Disruptions in the market for U.S. Treasuries, the most liquid of government securities markets and one that plays an indispensable role in the financial system, led the Securities and Exchange Commission in September 2022 to propose a central clearing requirement for many transactions that currently clear bilaterally.

Despite its risk-mitigating intentions, the rule has not been fully embraced. Major, traditional market participants generally prefer to see it rolled out gradually or narrowed in scope. Others endorse the move more wholeheartedly, while innovations in the market may lessen the need for a broad mandate.

According to a December 2022 Federal Reserve Bank of Dallas research report that supported the SEC’s rationale, out of an estimated $600 billion of Treasury cash transactions per day, 68% were not centrally cleared, and 19% only partially. Most triparty repo not centrally cleared would fall under the proposed rule, the report said, as would the nearly two-thirds of repos cleared bilaterally.

“Increasing the scope of transactions that are centrally cleared would enhance the resilience of the Treasury market in several ways,” said authors Matthew McCormick and Sam Schulhofer-Wohl, including more uniform risk management standards, increased netting of intermediaries’ repo positions to reduce balance-sheet overloads, and mitigated settlement risk.

Market-Structure Issues

Without specifically citing the SEC proposal, Federal Reserve Vice Chair Philip Jefferson in an October 19 speech noted that recent discussions on Treasury market microstructure and market design have involved such questions as: “Is the current intermediation capacity of dealers sufficient given the size of the market? Would an increase in the share of transactions that are centrally cleared help that intermediation capacity? Is a decentralized dealer-intermediated market optimal, or could an all-to-all market for Treasury securities be more resilient under stress?”

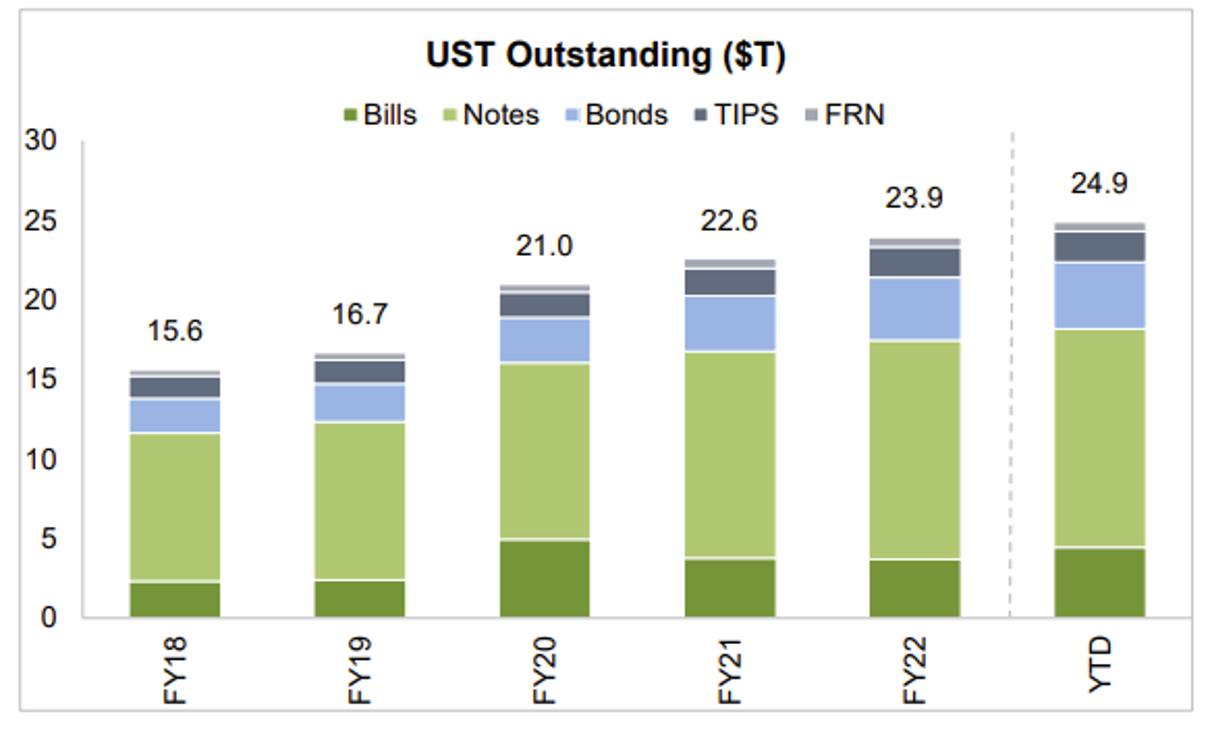

“The U.S. Treasury market clearly remains the largest and deepest government securities market in the world,” Jefferson commented. He then quoted Treasury Under Secretary for Domestic Finance Nellie Liang: “The market has changed significantly over time, with changes in technology, participants, and regulations, and Treasury debt outstanding has grown substantially.”

