The Commodity Futures Trading Commission said that renowned financial risk manager Robert Litterman will chair the newly impaneled Climate-Related Market Risk Subcommittee of the CFTC's Market Risk Advisory Committee (MRAC).

Litterman, formerly of Goldman Sachs and currently chairman of the risk committee and a founding partner of Kepos Capital, is one of 35 subcommittee members named in a November 14 CFTC announcement.

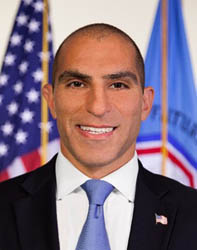

CFTC Commissioner Rostin Behnam, who is the MRAC sponsor, said there were 90 nominations for subcommittee membership, indicating “that this first-of-its-kind effort to provide a federal independent agency-sponsored forum to address climate-related financial market risks is well-timed to raise awareness on the urgency of taking action.”

Behnam added in his statement, “Addressing the near- and long-term impacts of climate change on our financial markets and the greater economy requires an unprecedented level of coordination. In choosing the Climate Subcommittee members, I sought to balance representation across participants of the derivatives and larger financial industry, cutting edge climate and sustainability research and analysis, and the highest level of risk management expertise. I aim to ensure that those who are most vulnerable to the physical and transition risks associated with climate change will benefit from the output of this Climate Subcommittee.”

Behnam had discussed plans for the subcommittee in opening remarks to the June 12 meeting of the MRAC, whose chair is Nadia Zakir, executive vice president and deputy general counsel of Pimco.

The commissioner mentioned international climate-focused initiatives such as the Network for Greening the Financial System and Task Force on Climate-Related Financial Disclosures, and said, “Assessing climate-related market risk must be a priority - and it must start now . . . My intention is to first take the necessary internal steps to form a MRAC subcommittee focused exclusively on examining climate-related financial market risk,” and then “to identify experts from all relevant disciplines willing to contribute to this exercise.”

Corporates, Academics, Advocates

Among those represented are financial institutions (including Allianz, BNP Paribas, Citigroup, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley and Vanguard Group), nonfinancials (BP, Bunge, Cargill), information services (Bloomberg, S&P Global), academia (Harvard Kennedy School, University of Oxford, NYU Stern), Ceres, Dairy Farmers of America, the Nature Conservancy, Environmental Defense Fund, and Sustainability Accounting Standards Board.

Said Litterman: “I am honored to join this effort to proactively identify and assess the financial market impacts of climate change, and to provide recommendations that are results-oriented, data-driven, and actionable on how best to mitigate those risks. Having spent my career focused on risk management, and most recently climate risk, I am encouraged that the CFTC is bringing the private sector, academia, and the public interest together on this urgent issue. I look forward to working with all members of the Climate Subcommittee.”

Litterman, who has a B.S. degree in human biology from Stanford University and a Ph.D. in economics from the University of Minnesota, recently reflected on his career and contributions to quantitative finance and environmental causes in an interview published by the Federal Reserve Bank of Minneapolis, where he once worked as an economist. He went on to a 23-year career with Goldman Sachs, where he was co-head of the Fixed Income Research and Model Development Group with Fischer Black and co-developed the Black-Litterman global asset allocation model. He was named a Goldman partner in 1994 and became head of the firm-wide risk function.

He joined Kepos Capital in 2010 and lists board affiliations including Commonfund, Options Clearing Corp. (OCC), Resources for the Future, World Wildlife Fund, Robert Wood Johnson Foundation and Sloan Foundation.

OCC's executive leadership issued a statement congratulating Litterman on his CFTC subcommittee appointment and “commend[ing] the CFTC for recognizing Bob's thought leadership on the issue of climate risk. We are confident that his leadership will play an important role on this issue, and we look forward to the work of the committee.”

Carbon Pricing

Litterman, noting in the Minneapolis Fed interview that he serves on the board of the Climate Leadership Council, said, “We propose a carbon dividend plan that gives back the tax revenues in a lump-sum payment. It's a very progressive plan. About 70% of people would be better off . . . What makes it difficult politically is there are winners and losers from pricing carbon. The winners are mostly not represented at the table. They are the future generations: my grandchildren and their grandchildren and their grandchildren's grandchildren, none of whom are here voting today. They're the ones who are going to be made better off by this policy.”

He expressed optimism on the issue of global warming, but said, “We don't have 10 years to spare. We don't have three years. This should have been done long ago. Carbon pricing is the only brake we have, and we've got to slam on it immediately.”

Litterman's many accolades include the International Association for Quantitative Finance Financial Engineer of the Year award for 2008; the inaugural S. Donald Sussman Fellowship of the MIT Sloan School of Management, recognizing achievement in quantitative investment, in 2012; and the GARP Risk Manager of the Year award for 2013.

He and subcommittee member Ben Caldecott, director of the Oxford Sustainable Finance Program, are participants in a panel discussion on climate risk to take place during the GARP Risk Convention on March 10, 2020.