Post mortems on the COVID-19 crisis, from a financial market perspective, home in on emergency interventions by the Federal Reserve and ensuing dysfunctions in U.S. Treasuries. There is no disputing that “the market for U.S. Treasury securities is the largest, most liquid, and most important financial market in the world,” as one report puts it, but the volatility and related funding concerns sparked calls for corrective actions.

One lesson learned, Fed vice chair for supervision Randal Quarles reflected in an October speech, was “that the Treasury market is not immune to the problems of short-term and dollar funding markets.”

What happened in March 2020 was “another in a series of episodes of abrupt market adjustments and disrupted trading, highlighting the decline in recent years of the resiliency of the Treasury market,” says the Task Force on Financial Stability, an effort supported by the Brookings Institution's Hutchins Center and the University of Chicago's Booth School of Business.

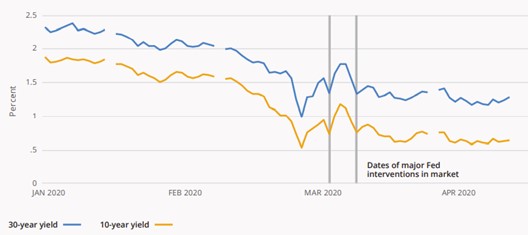

“Stock prices fell, but so did prices of U.S. Treasuries, the opposite of what usually happens at such moments,” says the task force report's chapter on the Treasuries market. The 10-year yield “rose by a large 0.64 percentage points, not due to higher expected inflation or increased U.S. government default risk, but because some holders of Treasuries rushed to sell them to raise cash for a variety of reasons.

“Mutual funds had to meet investor demands for redemption, hedge funds had to meet margin calls, and foreign central banks needed U.S. dollars to lend to banks in their economies that had trouble accessing the usual markets for borrowing dollars.”

Markets continued to function, however, a testament to infrastructure operations like the Depository Trust & Clearing Corp. (DTCC) and its Fixed Income Clearing Corp. (FICC), which in March 2020 saw record clearing volumes above $6 trillion daily, almost 43% over the daily average of $4.2 trillion.

[On July 28, a Group of Thirty working group chaired by former U.S. Treasury Secretary Timothy Geithner issued a report with Treasury market recommendations that include central clearing. Geithner said that a combination of “viable reforms” in clearing, liquidity facilities, regulation of market intermediaries, and market regulation and transparency “would make a meaningful contribution to improving the functioning of the Treasury market, both in normal times and in periods of crisis. We believe a Standing Repo Facility that is open to a broad range of market participants is especially important to improve market functioning and liquidity.”]

Fragmentation and Contagion Risk

A DTCC white paper in May this year advocated more central clearing in the cash Treasury market, spreading the risk-mitigating central counterparty (CCP) benefits of transaction netting and a trade guarantee. DTCC maintains that the prevalence of bilateral clearing fragments the market and can pose contagion risk - an issue of increasing urgency amid market volatility.

The Fed estimates that up to 60% of outright purchases and sales of Treasuries through interdealer brokerages (IDBs) involve principal trading firms (PTFs) that generally don't participate in central clearing.

DTCC head of clearing agency services and global business operations Murray Pozmanter said that “the bifurcation of Treasury clearing activity, where part is bilaterally cleared and part is centrally cleared, is introducing greater risk into this growing market. DTCC continues to engage the industry to encourage further adoption of central clearing, to lower this risk and better protect the industry.”

“This fragmentation directly reduces the systemic benefits that FICC was created to provide,” the DTCC paper says.

“If a PTF with large open trade exposures defaults, in addition to the loss of liquidity provided by that PTF, there could be much larger systemic impacts, especially if the PTF's default caused its prime broker or IDB to also suffer significant losses or liquidity shortfalls,” explained Laura Klimpel, managing director, clearing agency services. “The contagion risk in this scenario is not insignificant.”

The Brookings-Booth School initiative recommends study of “the costs and benefits of a central clearing requirement for Treasuries and Treasury repo, including the impact central clearing might have on market liquidity.”

Avoiding Settlement Failures

While bilaterally cleared trades have grown in volume over the last decade, along with the amount of Treasury debt and the emergence of sophisticated trading technology, new services have emerged to make bilateral trades more efficient and reliable.

BNY Mellon, for example, announced in February a collaboration with Google Cloud to help market participants predict settlement failures, which the bank, the largest U.S. clearing firm, estimates at 2% of its transactions. A failure occurs when a buyer and seller fail to exchange cash and securities by the close of business on the scheduled settlement date.