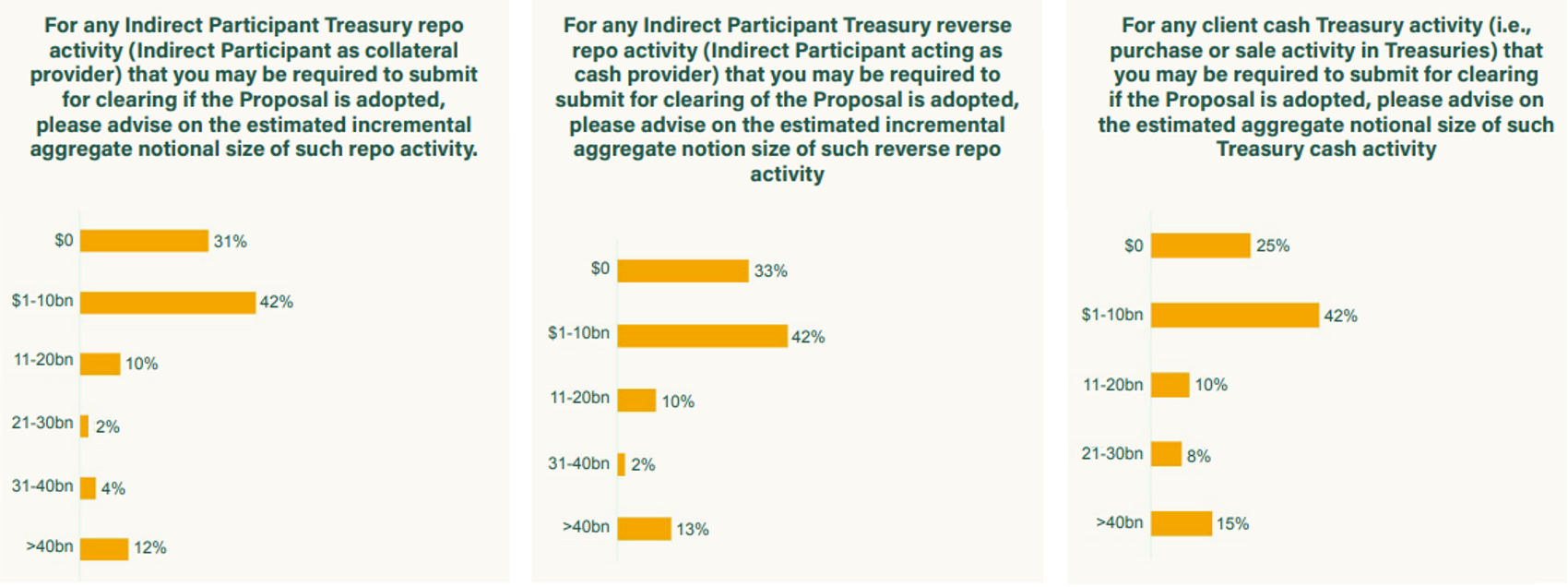

The Depository Trust & Clearing Corp. (DTCC), whose Fixed Income Clearing Corp. (FICC) subsidiary is now the only central clearer for Treasury transactions, in a September 2023 paper on the SEC proposal’s implications projected that approximately $1.63 trillion per day in incremental indirect participant Treasury activity would be cleared. The estimated split: $500 billion of repo, $520 billion of reverse repo and $605 billion of cash trades.

Data from a survey of Fixed Income Cleating Corp. members led to the estimate that an additional $1.63 trillion per day would be centrally cleared under the SEC proposal.

Comment letters submitted to the SEC questioned the market’s ability to handle a big shift and whether the potential benefits warranted the cost. The Investment Company Institute, for example, requested that the SEC exclude from the clearing mandate cash Treasury transactions by non-clearinghouse members, including funds, that are conducted through interdealer brokers and other Treasury trading platforms. It also saw a mandate covering repo and reverse repo “premature” given current market structure.

The Securities Industry and Financial Markets Association maintained that Treasury market disruptions were ultimately liquidity crises that central clearing may not resolve at the time of trade. Like the ICI, SIFMA said central clearing is likely to substantially increase Treasury transaction costs.

ASL Capital Markets, a nonbank Treasury dealer, noted increased costs could prompt smaller participants to leave the Treasury market, reducing liquidity. Like SIFMA and ICI, it recommended the agency take more incremental steps.

The Swap Precedent

Audrey Blater, senior analyst at Coalition Greenwich, said that imposing clearing on Treasury trades somewhat echoes the derivatives clearing mandate in the wake of the Great Financial Crisis. That was intended to increase transparency and reduce costs, largely through SEFs (swap execution facilities).

For a firm trading a lot of Treasuries, “the clearing cost may be bearable and is minimized by the volume transacted,” Blater said. “Firms that don’t clear a lot will still have to deal with clearing fees, and that could be a problem.”

In addition, she said, there is no “off-the-run” swap market like there is for Treasuries, in which sophisticated analytics are required to determine prices of seasoned instruments, further complicating clearing should it ever reach that part of the market.

