ESG, which stands for Environmental, Social and Governance, covers a broad range of non-financial issues that are increasingly regarded as sources of both financial risk and opportunity. However, establishing robust and relevant metrics is fraught with difficulty, and a focus on ESG principles has recently attracted controversy.

The Origins and Growth of ESG

The original use of the term ESG dates back to 2004, when the then United Nations Secretary General Kofi Annan invited 55 chief executive officers of major financial institutions to participate in an international project to integrate ESG into capital markets. That group produced a study in 2005 titled Who Cares Wins, which set out the business case for embedding ESG factors into investment decisions to improve the sustainability of markets and lead to better outcomes for society.

This report described issues that might have a material impact on investment values, including over a longer-term time horizon (10 years and beyond) and intangible aspects impacting company value. There were four overall goals of the recommendations in the report:

- To create stronger and more resilient financial markets;

- To contribute to sustainable development;

- To raise awareness and mutual understanding of involved stakeholders (which basically covered the entire economy as Figure 1 shows); and

- To improve trust in financial institutions.

Figure 1. ‘Who Cares Wins’ Recommendations on ESG

Source: Who Cares Wins - Connecting Finance to a Changing World, The U.N. Global Compact (2004)

ESG’s roots are therefore in the financial world, based on the belief that companies performing better on these issues can increase shareholder value by more than those which disregard them. That might be, for example, through avoiding the reputational or litigational risks associated with envionmental disasters or poor governance. (The report was, after all, written in the wake of the Enron accounting scandal).

