Inflation, geopolitical risk, and escalating interest rates and energy prices were among the factors that were expected to send the global economy spiraling in 2023. But a funny thing has happened along the way to the abyss: many of the doom-and-gloom predictions, quite surprisingly, haven’t yet come to fruition.

The financial toll of the Russia-Ukraine war, for example, hasn’t been as dramatic as predicted – and, despite the all the volatility we’ve seen, economies in the U.S., Europe and Asia have remained fairly resilient. However, while 2023 has turned out better than expected in many respects, economic risks and uncertainty remain high.

Let’s now take stock of current conditions, lay out a likely path for the global economy, and illuminate key macro risks.

The Resilient U.S. Economy

The primary threat to the U.S. economy throughout the rest of 2023 and 2024 is the persistently high level of inflation and the associated risk that additional interest rate hikes designed to cool the economy go too far, potentially causing a recession. In addition, weakness in the banking sector could lead to further tightening of lending standards that starve the economy of credit.

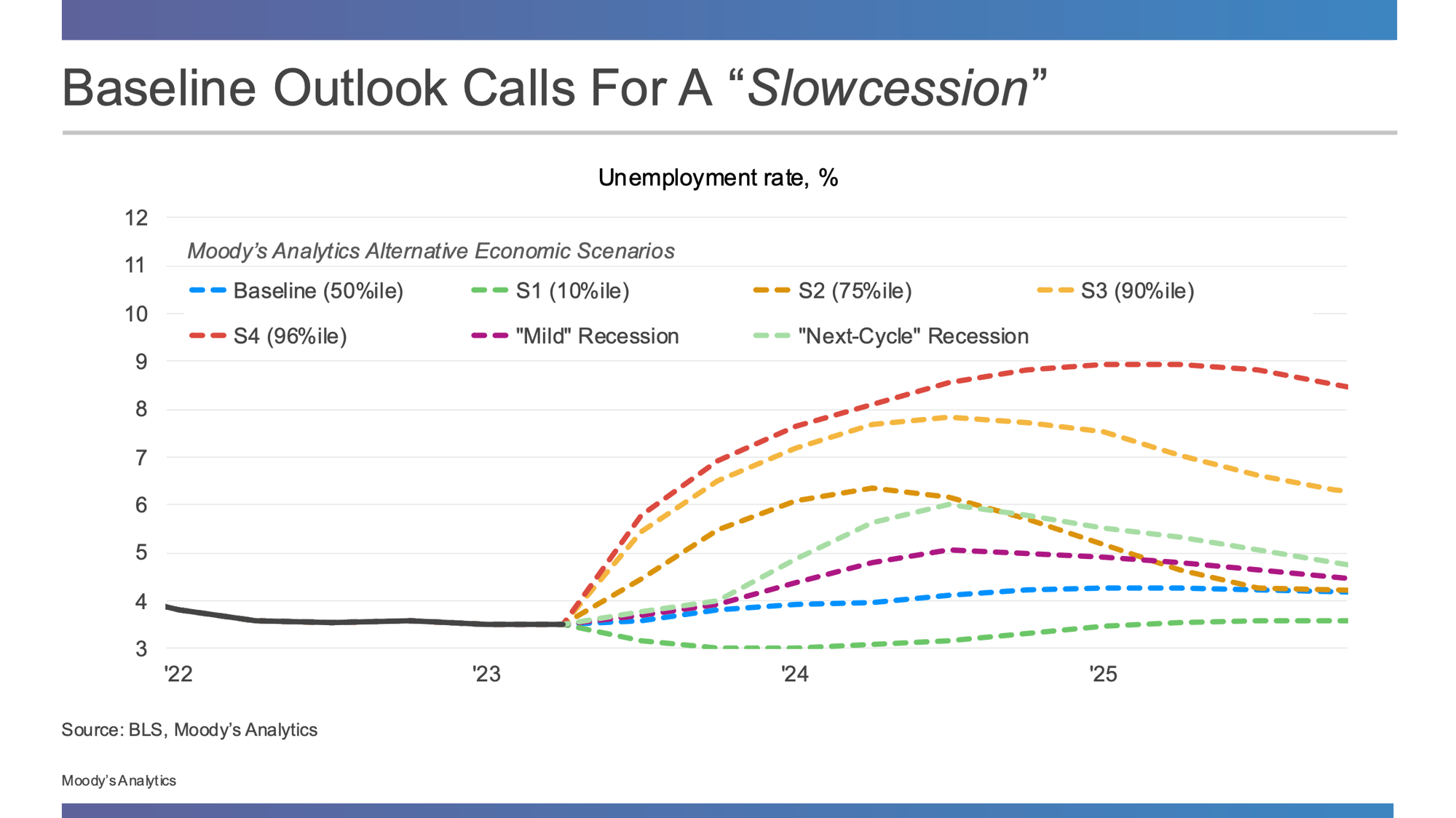

While the Moody’s Analytics baseline forecast calls for the U.S. to narrowly avoid recession, the expected so-called slowcession will pressure lower income households and highly leveraged businesses. The job market will slow in certain industries, and sectors such as commercial real estate are expected to experience significant declines.

Figure 1: “Slowcession,” Not Recession

These somewhat mild projections are only possible because the U.S. economy proved remarkably resilient over the past three years, even amid an unprecedented crisis. Unlike previous downturns, most business and household balance sheets came out of COVID-19 stronger than before the pandemic started.

Homeowners were able to refinance into long-term fixed-rate mortgages at historically low interest rates. As a result, monthly mortgage payments have remained low, even as the Federal Reserve aggressively hiked interest rates by 500 basis points. Low debt-service ratios, meanwhile, have provided households and businesses with some financial breathing room to cope with high inflation.

While lockdowns early in the pandemic sent the economy into a deep recession, factors such as the rapid appreciation of asset prices and an unprecedented amount of government stimulus resulted in forced saving, permitting households to accumulate nearly $1.4 trillion in “excess savings” – or reserves above what households would have been expected to save otherwise. These resources have provided a significant financial cushion against rising prices and are a key reason why consumer spending has remained strong.

