After a relatively quiet August, September brought forward significant risk management challenges - ranging from the estimation of losses for another quarterly CECL submission to the Federal Reserve's release of an additional set of bank stress testing scenarios. Complicating matters further is the still-elevated level of new COVID-19 cases in many parts of the world and the specter of another wave of infections, as temperatures drop and more individuals congregate inside in the northern hemisphere.

The only constant in 2020 is change. Risk managers (and everyone else) will want to buckle up. The rest of the year will be a bumpy ride.

Episode 3: The Return of CECL

The end of the third quarter will kick off another round of financial reporting for many institutions across the globe. While the international accounting rule governing loss allowance calculations, IFRS 9, went live in 2018, the US version, CECL, has (as of this writing) only been in effect for the first two quarters of 2020.

The surprising arrival of COVID-19 presented unique challenges to CECL filers in March (end of Q1) and June (end of Q2), and one might therefore think that September's loss estimate would be relatively straightforward. But one would be wrong.

End-of-September (Q3) CECL filers not only have to contend with uncertainty around the continued spread and resolution of the coronavirus but also need to incorporate assumptions about the extension of government support for households and businesses - programs (like the Paycheck Protection Program) that expired around the end of July. Moreover, election-year politics will force expected loss estimates to be less mathematical and more subjective - as filers posit the impact of deferred payment policies, foreclosure moratoria and potential changes to the tax code.

The good news is that the economy has performed better than was expected last quarter. While the reopening of the economy may have been premature in terms of containing the spread of COVID-19, it did lead to a sharp rise in spending and employment in the third quarter, with an accommodative monetary policy and government fiscal support equally important to boosting output.

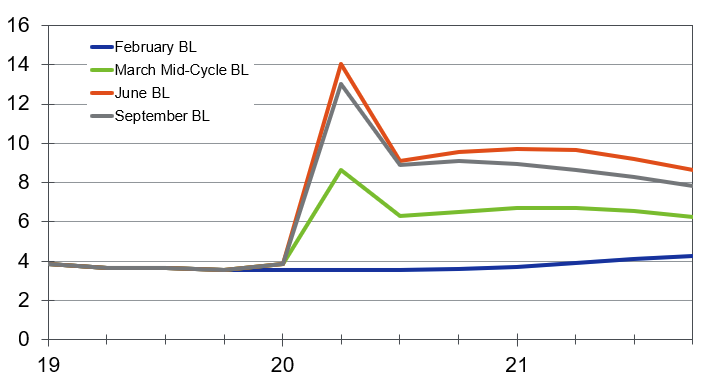

Figure 1: Unemployment Recovers Faster

Unemployment rate, %

While a stronger output forecast would be expected to lower the estimate of period-by-period loan losses, the impact on overall lifetime loss estimates between the June and September forecasts may be relatively small, as lenders have already discounted the effect of the second quarter's abnormally high unemployment rate.

Moreover, stimulus checks, payment forbearance programs and extended unemployment insurance benefits from the CARES Act significantly reduced the likelihood that borrowers would default on their mortgages, credit cards, auto loans or personal loans - at least in the immediate term.

As lenders await additional information, loan loss reserves are expected to remain largely unchanged for the third quarter. Realized charge-offs have been far lower than anticipated, but this effect may be temporary if government support has only delayed - rather than avoided - loan defaults.

Lenders will want to see sustained performance improvement for several quarters before they start to release reserves in significant volume. In theory, this would reduce the availability of credit, but, so far, balances have been growing for mortgages, auto loans and student loans.

Although interest rate spreads have widened, offered rates to borrowers are at or near historic lows. Indeed, most borrowers are still able to obtain credit - if they want it.

CCAR Stress Testing, Part Two

While firms were prepping and weighing the potential impact of Q3 CECL filings, the Federal Reserve on September 17 launched another round of CCAR stress testing for the nation's top 34 banks, with the release of updated scenarios.

Hypothetical economic scenarios for the annual exercise were originally released back in February, prior to the rise in COVID-19 cases and the lockdown measures that sent unemployment rates skyrocketing.

Although these scenarios were severe relative to conditions at the start of the year, they were superseded by April's 14.7% unemployment rate. Given the uncertain environment, the Fed proceeded with the stress test as planned, to provide markets with an assessment of bank capital prior to the crisis.

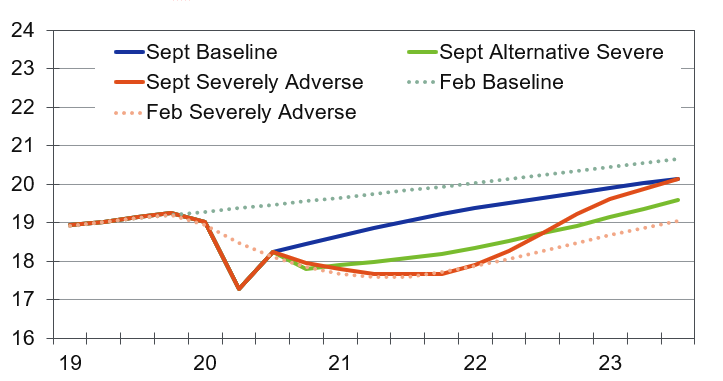

Figure 2: September CCAR More Severe

Real GDP, 2012$ trl

As a supplement to this year's tests, the Fed also ran three updated scenarios (also known as a sensitivity analysis), representing V-, U- and W-shaped recoveries. While all banks had adequate capital under the original stress tests, the results - released in June - showed that several reportedly fell short under these modified scenarios.

Consequently, the Fed recently announced it would require an updated stress test to account for the eroding conditions. The updated test will feature “severely adverse” and “alternative severe” scenarios, and the results will be released at the end of 2020.

Though severe, the updated scenarios are reasonable, given current conditions. Under the new severely adverse scenario, the unemployment rate is assumed to increase, before falling rapidly in 2022; under the alternative severe scenario, unemployment is assumed to remain lower - but elevated - for an extended time. Meanwhile, interest rates are assumed to remain low, but avoid turning negative, under both scenarios.

The precise impact of these scenarios on individual lenders will depend on their unique portfolio composition. However, the overall financial system should have more than enough capital to weather the projected storm. Given all of the other risk factors to worry about, it is encouraging that the likelihood of a banking crisis remains low.

Watch Out

On a lighter note, September also saw the release of Apple's new smartwatch, “Series Six.” The device's added features include an electrocardiogram and pulse oximeter, and are consistent with a rising trend in risk management: continuous monitoring.

Purportedly, the Series Six constantly monitors the health of the wearer to identify the risk of heart attack, stroke, viral infection, and other ailments. The watch may even be able to call for an ambulance, if the wearer has fallen and he or she is nonresponsive.

Portfolio managers are moving in a similar direction, with direct feeds into alternative databases giving them real-time information and updates to the probability of an individual borrower becoming unemployed, overly indebted or otherwise unlikely to pay. If negative outcomes seem likely, early interventions can then be taken to minimize losses.

Accelerated adoption of cloud, AI and other technologies is turning what used to be fantasy into reality.

While the coincidence of CECL 2020/Q3 and CCAR 2020 2.0 are making for a busy month for credit loss modelers, we should recognize that this isn't just a one-time happenstance. Going forward, the need to produce forecasts and stress tests in real time - as conditions change and new threats emerge - will be critical for managing and mitigating risk.

If individual risk modeling teams don't evolve with the times, their competitors will. Luckily, we now have watches to help us manage the anxiety this might cause.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cris is named on two U.S. patents for credit modeling techniques. He can be reached at cristian.deritis@moodys.com.