[Editor's Note: We would like to welcome Cristian deRitis, the Deputy Chief Economist at Moody's Analytics, as our new Modeling Risk columnist. Cris, who has 20 years of experience as a modeler and a risk manager, will explore what it means to manage risk, with a focus on risk measurement, modeling, stress testing and validation. He welcomes your comments and questions.]

To the extent that risks cannot be eliminated, the practice of risk management involves many activities, from identifying potential threats, to assessing the likelihood and severity of shocks, to the consideration of different methods for risk mitigation. But all of these tasks really boil down to just one thing: storytelling.

Whether fiction or nonfiction, supported by mathematics or statistics, ultimately our profession seeks to paint a picture of potential outcomes so that companies, governments and individuals can make the best decisions possible. Our pictures may be more abstract mosaics than realistic portraits at times, but they all have value.

As risk managers we are challenged to consider the stories that are most useful for exposing the unique threats within our portfolios, and our organizations more broadly. So, while industrial espionage may make for an exciting thriller, the subtle increase in shadow lending over the past decade may be the real risk to mortgage investors.

Stress Scenario Stories

Over the past few weeks, I spent time with the broader economics team at Moody's Analytics developing fully fleshed-out scenarios for the Federal Reserve's Comprehensive Capital Adequacy Review (CCAR) stress testing program. Large banks generate loss forecasts under these scenarios, allowing regulators, investors and bank analysts to assess the strength of bank balance sheets to withstand a variety of economic shocks.

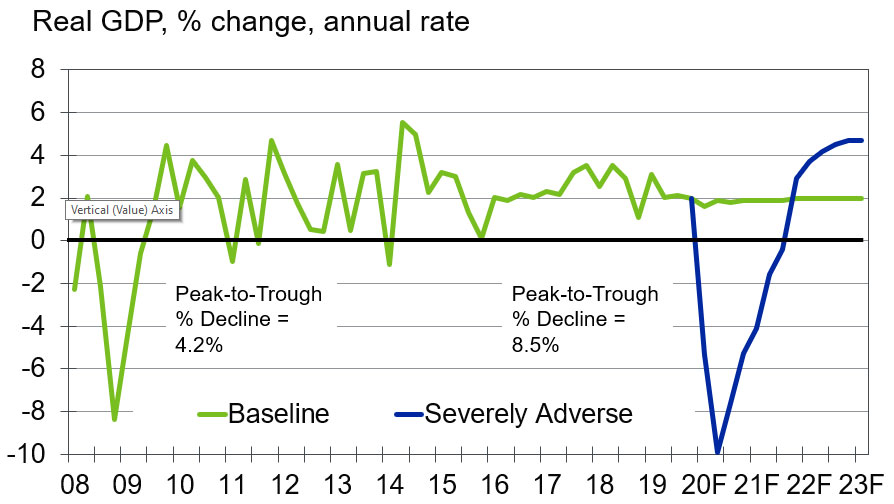

Chart 1: CCAR Is A Tough Test

Now in its 10th year, a common criticism of the CCAR process is that the scenarios are unrealistic. Features of the scenarios are often said to be inconsistent with current market views or generally accepted economic theory.