European Fault Lines Form

European economies also proved much more resilient to economic threats than was anticipated at the start of 2023.

Russia’s invasion of Ukraine was expected to yield high prices for natural gas and petroleum, resulting in a drag on industrial production and consumption. Instead, European businesses and policymakers demonstrated an amazing ability to reduce overall energy consumption and pivot to other energy providers. A warm winter helped to ease some of the pressure while other sources of energy – such as U.S. liquified natural gas – came online. As a result, oil and gas prices have fallen back to pre-invasion levels.

Despite these remarkable achievements, European countries continue to face several headwinds that will continue to be a drag on performance, increasing the odds of recession above those for the U.S. Inflation, for example, remains stubbornly high and is quickly eroding the purchasing power of households and businesses.

The continent, moreover, continues to face many demographic challenges, including an aging population and the influx of millions of refugees from Africa, the Middle East and Eastern Europe. The ongoing war in Ukraine, meanwhile, is weighing on consumer and business confidence, shifting resources toward defense and away from more productive activities.

Europe may avoid a sharp protracted recession. However, given the continent's export orientation, much depends on the strength of other economies, like the U.S. and China.

Asia’s Diverging Paths

China’s post-COVID rebound was highly anticipated at the start of the year. With strict lockdown restrictions relaxed, household spending was expected to sharply rebound. However, while a small bounce was registered around the Lunar New Year celebration, it proved to be lackluster. Households in China, in short, remain cautious about their futures.

Cristian deRitis

The broader economic outlook for Asia-Pacific (APAC) has brightened relative to the start of the year, though risks remain. Foreign direct investments in China have declined, largely because of regulatory uncertainty and the desire of Western companies to diversify their supply chains. While trade linkages between the U.S. and China remain strong, tension in the Taiwan Straits is causing companies to move their operations from China to other APAC countries, such as Vietnam or India. (Financial hubs such as Singapore will continue to grow as firms diversify operations from Hong Kong and Shanghai.)