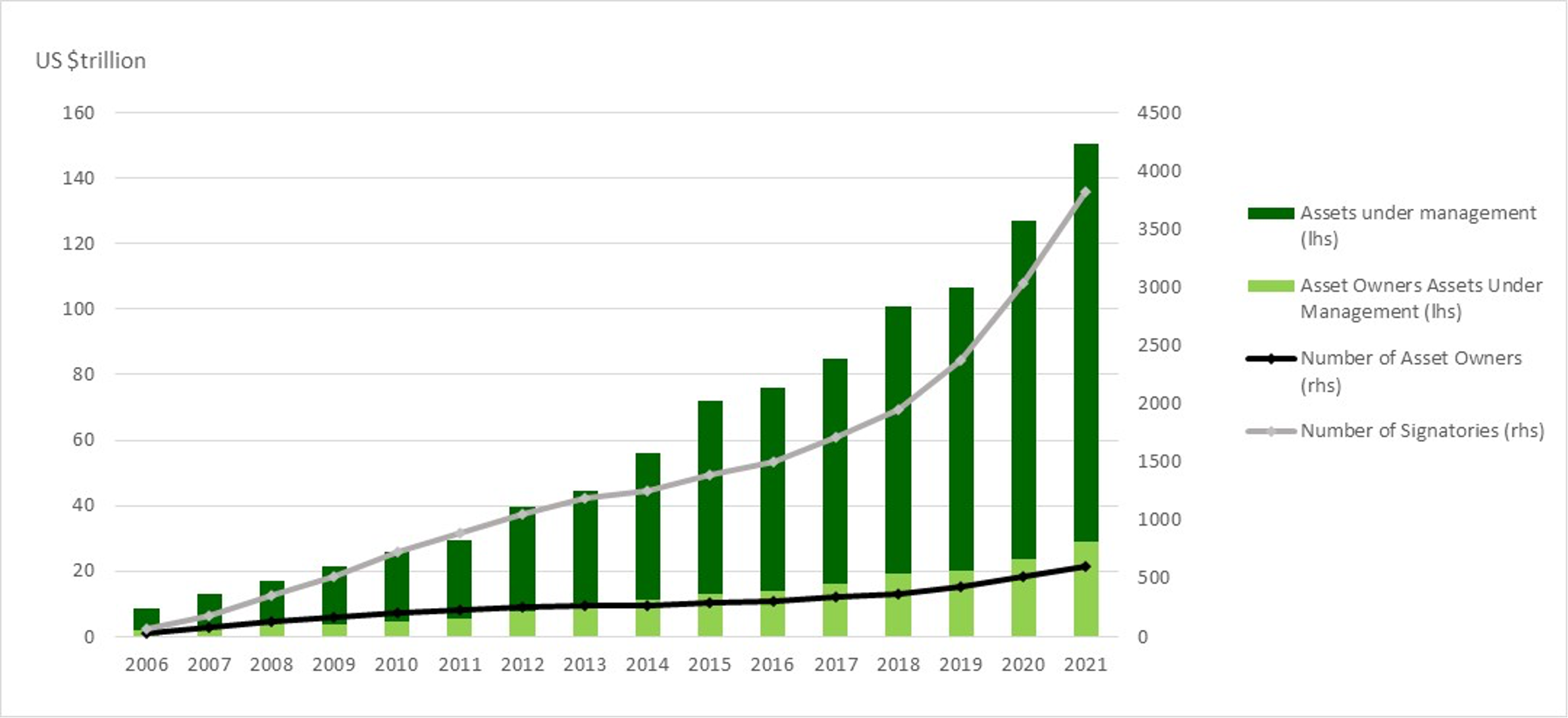

Since those early days, ESG investing has grown significantly. One indicator is the growth in the number of signatories and assets covered by the Principles for Responsible Investment Initiative (PRI) (Figure 2). Launched in 2006, signatories commit to incorporate ESG considerations into their businesses and investment processes.

Figure 2. PRI Growth 2006 – 2021

Source: About the PRI

ESG issues are not just pertinent to asset management and asset owners. Initiatives similar to the PRI were launched more recently for insurance and banking. The spirit of all these initiatives is that ESG issues need to be considered as potential sources of risk. Indeed, today’s 24-hour news cycles and social media make the reputational impacts of ESG transgressions particularly difficult to manage.

What Counts as ESG?

- The Environmental pillar refers to issues related to the natural world, and includes aspects such as greenhouse gas (GHG) and non GHG emissions; renewable/non renewable energy generation and usage; biodiversity; land use; material resource use; water management and waste.

- The Social pillar refers to issues related to the lives of humans, such as human rights, modern slavery, child labour, working conditions and employee relations.

- The Governance pillar captures the decision-making factors affecting a business, such as the gender and ethnic diversity of board composition, executive pay, bribery and corruption policies, political lobbying and donations and tax strategy/transparency.

Some risks will span multiple categories. Take the risks and opportunities from a changing climate. Most obviously these fall in the environment pillar, although they may also touch on social concerns (e.g. support for a ‘just’ transition to a low carbon economy) as well as matters of governance (e.g. how well executive incentives align to climate outcomes).

But the ESG landscape is confusing. First, ESG can lack clarity; sometimes, it is seen as purely about risk management, but at other times it seems to stray more into the realm of having impact. Second, it is difficult to measure E, S and G, and the scoring landscape is fragmented and inconsistent. We turn to these two issues now.

Risk Management or Impact?

The first area of confusion is about whether investing that takes account of ESG factors is solely about risk management or whether it’s about something more, such as impact. In a recent episode of the GARP Climate Risk Podcast, we spoke about this with Professor Bruce Usher (who was part of the original working group for the ‘Who Cares Wins’ report). Although our conversation was focused on climate change, his insights are relevant to broader ESG investing. Professor Usher set out a helpful taxonomy comprising five investment strategies that investors can adopt, namely:

- Risk Management: Where the focus is to consider the risks affecting an investment. In the contact of climate change, this would be physical and transition risks.

- Divestment: Where investors actively sell investments (e.g., in heavily-polluting companies or companies not meeting certain social standards).

- ESG Investing: Where material ESG factors are factored into investment processes because they are expected to affect the value of those investments.

