Banks are facing a November 2022 deadline to be able to receive cross-border payments in a new, data-rich messaging format. It is a step in the global migration to the ISO 20022 standard, which should bring significant benefits in the long term but plenty of operational challenges along the way.

Members of SWIFT, the international banking communications network used for the vast majority of high-value cross-border payments, will be required to accept payments using the MX messaging format. Based on ISO 20022, the highly structured format has numerous fields and enriched data, representing a significant upgrade from the legacy MT format.

SWIFT members, which include some large corporates, must be able to send payments using the standard no later than November 2025

In the meantime, regional payment infrastructures such as the Federal Reserve’s Fedwire Fund Service and the Clearing House Interbank Payments System (CHIPS) will also be adopting ISO 20022. Those U.S. networks scheduled the move for November 2023.

Less Risk, More Automation

The ISO 20022 standard has been under development for more than 20 years, and simpler versions have been adopted across Asia and by Europe’s Single Euro Payments Area (SEPA). The advanced ISO 20022 capabilities will give counterparties more information about each other, reducing financial crime, and payment recipients will better automate reconciliations and allocations.

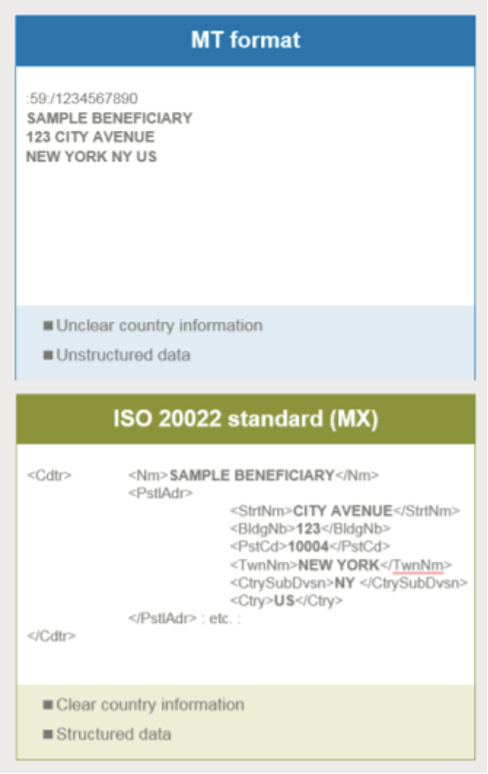

This image from a 2020 SWIFT white paper indicates the enhanced, structured data capacity of the MX format.

Today, a company paying a supplier for 95 out of 100 widgets because five are defective must go through a complicated process of seeking a credit. A SWIFT ISO 20022 message would allow efficient communication of what the buyer is paying for and why.

The parties would have a better understanding of their respective cash positions, and “there will be less manual work,” said Stephen Lindsay, business lead, SWIFT platform.

Wider adoption of the upgraded messaging will bring economies of scale, as users can “use the same applications and analytics, the same processes for compliance, across a range of different payment types,” Lindsay said.

Evolving Business Needs

Despite the new messaging standard’s data capacity and other advantages, there will be risk over time that business needs will outpace the messages’ capabilities, said Simon Hull, head of financial services at technology consultancy BJSS, there’s. In that instance, similar to what has happened with SWIFT’s MT, counterparties may add bespoke features to facilitate particular situations or use cases.

“When that happens, you start to lose the benefits of a standard,” Hull said.

A bigger risk, Hull added, may be to banks that are slow to fully adapt their systems to both receive and send MX messages. SWIFT and other vendors will offer solutions enabling acceptance of limited versions of MX that their payment technology can process, but they will lack the benefits of the data-rich message. U.S. financial institutions could be temporarily out of sync with counterparts in the U.K. and continental Europe, where high-value payment systems are to be fully on ISO 20022 for sending messages in November 2022 and for receiving in April 2023.

While it will still be possible to do business using the limited version, Hull said, “When lots of areas of the market have moved to the fully fledged ISO 20022 standard, those institutions will probably work with other banks that have also moved forward with the standard to get the full benefits of the richer dataset,” Hull said.

Service Challenges

Banks that are slow to adopt SWIFT’s messaging enhancement could see corporate customers taking their business elsewhere. Mohan Murali, CEO of Axletree Solutions, a SWIFT service bureau, said that is what happened in the early 2000s when corporates were first allowed to communicate with their banks over SWIFT using the MT format.

“This was not just a payment processing event,” he said, and, similar to the migration to MX, it was more about streamlining connectivity between their financial institutions to speed up payments and benefit their businesses.

Mohan Murali, Axletree Solutions

He added that the migration to ISO 20022 should prompt banks to explore and address what will likely be its broad impact across the organization, since it can strengthen a bank’s servicing and processing on behalf of clients.

“There’s a need to educate across a wider spectrum of stakeholders within the bank than may seem necessary, including project management and marketing, as well as technology, infrastructure and risk management,” he said. “The C-suite must also be educated on the big picture for why ISO 20022 is critical to the organization.”

Data Mapping and Translation

Any such financial industry transition introduces risk. Hull said older legacy systems may not be well understood or easily converted by current IT staffs. The decades-old MT format has become ingrained within banks, touching not only payment systems but also ledgers, accounting and billing, as well as sanctions and anti-money laundering (AML) compliance.

Banks will have to map the data from existing systems and sources of payment and transaction data to the MX standard, Hull said. “And this means not just identifying where the pieces of data come from, but identifying all of the data translation that needs to happen to correspond to the specifications of ISO 20022, and testing it with counterparties and market infrastructure.”

Any 11th-hour programming scrambles, or stop-gap rather than permanent solutions, can cause data management problems that will have to be untangled later, Hull said, noting that banks have taken years to overcome shoddy implementation of MiFID II (Markets in Financial Instruments Directive) reporting requirements.

Service Bureau Role

To access the SWIFT network, many banks rely on service bureaus such as Axletree and other vendors, which will translate between MX and MT messages and otherwise facilitate the changeover. However, the banks still bear responsibility to monitor vendors’ progress along with their own readiness.

There are also compliance considerations. Care has to be taken that sanctions and AML components, for example, are not lost as full-fledged MX messages are translated to be digested by legacy payment systems.

Longer term, if most or all payment systems adopt the updated version of ISO 20022, both banks and their corporate clients could gain significant efficiency, speed and accuracy through automation, along with improved data and analytics for product and service development.

However, during the transitional phases, banks will have to support a mix of messaging formats as different payment systems adopt the standard.

Payment and messaging interfaces “will need to be quite robust and able to handle different types of messages that essentially are representing the same thing,” Hull said. “From the implementation point of view, I see that as one of the biggest areas of risk.”