For many years, financial institutions have had a difficult time figuring where, exactly, their financial instruments should be allocated. Whether an instrument should be accounted for in the trading book or the banking book was unclear, thanks in large part to malleable regulation on market risk. But this is about to change - dramatically.

The Basel Committee on Banking Supervision (BCBS) recently released its long-awaited final standard for the minimum capital requirements for market risk - complete with clear instructions of the allocation of financial instruments to either the banking book or the trading book.

What sets this standard apart is that it uses a new “modular format” that the BCBS will also use for future standards. The section on the boundary between the trading book and the banking book, for example, is coded as “RBC25”; the standardized approach is coded “MAR20” to “MAR23,” while the internal models approach is referred to as “MAR30” to “MAR33.” Similar codes will be applied in future BCBS standards for credit risk and operational risk, so that these all fit like pieces of a jigsaw puzzle in a future comprehensive framework.

While the new standard specifies the standardized and internal modeling approaches for the calculation of the minimum requirements for market risk, the clarification of the boundary between the trading book and the banking book is most important.

Basel II's flexible definition of the boundary left ample room for arbitrage. Indeed, the trading book/banking book allocation rules were quite open to interpretation, and firms took advantage of this weakness by moving instruments toward the book with the lowest capital requirements. The BCBS has therefore been keen to replace the Basel II trading book/banking book boundary with a more intractable one.

The new BCBS standard provides a clear framework for the boundary between trading book and banking book, although one probably needs to read the articles in the section RBC25 multiple times to get a proper understanding of the demarcation. For example, when trading assets are held for short-term resale while there's a legal impediment against hedging them, should they be accounted for in the banking book or the trading book?

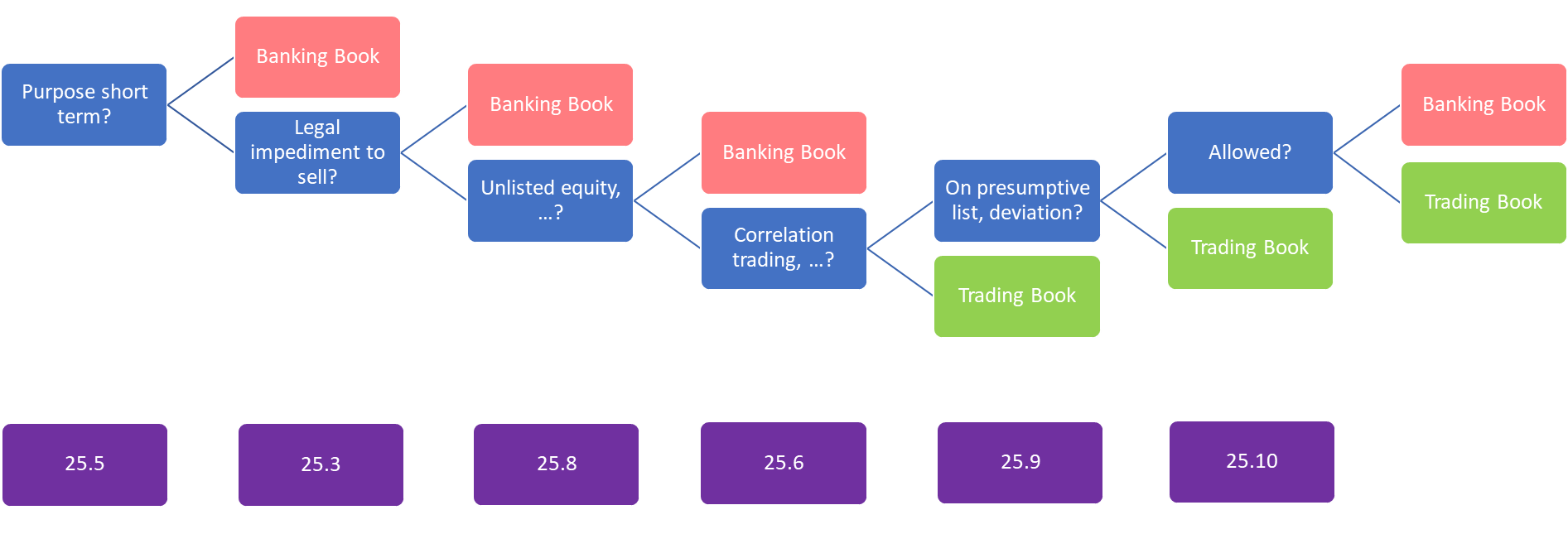

To understand the reasoning adopted by the BCBS and to provide more clarity about the trading book/ banking book criteria, take a look at the following diagram:

Figure: The Market Risk Highway

In the diagram, the decision nodes are blue and the final branches either pink (for definitively banking book) or green (for definitively trading book), while references to the specific articles within the RBC25 section are purple. The exact wording of the criteria need not be fully captured on our highway, because that can be extracted from the articles referred to in the purple boxes.

The highway is an illustration for first designation. There are separate rules (see articles 14 to 17 of RBC25) about moving instruments between trading book and banking book after initial designation.

Driving on the Market Risk Highway

So, let's go for a ride! The navigation works in such a way that while we're heading for the trading book, there are several off-ramps that might take us to the banking book.

The purpose for which a bank holds a given instrument is the main criterion (see art. RBC25.5) for determining whether it gets allocated to the trading book or the banking book. If the purpose is for short-term resale, or profiting from short-term price movements, or locking in arbitrage profits, then the instrument is, in principle, a trading book instrument. The trading book is also the destination for instruments that are used to hedge risks in any of the above scenarios. Under all other circumstances, it should be allocated to the banking book.

There are, moreover, two off-ramps toward the banking book. For an instrument to qualify for the trading book, there must not be any legal impediment (see RBC25.3) to selling or fully hedging it. This means that, if there is any such impediment, the instrument must be allocated to the banking book - even if it is meant for short-term resale.

The second off-ramp to the banking book presents itself if the instrument is on a product list that must be included in banking book. This list contains, among others, unlisted equities, real estate holdings, retail or SME credit, and derivatives of these instruments. This means, for example, that a credit derivative that references a portfolio of SME loans and that the bank holds for the purpose of short-term resale, will end up in the banking book - even though it is a derivative and it is held for a short-term purpose.

There are several clear-cut cases (see article RBC25.6) in which instruments will end up in the trading book. Instruments in the correlation-trading portfolio, for example, will be accounted for in the trading book.

However, if an instrument is not on this list of clear-cut cases, but rather on the “presumptive list,” there is still a chance that it will end up in the banking book. Items on this presumptive list include instruments held as accounting trading assets and liabilities, instruments resulting from market-making activities, and listed equities.

That said, if a firm wants to designate any of these instruments to the banking book, it first must pass an important toll-gate: supervisory approval. Article RBCS25.10 states that a bank must submit a request to its supervisor, and receive explicit approval for a banking book designation, for instruments on the presumptive list.

Parting Thoughts

The publication of the BCBS standard #d457 is an important step forwards toward the review of the trading book treatment. An important issue - the demarcation of the boundary between trading book and banking book - has been clarified.

The standard will come into effect on January 1, 2022, and banks will need a roadmap to implement the new market risk treatment. Understanding the “highway” outlined in this article is a good first step.

Marco Folpmers (FRM) is a managing director of finance and risk at Accenture. He is also a professor of financial risk management at Tilburg University and TIAS Business School.