Concerns are growing among lenders that regulatory initiatives at the National Association of Insurance Commissioners (NAIC) could interfere with financings of riskier companies in the collateralized loan obligation (CLO) market.

Insurers, which are state-regulated under standards set by the NAIC, have long invested in asset-backed securities (ABS) and played a critical role in the CLO segment, where an estimated 65% of leveraged loans are purchased. The more traditional life insurers have invested heavily in CLO bonds rated AA and AAA. Those selling annuities and other products offering higher yields, often owned by or affiliated with private equity firms, have bought riskier mezzanine bonds in the BB to A range, and less frequently the riskiest residual equity.

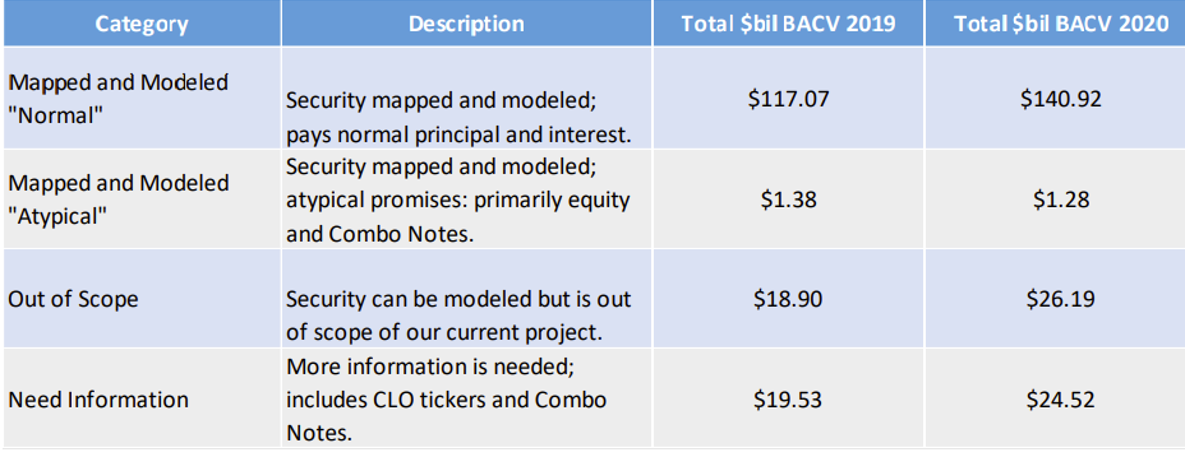

A NAIC stress test report for year-end 2020 unexpectedly indicated losses reaching CLO tranches rated A, and even those as high as AA for transactions with “unusual payment promises.” The report raised eyebrows because tranches carrying such high ratings from the nationally recognized statistical rating organizations (NRSROs) had never experienced losses.

The NAIC downplayed the findings, noting that CLOs remained an “insignificant risk” for insurers. However, it warned that insurers’ exposure to CLOs was increasing rapidly, rising 23% in 2019 alone.

The issue re-emerged last year, when a succession of NAIC task forces considered whether to revise capital requirements for CLO investments. Their decision to do so has caused consternation among CLO market participants as the standard-setter continues to work out the details.

U.S. insurance industry CLO exposure (book/adjusted carrying value), from 2020 stress test report.

Risk-Based Capital Factors

In May 2022, the NAIC Structured Securities Group (SSG), led by Eric Kolchinsky, formerly head of methodology for structured finance valuations at Moody’s Investors Service, told the NAIC’s Valuation of Securities Task Force (VSTF) that investing in a pool of B-rated corporate loans resulted in a risk-based capital (RBC) factor of 9.535%. That compared to 2.917% for investing in a slice of the same loans securitized in a CLO’s six tranches, from AAA down to the equity. The SSG recommended eliminating that “RBC arbitrage” by switching to its own methodology to rate CLO tranches according to a series of calibrated and weighted collateral stress scenarios.

SSG’s recommendation, which the VSTF exposed for comment soon thereafter, set off alarms because market participants feared that the change would lead to RBC increases, reducing returns on those investments. Later, in December, the VSTF proposed amendments to the NAIC Investment Analysis Office’s Purposes and Procedures Manual to make the switch, and in February this year, the task force adopted them.

The NAIC applies its own ratings methodologies to residential and commercial mortgage-backed securities. While it has approved adopting its own methodology for CLO debt tranches, it still must iron out the details on how to apply it before it takes effect next January, for 2024 RBC calculations.

An Interim Approval

Regarding the residual tranche, or equity, the NAIC Capital Adequacy Task Force on June 30 approved increasing on an interim basis, starting in 2024, the RBC factor for residual tranches of all securitizations, including CLOs’, to 45% from the current 30%.

Representatives from the insurance industry, the American Academy of Actuaries, and regulators who sit on the NAIC Risk-based Capital Investment Risk and Evaluation Working Group noted the lack of data to support the increase. The working group said it would recommend changing the RBC factor if warranted by new information.

Insurers are not major investors in CLO residuals, subject to the securitized loans’ first losses, but their reaction to the interim step exemplifies the wrangling that is likely ahead over how the NAIC adapts its rating methodology to CLO debt.

Life Insurers Weigh In

In comment letters filed in May to the NAIC regarding its Risk-Based Capital Investment Risk and Evaluation (RBCIRE) Working Group’s proposed 45% RBC for securitization residuals, insurers offering higher-return products that invest in mezzanine argued against the increase. “Imposing a 45% charge on ABS residuals with no evidence of significant investment or solvency risk runs counter to the integrity of the RBC system and fair competition,” said a comment from Everlake Life Insurance Co., Security Benefit Life Insurance Co. and two others.

