Discussions around climate change and climate risk gained significant momentum in the past year, particularly in the lead-up to COP26, the United Nations’ climate change conference in November. As these topics climbed the agendas of top global policymakers and regulators, they have brought to bear specific challenges for financial institutions – challenges that require risk management and finance professionals’ immediate attention.

Carbon Accounting and Carbon-Weighted Assets

Bankers, insurers and asset managers alike are paying closer attention to their operations’ carbon intensity, especially around their firms’ financing and investment activities.

Following COP26, the Glasgow Financial Alliance for Net Zero (GFANZ) now represents more than 450 financial firms across 45 countries with total assets over $130 trillion. These institutions have committed to fully decarbonize their loan and investment portfolios to reach net-zero portfolio carbon emissions by 2050 – with the added goal of achieving significant decreases by 2030.

In some jurisdictions, banks are already required to report these so-called “financed emissions,” or scope 3 emissions, from 2022 onwards. “Carbon-weighted assets” might be a more appropriate term, because that’s what the leading portfolio carbon measurement methodologies, such as the PCAF global carbon accounting standard, are all about.

Similar to Basel risk-weighted assets, the counterparty’s carbon footprint (the equivalent of risk rating under Basel) is used for weighting exposures to derive a single measure that indicates how “carbon intensive” (instead of how risky) the exposure is. This can also be aggregated up to counterparty, segment and portfolio level.

All in all, customer- and institution-level carbon footprint data is gaining significant traction – but such data is often difficult to come by.

Climate and Net-Zero (Big) Data Analytics

In a recent SAS webinar, the chief risk officer of a global systemically important bank (G-SIB) stated that his institution had obtained carbon footprint data for a mere 17% of its corporate customers; it had to use proxies for the rest.

In the quest to better understand their customers’ present and future carbon footprints, firms will need a wider variety of data, much of it unstructured – geo asset distribution, disclosures, physical hazards sensitivities data and more – to assess their customers’ net-zero transition risk.

“Far greater visibility” will be needed to plan decarbonization paths, SAS’s Peter Plochan writes.

Unfortunately, even when data is available, it often comes with comparability and auditability challenges. For example, when institutions calculate their portfolio-financed carbon footprint using the PCAF framework, they must assign each exposure-level carbon calculation into one of the five data quality buckets. Scores are based on the availability and reliability of the respective carbon data used in the calculation, and they are obliged to report their average data quality score per each asset class.

Notably, this method only provides a snapshot of today’s (static) carbon footprint. To plan their portfolio decarbonization paths through 2050, financial institutions must develop far greater visibility. How will their customers’ carbon footprints evolve? And how will various climate scenarios and/or actions by institutions and policymakers impact things along the way?

The Transition Pathway Initiative provides a glimpse into what a central repository of large corporations’ public carbon commitments could look like, inclusive of both current and future transitional carbon footprints (where available). The data collected is publicly available and thus accessible for financial firms’ use.

As another example, we see the industry coming together to share and compare data. Global Credit Data represents 55 global banks that share credit data among themselves. They recently established two workgroups to determine which climate data can be pooled and shared among the banks.

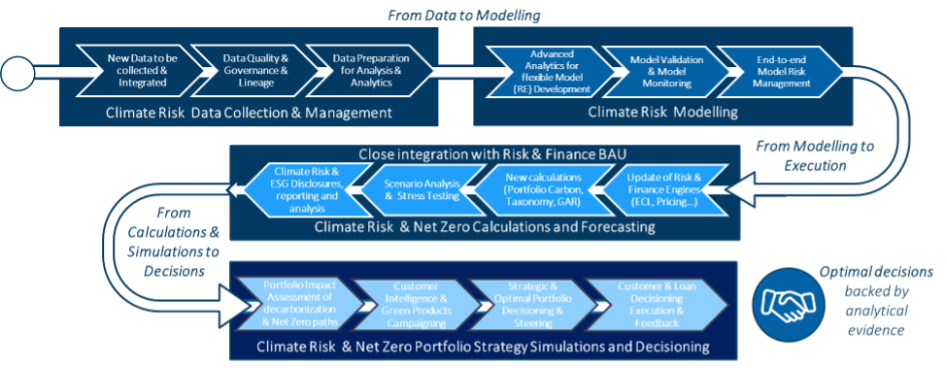

Of course, beyond the data, financial organizations will need to develop more complex risk models based on this new customer data.

Compared to traditional credit risk modeling, climate risk modeling presents greater challenges (as illustrated above) – but some leading financial institutions are already deploying the latest advanced analytics techniques to tackle these.