- Thematic Impact Investing: Where a specific theme is chosen as the basis for investment (e.g., by gaining expertise and having a focused investment portfolio, such as on solar farms).

- Impact First Investing: Where investors are focused primarily on having impact (e.g., on reducing greenhouse gas emissions) and are willing to accept a below-market return on these investments.

ESG investing in this taxonomy is not about creating impact, although it may well be taking a longer-term perspective about risk management than some investors take. Clearly there is room for disagreement. That said, whatever you think about this particular way of framing ESG investing, one thing is absolutely certain: there needs to be greater clarity and transparency in the market when ESG claims are made.

Part of the confusion stems from an area of long-standing debate, particularly for asset managers, which is the extent to which taking account of ESG issues is compatible with their ‘fiduciary duty.’ This is the duty to work in the best interests of one’s clients. If fiduciary duty is interpreted as the maximization of shareholder value, it provides a reason to ignore broader environmental or social impacts, which might be costly to improve or rectify. So, it clearly matters over what time horizon the investment is being judged; a very short time horizon for judging performance may favor investments in firms that score less well on ESG concerns and have not had to incur the costs associated with addressing these issues.

A report sponsored by the United Nations Environment Programme Finance Initiative (UNEP FI) in 2005 made it clear that there were no legal barriers in taking ESG considerations into account. Indeed, as they noted “…there is a body of credible evidence demonstrating that such considerations often have a role to play in the proper analysis of investment value.” While that report was helpful, it didn’t manage to end the debate and over the years this has been a constant refrain. Extensive work by the PRI and UNEP FI on this issue culminated in a 2015 report which stated that “Failing to consider long-term investment value drivers, which include environmental, social and governance issues, in investment practice is a failure of fiduciary duty.”

