Securities financing, used by institutional investors to generate returns on assets and hedge price volatility, is becoming increasingly popular among cryptocurrency holders.

Evidence of the strategy's popularity is in pronounced declines in lending rates over the past year and a half. Steve Swain, founder and CEO of Gibraltar-headquartered Lendingblock, a digital-asset loan platform, said rates have fallen over that period to a range of 2% to 4%, from 5% to 9%, depending on the specific digital currency and the borrower.

“Perhaps more troubling, there are more lenders willing to take on credit risk by reducing collateral levels,” Swain said. “So there's competition not just on rates, but also the amount of collateral borrowers must provide.”

Swain, whose firm recently licensed its software for the first time, to Singapore-based exchange operator EQONEX Group, said 150% collateral would have been the norm to borrow 18 months ago. Now it is closer to par, and some borrowers can secure loans under par.

That's due in part to the increasing sophistication of lenders' analysis of the risk they're taking on, Swain said. Business relationships may also play a role, he added, as is the increasing number of parties willing to lend, as institutions dip their toes into the digital-asset market.

Collateral Variations

Jennifer Liu, head of lending at Anchorage, which in January obtained conditional approval for a national trust bank charter from the U.S. Office of the Comptroller of the Currency, also sees lending rates in mid-single digits. “Each loan has a different collateral ratio,” she said, “and it can vary quite a bit depending on the collateral asset and the borrowing counterparty.”.

Genesis Global Trading, a Digital Currency Group company that presents itself as a prime brokerage for digital assets, has said “lackluster demand” from borrowers is to blame for substantial declines in yields on bitcoin.

In previous quarters, the firm borrowed bitcoin at between 3% and 6%, while “in the current market structure, in most cases, rates have fallen to 1-3%,” Genesis said in a first quarter Market Observations report.

Genesis' second-quarter report, did not provide a range for rates but said the supply of cash loans collateralized by cryptocurrencies outweighed demand, and that “imbalance has pushed cash rates much lower than over previous quarters.” Demand to borrow cryptocurrencies, on the other hand, increases in a bear market, and “crypto lending rates have moved a bit higher.”

Typically Bitcoin

Anchorage provides custody, brokerage, and financing, with much of the latter comprising U.S. dollar (USD) loans collateralized by bitcoin or other digital assets. Liu said Silvergate Bank and Bank Prov are two institutions lending through the Anchorage platform. Corporate treasuries are increasingly entering the space, she added, as the lending rates and collateralization remain very attractive compared to more traditional options.

MicroStrategy, MassMutual, Tesla and Square are some of the corporate names making high-profile digital currency investments, typically bitcoin. They've indicated buy-and-hold rather than frequent-trading strategies, and lending digital assets or U.S. dollars collateralized by crypto provides an attractive return that can cover custody fees and mitigate price volatility.

Allison Rossi, Square's global treasury lead, said in a meeting earlier this year of corporate treasury executives arranged by the NeuGroup that the company had purchased $220 million in bitcoin, about 5% of its cash. She added that Square is considering making its bitcoin holdings available for lending to pick up additional income.

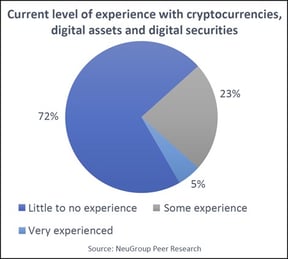

Liu said that corporates looking to lend digital assets tend to be already in the crypto space, although that's changing. A NeuGroup survey of large-corporate treasury executives found just over half saying they expect cryptocurrency to become a regular part of day-to-day treasury activity, but relatively few were experienced with it.

Lendingblock's Swain said other providers of crypto-collateralized loans include early buyers of bitcoin and other cryptocurrencies that have amassed digital fortunes, and funds such as those offered by Digital Currency Group's Grayscale. A Wall Street veteran who held technology and risk positions at firms including Lehman Brothers and UBS, Swain said there is a significant market for borrowing dollars using crypto assets as collateral, often for operational purposes, and traders with long/short neutral trading strategies or those looking to hedge may seek to borrow crypto assets.

Ecosystem Component

The market for crypto-collateralized borrowing is still nascent, and established digital-asset firms providing exchange, trading and custodial services are adding it to their platforms, with the aim to provide prime brokerage-type services. An EQONEX spokesperson said the firm will soon launch EQONEX Lending, running on Lendingblock's software, which will be available to a range of vetted institutional clients including funds, proprietary trading firms, market makers, exchanges, asset managers and corporate treasuries. Its open order book will allow potential borrowers and lenders to view market rates being offered and establish competitive terms for collateralized transactions.

“The lending business will provide another key component of the EQONEX financing and trading ecosystem and will provide a key element of market infrastructure for the digital assets market,” the spokesperson said.

Anchorage first rolled out a collateral management service in January 2020 for Silvergate, which sought to lend USD collateralized by bitcoin. In fall 2020, it began originating its own USD loans, with the majority collateralized by bitcoin or ethereum.

“Loan parameters are modeled by our quant team and approved by our risk management committee, with extensive due diligence and risk review for both counterparties made ahead of any loan,” Liu said. “Anchorage offers asset support for over 60 coins, which enables a breadth of cryptocurrencies available to be used as collateral.”

Volume Indicators

Liu declined to disclose digital-asset lending volumes. Other digital-asset players that have recently added lending to their service menus, including BitGo, Coinbase and Kingdom Trust, declined to discuss details.

Some hesitancy may stem from extreme volatility in digital-asset values this year, with bitcoin topping $60,000 per coin in April and dropping below $30,000 in July before recovering.

Sources estimated at least $10 billion in crypto-collateralized loans as the end of the second quarter approached, and the number may be significantly higher. Genesis said its active loans outstanding increased to $9 billion in the first quarter, up $136.4%, from $3.8 billion, in the previous quarter.

“Our loan portfolio increased substantially in value through a combination of new issuance across cash, [ether], and [decentralized finance] assets alongside a significant rise in asset prices across our existing crypto book,” Genesis said.

In loan originations, the second quarter was Genesis' “largest quarter to date, with $25.0 billion in new originations, up from $20.0 billion in Q1. Despite a 41% decline in BTC [bitcoin] price, total active loans outstanding decreased only 8.1%, to $8.30 billion. Mark-to-market depreciation in book value was offset by organic loan portfolio growth.”