Early this year, market participants were worried about the lack of a Libor-replacement rate with a term structure similar to Libor's. Now it is a case of which one to choose.

Although the Federal Reserve-hosted Alternative Reference Rates Committee (ARRC) has been publishing the secured overnight financing rate (SOFR) since April 2018, relatively few loans and other cash financial products have been priced using the new benchmark. Averaging the overnight rate is more complicated operationally than is term Libor, and borrowers discover their interest payments shortly before the end of the billing period, instead of at its start.

Responding to those concerns, Bloomberg and the American Financial Exchange (AFX) each announced Libor replacements earlier this year with forward-looking term structures. Yet on March 23, the ARRC said it would be unable to recommend a term SOFR as it had planned, by June 30, and encouraged market participants to transition “using the tools available now.”

The outlook brightened April 21, following the ARRC's publishing key principles for a forward-looking SOFR term rate and CME Group's announcement of term SOFR reference rates for one-, three- and six-month tenors. On the same day, Bank of America announced issuance of a six-month, $1 billion floating rate bank note priced over the one-month tenor of the Bloomberg Short-Term Bank Yield Index (BSBY).

CME as Administrator

On May 21, the ARRC said that CME Group had emerged from its request-for-proposal process as the likely administrator for a forward-looking SOFR term rate. “Given that continued progress in developing SOFR derivatives market liquidity is readily achievable, a recommended term rate is now in clear sight,” and market participants could soon take preparatory steps, stated Tom Wipf, ARRC chairman and vice chairman of institutional securities at Morgan Stanley.

“We have long been aligned with the ARRC, and look forward to working with the ARRC and market participants to reach the market indicators the ARRC has set out for the recommendation of a SOFR term rate,” said Sean Tully, CME's global head of financial and OTC products.

Also in the works is the ICE Bank Yield Index, developed by ICE Benchmark Administration (IBA), which currently publishes Libor. The overnight version is anticipated to be launched his summer, with a term version later on.

A report on overnight risk-free rates and term rates was one of several documents that the Financial Stability Board issued on June 2 “to support a smooth transition away from Libor by the end of 2021.”

Meredith Coffey, executive vice president of research and co-head, public policy at the Loan Syndications & Trading Association (LSTA), said its members should be preparing for “a multi-rate environment for a period of time,” though the number of replacement rates may eventually winnow down.

Perceived Shortcomings

SOFR is generated from the secured overnight repurchase agreement (repo) market, which, with upwards of $1 trillion in transactions daily, is viewed as difficult to manipulate. But banks of different types perceive, and seek to work around, certain limitations.

Regional lenders worry that the benchmark will fall precipitously in stressed markets, resulting in loan income falling while the cost of funds rises. SOFR alternatives address the issue by incorporating various unsecured bank funding rates into their calculations.

Term benchmarks are a big step forward, but market participants face other major changes. For one, Libor's forward-looking term rates are generated from Eurodollar futures, a huge market with CME-listed contracts' open interest hovering just under 12 million contracts as of early May, compared to 819,000 for SOFR futures. The AFX's Ameribor futures, listed on the Cboe market, had combined open interest below 1,000 contracts.

Hedging Challenges

Those numbers are critical for swap dealers seeking to lay off counterparty risk in the futures market, since insufficient liquidity there may require them to retain exposures.

CME, in its April 21 announcement acknowledging the ARRC's principles, said it will restrict licensing the term benchmarks to cash transactions, so hedging a loan priced over three-month SOFR with a swap priced over the same-tenor SOFR will not be possible.

The ARRC's concern is that such hedges could materially reduce trading in the underlying overnight SOFR-linked futures required to construct the rate. Still, Coffey said, loans priced over forward-looking term SOFR should be hedged effectively, if not perfectly, by referencing the overnight SOFR rate averaged on a compounded basis.

“It may be off slightly,” the LSTA official said, “but unless something really unexpected happens, the market's forecasting power is pretty good and probably sufficient to get an effective hedge” for hedge accounting purposes.

Momentum Anticipated

In March, CME SOFR futures average daily volume (ADV) increased 82% year-over-year, to 113,000, with notional ADVs in the first quarter for one-, three- and six-month SOFR clocking in, respectively, at $75 billion, $125 billion and $160 billion.

Agha Mirza, CME Group's global head of rates and OTC products, said client demand, the growth metrics, and CME's cleared SOFR swaps reaching $500 billion notional were factors prompting the exchange's term SOFR announcement.

Those numbers still pale next to CME Eurodollar futures, although the SOFR volume will increase due to fallbacks in Eurodollar contracts that became effective in March. All Eurodollar futures are to convert to corresponding SOFR futures in June 2023.

Incorporating Credit Risk

To incorporate credit risk in a way that meets the needs of smaller and regional lenders, alternative benchmarks are generated using a variety of bank-financing data, rather than derivative contracts. BSBY, for example, pulls short-term bond data from the Financial Industry Regulatory Authority's Trade Reporting and Compliance Engine (TRACE) and combines it with commercial paper and certificate-of-deposit (CD) data from Bloomberg Electronic Solutions.

Umesh Gajria, Bloomberg's head of index-linked products, said its data comes with an “ecosystem” of BSBY services and tools, including fallback language for existing loans and derivatives as well as analytics.