ESG Measurement and Fragmentation

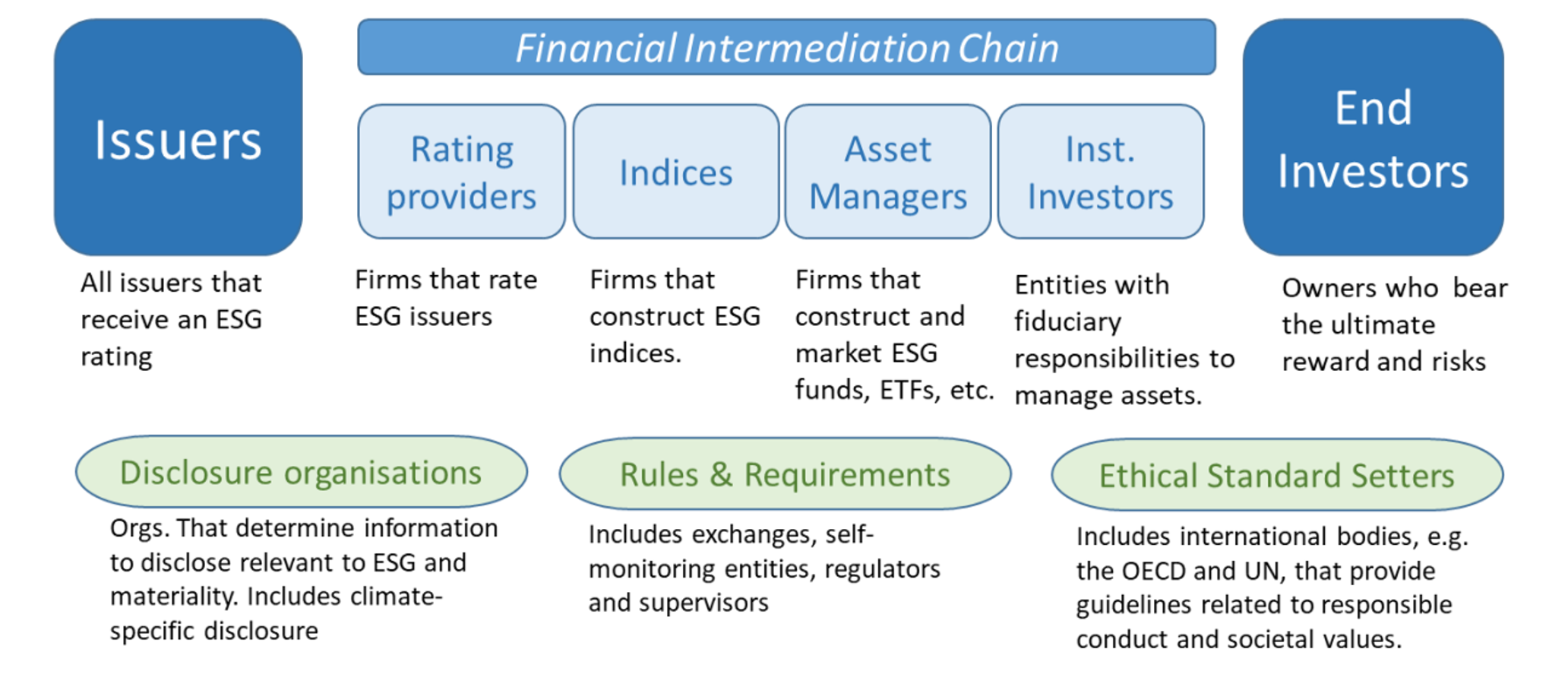

The second area of confusion relates to measurement. Judging which ESG issues are financially relevant and material for a particular firm can be difficult. Because ESG data and metrics have not traditionally been part of the mandatory financial reporting frameworks, a plethora of different approaches have grown up, making it challenging to compare across firms. And although there are efforts to introduce a globally more consistent approach to sustainability reporting, the landscape at the moment is confusing and fragmented. Indeed, as a 2020 OECD report titled ESG Investing: Practices, Progress and Challenges noted, there is now an entire ESG financial ecosystem, from issuers to end investors, ratings providers, firms that construct ESG indices, standard setters and disclosure organisations, and they could all be using different definitions and metrics (Figure 3).

Figure 3. ESG Financial Ecosystem

Source: ESG Investing: Practices, Progress and Challenges, OECD (2020)

Work is underway to establish more standardized sustainability disclosures, with the establishment of the International Sustainability Standards Board (ISSB). And the OECD has published recommendations on policies needed to strengthen ESG investing and finance, including measures to promote greater transparency in ESG ratings.

But all this will take time. In the meanwhile, care is needed. Self-reported ESG metrics by firms tend to put a gloss on issues of interest from a risk perspective. ESG ‘scores’ of companies from different providers are not well-correlated, reflecting differences in proprietary methodologies, weighting schemes and materiality assessments. Indeed, it is questionable if it even makes sense to weight together the differing aspects of the three E, S and G pillars to get to an aggregate score (as discussed on one of our early Climate Risk Podcasts).

But even if you restrict yourself to just looking at the Environmental pillar, a recent OECD report highlights how little alignment there is between E scores from key rating providers. As they put it, “high E pillar scores are not correlated with factors such as reduced greenhouse gas emissions and emission intensity over time or increased use of and investment in renewable energy. In turn, this makes the E pillar not a useful tool to assess or indicate a company’s current level of short-term reduction in greenhouse gas emissions and emission intensity or investment in environmental R&D and renewable energy, which could limit market participants’ use of it.” This is definitely food for thought for anyone wanting to use ESG scores as a shortcut to investing in climate friendly investments.

Jo Paisley, President of the GARP Risk Institute, has worked on a variety of risk areas at GARP Risk Institute, including stress testing, operational resilience, model risk management and climate risk. Her career prior to joining GARP spanned public and private sectors, including working as the Director of the Supervisory Risk Specialist Division within the Prudential Regulation Authority and as Global Head of Stress Testing at HSBC.

Topics: Green Finance & Sustainable Business, Climate Risk Management