On the positive side, after a long hiatus, Japan is seeing greater interest from foreign investors as businesses adjust to new export opportunities. Moreover, while weaker demand for Australian commodities from Chinese businesses will be a headwind in the near term, it is unlikely to persist – as demand for these commodities from other APAC countries is expected to increase.

Outside of China, most APAC economies are expected to avoid recession this year — provided that inflation can be tamed and demand from U.S. and European trading partners does not decline appreciably.

Emerging Markets: Most Vulnerable

While most emerging markets are not currently experiencing a recession, the risk of a significant downturn is elevated. With weaker growth projected for key export markets in North America, Asia and Europe, it will be difficult for many emerging markets to find offsetting sources of growth.

Indeed, economies in Africa, Latin America, and the Middle East will face several challenges throughout the remainder of 2023. While lower energy and food prices are welcome news to consumers across the globe, including those in emerging markets, falling prices for energy, minerals and agricultural commodities will impinge on the ability of governments and businesses to pay their accumulated debts.

Political instability and social unrest related to the high cost of living further add to the risk of an economic meltdown. Productivity is also being reduced by increased emigration, as individuals in emerging-market countries look for better opportunities elsewhere.

Plentiful Risks

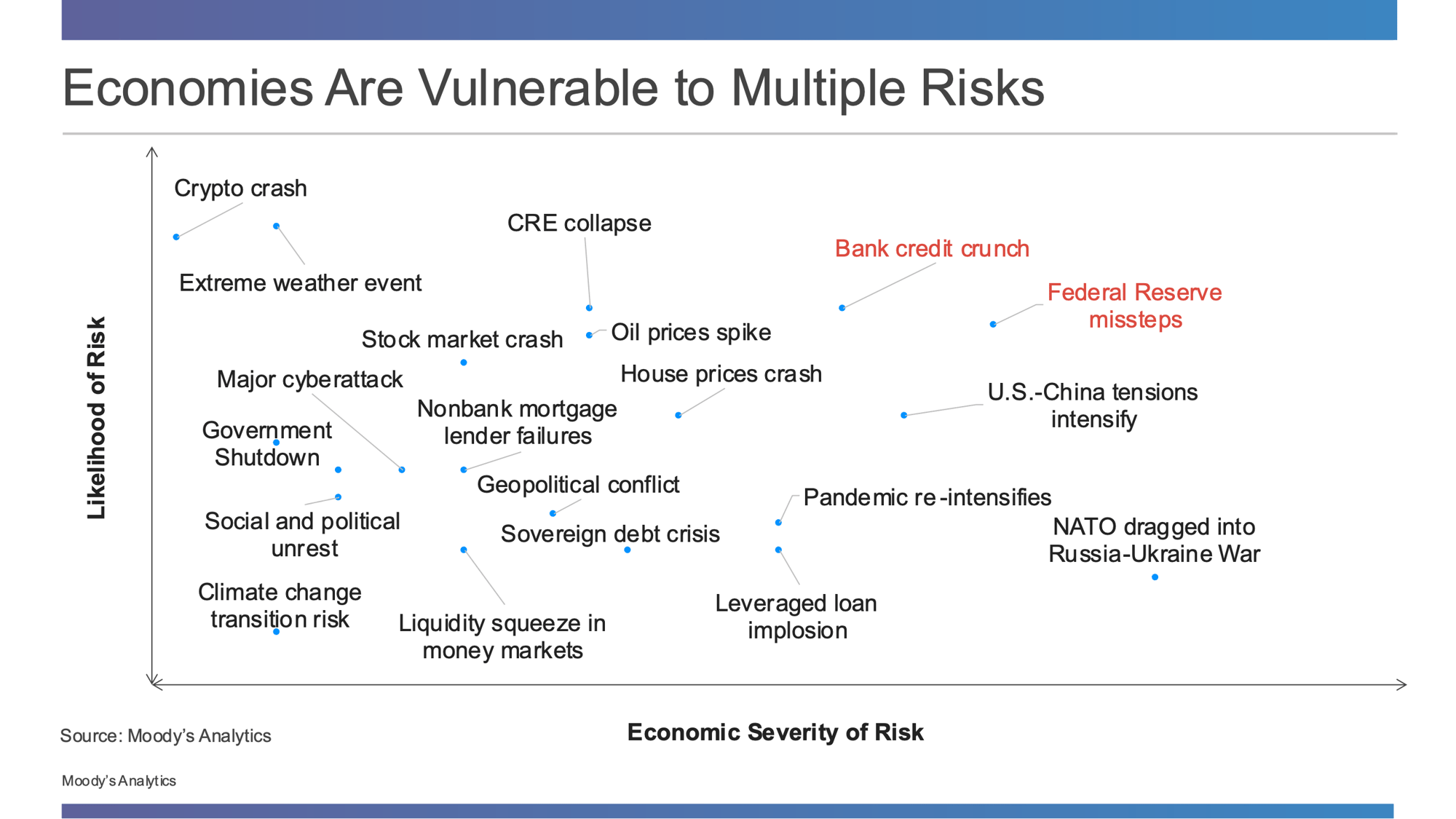

Given the fragile state of most economies, the risks to the global outlook remain numerous.

While the U.S. economy may be better off than most, nervous consumers and businesses cannot be counted on to support demand for the rest of the world. The Federal Reserve is attempting to tighten monetary policy just enough to slow the U.S. economy and reduce inflation, without sending the economy into recession. While a “soft landing” may yet be possible, the risks of a misstep are uncomfortably high.

Figure 2: Geopolitical Risk, Debt, Disruptive Technology Among the Biggest Global Dangers

Countries are also coping with the consequences of having borrowed and spent heavily during the pandemic to keep their citizens healthy and to keep their economies from cratering. High levels of accumulated debt will drag on government finances, especially in the face of significantly higher interest rates.