“BNY Mellon is using Google Cloud for its scalable data analytics capabilities and to train models on millions of trades to consider every value and factor that could result in a failure,” the bank said in a statement. “This will help reduce client risk and create a more efficient financial market with fewer failure points and greater liquidity.”

The tool is being piloted with several clients, and benchmarking their settlement activity using the model's output has suggested it will save millions of dollars in fees for fails, said Brian Ruane, CEO, BNY Mellon Government Securities Services Corp.

The bank does not disclose its bilateral Treasury clearing and settlement volumes, but the overall Treasury market is some $22 trillion, and BNY Mellon is a major facilitator. Bilateral clearing almost certainly saw a spike last year in line with Treasuries as a whole.

Ruane pointed to an August 2020 white paper, analyzing repo market resiliency as well as clearance and settlement of U.S. government securities, which concluded that despite significant pressure during the worst of the COVID-19 period, “U.S. triparty repo and U.S. government securities settlement continued to operate without major disruption.”

DLT for Repo

In another initiative to reduce bilateral risk, Broadridge Financial Solutions announced June 14 a platform for repo trade execution using distributed ledger technology (DLT, also known as blockchain) and smart contracts.

“The higher up in the transaction workflow that counterparties can capture and resolve differences in their transaction data, the less likely transactions will fail at the reconciliation stage,” said Horacio Barakat, head of digital innovation for capital markets at Broadridge.

He said the distributed ledger repo (DLR) platform rests between broker-dealers' front and back offices, reducing the need for major systems changes to implement it. The platform captures the details when counterparties A and B agree to a transaction and compares both sides of the trade. If they match, it creates a smart contract to bind the transaction and seal it to the permissioned blockchain.

“That's where the efficiency and risk reduction start, because the possibility of a mismatch, where counterparties thought they agreed on terms but hadn't, is reduced to practically zero,” Barakat said.

As of late June, the platform was averaging more than $30 billion in daily transactions, and more participants are being added over the summer. The initial focus is on Treasury repo, Barakat said, and it is being expanded to other fixed-income securities and transactions related to securities lending.

Bilateral Model Persists

Vinod Jain, a senior analyst at the Aite group, said he has yet to see a major uptick in CCPs adopting DLT, though they are speeding up their settlement systems while providing the benefits of transaction netting to lower the members' capital requirements. “It comes down to a choice between the CCP's benefits of netting and the settlement guaranty, or the movement of the bilateral model to a DLT platform,” Jain said.

The bilateral model is attractive to firms new to the fixed-income market or handling lower volumes, because it is more costly to on-board with a CCP. “As volume increases, they may consider whether to get the benefits of a CCP model, which has been long tested, and settlement is much more guaranteed,” Jain said.

Larger market participants at times go bilateral, and much of the bilateral volume has come from high-volume PTFs.

The DTCC paper says that prior to 2000, all IDB platform users were traditional broker-dealers and FICC members, and all purchases and sales of Treasuries through IDBs were centrally cleared. The share of bilateral cleared and settled Treasury transactions through IDBs has increased steadily since then, and that U.S. Treasury officials estimate PTFs now average 20% of the overall Treasury cash market and account for 50% to 60% of IDBs' Treasury volume.

Risk-Reducing Justification

Josh Galper, managing principal of Finadium, noted that banks' limited balance sheets were said to have hindered the clearing and settlement of record Treasury-transaction volumes in March 2020. “The argument is, if everything is settled centrally on a CCP, then dealers would be able to net down their settlement exposures and expand capacity,” Galper said.

In an email, Klimpel of DTCC said benefits of central clearing and settlement, besides lower net settlement exposures, include mitigation of bilateral counterparty risk through novation to FICC, and reduced market risk through standardized margin processing.

“Central clearing of all market making U.S. Treasury cash activity, inclusive of PTF activity, undoubtedly would reduce market, credit, liquidity and operational risks in the market,” Klimpel said.

She said FICC has made “substantial modifications” to reduce fees for market participants with relatively flat end-of-day exposures, such as PTFs, and has expanded sponsored access. Yet PTF economic incentives still favor bilateral clearing.

At FICC, we believe that while industry efforts continue, official sector action will ultimately be required in order to see this activity migrate into the CCP,” Klimpel said. That could require market makers in U.S. Treasury securities, or firms whose Treasury cash activity satisfies certain liquidity and/or volume thresholds, to “be required to centrally clear such activity,” she added.