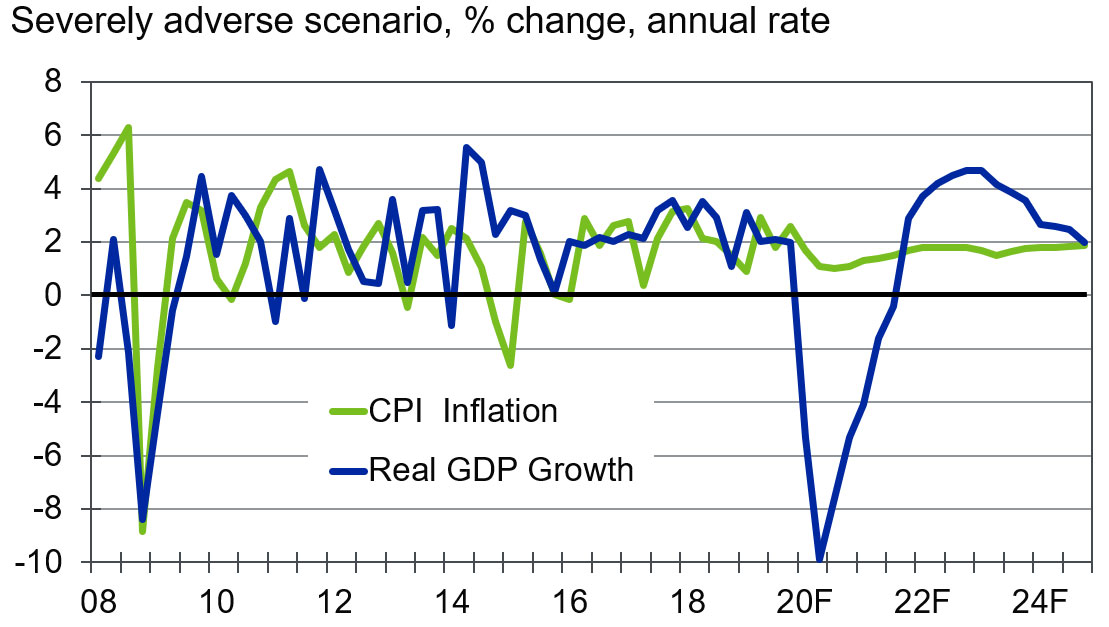

For example, this year's edition of the severely adverse stress scenario included a dramatic decline in GDP - much larger than what was experienced during the Great Recession (see Chart 1, above). Coupled with this was an assumption that inflation would remain above 1% over the nine quarters of the stress test (see Chart 2). If the unemployment rate rises to 10% as described by the Fed's scenario, it's hard to believe that there would be sufficient demand to cause prices to rise. It's certainly counter to our experience during the Great Recession.

Chart 2: Inflation Holds Firm, Despite GDP Collapse

There can't possibly be any value in evaluating losses under the above scenario, right?

This conclusion reminds me of the time my uncle had to perform a stress test on his heart. The doctors asked him to pedal a stationary bike as fast as he could over a range of resistance levels while they monitored his pulse, heart and oxygen levels.

My uncle complied but failed to see the value of this test. He hadn't ridden a bicycle in years, and certainly wasn't planning to ride up the mountains anytime soon! If he was going to have a heart attack, it wouldn't be under these contrived conditions.

But the point of the exercise wasn't to mimic the precise conditions prompting cardiac arrest. Rather, the test was designed to identify points of weakness. Were there arterial blockages limiting blood flow? Was his heart muscle atrophied? The contrived test was designed to distinguish and prioritize risks in a controlled setting.

Similarly, the stories behind bank stress tests are useful for focusing our attention. There are many things that could ultimately go wrong within a financial institution. Scenario analysis helps us to prioritize our anxieties, to worry more effectively. This year the Fed wanted to focus on the risks posed by banks' fast-growing commercial real estate and commercial loan portfolios, so they cooked up scenarios that were particularly harsh on these asset classes.

Accounting for CECL and Tail Risks

We should not underestimate the power of narratives. The stories risk managers tell their bosses, their regulators, their auditors and their customers can have profound influence on the bottom line. This is even more apparent with the adoption of the Current Expected Credit Loss (CECL) accounting standard. CECL effectively requires each firm to describe the credit losses they anticipate realizing in the future. Institutions that tell a reasonable and supportable story will be rewarded. Those that cannot will be punished.

Beyond a deep understanding of financial concepts and the mathematics of risk, managers need to cultivate a broad perspective to identify potential outliers and develop their storytelling skills. While few banks may have considered the recent rise of protectionism, or pandemics, such scenarios have long been contemplated by historians, futurists and science fiction writers.

In the past we lacked the tools to quantify these tail risks much beyond idle speculation, but we are now in an era where we can quickly model the impact of a wide range of scenarios. Whereas it took large institutions months to run the first CCAR stress tests, enhanced data, models and IT systems now permit us to run tests in a matter of days if not hours. With these new tools we have the capacity to add many more volumes to our library of stories.

Inevitably, there will be risks that we haven't considered. But the chances of having a relevant playbook are improving with each new stress scenario we design. The COVID-19 virus is a case in point. Although we may not have considered the impact of this specific type of illness, economists and risk managers were able to quickly look back to SARS and other epidemics to gauge the potential impact on the economy and individual sectors.

As Mark Twain reportedly said, “History doesn't repeat but it often rhymes.” As long as we keep using historical experience and our imaginations to develop new scenarios, we will be well positioned to measure and mitigate future risks. More importantly, our ability to translate the results into compelling, understandable narratives will ensure that the findings lead to action.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, Cris specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, Cris worked for Fannie Mae. In addition to his published research, Cris is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.