Whether we're talking about the U.S.-China trade war or Brexit or climate change or the COVID-19 pandemic, the events of 2020 have highlighted that it's impossible to separate geopolitical and political risks from other hazards in a typical enterprise risk management (ERM) framework. But how, exactly, are these risks connected with other types of exposure - including people risk - and what steps can a firm take to take advantage of geopolitical opportunities?

Before we delve further into these issues, it's important to explain what we're discussing. The Federal Reserve defines geopolitical risk as “the risk associated with wars, terrorist acts, and tensions between states that affect the normal and peaceful course of international relations.” Political risk, on the other hand, can be viewed as “a political event that alters the expected value of a business investment or economic outcome.”

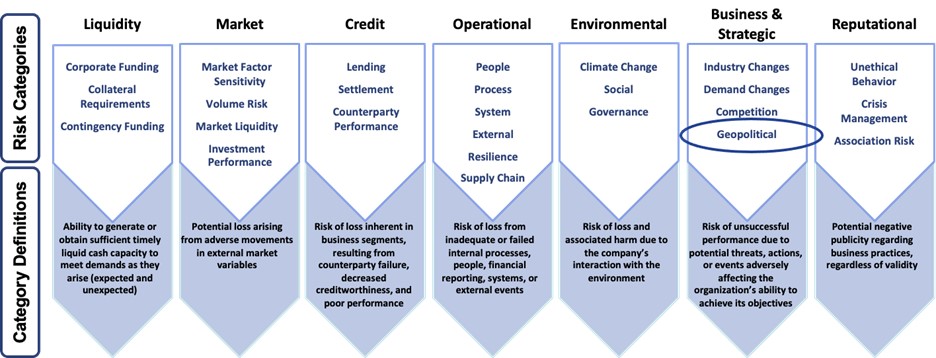

These is certainly some overlap between these risk types, and in some circles they are considered interchangeable. While geopolitical risk occupies its own risk category, it can also be a significant factor in other risk categories. People and environmental risks are good examples (see Figure 1).

Figure 1: ERM Risk Categories

The Geopolitical-People Risk Connection

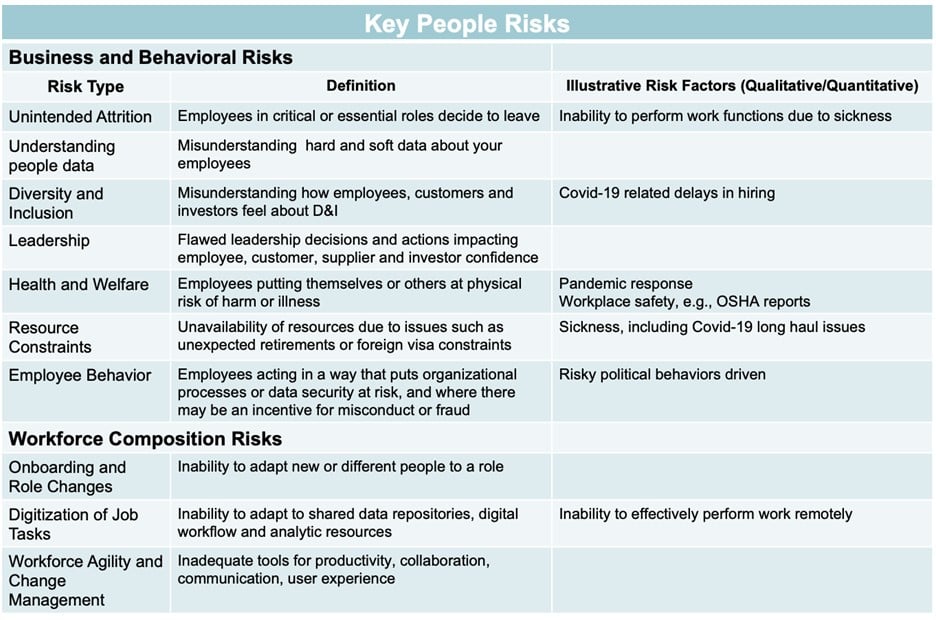

As we have learned since the start of the pandemic, geopolitical risks (like COVID-19) heavily influence key people-risk drivers. It's important to understand this link, because a comprehensive risk assessment must consider critical people risks. Based on the COVID-19-influenced risk factors listed below, people-risk levels may be increasing because of unintended attrition and lower-than-planned diversity and inclusion.

Figure 2: People Risks - Risk Factors Should Reflect Recent Geopolitical Events

Opportunity Knocks

When assessing geopolitical events - like COVID-19, climate change and social unrest - it's important to keep in mind that they present opportunities, as well as risks. Indeed, Amazon, Salesforce, Google and Pfizer, among others, have successfully responded to the COVID-19 challenges to create stronger companies.

Of course, this is not just about the present but also the future. Down the line, environmental risk mitigation, for example, will require significant investments by households, companies and countries. If properly coordinated, moreover, country-level environmental risk mitigants will have a significant impact - sooner rather than later.

In pursuit of geopolitical/environmental opportunities, businesses that want to lighten their carbon footprint can take a number of steps. For example, greenhouse gas emissions can be reduced by phasing out fossil fuels, increasing energy efficiency, adopting renewable energy sources and improving land use and agricultural practices.

PPP: Advancing the Cause

When attempting to manage geopolitical risk, going it alone is not the best approach. Rather, it makes more sense to join a consortium or support a government initiative in a public private partnership (PPP).

Public investment multipliers are higher and tend to stimulate private investments in firms with less leverage. Through investments in human health, climate change, education and digitization, PPPs can push the needle forward in areas like inequality, resiliency and greenhouse gases.

Parting Thoughts

To mitigate today's most pressing geopolitical risks, financial institutions must properly train their employees about these threats and take actions to manage climate-change risk and COVID-19 hazards more effectively.

One strategy for achieving this is to re-evaluate your organization's ERM categories - particularly with respect to the most significant geopolitical factors that drive each risk type. When geopolitical risks are high, joining a PPP and supporting your country's multilateral engagement will accelerate progress and, ultimately, reduce your organization's overall risk.

Brenda Boultwood is an independent risk management consultant and company advisor. She is the former senior vice president and chief risk officer at Constellation Energy, and has served as a board member at both the Committee of Chief Risk Officers (CCRO) and GARP. Previously, she was a senior vice president of industry solutions at MetricStream, where she was responsible for a portfolio of key industry verticals, including energy and utilities, federal agencies, strategic banking and financial services. Before that, she worked in a number of risk management, business roles and as the global head of strategy, Alternative Investment Services, at JPMorgan Chase, where she developed the strategy for the company's hedge fund services, private equity fund services, leveraged loan services and global derivative services. She currently serves on the board of directors at the Anne Arundel Workforce Development Corporation.