“Packaging these things together makes BSBY very usable,” Gajria said, and with much of the market transitioning to SOFR, “BSBY can also be used as a credit spread over term SOFR.”

Benchmarks generated from bank-funding data allow term rates to be hedged while allaying concerns that SOFR will be cannibalized. However, the rates are based on much smaller transaction volumes - less than $10 billion daily - presenting Libor-like concerns if those funding markets are adversely impacted. The rates include volume minimums below which a fallback process looks back in one-day increments until reaching the volume threshold.

CME announced May 24 that it will launch futures tied to three-month BSBY in the third quarter and cleared swaps in the fourth quarter, subject to regulatory approval.

AFX's Ameribor

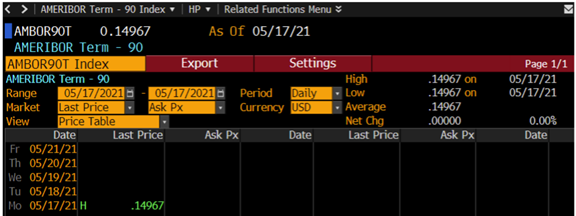

Similar to Libor, BSBY relies on large banks' funding transactions, while the AFX exchange-generated Ameribor reflects the credit risk of a broad range of banks. Bloomberg began publishing Ameribor Term90 on May 18.

“The AFX forward-looking rates are composed entirely from real-world funding transaction data comprised of commercial paper and commercial deposit issuances collected by the DTCC (Depository Trust and Clearing Corp.) and combined with the Ameribor unsecured lending data,” the Chicago exchange operator explained on May 19. Its chairman and CEO, Richard L. Sandor, said, “Ameribor Term90 and a term structure have been under development for the past year. It was a collaborative effort of AFX staff and members of the Ameribor panel.”

Dr. Sandor said in a recent Reuters article that he has “never been more bullish” about the post-Libor opportunity, while going on the assumption that multiple benchmarks will coexist. He characterized as a “significant step” the licensing of Ameribor, announced June 1, to IntraFi Network.

He says that the inclusive nature of Ameribor - AFX has more than 200 bank and nonbank members across the U.S., and the benchmark reflects the unsecured borrowing costs of more than 1,100 banks and financial institutions - makes it “the best representative of short-term rates with a credit spread,” and “by definition, that is difficult if not impossible to manipulate.”

Pricing on Numerix

In what Sandor called “another significant step for AFX” in the term structure direction, risk and trading technology company Numerix agreed to provide spot Ameribor rates for the overnight, 1-week, 1-month, 3-month, 6-month, 1-year and 2-year yield-curve points.

“AFX and Numerix plan to extend the Ameribor spot term structure of interest rates beyond 2-year as the maturities of the Ameribor futures strip is extended,” the companies said on May 25.

“As a market leader in the transition to alternative rates globally,” said Numerix president and CEO Steve O'Hanlon, “we are delighted to have formed this partnership with AFX where the flexibility and robustness of our analytics fulfil a market need to construct Ameribor term rates. Because of the partnership, market participants now have a viable opportunity to issue, risk mange and settle a range of products with reference rates that reflect the actual traded market.”

IBA, IHS

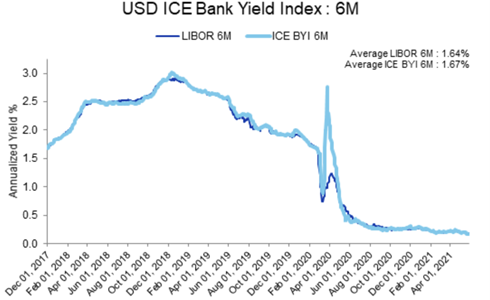

Intercontinental Exchange's IBA is developing what it sees as robust term SOFR rates as well as the ICE Bank Yield Index (BYI), which can supplement SOFR to incorporate credit risk or be used as a standalone credit-sensitive rate.

The IBA's term SOFR for one-, three-, six- and 12-month tenors uses a waterfall methodology of data inputs, starting with prices from transacted SOFR-linked futures and overnight index swaps (OIS), that IBA president Timothy Bowler said is more robust than relying on one or the other.

Now in its testing phase, ICE BYI pulls commercial paper, CD and wholesale-deposit data directly from banks and secondary-market bond data from TRACE; the data is coming typically from institutions with at least $250 billion in assets.

Bowler said the ideal outcome would be for a couple of credit-sensitive benchmarks to emerge, enabling market participants to embed a primary rate and a backup rate in their contracts “to make them safer in case, for whatever reason, one rate went away unexpectedly.”

Another leading market data source, IHS Markit, said that as of June 1, forward-looking dynamic term rates on its USD Credit Inclusive Term Rate (CRITR) and USD Credit Inclusive Term Spread (CRITS) are available and updated daily for overnight, 1-month, 3-month, 6-month and 12-month tenors, with historical data back to the start of 2015.

“CRITR and CRITS offer a straightforward and robust solution for firms that are keen to transition their exposure away from USD Libor before its publication ceases,” said Julien Rey, IHS Markit executive director and head of the Libor Transition Program. “Going forward, we anticipate the market will transition to a multi-rate environment, and we are proud to support this evolving ecosystem.”

The rates are administered by IHS Markit Benchmark Administration.