Darrell Duffie

On a Peterson Institute for International Economics webcast October 12, finance professor Darrell Duffie of the Stanford University Graduate School of Business said that despite the initial pushback and “doom and gloom” about swap clearing, “liquidity has not disappeared, volumes are every bit as high or higher than before, and the bid-offer spread for trading interest rate swaps is now roughly one-tenth what it was before the advent of central clearing. My guess is similar things would happen in the Treasury market,” ultimately resulting in a “public good.”

Duffie considers the SEC’s proposal “excellent,” and although acknowledging the controversy and concerns about costs, he believes “the benefits easily exceed the costs” – “dramatically” in terms of dealers’ risk reduction from netting of settlement exposures, which in turn lowers capital requirements.

“The efficiency gains would be quite significant,” Duffie said. “It is true there would be some costs, but the market would be much safer because the central counterparty is there to make sure that it doesn’t unravel into systemic crisis.”

Sponsored Service Growth

The SEC may ultimately choose to pursue more incremental change, in part because recent developments may persuade market participants to centrally clear voluntarily.

One vehicle is the FICC’s sponsored general collateral (GC) service. Launched in September 2021, it allows sponsoring members to submit to central clearing triparty repo transactions executed on a general collateral basis across U.S. Treasury securities, agency debentures and agency mortgage-backed securities collateral.

Sponsored membership volume has increased over the past year to more than $700 billion daily, from about $300 billion. Laura Klimpel, general manager of FICC, attributed much of that growth to market conditions, but the sponsored GC service has had a significant and greater than expected impact, at “around $130 billion daily,” she said recently.

The GC service is especially popular among long-only asset managers, likely due to operational benefits, Klimpel added.

“We have seen a significant increase in sponsored repo volume,” said Horacio Barakat, head of digital innovation for capital markets at Broadridge Financial Solutions, whose Distributed Ledger Repo platform supports both bilateral and sponsored repo transactions. “It alleviates capital requirements for broker-dealers to execute Treasury repo transactions. They can continue to offer repo to their clients, but in a more balance-sheet-efficient way.”

Enhanced Cross Margining

DTCC and CME Group obtained SEC and Commodity Futures Trading Commission approval in September to cross-margin an expanded suite of products, including CME SOFR futures, Ultra 10-Year U.S. Treasury Note and Bond futures, and FICC-cleared U.S. Treasury notes and bonds. Repos with Treasury collateral and more than one year to maturity will also be eligible.

Laura Klimpel

“The arrangement will enable capital efficiencies for clearing members that trade and clear both U.S. Treasury securities and CME Group Interest Rate futures and is expected to launch in January 2024,” DTCC’s announcement said. Currently, however, the cross margining is limited to the members of FICC and CME, Klimpel said, and the clearinghouses will be proposing to extend cross margining to members’ customers.

The DTCC-FICC survey indicated a need to educate members on the various available models to access central clearing – an effort that might draw more volume even without a mandate.

In an October 17 article, Klimpel said 52% in the survey “were unsure which model to use for Treasury reverse repo and Treasury repo activity, while 58% said they were unsure which to use for indirect participant Treasury cash activity.” FICC will be working to raise awareness of its USTClearing.com information hub and is “committed to working with members, their clients, the broader market and public-sector stakeholders to understand the impact of and to prepare for expanded clearing requirements,” she wrote.

Some market participants not using central clearing today would likely face extra work. “As we read the proposal, it would require levered players to bring Treasury cash and repo activity with FICC/government securities division netting members to central clearing,” Klimpel told Risk Intelligence, while long-only funds need only clear repo transactions.

U.S Treasuries data from SIFMA’s report on fixed income markets, 2Q 2023.

“A Workable Solution”

Interestingly, some high-tech market players clearly favored the SEC’s proposed rule. Intercontinental Exchange, the electronic futures trading and clearing pioneer that acquired the New York Stock Exchange in 2013, expressed support, as long as it expressly acknowledges the potential for multiple central clearing agencies.

“ICE understands the concerns that the SEC has identified about the current operation of the U.S. Treasury market and believes the SEC’s proposal is a workable solution to the problems the SEC has identified,” said ICE’s comment letter.

“If implemented thoughtfully,” said hedge fund Citadel and its market-making business Citadel Securities, “increased central clearing of Treasury cash and repurchase transactions will reduce systemic risk and meaningfully improve counterparty risk management, market liquidity and resiliency. A market-wide clearing requirement can optimize dealer balance sheet utilization, reduce credit and operational risk, enhance competition and foster innovation in trading protocols.”

Any clearing requirement must capture a broad cross-section of the market, Citadel said, to realize benefits associated with central clearing, and that may take time. “Additionally, before a market-side central clearing requirement goes into effect, all market participants must be able to efficiently access central clearing, including indirectly through customer clearing offerings.”

Topics: Counterparty