Across the globe, in response to unprecedented economic disruptions caused by COVID-19, central banks have implemented unconventional monetary policies. In the U.S., for example, the Federal Reserve has started an unlimited quantitative easing (QE) program, increasing its balance sheet by more than $3 trillion in a mere three months. The Bank of Japan (BOJ), meanwhile, recently signaled its intention to deploy stronger QE measures, while maintaining its negative interest rate policy.

Naturally, monetary actions on this scale could stoke fears about inflationary risk. However, although the risk of inflation is certainly a concern in the long term, the most imminent risk of these stimulus programs - commonly referred to as “helicopter money” - is deflation in the global economy.

Deflation risk may seem counterintuitive. Too much inflation diminishes purchasing power, so why is the opposite also problematic?

Deflation is often associated with an economic recession as a consequence of reduced demand and purchasing power - as witnessed in the current pandemic. Even worse, deflation decreases consumption and, therefore, income in a recession, which could further reduce corporate and consumer confidence and depress future demand as a vicious cycle. This vicious cycle is often called the deflation trap.

Deflation Signs

To determine whether we are indeed headed in this direction, let's first look at recent data. According to Reuters, after a 2.4% decline in March, U.S import prices fell by 2.6% in April, the largest decline since 2015. Although import prices rose slightly (1%) in May, mainly driven by the rebound of costs for petroleum, current import prices are still at levels not seen in recent years. At the same time, U.S. export prices fell by 6.0% on a year-on-year basis in May, after declining 6.8% in April.

By definition, deflation is a decline in the general price level. The significant decline in both import and export prices are clearly signals of deflation.

There are clear economic reasons behind the declining prices. In February 2020, the National Bureau of Economic Research stated that the U.S. economy had slipped into a recession. Moreover, despite support from the Federal Reserve and the government, millions of businesses shut down and the U.S. saw record levels of unemployment - trends that could be long term, given pandemic-driven social distancing requirements.

In such a recession, consumers and businesses suffer from demand and financial constraints, and are forced to cut spending. Therefore, until a clear global recovery is in sight, we could stay in a worldwide period of deflation.

Inflation risk and observed deflation are, of course, nothing new. Indeed, the Fed implemented QE programs in the aftermath of the 2008 financial crisis, and has been targeting a 2% inflation rate over the past decade.

However, as the Wall Street Journal recently reported, the possibility of deflation is now a “major worry” for the Fed. This concern is at least partly the result of low and negative interest rates adopted by central banks.

The Interest Rate Conundrum

Economists' predictions of deflation risk are certainly connected to the global interest rate environment. The Federal Funds Rate is currently close to zero, and U.S. 10-year bond yields are trading well below 1%. Clearly, these are signs of distress and deflation in the U.S.

Complicating matters further are the more dramatic negative interest rate environments in Europe and Japan. These “below zero” rates drive economic stagnation via lowering people's inflation expectation - which, in turn, subdues business growth and consumer rates. The European Central Bank (ECB) and the BOJ introduced negative interest rates in June 2014 and January 2016, respectively.

Debt and Money Velocity

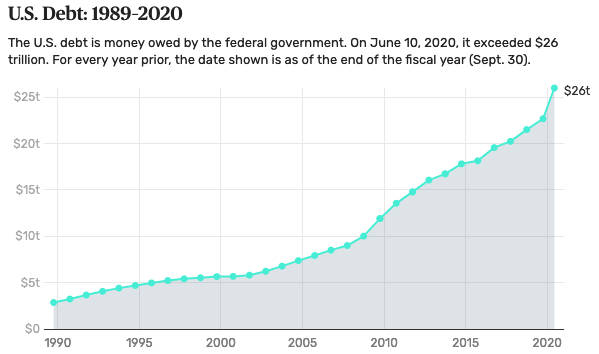

To make matters worse, U.S. debt exceeded $26 trillion in June. Indeed, the business disruption caused by COVID-19 led to an unprecedented increase in total global corporate debt to around $9.3 trillion - with U.S. household debt rising to $14.3 trillion in May.

Even with low interest rates, loans will need to be repaid over time, and the increasing amount of debt may crowd out future consumer demand when it is needed most.

