The Basel III Endgame is on in the U.S. The rewriting of risk-based capital standards for the biggest banks, formally proposed by regulators in July, is open for public comment through November, and battle lines are drawn.

Mustering powers of persuasion and lobbying clout, senior bankers and their trade associations are warning that higher capital requirements will constrain lending and economic growth. JPMorgan Chase & Co. CEO Jamie Dimon called the plan “hugely disappointing.” Top-tier institutions will be taking a “punch in the stomach,” said veteran Wells Fargo Securities analyst Mike Mayo. The Bank Policy Institute launched a Stop Basel Endgame campaign and, in a joint protest with the American Bankers Association, U.S. Chamber of Commerce and other groups, alleged that the federal regulators violated the Administrative Procedure Act by publishing the rule – which would begin to be phased in on July 1, 2025 – with insufficient and opaque supporting data.

Beneath that contentious surface, however, banks investing in the safest structured products may find some relief.

At least five types of securitizations rated AAA, including collateralized loan obligations (CLOs), will see their risk weights – defining the capital banks must hold against those assets – drop to a minimum of 15% from the current 20%, according to an August 7 client note from Lea Overby, head of U.S. CMBS Research and ABS Research at Barclays.

Lower risk weights may eventually encourage investments in the top-rated tranches of those securitizations, as less required capital could aid in achieving investment-return targets. Global systemically important banks (G-SIBs), as well as large regional banks, have been major investors in CLOs, especially in the senior AAA tranche that would see a risk-weight drop.

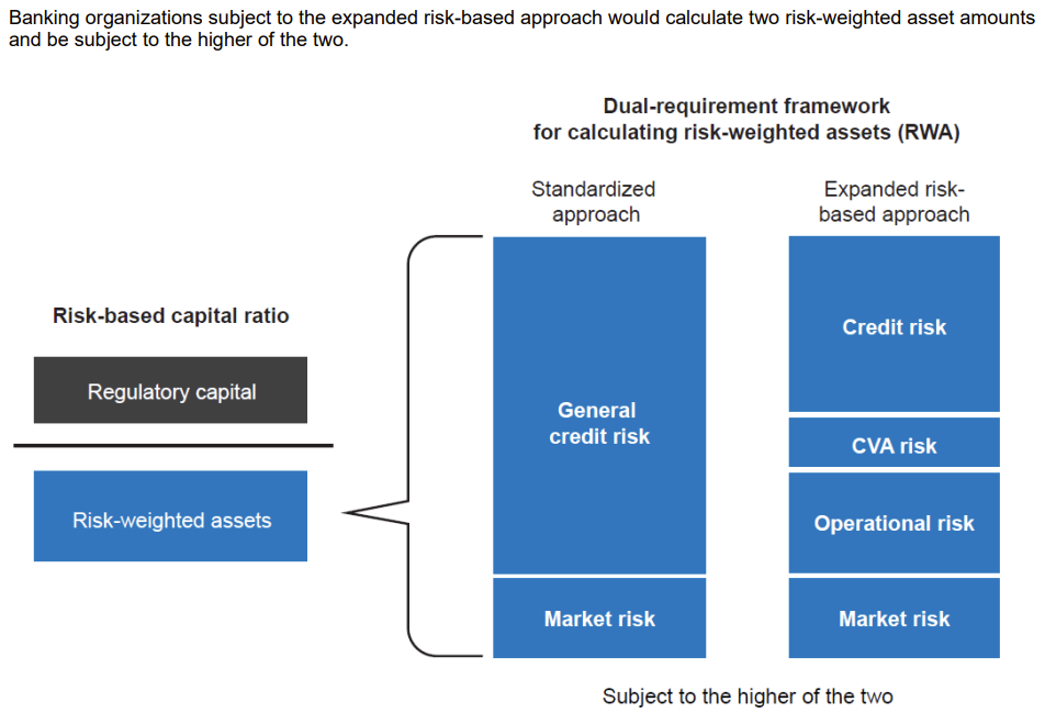

Source: Overview of the Notice of Proposed Rulemaking

Source: Overview of the Notice of Proposed Rulemaking

The P Factor

The proposal could make the riskier “mezzanine” tranches less attractive for impacted banks because it increases the so-called P factor, which raises the risk weight of assets more rapidly as credit quality drops than under current rules.

Banks with less than $100 billion in assets would not be subject to the proposed rule’s P factor, so “it could be more advantageous for them to hold lower tranches in a securitization,” said Matthew Bisanz, a partner in Mayer Brown’s financial services and regulatory enforcement practice.

“You will probably see more interest in holding some of these lower tranches from firms who don’t have regulatory capital requirements, such as private equity funds,” he added.

Matthew Bisanz, Partner, Mayer Brown

The increased P factor lowers the risk weight to the minimum 15% for several types of senior AAA asset securitizations besides CLOs. Barclays provides examples in private student loan asset-backed securities (ABS), non-agency jumbo residential mortgage-backed securities (RMBS) and non-agency non-qualified RMBS.

Conversely, the risk weight would go up significantly on securitizations with less subordination, even if they hold a top rating. According to Barclays, a private student loan ABS, rated AAA but with less subordination supporting it, would see its risk weight increase to 36%, from 20%.