Equitable, MetLife, Prudential Financial and three other companies maintained that the interim 45% RBC factor “is consistent with the existing high-beta equity RBC charge” and “should be adopted as exposed.”

As the NAIC tackles in the months ahead how to apply its ratings methodology to CLO debt, insurers investing in CLO mezzanine are expected to ramp up efforts to avert RBC increases that could impact their investment returns and business strategies.

CLO Managers Uneasy

The NAIC’s mandate to protect insurance policyholders underlies its concern that the arbitrage between investing in CLOs or directly in loans indicates insufficient risk-based capital for CLO investments, putting those insurers and their policy holders at risk. Higher RBC charges, however, could prompt those insurers to reduce mezzanine investments, adversely impacting CLO issuance and the “wide-ranging businesses who rely on the $1.40 trillion CLO market that is the funding source for over 60% of leveraged loans,” said a July 15 Structured Finance Association (SFA) letter regarding the VSTF’s issue paper.

SFA president Kristi Leo said in an interview that CLO managers are increasingly uneasy about the potential changes, and her association is working with the NAIC to better understand how the methodology will work with respect to CLOs and to what extent market participants will be able to provide input as the requirements are shaped.

“The biggest concern of the CLO market is transparency of the NAIC’s process to determine how it will apply its models,” said Paul Forrester, partner, Mayer Brown. “RBC is an increasingly important consideration for insurers when making investments.”

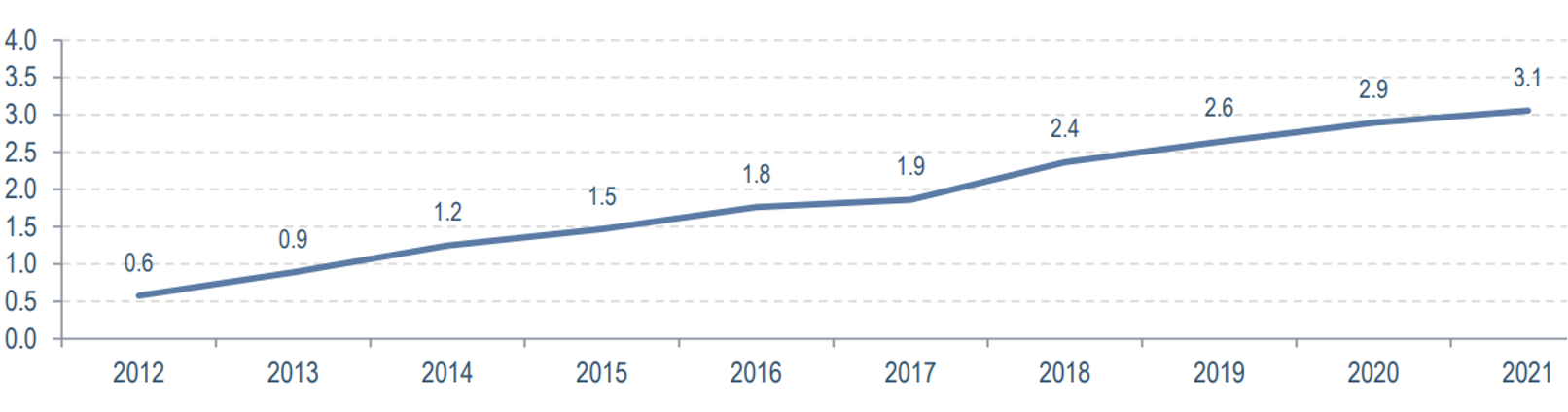

Life insurance CLO holdings (% of general account assets). Source: American Academy of Actuaries, S&P Global and Neuberger Berman data.

Private Equity Opposition

CLO market participants argue that the NAIC has not sufficiently considered the diversity of CLOs’ underlying assets, credit enhancements and risk-mitigation features that justify a lower RBC. The American Investment Council, representing private equity, said in its comment letter that NAIC’s arbitrage-reducing goal will likely result in lower-rated CLO tranches carrying higher capital charges.

“We do not believe that a higher capital charge is an appropriate outcome, nor would it appropriately characterize the actual risk associated with CLOs,” the council said.

The American Academy of Actuaries analyzed the risk CLOs pose to life insurers’ statutory capital and capital-requirement considerations. According to a December 2022 presentation, responding to a request from NAIC’s RBCIRE Working Group, the academy concluded that the RBC charges are “probably” too high for the top-rated tranches and too low for mezzanine, but it opposed eliminating the risk arbitrage altogether.

Edwin Wilches, co-head of securitized products at PGIM, said in an interview that the NAIC’s methodology will probably result in RBC increasing for CLO mezzanine, and by how much may fuel debate extending past the intended 2024 start date. But ultimately, mezzanine makes up a relatively small part of the CLO capital structure, typically around 10%, and the impact of a higher RBC charge can be mitigated in a number of ways, he said.

One way to lessen the hit to mezzanine would be for investors in AA and AAA tranches, which already offer a significant premium over comparably rated bonds in other asset classes, to accept slightly lower returns. Other mitigation options include slightly wider spreads on bank loans, dealers cutting their fees, or a combination of these measures.

Some CLO market disruption is likely as these developments unfold, and issuance may temporarily slow, Wilches said, adding, “It’ll change the market, but it’s not going to stop funding or CLOs from happening.”

Topics: Regulation & Compliance