Explosive growth in buy-now-pay-later programs is disrupting point-of-purchase consumer credit, in the process highlighting the use of alternative data, underwriting and risk management approaches and challenging the existing regulatory framework.

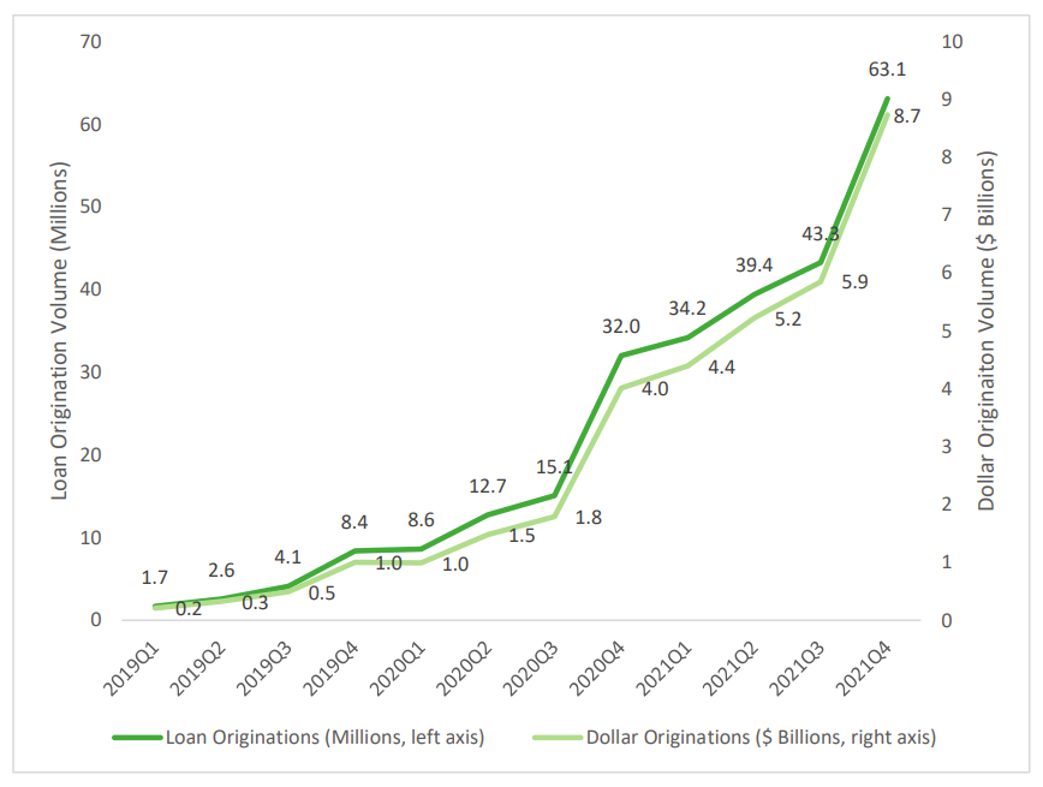

BNPL momentum has been building for a decade, driven by fintech innovators such as Affirm, AfterPay and Klarna. Data from five major BNPL lenders in a Consumer Financial Protection Bureau (CFPB) survey published in September showed that their loan volume from 2019 to 2021 increased by 970%, to $24.2 billion.

The accessibility and simplicity of the short-term, interest-free credits, typically on transactions up to $1,000, have fueled consumer popularity and attracted more than 100 lenders into the business. By using alternative analytics, not depending entirely on traditional credit reporting databases, they are extending credit to borrowers with relatively low credit scores.

“We have worked relentlessly over the last several years to evolve our approach to identifying and underwriting creditworthy applicants left outside the traditional credit reporting infrastructure,” Max Levchin, CEO of Affirm, said in August during a company earnings call.

Quarterly BNPL loan originations through 2021, from the Consumer Financial Protection Bureau’s report.

Behavioral Insight

These lenders tout “secret sauce” artificial intelligence-enhanced algorithms in their credit decision-making. In a June 14 fireside chat, Affirm chief financial officer Michael Linford said one of the “signals” is a transaction’s time of day. “It turns out that people at 2:00 in the morning are higher credit risk than people at 2:00 in the afternoon,” he noted.

Of the BNPL providers that CFPB surveyed – Affirm, AfterPay, Klarna, PayPal and Zip – three use credit bureau profiles and scores, and a fourth does for new customers, while often using alt data and strategies to approve riskier applicants. They raise loan limits as customers reliably pay off their debts.

Alternative factors have made inroads at other nonbanks. Chicago-based fintech Avant takes into account applicants’ employment, use of payday or title loans, and other alternative information that may come from a consumer credit report and often is available from a nationwide credit bureau such as Equifax, Experian or TransUnion.

“For us, it’s very important to go beyond just a score and look at the holistic picture of the financial situation of customers, people we believe have been left behind by the traditional scoring methods,” said Avant chief risk officer Bhanu Arora. Avant customers have an average FICO score of 630 and income of $50,000.

