GARP MEMBERSHIP

Professional Chapters

With over 30 local Chapters in more than 25 countries, our global risk community helps you develop your career, make valuable new contacts, and stay up to date with today’s most important topics in risk management.

Expand Your Professional Network

Led by practicing risk managers around the world, GARP Chapters are the cornerstone of our commitment to supporting members in their quest for ongoing knowledge, insights, and access to a professional network for sharing current industry practices and making new connections. Members receive priority registration to attend and network at Chapter meetings anywhere for free, including those outside your home region.

Upcoming Meetings

Australia

Sydney Chapter: Financial Consequences of Physical Climate Risks

March 11, 2026 | 5:00 PM

In-Person | Deloitte, Quay Quarter Tower, Level 47, 50 Bridge Street, Sydney, 2000

Attend as a Guest Affiliate

We welcome new faces at our Chapter meetings. If you’re a student, recent graduate, or experienced professional from the wider risk or finance community, you can attend as a guest if seats are available. When you register, you’ll automatically enroll as an Affiliate (USD 0), receive our free weekly risk newsletter, and stay informed of future GARP events and learning opportunities.

Experience Past Chapter Meetings

Missed an event? Watch available recordings at your convenience in our Member Multimedia Library, an on-demand archive of Chapter meetings, webcasts, and presentations on a wide range of financial, climate, and energy risk topics. Plus, experience 30+ hours of insights from the GARP Financial and Climate & Nature Risk Symposiums, all available exclusively for Individual Members.

Volunteer for Your Local Chapter

GARP relies on the dedication and enthusiasm of volunteer Chapter Directors and their fellow committee members to raise awareness and foster a thriving network of risk professionals. Whether by identifying topics, recruiting speakers, or even greeting attendees at the door, we encourage Individual Members to volunteer and contribute to the success of your local Chapter.

Chapter News and Updates

GARP Launches Two New Chapters in 2024!

GARP is thrilled to announce the launch of two new Chapters in 2024. Co-Directors Justin Ong, CFA, FRM and Junaida Ghazie, FRM, are spearheading the creation of a vibrant local community of risk professionals in Malaysia. In Montreal, Facundo Zapata, FRM and SCR holder, David Whittall, are planning an exciting program of educational events that will cover a wide range of pertinent risk management topics.

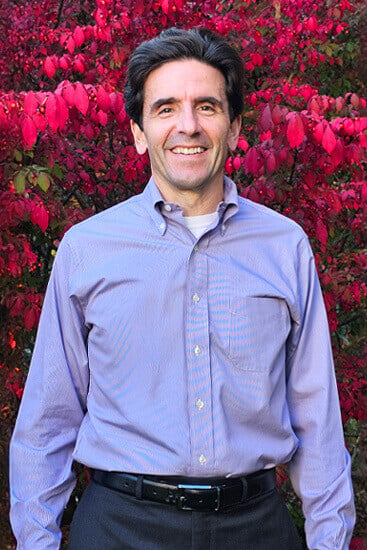

Glenn Barry, FRM, Wellesley, Massachusetts

Managing Director, SLC Management

Being a member of a professional association such as GARP has allowed me to build credibility with others in the industry and has given me access to a wealth of knowledge.

Glenn Barry, FRM, Wellesley, Massachusetts

Managing Director, SLC Management

Become a Member

Access premium content and practice-based resources, priority registration for Chapter meetings, and exclusive opportunities to network with industry peers by becoming an Individual Member today!