Large-scale government interventions like the ones we've experienced recently can provide essential support in an emergency, preventing a recession from developing into a depression. However, they also run the risk of creating perverse incentives or “moral-hazard” problems that can spark subsequent contractions.

Would consumers, businesses and investors behave differently if they didn't have government protections? Certainly, government-support programs (like stimulus checks and the Paycheck Protection Program) will have some unintended results, but what exactly are these undesired consequences and how can financial institutions manage this risk? Before answering these questions, we need to take a closer look at the current landscape.

The Federal Reserve has provided extraordinary amounts of liquidity during the COVID-19 crisis to keep interest rates low and credit flowing throughout the economy. While effective in avoiding a financial collapse, many market participants have now become addicted to low rates. The “Powell put” has caused investors to take on additional uncompensated risks under the assumption that the Fed would never allow the market to crash. Asset values, from housing to stock markets to bitcoin, have shot up as a result.

The difficulty in unwinding this Faustian bargain was demonstrated in the 2013 Taper Tantrum. At the time, a mere mention by Chairman Bernanke that the Federal Reserve was planning to normalize monetary policy - via gradually reducing the pace of Treasury bond purchases - was met by a sharp market sell-off. It was the ultimate Catch-22: the Fed wanted to remove emergency support to return to a more stable equilibrium, but that act alone caused disequilibrium.

Getting Fiscal

Fast forwarding to today, fiscal stimulus is now catching up with the scope and breadth of monetary policy. Here, again, we should be careful what we wish for.

The additional $1.9 trillion stimulus package proposed by the Biden administration would supplement the $900 billion package recently passed by the US Congress, providing much-needed support to unemployed households struggling with food and housing insecurity. Moreover, it would offer aid to small businesses that may be teetering on the edge of bankruptcy, and remove barriers to many workers returning to the workplace, through childcare tax credits and funds to reopen schools safely.

However, while these are the noblest of intentions and provide stability to a fragile system, we cannot ignore the potential for inadvertent consequences. If not structured properly, government support may be misallocated or misspent.

Indeed, the Biden stimulus package could potentially introduce disincentives for some individuals to look for work or to start businesses, prolonging the recovery. Similarly, if introduced abruptly or without consideration of the economic cycle, a higher minimum wage might distort local labor markets and could harm small businesses in certain industries.

Equating this to our everyday lives, a local fire department can often prevent tragedy when accidents happen, but individuals may also take fewer precautions to prevent fires in the first place, knowing that help is just a phone call away.

Managing the Government-Support Dilemma

Given the potential for government interventions to harm, as well as help, what's a risk manager to do? How do we incorporate the benefits of supporting households and small businesses in the short term with the potential drag on longer-term growth and the formation of asset price bubbles?

Empirical evidence from the last two recessions might lead us to conclude that the government will intervene aggressively whenever the economy is under siege. But what happens when the authorities don't or can't help in the future? Should risk managers simply ignore the last two recessions as outlier events? Is it “reasonable and supportable” to do so?

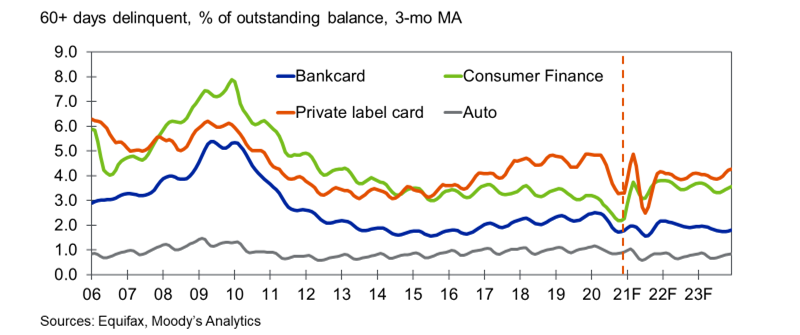

As usual, the answer is neither a firm “yes” or “no,” but a definite “maybe.” For short-term forecasting where stimulus has a high likelihood of adoption, we should incorporate it into our outlook - perhaps with a probability weight or haircut to account for some degree of political or execution risk. For example, as a result of the one-time stimulus checks and extended unemployment insurance benefits passed in December's stimulus (along with expectations of an improving economy and additional stimulus to come), our delinquency and default projections for residential mortgages, auto loans and credit cards for 2021 may be lower than originally anticipated.

Stimulus Benefits for the Credit Card and Auto Industries

Longer term, it would be folly to assume that the government will always respond to a crisis in the same way. One clear consideration is capacity: unless it normalizes or abandons its policy against negative interest rates, the Federal Reserve has no more room to cut rates further.

At some point, global investors won't be willing to finance US government debt at rock-bottom rates. Like a thief in the night, we know not the time nor the hour that investors will retreat - but we do know that credit can't be expanded indefinitely.

Given the current levels of central-bank support and labor-market slack, the likelihood of a run-up in inflation or a market crash may be low in the immediate term. But this is precisely the time when portfolio managers need to be the most vigilant about future risks.

Parting Thoughts: Upside vs. Downside Risks

While risk managers are often portrayed as pessimists obsessed with disaster or doomsday scenarios, history tells us that the seeds of the next recession are actually sown during economic expansion. Consequently, risk professionals must consider the consequences of more positive “what-if” scenarios, as well as negative risks. Upside risks provide a more holistic view of the uncertainty around prognostications, potentially enabling risk managers to identify hidden vulnerabilities more effectively.

Complicating this analysis may be our focus on stress testing. Our management processes and credit models may be so well-trained to deal with risks to the downside that they become overwhelmed or blindsided by good news. Though beneficial in the short run, positive shocks may quickly turn into threats by giving us a false sense of security or invincibility.

If the Federal Reserve assumes a -5% decline in output under a severely adverse stress test, we might carefully consider both the forces that would produce +5% growth and the impact of those forces on our portfolios. When you run through this type of “anti-stress test,” you just might discover the theme for your next scenario design exercise.

The current environment provides a live 'downside vs. upside' case study. There are still plenty of downside risks clouding our economic outlook, from the spread of the COVID-19 pandemic to geopolitical tensions and domestic instability. But vaccines and expanded government support for struggling households and small businesses point to some optimism within the next year, if not immediately.

The best risk managers are like the best farmers: they hope for the best but plan for the worst. They read the signs all around them before they decide what to plant, when to harvest and when to cull a bad crop. Above all else, they consider what could go wrong in the next season, even in a time of abundance.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cristian is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.