Figure 1: The Rise of U.S. Debt

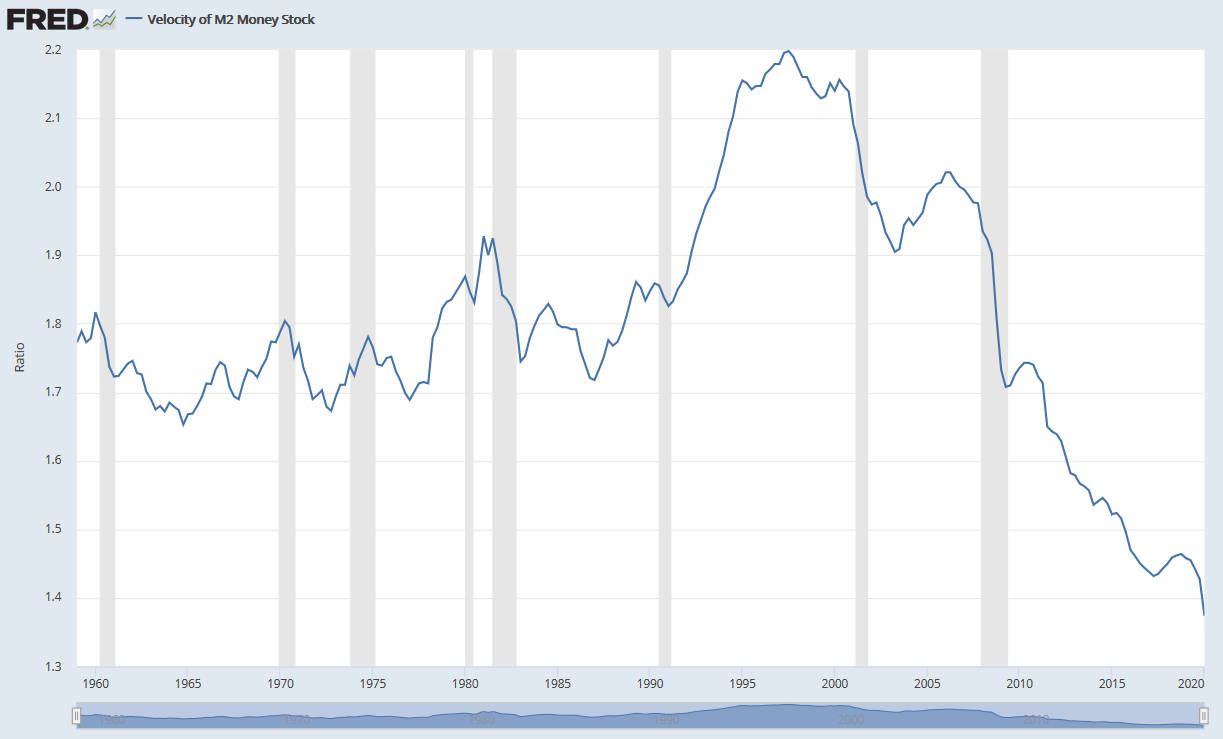

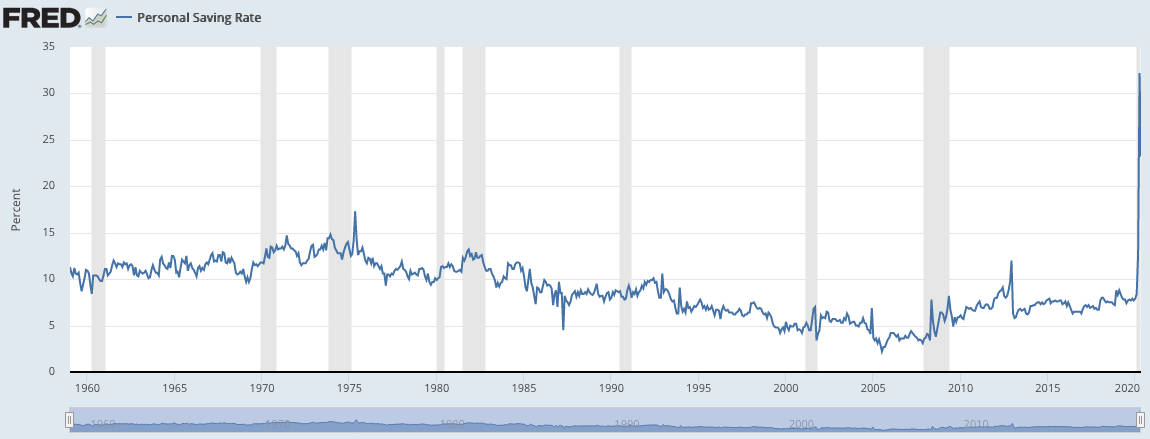

What's more, while there has been a big increase in the monetary base supply, money velocity - the circulation speed of money over a given time period - is declining. According to data from the Federal Reserve, from the 2008 crisis to early 2020, U.S. money velocity remained relatively low. But since the COVID-19 crisis, the personal saving rate in the U.S. has skyrocketed - contributing to an even lower money velocity and, hence, greater deflationary risk.

Figure 2: Money Velocity and Personal Saving Rate Trends in the U.S.

Source: Federal Reserve Bank of St. Louis

fred.stlouis.fed.org

Source: U.S. Bureau of Economic Analysis

fred.stlouis.fed.org

Parting Thoughts

The actions of the Fed and the BOJ are not surprising, given that economies across the world are still suffering from the effects of the pandemic. Prices, in fact, continue to slip in Japan - with the consumer price index projected to fall to at least negative 50 basis points through March 2021.

Moreover, considering the recent increases in COVID-19 cases in California, Texas, and Florida, another shutdown that further depresses economic growth and consumer spending looms as a possibility. That would send prices and wages lower, potentially growing the recession.

Consequently, while inflation is still a risk in the future, deflation may emerge as the most serious threat to the near and midterm economy since the Great Depression.

Tianyang Wang (FRM/CFA/ASA) is an associate professor in the Department of Finance and Real Estate at Colorado State University.