are the most computationally complex areas of Basel III, per the report, while the new definition of capital, the liquidity ratios and the operational risk calculations are less complex. Overall, the BCBS concludes that the Basel III framework is indeed complex, but elaborates that this heightened degree of difficulty should be seen “in the light of the positive effect of Basel III’s contributions to banks’ resilience.”

The Evaluation Evaluated

The BCBS’s December 2022 analysis concludes that Basel III reforms raised banks’ capital ratios and strengthened resilience – without contracting the credit supply to the real economy. Any additional complexity yielded by the reforms, moreover, is more than compensated for with the additional layers of safety provided by the Basel III, according to the BCBS report.

But this backward-looking analysis fails to examine the full picture. “The evaluation is primarily based on the period up to 2019 in order to assess the impact of the reforms immediately following their introduction. This period was characterized by broadly stable economic conditions accompanied by low interest rates and accommodative monetary policies in most jurisdictions,” the authors of the December 2022 report concede.

It should be noted that this report was actually the BCBS’s third evaluation of the impact of Basel III reforms. In July 2021, the Committee published its preliminary assessment of whether the Basel III reforms had functioned as intended amid the Covid-19 pandemic. Subsequently, in October 2022, the BCBS published an examination of the usability of Basel III capital and liquidity buffers.

In contrast, the December 2022 report focused on the remediation of the capital and liquidity requirements after the GFC. The 2011-2019 time window that the BCBS primarily used for that statistical analysis was characterized by benign macroeconomic circumstances – including extremely low interest rates – in most developed geographies. Although the analysis controls for the GDP growth (i.e., it isolates, as much as possible, the relationship between inputs, the Basel III measures, and the resulting resilience measures), the conclusions only cover the aforementioned benign period.

So, what would happen if economies were to, say, contract in 2023? Under that scenario, could Basel III’s higher capital requirements result in banks downsizing their credit risk exposures, while also leading to a contraction in lending volumes?

When we weigh the impact of Basel III, we shouldn’t necessarily be thinking about the reforms performed during a largely benign period in the aftermath of the GFC. Rather, looking forward, we need to consider whether Basel III is flexible enough to deal with external shocks such as inflation, an energy crisis, supply-chain problems and rising geopolitical risk. Will its macroeconomic “shock-breakers” (such as its countercyclical buffers), for example, work as expected under extremely volatile conditions or are they too small to have a real impact?

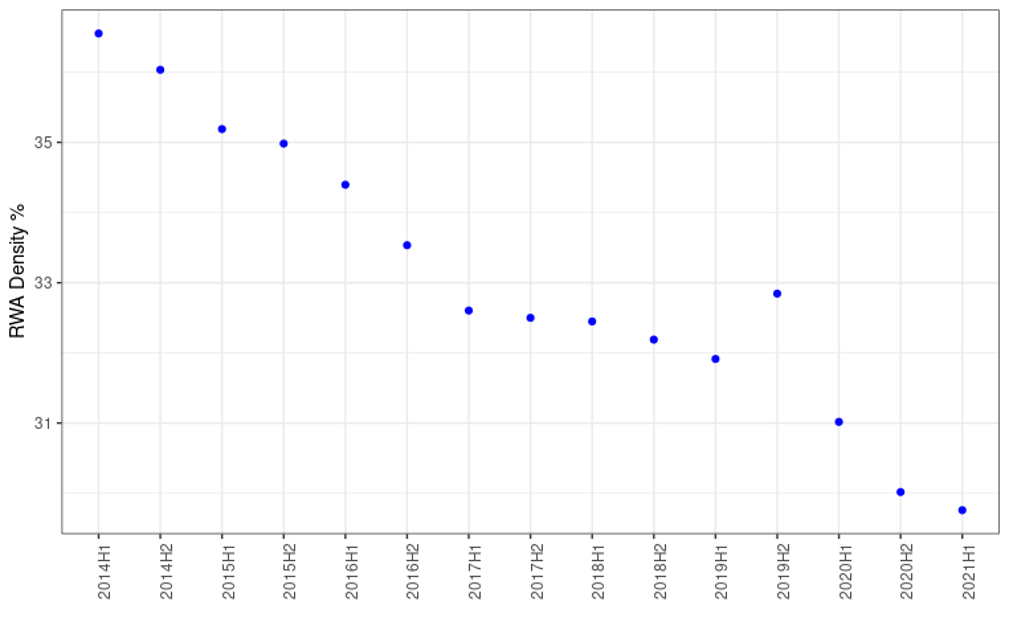

A case in point is the BCBS’s RWA density analysis. In its December 2022 report, the BCBS explains that RWA volumes are primarily driven by credit risk. The Committee illustrates that, for Group 1 banks, aggregated exposure increased, whereas aggregated RWA remained more or less stable from 2014-2021. As a result, the credit risk RWA density (or credit-risk RWA per euro exposure) declined from 36% in H1 2014 to 30% in H1 2021.

Figure 1: RWA Density (Group 1 Banks)

Source: BCBS, December 2022 report

What would happen, however, if the data cited in Figure 1 were reversed – e.g., if aggregated RWA were to increase? Given the previously-cited macroeconomic conditions, one would expect probability of default (PD) and loss given default (LGD) to rise for retail, SME and corporate portfolios. Rampant inflation, for example, will leave less income for servicing a mortgage loan, especially after the interest rate of such a loan has been reset to a higher level.

For this reason, it is not far-fetched to anticipate a tipping point where RWA densities increase in the near future. The question is how banks’ resilience will be impacted by a potential RWA increase, especially with respect to their lending volume to the real economy.

Parting Thoughts

In the executive summary of its December 2022 report, the BCBS states that one of the key objectives of Basel II was “improving the banking sector’s resilience and ability to absorb shocks arising from financial and economic stress.” Since banks are now significantly more well-capitalized, it’s hard to argue that this aim has not been achieved.

However, there remain open questions about the long-term effectiveness of Basel III – particularly since there are important elements that have not yet been fully implemented and because, by the BCBS’s own account, the scope of its December 2022 evaluation of the reforms was limited to a time period (2011-2019) with favorable economic conditions.

While the BCBS’ self-evaluation is generally positive about the impact of the Basel III reforms, some doubts are justified, since the statistical analysis it used is backward looking. What we do not yet understand is how the Basel III reforms will hold up during the new, post COVID-19 macroeconomic reality.

If inflation, interest rates and geopolitical risk continue to rise, will Basel reforms, including its heightened capital requirements, prove problematic? Is there any chance, for example, that large banks will feel squeezed enough to restrict lending?

In its December 2022 Basel III report, the BCBS relied on backward-looking data to considered efficacy of the accord, focusing on past developments and drawing conclusions based on the performance of the reforms amid benign macroeconomic conditions. It would have been much more enlightening if the Committee had supplemented its analysis by weighing the potential effectiveness of Basel III under forward-looking scenarios that reflect current macroeconomic trends.

Dr. Marco Folpmers (FRM) is a partner for Financial Risk Management at Deloitte the Netherlands.

Topics: Regulation & Compliance