Rising geopolitical risks to the global economic outlook present another challenge. The ongoing war in Ukraine continues to claim thousands of lives, while simultaneously weakening global growth. The threat of an expanded conflict cannot be discounted as the war drags on, with no signs of coming to an end anytime soon. Complicating matters further, military exercises in the South China Sea and heightened rhetoric are increasing the chances that an accident or miscommunication leads to an armed conflict between China and the U.S.

The high degree of fragility in the financial system also means that the risk of other known and unknown threats to the global economy (such as cyberattacks or the failure of additional banks) is elevated. Contagion, moreover, could spread rapidly, as global investors remain on edge. Algorithmic trading and unproven technologies, such as artificial intelligence (AI), could exacerbate economic weaknesses that might otherwise have been contained.

Parting Thoughts

The economy this year has fared better than pessimists and even most optimists assumed it would. Considering all of the challenges that households, businesses and governments have had to deal with, it is remarkable how strong hiring and consumer spending have been – not only in the U.S. but also in other parts of the world.

The latter half of 2023 and the first half of 2024 will be particularly challenging for economies transitioning from a post-pandemic recovery to a more sustainable growth path. Many of the effects from rising interest rates have yet to be felt. When consumers and businesses seek out additional credit, the bite of higher rates and limited credit availability will lead to slower investment and spending, as the cash buffers stockpiled during the pandemic are depleted.

Continued strong labor demand, coupled with recovering confidence and the roll out of infrastructure projects in the U.S. and Europe, will provide a boost that should be enough to overcome these headwinds and to avoid a long, protracted recession. But the risk of a darker outcome is high, as policymakers may have few options if another economic shock should strike.

Now more than ever, financial institutions will need risk professionals to help them navigate these choppy waters.

Cristian deRitis is the Deputy Chief Economist at Moody's Analytics. As the head of model research and development, he specializes in the analysis of current and future economic conditions, consumer credit markets and housing. Before joining Moody's Analytics, he worked for Fannie Mae. In addition to his published research, Cristian is named on two U.S. patents for credit modeling techniques. Cristian is also a co-host on the popular Inside Economics Podcast. He can be reached at cristian.deritis@moodys.com.

Topics: Metrics