Mortgage Risk Weights

Concerning direct mortgage market impacts, and in turn “macro implications for housing,” Mortgage Bankers Association president and CEO Robert Broeksmit stated in September 14 House Financial Services Committee testimony that proposed higher risk weighting on certain single-family mortgage loans “goes beyond the Basel III Accord” and “could make homeownership less attainable to first-time homebuyers and low- and moderate-income borrowers, many of whom are minority borrowers, with smaller down payments.”

“For reasons not yet fully explained,” he added, “the banking agencies chose to ‘gold plate’ the Basel risk weights for home mortgages by adding 20 percentage points across the board and providing no credit for private mortgage insurance.” Broeksmit said that defeats the purposes of the insurance while raising homeowners’ costs.

“Large banks will face higher capital requirements than those imposed under the current applicable rules for loans with LTVs greater than 80%,” the association head continued. “In addition, the G-SIBs – which had used internal models for their risk weighting – likely will face higher capital requirements across the board for mortgages.”

In a separate regulatory effort focused on CLOs, the National Association of Insurance Commissioners, which sets standards for state-level insurance regulation, is seeking to reduce capital requirements for the top-rated tranches of structured transactions while increasing them for riskier portions. The pending changes have raised concerns among CLO managers because insurers are significant investors in CLOs’ mezzanine tranches, and higher capital requirements could inhibit their participation in deals. (See Insurance Regulation Could Stymie Financing for Risky Companies.)

New Approach for RWA

A potential plus of the banking agencies’ proposal may be to reduce the operational burden of investing in CLOs and other highly rated securitizations. The two main approaches for banks to determine risk weighted assets (RWA) – the supervisory formula approach (SFA) and the simplified supervisory formula approach (SSFA) – would be replaced by the new securitization standardized approach (SEC-SA). Barclays’ Overby noted that the SFA requires more granular information on the underlying securitization collateral that is more burdensome to capture and process, but it can lower RWA compared to the SSFA.

Lea Overby of Barclays

The SEC-SA requirements, however, are similar to those of SSFA, making it easier operationally for banks now lacking the resources to take the SFA approach. It thus may give smaller banks an incentive “to participate more in the non-agency securitized senior notes market,” Overby said.

Meanwhile, dropping the risk weight of AAA CLOs to 15% could incentivize investments in those securities by the largest banks. A Bloomberg Intelligence analysis of Form Y-9C filings showed that banks ramped up CLO investments dramatically in 2021, and to a lesser extent in 2022. In the first half of 2023, however, their holdings stagnated after regulators imposed higher capital buffers on several of the largest banks that purchase the most CLOs.

Dissenting Voices

The U.S. endgame proposal would replace the internal-models approach, which the largest banking institutions use to calculate capital requirements, with standardized requirements applicable to all banks with at least $100 billion in assets. That size range would have included Silicon Valley Bank and other large regionals that failed this year.

Federal Reserve Governor Christopher Waller asserted in a July 27 statement that “increases in capital requirements are not free.” He cited a staff estimate that all large banks would have to boost capital by 16%, “in large part driven by an increase in the capital required for operational and market risks – risks that we have already been capturing in our stress testing for the past decade.”

Waller asked, “What problem is solved from this proposal?” He suggested it could be a well-intended action that nevertheless could end up “undermin[ing] the indispensable role banks play in providing financial intermediation.”

In the same vein, Fed Governor Michelle Bowman noted that U.S. banking is “much better capitalized than after the 2008 financial crisis” and questioned whether the benefits of higher capital requirements on banks above $100 billion in assets justified the costs.

FDIC Director Jonathan McKernan

“Deviations” and “Reservations”

Bowman also raised the issue of “international consistency” because of “the many deviations from internationally agreed standards . . . for large, internationally active banks.”

Federal Deposit Insurance Corp. board member Jonathan McKernan had “serious reservations” about the Basel III standards themselves: “Notably, there is an absence of any stated rationale for some key decisions made by the Basel Committee [on Banking Supervision] . . . Second, while departures from these international standards can be appropriate to serve American interests, this proposal generally deviates from these standards with a singular focus: pushing capital levels yet higher and higher. This reverse engineering of higher capital pays little heed to the associated economic costs and, if finalized, would result in a capital framework unmoored from the principles that have historically rationalized the framework.”

Even Fed Chair Jerome Powell expressed concern about provisions such as eliminating internal models for credit and operational risks, which he described as going beyond the Basel agreement.

PwC partner and global senior regulatory advisor Adam Gilbert pointed to a potential competitive disparity: The EU’s adoption of the simple, transparent and comparable approach to securitizations uses criteria set out in July 2015 by the Basel Committee and the International Organization of Securities Commissions (IOSCO) that would permit a risk-weight floor of 10% for top-rated structured transactions

That lower floor could be an advantage for banks in Europe. Although it is uncertain whether it will be in the final EU rule, Gilbert said, “I would expect U.S. banks to push back in areas where there would appear to be global, competitive issues based on the proposal.”

Topics: Default