The larger of two sets of asset managers implementing new initial margin rules by September for uncleared, over-the-counter derivatives faced significant challenges marshaling adequate resources and expertise to make the necessary changes. The more numerous, smaller firms slated to be compliant by September 2022 should move soon to avoid the crunch and, potentially, losing access to hedging instruments.

The initial margin (IM) rule amendments were originally slated to be implemented in five phases over several years, with the first four mostly impacting large dealers. The Commodity Futures Trading Commission estimated the fifth and final phase would affect 670 mostly buy-side firms with 7,500 swap trading relationships, compared to the first four phases impacting fewer than 40 entities. CFTC decided, in a November 2020 final rule, to split that phase into two parts, with typically larger firms in the first phase required to comply in September 2021, and those in the new phase 6 a year later.

The International Swaps and Derivatives Association (ISDA) estimated bigger numbers: 315 entities in phase 5 and 775 in phase 6, and 9,000 separate counterparty relationships.

Ilene Froom, a partner at Reed Smith, called the regulators’ decision to split the final phase “wise,” after she worked on a number of phase 5 negotiations and found “resources were stretched for all the parties.” Those included already compliant dealers helping bring on-board the phase 5 firms, as well as counterparties and custodians.

Competition for Resources

The CFTC concluded the original phase 5 firms, before the split, many with smaller derivative portfolios and less experience pursuing documentation changes, would have to compete for the same, limited number of vendors providing IM services, such as preparing IM-related documents, approving and implementing risk-based IM calculation models, and establishing custodial relationships.

Consequently, some firms may not meet the deadline, the CFTC said in its November rule, and counterparties could thus be “restricted from entering into uncleared swaps and therefore might be unable to use swaps to hedge their financial risk.”

Firms in the first four phases tended to be well acquainted with documentation changes, the related negotiations and the various complications that can arise. For example, credit support annexes and deeds may differ; some parties may use a collateral transfer agreement and security agreement from ISDA and others Euroclear; custodians often use different documentation forms; and parties must negotiate what they’re willing to accept or post as eligible collateral.

“It requires a lot of discussion and resources on the part of all the parties,” Froom said, adding that “within phase 5 we started to see parties who were newer to this documentation negotiation process.”

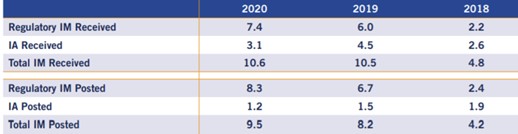

Regulatory initial margin (IM) and independent amount (IA) data for phase 1 firms, table above, and phase 2 and 3 firms, table below, according to an ISDA annual survey.

Early Start Recommended

Ted Leveroni, head of margin services at BNY Mellon, said the buy-side firms had to be educated about areas such the triparty and biparty collateral segregation models and which of the two approaches to choose.

“One of the biggest surprises was that buy-side firms were expected to choose the third-party model, but about half chose triparty,” Leveroni said.

Leveroni advised phase 6 firms, often pension funds managing a sleeve of assets but with less exposure to swap regulation, to start the time-consuming education process as early as possible, as lead time is necessary to make onboarding preparations before actually signing documents and opening accounts to exchange margin.

“A lesson learned is that how early you actually start preparations dramatically impacts how smooth the implementation process is, because you’ll get more of your service providers’ and counterparties’ time,” Leveroni said.

Froom is also advising clients to begin documentation work as soon as possible, given dealers’ and custodians’ limited resources. She noted market participants must calculate the size of their derivative portfolios on the last days of March, April and May, to determine if they are in scope for compliance in September.

Ongoing Calculations

Those still below but approaching the threshold should begin preparations now, Leveroni said, adding that “every year they’re going to have to calculate whether they’ve broached the $8 billion threshold.”

Leveroni said critical operational components for firms to adopt the new rules include a sophisticated collateral management engine, electronic instruction capabilities such as SWIFT messaging, and collateral and regulatory experts on the team.

“If you don't have those three things at your starting point, then your journey is going to be a lot longer and your lift a lot heavier to get to a compliant state,” Leveroni said.

Recognizing the time constraints, the CFTC has allowed firms to delay documentation governing the posting, collection and custody of initial margin until the IM threshold amount exceeds $50 million, as determined by the standard initial margin model (SIMM) for non-cleared derivatives.

Leveroni said firms so far have not pushed the envelope in terms of the delay and have made the necessary preparations well in advance of when they anticipate exceeding the SIMM threshold. They would “need to start exchanging margin right away. And if they’re not set up for that, they run the risk of not being able to trade.”

Calculating average aggregate notional amounts (AANA) “is the first step toward determining if an institution is in scope” for uncleared margin rules, said Simon Millington, head of business development of CloudMargin. The London-based collateral management workflow vendor on November 8 announced an AANA calculation service in collaboration with Margin Tonic. “Many firms don’t realize that they’ll need to maintain these AANA calculations on an ongoing basis, whether or not they fall into scope for phase 6,” he said.

CloudMargin had previously announced that to support clients’ preparedness for phases 5 and 6, it was connected to nearly 60 custodians globally for cash, securities and third-party SWIFT settlement, in addition to its long-established SWIFT connectivity to the major triparty agents.