Forward-Looking Climate Risk and Net-Zero Portfolio Simulations

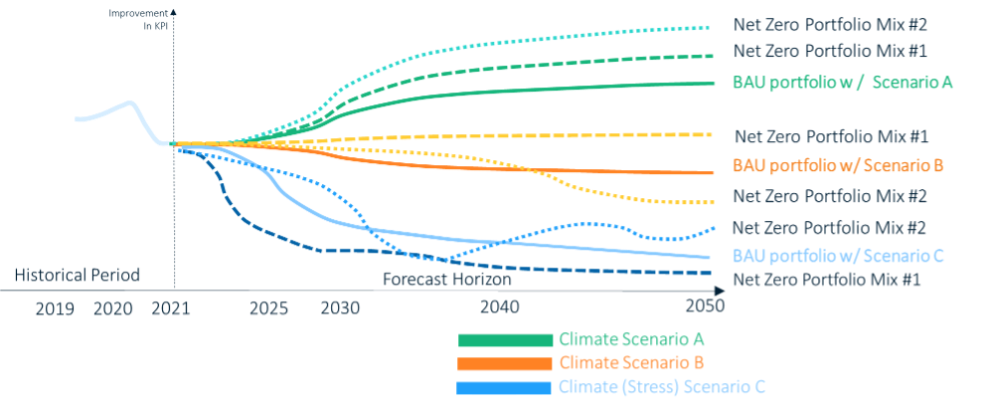

There are many portfolio roads that lead to “Net-Zero Rome,” each with a different risk-and-return profile. The challenge lies in finding the optimal portfolio mix that will lead to portfolio net-zero carbon footprint by 2050 – combined with the lowest risks and highest returns along the way under varying macro and climate scenarios.

To identify this optimal pathway, portfolio managers will need to collect more data and do more forward-looking portfolio analytics. That will require them to get better, and smarter, in simulating the impact of their choices on portfolio key performance indicators (KPIs) and key risk indicators (KRIs), which from now on should include carbon footprint indicators and forecasts.

Compared to today’s status quo, firms will need to run more simulations with multiple alternative asset allocation mixes over longer time horizons, under multiple scenarios and with alternative business and modeling assumptions, like so:

Having done their math, portfolio managers can then make smarter portfolio allocation decisions, backed by analytical evidence, ideally maximizing their returns while meeting their carbon targets and minimizing the risks. This will require institutions to augment their strategic asset allocation processes with more extensive scenario analysis and portfolio optimization techniques. That’s according to the Net Zero Investment Framework developed by leading global asset managers. Supporting this assertion, the 2021 Global ESG Survey found that more than half of surveyed asset managers plan to invest in their data aggregation and analysis capabilities.

Leveraging advanced analytics, scenario analysis and simulation capabilities, financial institutions can more quickly and easily assess the impact of the alternative management actions and portfolio strategies on their KPIs and KRIs at the institution, portfolio, sector and even individual customer level.

Understanding quantitatively the potential future impact of alternatives (e.g., the aforementioned net-zero portfolio decarbonization mixes) is important input for making optimal portfolio- and customer-level decisions.

Moreover, once firms devise the optimal portfolio management strategy, target growth products, and define segments, they can use customer intelligence analytics to market products and services, automate the loan decisioning and approval processes, and improve the execution and success of these new strategies.

Parting Thoughts

According to Standard Chartered’s Zeronomics study, 52% of top corporations believe their net-zero transition will be the most expensive initiative they’ve ever undertaken. Maybe that’s why 61% of institutional investors indicate they won’t invest in companies that lack a clear net-zero transition strategy. These findings signal that such planning is no longer a nice-to-have, but a must-have across industries.

Climate risk and net zero represent additional use cases and the logical extension of existing analytical capabilities already in use by financial institutions around the world. According to the Bank for International Settlements: “A bank’s ability to assess its overall exposure to climate risks across all of its significant operations will be heavily dependent upon the quality of its IT systems and its ability to aggregate and manage large amounts of data.”

The challenges that come with these new developments will put extra pressure on existing processes and infrastructure. Accordingly, institutions with legacy systems and/or fragmented application landscapes will face greater difficulty responding to these challenges in an efficient and effective manner.

The good news? Financial institutions can leverage today’s climate risk and net zero imperatives to modernize and automate their processes and analytic capabilities. As illustrated below, the end-to-end process chain begins with climate data collection and integration, continues through the modeling and analytics, and culminates in optimal portfolio- and customer-level decisions.

Ultimately, institutions that can better analyze the impact of various alternative future scenarios and management actions on their customers and portfolios will be best positioned to make smarter, impact-aware decisions. And, in that, they’ll be better prepared to navigate the inevitable uncertainty ahead.

Peter Plochan is EMEA Principal Risk & Finance Specialist at SAS Institute assisting institutions in addressing their challenges around climate risk, finance and risk regulations, enterprise risk management and risk analytics. He has a finance background (Master’s degree in banking) and is a certified Financial Risk Manager (FRM) with 15 years of experience in risk management in the financial sector. He also delivers risk management trainings globally (PRMIA, Risk.net, Bluecourses) covering climate risk, stress testing, ERM and model risk management.