In its real-time approvals, Avant also considers the status of applicants’ bank accounts, and it uses account transaction information to estimate their incomes. “We are exploring other means to use this cash flow data to be able to expand further our customers’ access to credit,” Arora added.

More Sophisticated Scoring

Customer-permissioned cash flow data from transaction accounts is especially promising in terms of determining creditworthiness of a wider swath of consumers. Kelly Cochran, deputy director of innovation research and testing center FinRegLab, said upwards of 20% cannot be scored using traditional credit reporting, but 96% of U.S. households have a bank or prepaid card account, and 91% have at least one utility account.

Kelly Cochran, FinRegLab

In 2016, FICO introduced the FICO Score XD, which analyzes traditional as well as alternative credit data from LexisNexis Risk Solutions, including real estate and public records, and the National Consumer Telecom and Utilities Exchange, an Equifax-managed database. Most users have been unsecured-credit lenders gauging the creditworthiness of applicants who have outdated FICO scores or lack credit histories.

FICO Score XD has so far gauged creditworthiness with the same accuracy as traditional FICO for consumers who otherwise would receive low scores or none at all, according to FICO vice president of product management David Shellenberger.

FICO is now testing UltraFICO, created with Experian and data aggregator Finicity, that provides insight into loan applicants’ cash flow data from financial accounts. To be considered for an UltraFICO score, consumers must permit the lender to access checking, savings and/or money market accounts to obtain account age, transaction frequency and balance level. No specific purchases or vendors, Shellenberger said, since “those types of things dip into privacy issues.”

David Shellenberger, FICO

Among pilot customers maintaining balances of at least $400 over three months without bounced checks, 78% had a credit score increase, and for more than 40% the improvement was 20 points or more. “It’s much more dynamic than the traditional credit bureau data subject to the billing cycle and other delays,” Shellenberger said.

Financial trade associations have petitioned the CFPB to regulate data aggregation servicers so that their practices are aligned with banking rules. Paige Pidano Paridon, senior vice president and senior associate general counsel of the Bank Policy Institute, who supported the industry position in an October 3 letter to CFPB director Rohit Chopra, stated, “Data aggregators offer tremendous benefits by allowing consumers to connect to the apps of their choosing, but they can also be a one-stop-shop for cyber criminals unless they are held to the same data security standards and expectations as banks to protect consumers and their highly sensitive data.”

Analyzing Transaction Data

Reliably paying telecom and utility bills and rent correlates with creditworthiness, and more detailed transaction data can build still richer credit profiles. For example, the Prism Data platform, spun off from the Petal credit card, analyzes information including income-stream consistency, balance trends, and discretionary and nondiscretionary spending.

“Do borrowers have enough money to live comfortably even beyond those monthly bills, and how are they spending and in what categories?” said Erin Allard, general manager of Prism Data. “We’re looking more broadly to paint a more accurate picture” of creditworthiness.

Major banks are testing permissioned transactional data access to approve credit. In July 2020, the Office of the Comptroller of the Currency launched Project REACh – Roundtable for Economic Access and Change – which in part identifies alt-data credit assessment as a way to promote financial inclusion. Ten major banks in May 2021 said they would share customer account information to extend more credit.

Bank of America and Citi have announced programs forgoing traditional credit scores and relying on alt data for mortgages, credit cards and other loans. Citi’s “will use information like an applicant’s income and spending habits to measure creditworthiness,” while Bank of America lists such information as home location, and payment history for rent, utilities and auto insurance.

Karan Kaul of the Urban Institute’s Housing Finance Policy Center

Karan Kaul, principal research associate at the Urban Institute, in a March 2021 article favorable toward alt data, acknowledged that there are questions as to who collects it and how, the laws and regulations governing its use, and the need for data security and privacy protections.

“Our traditional system of credit reporting works well for those with established credit histories, but it unfairly penalizes people who don’t use credit,” Kaul concluded. “Although alternative data will not create equality, it could reduce financial inequities and improve the accuracy of underwriting.”

CFPB director Chopra has indicated that the agency will address issues related to customer permissioning and intends to issue regulations under Section 1033 of the Dodd-Frank Act by next spring.

Default Characteristics

The SEON Technologies fraud prevention platform provides “hundreds of real-time data points” for verifying loan applicants’ veracity and categorizing them for marketing and potentially underwriting purposes. The company says one of its customers using profiling tools determined that 75% of defaulting customers had no social media presence, and other information such as phone brand and where they live can also provide insight.

“We’ve seen our customers use our IP address intelligence, device fingerprinting data, email data enrichment and more, all to see how creditworthy someone is,” a SEON spokesperson said.

The CFPB report notes BNPL lenders’ rising net charge-off rates currently resemble other lenders’. That could change if economic headwinds test the accuracy of alt data in determining creditworthiness. An even bigger risk for those lenders operating on thin margins may emerge if new open banking rules significantly increase compliance costs.

“Buy-now-pay-later is a rapidly growing type of loan that serves as a close substitute for credit cards,” Chopra said in September. “We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a buy-now-pay-later loan.”

Topics: Counterparty